Professional Documents

Culture Documents

Installment Liquidation Methods

Uploaded by

Hancel Nagera0 ratings0% found this document useful (0 votes)

32 views1 pagepartnership liquidation module

Original Title

METHODS OF PARTNERSHIP LIQUIDATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentpartnership liquidation module

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views1 pageInstallment Liquidation Methods

Uploaded by

Hancel Nagerapartnership liquidation module

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

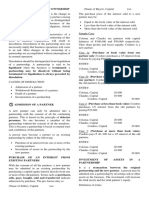

METHODS OF PARTNERSHIP LIQUIDATION

1. LUMP-SUM

2. INSTALLMENT

-is the method where realization of non-cash assets is accomplished over an extended period of time. When cash

is available, creditors may be partially or fully paid.

-Any excess may be distributed to the partners in accordance with a program of safe payments or cash priority

program. This persists until all non-cash assets are sold.

STEPS IN INSTALLMENT LIQUIDATION

1. Realization of n0n-cash assets.

2. Payment of liquidation expenses and adjustment for unrecorded liabilities. (Distributed according to P/L ratio)

3. Payment of liabilities to outsiders

4. Distribution of available cash based on a schedule of safe payments or cash priority program.

SCHEDULE OF SAFE PAYMENTS

- is a reliable method of computing the amount of safe payments to partners for it prevents excessive payments

to any partner.

CASH PRIORITY PROGRAM

- is a procedure which is prepared at the start of the liquidation process that help the partners project the expected

cash distribution.

ENTRIES RELATED TO LIQUIDATION

SALE OF NON-CASH ASSETS DISTRIBUTION OF GAIN OR LOSS ON

a. At book value REALIZATION

Cash xx Gain on realization xx

Non-cash assets xx A, capital xx

b. Above book value B, capital xx

Cash xx C, capital xx

Non-cash assets xx

Gain on realization xx A, capital xx

c. Below book value B, capital xx

Cash xx C, capital xx

Loss on realization xx Loss on realization xx

Non-cash assets xx

PAYMENT OF LIABILITIES EXERCISE OF RIGHT OF OFFSET

Liabilities xx A, loan xx

Cash xx A, capital xx

ADDITIONAL INVESTMENT BY PARTNER DISTRIBUTION OF CASH

Cash xx A, capital xx

A, capital xx B, capital xx

C, capital xx

DEFICIENCY ABORBED BY SOLVENT PARTNER Cash xx

A, capital xx

B, capital xx

You might also like

- Value Investing A Value Investor S Journe Neely J Lukas PDFDocument1,814 pagesValue Investing A Value Investor S Journe Neely J Lukas PDFYash Kanda80% (5)

- A Primer On Syndicated Term Loans PDFDocument4 pagesA Primer On Syndicated Term Loans PDFtrkhoa2002No ratings yet

- Elliott Wave Final ProjectDocument81 pagesElliott Wave Final Projectrinekshj100% (2)

- Chapter 4Document15 pagesChapter 4nicole bancoro100% (1)

- Partnership Liquidation NotesDocument7 pagesPartnership Liquidation NotesMary Rica DublonNo ratings yet

- Aia g702 FormDocument2 pagesAia g702 Formjnolan450% (2)

- G2M Fintech - by LawsDocument12 pagesG2M Fintech - by LawsAdi Cruz100% (1)

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- Business Combination and Consolidation On Acquisition Date SummaryDocument6 pagesBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- DAR GuidelinesfortheProcessingofLandUseConversionDocument6 pagesDAR GuidelinesfortheProcessingofLandUseConversionMaricar Badiola CuervoNo ratings yet

- P1-Single Entry FormulasDocument3 pagesP1-Single Entry FormulasJohn Yrick EraNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Accounting for freight charges on sales and purchase transactions under different FOB termsDocument2 pagesAccounting for freight charges on sales and purchase transactions under different FOB termsJaybie John Palco Eralino100% (1)

- Duration GAP analysis: Measuring interest rate riskDocument5 pagesDuration GAP analysis: Measuring interest rate riskShubhash ShresthaNo ratings yet

- Cash and Accrual Basis of Accounting, Single Entry and Error CorrectionDocument11 pagesCash and Accrual Basis of Accounting, Single Entry and Error CorrectionJoana Trinidad100% (3)

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Receivable FinancingDocument6 pagesReceivable FinancingErla PilapilNo ratings yet

- Pledge - : Far 6810 - Receivable FinancingDocument3 pagesPledge - : Far 6810 - Receivable FinancingKent Raysil PamaongNo ratings yet

- Classification of Bond Investments Journal EntriesDocument1 pageClassification of Bond Investments Journal EntriesRanie MonteclaroNo ratings yet

- Investment in BondsDocument1 pageInvestment in BondsNa Dem DolotallasNo ratings yet

