Professional Documents

Culture Documents

(PubCorp) 12 - Funa V MECO - Rodriguez

Uploaded by

Isabella RodriguezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(PubCorp) 12 - Funa V MECO - Rodriguez

Uploaded by

Isabella RodriguezCopyright:

Available Formats

B2022 REPORTS ANNOTATED VOL 32 [Date]

Funa v MECO Funa v MECO

I. Summary and relevant doctrines “authorized” by the gov’t to perform certain “consular and other functions”

related to promotion, protection and facilitation of PH interests in Taiwan.

Funa requested COA for a copy of MECO’s latest financial and audit MECO currently oversees the rights of OFWs in Taiwan and promotes

reports. COA however has never audited MECO. Funa filed a petition for the PH as a tourist and investment destination to Taiwan.

Mandamus claiming that COA should audit MECO because MECO is a

Government owned and controlled corporation. Facts Leading to the Mandamus

On Aug 23, 2010, Dennis Funa sent a letter to COA requesting a copy

The Court defined MECO not as a GOCC but as a Sui Generis entity. “of the latest financial and audit report” of MECO invoking it as his

COA can still audit MECO on government related funds such as the constitutional right to information of public matters. Funa believed that

verification and consular fees. MECO is a government owned and controlled corporation (GOCC) and

subject to audit jurisdiction of COA. On Aug 25 COA Assistant

II. Facts of the case Commissioner Jaime Naranjo revealed in a memorandum that MECO was

not among the agencies audited by any of the 3 Clusters of the Corporate

Brief History of MECO Government Sector

After the Chinese Civil War, China had 2 governments, communist Funa filed an instant petition for mandamus on Sep 8 taking the

People’s Republic of China (PROC) which controls the mainland, and memorandum of COA to be an admission of never auditing MECO. Funa

nationalist Republic of China (ROC) which controls Taiwan. Both adhered claims that COA neglected its duty under Sec 2(1), Art IX-D of the

to the “One China Policy” (only one legitimate government in China). With Constitution, to audit the accounts of a GOCC or government instrumentality

conflicting claims of sovereignty, the question arose as to which should be (GI). He agrued that MECO possess all essential characteristics of a GOCC;

recognized as the country’s legitimate government. ROC was originally it is a non-stock corporation vested with governmental functions relating to

favoured, being a founding member of the UN; however most states public needs, and it is controlled by the gov’t thru a board of directors

terminated their official relations with ROC and established diplomatic appointed by the president. Funa also claims that the American Institute in

relations with the PROC, the Philippines included. Taiwan, the counterpart of MECO in the USA, is audited by Comptroller

The Philippines ended its official diplomatic relations with Taiwan on General.

June 9, 1975 when the PH and PROC expressed mutual recognition thru the MECO’s Position

Joint Communique between the two states. It reads “The Philippines’ MECO argues that the mandamus petition was prematurely filed. They

commitment to the One China policy of the PROC, however, did not preclude claim that there was no refusal by them or by COA to an audit and that Funa

the country from keeping unofficial relations with Taiwan on a "people-to- never demanded an audit to be done. The only demand was requesting a copy

people" basis.10 Maintaining ties with Taiwan that is permissible by the of the latest reports.

terms of the Joint Communiqué, however, necessarily required the MECO argues on merits that it is not a GOCC despite performing public

Philippines, and Taiwan, to course any such relations thru offices outside of functions. It is a corporation organized under the corporation code, and is

the official or governmental organs.” Taiwan and the Philippines maintained governed by provisions of the code, articles of incorporation and by-laws,

an unofficial relationship facilitated by the offices of the Taipei Economic thus all of its directors, officers, and members are private individuals and not

and Cultural Office, and the Manila Economic and Cultural Office (MECO). government officials. The government only has policy supervision over the

MECO was organized on Dec 16, 1997 as a NON-STOCK, NON- PROFIT MECO. MECO emphasized that categorizing it as a GOCC could violate the

CORPORATION, under BP 68 or the Corp. Code. country’s commitment to One China policy.

