Professional Documents

Culture Documents

Business Loan Interest Rates From Top Indian Banks

Uploaded by

Padma Santhosh0 ratings0% found this document useful (0 votes)

46 views2 pagesOriginal Title

Business Loan Interest Rates from Top Indian Banks

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views2 pagesBusiness Loan Interest Rates From Top Indian Banks

Uploaded by

Padma SanthoshCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

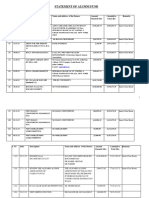

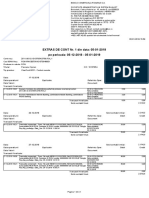

Business Loan Interest Rates from Top Indian Banks

Following are the interest rate in business loan by leading banks and NBFCs in India.

Lowest EMI per

Loan Business Loan lakh for Max Processing Fee on

Bank Amount Interest Rates* Tenure the Loan Amount

SBI Bank Rs. 1 11.20% - 16.30% Rs. 2,594 for 48 2% to 3%

Billion months

Max

HDFC Bank Rs. 50 15.50% - 18.30% Rs. 2,808 for 48 0.99% onwards.

Lakhs Max months Max 2.50%

ICICI Bank Rs. 40 12.90% - 16.65% Rs. 2,270 for 60 0.99% onwards. Up

Lakhs Max months to 2%

Axis Bank Rs. 50 15.50% to 24% Rs. 2,405 for 60 Up to 2%

Lakhs Max months

RBL Bank Rs. 10 20.00% - onwords Rs. 2,649 for 60 3%

Lakhs Max months

Kotak Bank Rs. 75 16.00% - 19.99% Rs. 2,432 for 60 Up to 2%

Lakhs Max months

Capital Float Rs. 1 Crore 18.00% – onwords Rs. 3,615 for 36 Up to 2%

Max months

Lendingkart Rs. 1 Crore 18.00% - onwords Rs. 9,168 for 12 2%

Max months

Bajaj Finserv Rs. 30 Interest rate 18% Rs. 2,938 for 48 Up to 2%

Lakhs Max onwards months

Standard Rs. 75 13.50% - 20.00% Rs. 2,301 for 60 2%

Lakhs Max months

Chartered

Deutsche Rs. 50 24.00% Rs. 3,923 for 36 Up to 3%

Lakhs Max months

Bank

Lowest EMI per

Loan Business Loan lakh for Max Processing Fee on

Bank Amount Interest Rates* Tenure the Loan Amount

Edelweiss Rs. 30 18.25% onwards Rs. 2,553 for 60 2% onwards

Lakhs Max months

Fullerton Rs. 50 16.00% onwards Rs. 2,834 for 48 2%

Lakhs Max months

India

Tata Capital Rs. 50 18.00% onwards Rs. 2,938 for 48 1.50% to 2.50%

lakhs Max months

Ziploan Rs. 5 Lakhs Interest rate 1-1.5% 3%

Max per month(Flat).

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Online Banking - Bank LoginDocument16 pagesOnline Banking - Bank LoginonliebankingNo ratings yet

- Phadke Complaint To RBIDocument6 pagesPhadke Complaint To RBIMoneylife FoundationNo ratings yet

- Union Bank Statement FreshDocument7 pagesUnion Bank Statement Freshbindu mathaiNo ratings yet

- Lecture 9 Multiple Deposit Creation and The Money Supply ProcessDocument62 pagesLecture 9 Multiple Deposit Creation and The Money Supply ProcessAmeen Zafar BabarNo ratings yet

- Sdad PDFDocument309 pagesSdad PDFPadma Santhosh100% (1)

- Acct Statement XX2797 07022023Document9 pagesAcct Statement XX2797 07022023bogili srinuNo ratings yet

- Reliance Need To FollowDocument364 pagesReliance Need To FollowPadma SanthoshNo ratings yet