- Classroom Notes 6393 and 6394Document2 pagesClassroom Notes 6393 and 6394Mary Grace Galleon-Yang OmacNo ratings yet

- 2 Assignment For Midterm - Merchandising Business: (Periodic System)Document4 pages2 Assignment For Midterm - Merchandising Business: (Periodic System)Lisa PalermoNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingArt EezyNo ratings yet

- Proforma Journal Entries - Merchandising TransactionsDocument4 pagesProforma Journal Entries - Merchandising TransactionsJames Christian AvesNo ratings yet

- UM TAGUM COLLEGE Cash Receivables OverviewDocument9 pagesUM TAGUM COLLEGE Cash Receivables OverviewNove Joy Majadas PatacNo ratings yet

- Vertical Balance SheetDocument6 pagesVertical Balance SheetNikhil Karkhanis100% (1)

- Pledge no Credit Card accounts entry disclosureDocument2 pagesPledge no Credit Card accounts entry disclosureMaeNo ratings yet

- Notes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONDocument8 pagesNotes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONSajan N ThomasNo ratings yet

- 2k15-Fin. Reporting Analysis-3Document30 pages2k15-Fin. Reporting Analysis-3flamerydersNo ratings yet

- Imprest system and bank reconciliation journal entriesDocument6 pagesImprest system and bank reconciliation journal entriesmaria lecturaNo ratings yet

- Factoring Accounts ReceivableDocument4 pagesFactoring Accounts ReceivableJohn MaynardNo ratings yet

- 6 Branch AccountingDocument48 pages6 Branch AccountingsmartshivenduNo ratings yet

- Loan Receivable and Receivable Financing PDFDocument3 pagesLoan Receivable and Receivable Financing PDFgenesis serominesNo ratings yet

- Receivable Financing: Quick Review!Document9 pagesReceivable Financing: Quick Review!Barbie BleuNo ratings yet

- Notes in Partnerships.Document4 pagesNotes in Partnerships.Jkuat MSc. P & LNo ratings yet

- Accounting For Petty Cash FundDocument6 pagesAccounting For Petty Cash FundAshianna KimNo ratings yet

- Accounts ReceivableDocument4 pagesAccounts ReceivableErla PilapilNo ratings yet

- (PAS 1 Par. 66) : Prepared By: Joseph R. Mendoza CPA, MBADocument3 pages(PAS 1 Par. 66) : Prepared By: Joseph R. Mendoza CPA, MBAJoshua LokinoNo ratings yet

- Corporate LiquidationDocument15 pagesCorporate LiquidationGen BNo ratings yet

- 04 Accounts Receivable Answer KeyDocument9 pages04 Accounts Receivable Answer Keywheein aegiNo ratings yet

- Vertical Income Statement: FormatDocument5 pagesVertical Income Statement: FormatHermann Schmidt EbengaNo ratings yet

- Cash Flows StatementsDocument4 pagesCash Flows StatementsMae-shane SagayoNo ratings yet

- Current liabilities and provisionsDocument3 pagesCurrent liabilities and provisionsKent Raysil PamaongNo ratings yet

- Prepare the necessary journal entries to record the above transactionsDocument5 pagesPrepare the necessary journal entries to record the above transactionsEj BalbzNo ratings yet

- Entrepreneurship and financial management group 8Document4 pagesEntrepreneurship and financial management group 8Aaron MushunjeNo ratings yet

- Accounting Process 2Document2 pagesAccounting Process 2Glen JavellanaNo ratings yet

- Adjusting Entries: Accrued Expense Accrued IncomeDocument3 pagesAdjusting Entries: Accrued Expense Accrued IncomeRyanKingNo ratings yet

- Nature of Shareholders' EquityDocument4 pagesNature of Shareholders' EquityAvox EverdeenNo ratings yet

- Partnership Liquidation (La Salle)Document18 pagesPartnership Liquidation (La Salle)Jocel Ann GuerraNo ratings yet

- AR AR FinancingDocument34 pagesAR AR FinancingDannis Anne RegajalNo ratings yet

- Summarized Notes: Let'S Go!Document7 pagesSummarized Notes: Let'S Go!Naiv Yer NagaliNo ratings yet

- Cash To AccrualDocument3 pagesCash To AccrualPaula De RuedaNo ratings yet

- Trade & Other Receivables Lecture NotesDocument7 pagesTrade & Other Receivables Lecture NotesRena Lyn ManzanoNo ratings yet

- FDP Form 9 Cash Flow StatementDocument2 pagesFDP Form 9 Cash Flow Statementricohizon99No ratings yet

- Bond Issue Price Plus Accrued InterestDocument5 pagesBond Issue Price Plus Accrued InterestmariahalexinNo ratings yet

- Review Materials Parliq EditDocument9 pagesReview Materials Parliq EditRosevie ZantuaNo ratings yet