MECO became the corporate entity entrusted to foster friendly and

unofficial relations with Taiwan, in particular: trade, economic cooperation, COA’s Position

investment, cultural, scientific, and educational exchanges. MECO was

G.R. NO: 155207 PONENTE: Perez, J

ARTICLE; TOPIC OF CASE: Government functions through a Sui Generis entity DIGEST MAKER: Joshua Pena (edtied for Pubcorp by Brod)

B2022 REPORTS ANNOTATED VOL 32 [Date]

Funa v MECO Funa v MECO

COA argues that the petition be dismissed on the procedural grounds. Funa claims that MECO be audited because it is a GOCC or government

They claim that Funa is not aggrieved of prejudiced by their failure to audit instrumentality (GI). The court states that it is not. GOCCs must be 1.)

the accounts of MECO, thus having no locus standi. Funa also violated the stock or non-stock corporations, 2.) vested with functions relating to

doctrine of hierarchy of courts, claiming the petition could have been well public needs, 3.) owned by the gov’t directly or through its

presented before CA or RTC. They also argue that the petition is moot when instrumentalities.

COA directed a team to proceed to Taiwan for the purposes of auditing

MECO. MECO is a non-stock corporation as it was incorporated as one on DEC 16

1977 under the Corporation Code. MECO also performs functions with a

public aspect. It facilitates unofficial relations with the people in Taiwan.

III. Issue/s However the Gov’t doesn’t own MECO.

W/N the COA is, under prevailing law, mandated to audit the accounts The gov’t own a stock or non-stock corporation if it has controlling interest

of the MECO. Conversely, are the accounts of the MECO subject to the in it. For stock corporations this is 51% of capital stock. For non-stock

audit of the COA. (Partial yes) corporations, controlling interest is affirmed, when majority of the members

are gov’t officials or if there is substantial participation of the gov’t in the

selection of the corporation’s governing board.

IV. Ratio/Legal Basis

Petitioner argued that gov’t has controlling interest in MECO because the

Yes, the COA should audit MECO but only on certain government President of PH indirectly appoints the directors thru “desire letters”

related funds such as Verification and Consular fees. addressed to its board. MECO countered that these are merely

recommendatory. As a corporation under the Corporation Code, matters

Under Section 2(1) of Article IX-D of the Constitution, the COA was vested relating to elections of officers and directors, as well as membership, are

with the "power, authority and duty" to "examine, audit and settle" the governed by provisions of the code, articles of incorporation and its by-laws.

"accounts" of the following entities: No members of MECO were established as gov’t appointees or public

officers.

1. The government, or any of its subdivisions, agencies and

instrumentalities; Court defined MECO not as a Government Instrumentality but as a SUI

2. GOCCs with original charters; GENERIS ENTITY (unique entity).

3. GOCCs without original charters;

4. Constitutional bodies, commissions and offices that have been granted MECO was not intended to operate as any other ordinary corporation.

fiscal autonomy under the Constitution; and The MECO was "entrusted" by the government with the "delicate and

5. Non-governmental entities receiving subsidy or equity, directly or precarious" responsibility of pursuing "unofficial" relations with the

indirectly, from or through the government, which are required by law or people of a foreign land whose government the Philippines is bound not

the granting institution to submit to the COA for audit as a condition of to recognize. Although private, the executive department must exercise

subsidy or equity. some form of oversight, no matter how limited. It is clear the MECO is

uniquely situated compared to other private corporations, maintaining

Complementing the constitutional power of the COA to audit accounts of its legal status as a non-gov’t entity while having functioning as one.

"non-governmental entities receiving subsidy or equity xxx from or

through the government" is Section 29(1) of the Audit Code, however these COA argues that despite it being a non-gov’t entity, it may still be

are limited only to “funds coming from or through the gov’t”. audited with respect to its Verification fees. MECO receives them by

reason of being the collection agent of DOLE in Taiwan. The verification

G.R. NO: 155207 PONENTE: Perez, J

ARTICLE; TOPIC OF CASE: Government functions through a Sui Generis entity DIGEST MAKER: Joshua Pena (edtied for Pubcorp by Brod)

B2022 REPORTS ANNOTATED VOL 32 [Date]

Funa v MECO Funa v MECO

fees are allocated as such MECO receives $10, DOLE receives $10,

common fund between them $10.