- Book 2Document1 pageBook 2Padma SanthoshNo ratings yet

- Vigilance Report Feb 16Document7 pagesVigilance Report Feb 16Padma SanthoshNo ratings yet

- 50 Hotelierstalk MinDocument16 pages50 Hotelierstalk MinPadma SanthoshNo ratings yet

- 15CS324E lp2017Document4 pages15CS324E lp2017Padma SanthoshNo ratings yet

- Chennai PincodesDocument5 pagesChennai PincodesPadma SanthoshNo ratings yet

- Tele Calling Validation SheetDocument1 pageTele Calling Validation SheetPadma SanthoshNo ratings yet

- Notice by Registrar For Removal of Name of A Company From The Register of CompaniesDocument25 pagesNotice by Registrar For Removal of Name of A Company From The Register of CompaniesPadma SanthoshNo ratings yet

- Trade Center Event DetailsDocument8 pagesTrade Center Event DetailsPadma SanthoshNo ratings yet

- Alumni DonorsDocument16 pagesAlumni DonorsAkram Tariq KhanNo ratings yet

- Ar 2011 Project Commitments ListDocument33 pagesAr 2011 Project Commitments Listtok222222No ratings yet

- Master SuplyerDocument178 pagesMaster Suplyerstevie baraNo ratings yet

- Top 50 Global Financial Transnational CorporationsDocument1 pageTop 50 Global Financial Transnational CorporationsFukyiro PinionNo ratings yet

- "Financial Analysis" OF: IciciDocument96 pages"Financial Analysis" OF: IciciVeekeshGuptaNo ratings yet

- Wa0001Document69 pagesWa0001Fahrizal Akbar HerbhaktiNo ratings yet

- Soniya BegDocument124 pagesSoniya BegRibhanshu RajNo ratings yet

- Yuktha101Document199 pagesYuktha101yukthaNo ratings yet

- Albka Lkyltvkc NU8Document4 pagesAlbka Lkyltvkc NU8mfsiNo ratings yet

- Universal BankingDocument13 pagesUniversal BankingmangundesanjuNo ratings yet

- Source: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIDocument4 pagesSource: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIManikanda Bharathi SNo ratings yet

- Banking Awareness November 2022 Set 1 1 - 1669093570Document72 pagesBanking Awareness November 2022 Set 1 1 - 1669093570Jai DewanganNo ratings yet

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38No ratings yet

- Vinayak Pandla Nbs (Bank of Baroda)Document19 pagesVinayak Pandla Nbs (Bank of Baroda)Vinayak PandlaNo ratings yet

- B Anthony Alexander 17.08.23Document2 pagesB Anthony Alexander 17.08.23Alok ChauhanNo ratings yet

- 1.sabri RachmanDocument4 pages1.sabri RachmanALEXANDRIANo ratings yet

- Alc ListDocument15 pagesAlc ListHIMANSHUNo ratings yet

- Research Proposal - Dissertation - 2018-23Document21 pagesResearch Proposal - Dissertation - 2018-23Abhijeet MondalNo ratings yet

- Curriculum Vitae Jeroen Rijpkema PDFDocument2 pagesCurriculum Vitae Jeroen Rijpkema PDFJoeri KerkhofNo ratings yet

- MSME Care ListDocument5 pagesMSME Care Listmksingh13No ratings yet

- 07 June 2021 Unopposed Motion Roll For Judge Keightly JDocument5 pages07 June 2021 Unopposed Motion Roll For Judge Keightly Jinstallment paymentNo ratings yet

- CH15 Mish11ge ArabicDocument47 pagesCH15 Mish11ge ArabicFadi OsamaNo ratings yet

- Statement 20190105044590Document3 pagesStatement 20190105044590DanielNo ratings yet

- Sadaf StatementDocument37 pagesSadaf StatementadilfaqiNo ratings yet

- Ashiwini P - PC181204Document80 pagesAshiwini P - PC181204Im RajuNo ratings yet