- Double-Entry BookkeepingDocument6 pagesDouble-Entry Bookkeepinge.melamed2637No ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- Quick NotesDocument7 pagesQuick NotesMelvin BagasinNo ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Afar 2 Module CH 9 & 10Document16 pagesAfar 2 Module CH 9 & 10Elaiza LozanoNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Accounting Books Journal LedgerDocument9 pagesAccounting Books Journal LedgerJamie Leih ApillanesNo ratings yet

- Chapter 6 Bank ReconciliationRev StudentsDocument20 pagesChapter 6 Bank ReconciliationRev StudentsNemalai VitalNo ratings yet

- CorpLiq Draft (Recovered)Document9 pagesCorpLiq Draft (Recovered)Via Samantha de AustriaNo ratings yet

- DissolutionDocument4 pagesDissolutionHancel NageraNo ratings yet

- CheckbookDocument1 pageCheckbookHancel NageraNo ratings yet

- BUDGETINGDocument3 pagesBUDGETINGHancel NageraNo ratings yet

- PROBLEMsDocument3 pagesPROBLEMsHancel NageraNo ratings yet

- 42407664Document13 pages42407664Ashish KapareNo ratings yet

- Lawsuit Papers UTA 51559232-decision-UTADocument77 pagesLawsuit Papers UTA 51559232-decision-UTARobert ForrestNo ratings yet

- Corporate Governance at TurkcellDocument41 pagesCorporate Governance at TurkcellgizemlislasNo ratings yet

- Ecuador Bondholder Groups Release Revised Terms - July 13, 2020Document5 pagesEcuador Bondholder Groups Release Revised Terms - July 13, 2020Daniel BasesNo ratings yet

- Gordon ModelDocument16 pagesGordon ModelallajunakiNo ratings yet

- NSE INDICES RUNS TESTDocument4 pagesNSE INDICES RUNS TESTDP DileepkumarNo ratings yet

- Final Project of Allahabad BankDocument22 pagesFinal Project of Allahabad BankNipul Bafna33% (3)

- Definition of Securities Under Securities Contract Regulation ActDocument40 pagesDefinition of Securities Under Securities Contract Regulation ActYunus Worn Out'sNo ratings yet

- Basics of Portfolio Planning and Construction: Presenter Venue DateDocument32 pagesBasics of Portfolio Planning and Construction: Presenter Venue DateAnonymous 45z6m4eE7pNo ratings yet

- Lim, Duran & Associates For Petitioner. Renato J. Dilag For Private RespondentDocument6 pagesLim, Duran & Associates For Petitioner. Renato J. Dilag For Private RespondentfranzNo ratings yet

- New York State Insurance Department First Amendment To Regulation No. 70 (11 NYCRR 165)Document2 pagesNew York State Insurance Department First Amendment To Regulation No. 70 (11 NYCRR 165)vladimirkulf2142No ratings yet

- Car Buyers Guide To The GalaxyDocument4 pagesCar Buyers Guide To The GalaxyJustin OGormanNo ratings yet

- Delong Holdings Annual Report 2008Document92 pagesDelong Holdings Annual Report 2008WeR1 Consultants Pte LtdNo ratings yet

- Financial Results Conference Call Transcript of The Company For Q3 9M FY17 (Company Update)Document21 pagesFinancial Results Conference Call Transcript of The Company For Q3 9M FY17 (Company Update)Shyam SunderNo ratings yet

- Combined Final VersionDocument84 pagesCombined Final VersionDanudear DanielNo ratings yet

- USD 200 Million Senior Unsecured Notes/Bond Issue Closed by Jain International Trading B.V., Netherland (Wholly Owned Subsidiary of The Company) (Corp. Action)Document2 pagesUSD 200 Million Senior Unsecured Notes/Bond Issue Closed by Jain International Trading B.V., Netherland (Wholly Owned Subsidiary of The Company) (Corp. Action)Shyam SunderNo ratings yet

- Assignment On SebiDocument8 pagesAssignment On SebiasthaparasarNo ratings yet

- French - Gold in WW1 2013 PDFDocument6 pagesFrench - Gold in WW1 2013 PDFJoe SampleNo ratings yet

- FMI7e ch19Document49 pagesFMI7e ch19lehoangthuchienNo ratings yet

- Intermediate Accounting BookDocument441 pagesIntermediate Accounting BookMD. Monzurul Karim Shanchay100% (1)

- 2.5 - Rep - Identity Staff - CIC - 14.03.2021Document3 pages2.5 - Rep - Identity Staff - CIC - 14.03.2021Parth BindalNo ratings yet

- Sail IndiaDocument24 pagesSail IndiaAswini Kumar BhuyanNo ratings yet

- 1101 Kas 1103 Piutang Usaha 1106 Biaya Dibayar Dimuka: Account No Account Name Account TypeDocument3 pages1101 Kas 1103 Piutang Usaha 1106 Biaya Dibayar Dimuka: Account No Account Name Account TypeAmelia LarasatiNo ratings yet