Consular fees are also auditable by COA as these are derived from their

exercise of consular functions entrusted to the MECO by the gov’t.

V. Disposition

VI. Notes

Mandamus. Order to perform a public or statutory duty

Government-Owned or -Controlled Corporation (GOCC) refers to any

agency organized as a stock or nonstock corporation, vested with functions

relating to public needs whether governmental or proprietary in nature, and

owned by the Government of the Republic of the Philippines directly or

through its instrumentalities either wholly or, where applicable as in the case

of stock corporations, the extent of at least a majority of its outstanding

capital stock: Provided, however, That for purposes of this Act, the term

"GOCC" shall include GlCP/GCE and GFI as defined herein.

3 Attributes required to be a GOCC

1. Stock or non-stock Corporations

2. Vested with functions relating to public needs

3. Owned by the Government directly or through its instrumentalities

G.R. NO: 155207 PONENTE: Perez, J

ARTICLE; TOPIC OF CASE: Government functions through a Sui Generis entity DIGEST MAKER: Joshua Pena (edtied for Pubcorp by Brod)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fairways v. Corp GovernanceDocument4 pagesFairways v. Corp GovernanceIsabella RodriguezNo ratings yet

- Republic of The Philippines Province of Davao de Oro Municipality of Monkayo Barangay SalvacionDocument2 pagesRepublic of The Philippines Province of Davao de Oro Municipality of Monkayo Barangay SalvacionGilbert BaguioNo ratings yet

- Special Power of Attorney Jessica ArcillaDocument2 pagesSpecial Power of Attorney Jessica ArcillaChase DaclanNo ratings yet

- Bearod - Atty. Axel CruzDocument13 pagesBearod - Atty. Axel CruzIsabella Rodriguez100% (2)

- Agreed Upon Procedures vs. Consulting EngagementsDocument49 pagesAgreed Upon Procedures vs. Consulting EngagementsCharles B. Hall100% (1)

- 1st CasesDocument14 pages1st CasesGerard Anthony Teves RosalesNo ratings yet

- ObligationsDocument21 pagesObligationsRaisa Gelera100% (1)

- Pili Vs RessureccionDocument10 pagesPili Vs RessureccionFrancis Coronel Jr.No ratings yet

- Admin Law Case AssignmentDocument25 pagesAdmin Law Case AssignmentIsabella RodriguezNo ratings yet

- 5 Sison Vs ComelecDocument2 pages5 Sison Vs ComelecrbNo ratings yet

- OCA CIRCULAR NO. 173-2017, August 17, 2017Document2 pagesOCA CIRCULAR NO. 173-2017, August 17, 2017Isabella RodriguezNo ratings yet

- 04 Sarah Woolley EJFall 13Document11 pages04 Sarah Woolley EJFall 13Isabella RodriguezNo ratings yet

- Impacts of Social Media (Facebook) On Human Communication and Relationships: A View On Behavioral Change and Social UnityDocument24 pagesImpacts of Social Media (Facebook) On Human Communication and Relationships: A View On Behavioral Change and Social UnityIsabella RodriguezNo ratings yet

- 1989 Wage - Rationalization - Act20170201 898 11a7l6a PDFDocument8 pages1989 Wage - Rationalization - Act20170201 898 11a7l6a PDFIsabella RodriguezNo ratings yet

- Refusal To Be TransferredDocument2 pagesRefusal To Be TransferredIsabella RodriguezNo ratings yet

- Gulf Resorts Inc. V Philippine Charter Insurance Gulf Resorts Inc. V Philippine Charter InsuranceDocument2 pagesGulf Resorts Inc. V Philippine Charter Insurance Gulf Resorts Inc. V Philippine Charter InsuranceIsabella RodriguezNo ratings yet

- PAL v. Civil Aeronautics Board - NOT MINEDocument4 pagesPAL v. Civil Aeronautics Board - NOT MINEIsabella RodriguezNo ratings yet

- Red Highlights Are Questions He Expressly Stated: Bea RodDocument15 pagesRed Highlights Are Questions He Expressly Stated: Bea RodIsabella RodriguezNo ratings yet

- Robbery With Violence of Intimidation of Persons: BearodDocument6 pagesRobbery With Violence of Intimidation of Persons: BearodIsabella RodriguezNo ratings yet

- BurpDocument239 pagesBurpIsabella RodriguezNo ratings yet

- GSISDocument5 pagesGSISIsabella RodriguezNo ratings yet

- Additional CasesDocument30 pagesAdditional CasesIsabella RodriguezNo ratings yet

- The Case: HcadisDocument7 pagesThe Case: HcadisIsabella RodriguezNo ratings yet

- Powers of Female Hindu in Case of Inheritance: BY T. Akash Kumar Venkata SaiDocument16 pagesPowers of Female Hindu in Case of Inheritance: BY T. Akash Kumar Venkata SaiSai Malavika TuluguNo ratings yet

- United States Court of Appeals Fourth CircuitDocument9 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- PAS 24 Related PartiesDocument4 pagesPAS 24 Related Partiesjapvivi ceceNo ratings yet

- Humangear ComplaintDocument46 pagesHumangear ComplaintSarah BursteinNo ratings yet

- Design Review StepsDocument4 pagesDesign Review Stepsapi-448508911No ratings yet

- Tarazi v. Geller Et Al. - Motion For Protective OrderDocument12 pagesTarazi v. Geller Et Al. - Motion For Protective OrderMyPetJawaBarbarossaNo ratings yet

- Filipino Grievances Against Governor WoodDocument15 pagesFilipino Grievances Against Governor WoodPatrick Hirang100% (2)

- State of Kerala v. M.A. Mathai: Cases - Voidable Contracts Case Name Citation JudgementDocument4 pagesState of Kerala v. M.A. Mathai: Cases - Voidable Contracts Case Name Citation JudgementAishwarya ShankarNo ratings yet

- Comparative Policing Theory and PraxisDocument23 pagesComparative Policing Theory and PraxisEljay LimyocoNo ratings yet

- LawSocietyRules 2020-12Document244 pagesLawSocietyRules 2020-12Yvonne BorsethNo ratings yet

- GazaDocument16 pagesGazaFIDELIS CHIKOMBANo ratings yet

- Zottola Et Al. Superseding Indictment 0Document8 pagesZottola Et Al. Superseding Indictment 0tom clearyNo ratings yet

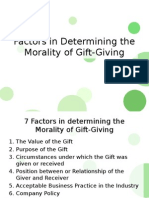

- Factors in Determining The Morality of Gift-GivingDocument11 pagesFactors in Determining The Morality of Gift-GivingDarling Mae Cabrera67% (3)

- United States v. William J. Armantrout, 411 F.2d 60, 2d Cir. (1969)Document8 pagesUnited States v. William J. Armantrout, 411 F.2d 60, 2d Cir. (1969)Scribd Government DocsNo ratings yet

- 2008 SCMR 1384 Case SummaryDocument3 pages2008 SCMR 1384 Case SummaryWaris ArslanNo ratings yet

- Code of Conduct and Ethical Standards For Public Officials and EmployeesDocument71 pagesCode of Conduct and Ethical Standards For Public Officials and EmployeesGleneden A Balverde-MasdoNo ratings yet

- Personnel Recruitment, Selection and Orientation PDFDocument10 pagesPersonnel Recruitment, Selection and Orientation PDFDarren Cariño0% (1)

- Ricafort Vs CalalangDocument28 pagesRicafort Vs CalalangSheina Marie OnrubiaNo ratings yet

- NCAA Draft ConstitutionDocument21 pagesNCAA Draft ConstitutionKatie CrolleyNo ratings yet

- PC & PNDT PresentationDocument42 pagesPC & PNDT PresentationKumar DashNo ratings yet

- Jehl 01 2019-1Document219 pagesJehl 01 2019-1Alexandre W. PedroNo ratings yet

- Murado Abdo - ExpropriationDocument40 pagesMurado Abdo - ExpropriationBiruk AmareNo ratings yet

- RR 18th AmendmentDocument6 pagesRR 18th AmendmentMaquacR7No ratings yet