Professional Documents

Culture Documents

5a44e258-cfcb-40eb-8eb9-e82e043d63b7

Uploaded by

qadam guiilenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5a44e258-cfcb-40eb-8eb9-e82e043d63b7

Uploaded by

qadam guiilenCopyright:

Available Formats

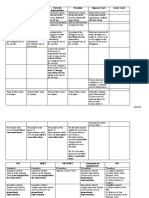

Auto Policy#: A3148082

MANDATORY UNINSURED MOTORISTS BODILY INJURY COVERAGE OFFER

The California Insurance Code requires that all automobile liability policies contain Uninsured Motorists

Bodily Injury Coverage with limits equal to your Bodily Injury Liability Coverage, but limits in excess of

$30,000 per person, $60,000 per accident split limits, or $60,000 per accident single limit are not required to

be offered. You may reject these limits and select limits lower than the Bodily Injury Liability Coverage.

Uninsured Motorists Bodily Injury Coverage pays for bodily injury losses to you and your passengers as a result of an

accident with a driver who has no liability protection and is legally responsible for the injuries. This includes a hit-and-

run vehicle whose owner and operator cannot be identified. Uninsured Motorists Bodily Injury Coverage also provides

Underinsured Motorists Bodily Injury Coverage. This coverage pays for bodily injury losses to you and your

passengers as a result of an accident with a driver who has liability protection with limits that are lower than the

Uninsured Motorists Bodily Injury limits you have selected, and that person is legally responsible for your injuries.

Please indicate your choices by initialing next to the appropriate item(s) below.

Rejection of Uninsured Motorists Bodily Injury Coverage

The California Insurance Code requires that we provide you with the following information:

The California Insurance Code requires an insurer to provide Uninsured Motorists Bodily Injury Coverage in each

bodily injury liability insurance policy it issues covering liability arising out of the ownership, maintenance, or use of a

motor vehicle. Those provisions also permit the insurer and the applicant to delete the coverage completely or to delete

the coverage when a motor vehicle is operated by a natural person or persons designated by name. Uninsured

Motorists Bodily Injury Coverage insures the insured, his or her heirs or legal representatives for all sums within the

limits established by law, which the person or persons are legally entitled to recover as damages for bodily injury,

including any resulting sickness, disease or death to the insured from the owner or operator of an uninsured motor

vehicle not owned or operated by the insured or a resident of the same household. An uninsured motor vehicle

includes an underinsured motor vehicle as defined in subdivision (p) of Section 11580.2 of the Insurance Code.

_______ I reject Uninsured Motorists Bodily Injury Coverage entirely.

_______ I reject Uninsured Motorists Bodily Injury Coverage only with respect to the following individuals:

Name(s) of Excluded Drivers(s):

DOUGLAS GUILLEN

Safeco Insurance Company of America

Auto Policy#: A3148082

Lower Limit(s) for Uninsured Motorists Bodily Injury Coverage

The California Insurance Code requires that we provide you with the following information:

The California Insurance Code requires an insurer to provide Uninsured Motorists Bodily Injury Coverage in each

bodily injury liability insurance policy it issues covering liability arising out of the ownership, maintenance or use of a

motor vehicle. Those provisions also permit the insurer and the applicant to agree to provide the coverage in an

amount less than that required by subdivision (m) of Section 11580.2 of the Insurance Code but not less than the

financial responsibility requirements. Uninsured Motorists Bodily Injury Coverage insures the insured, his or her heirs,

or legal representatives for all sums within the limits established by law, which the person or persons are legally entitled

to recover as damages for bodily injury, including any resulting sickness, disease or death, to the insured from the

owner or operator of an uninsured motor vehicle not owned or operated by the insured or a resident of the same

household. An uninsured motor vehicle includes an underinsured motor vehicle as defined in subdivision (p) of Section

11580.2 of the Insurance Code.

I Select Uninsured Motorists Bodily Injury Coverage limit(s) of $25,000/$50,000 which are lower

_______

than my bodily injury liability limit(s).

Coverage is generally described here. Only the policy provides a complete description of the coverages and their

limitations.

__________________________________ ______________

Safeco Insurance Company of America

Auto Policy#: A3148082

MANDATORY UNINSURED MOTORISTS PROPERTY DAMAGE COVERAGE OFFER

The California Insurance Code requires that we provide you with the following information:

Uninsured Motorists Property Damage Coverage pays for damages or destruction of a covered auto caused by an

auto accident where an insured is legally entitled to recover from the owner or operator of certain types of uninsured

motor vehicles.

Uninsured Motorists Property Damage Coverage is available only:

1. If you have not rejected Uninsured Motorists Bodily Injury Coverage, and

2. For autos for which you have not purchased Collision Coverage.

This coverage is not applicable to commercial vehicles transporting persons for hire, compensation or profit designed,

used or maintained primarily for the transportation of property.

Please indicate your choices by initialing next to the appropriate item(s) below.

I select Uninsured Motorists Property Damage Coverage at a limit of $3,500 for each accident for

_______

the vehicle listed below:

1999 TOYT CAMRY LE/XLE

YEAR MAKE MODEL

_______ I reject Uninsured Motorists Property Damage Coverage entirely.

I reject Uninsured Motorists Property Damage Coverage only with respect to the following

_______

individuals:

Name(s) of Excluded Drivers(s):

DOUGLAS GUILLEN

Safeco Insurance Company of America

Auto Policy#: A3148082

Coverage is generally described here. Only the policy provides a complete description of the coverages and their

limitations.

__________________________________ ______________

Safeco Insurance Company of America

Auto Policy#: A3148082

EVIDENCE OF COVERAGE

This certifies that the policy of insurance identified here was issued by an authorized insurer and is in force. Coverage

meets the limits required by law.

Date Prepared: 07/10/2017

Effective Date: 09/19/2016 Expiration Date: 09/19/2017

Insured: Agent:

DOUGLAS GUILLEN ONE STOP AUTO INS AGENCY INC

MARIA GUILLEN 322 W KATELLA AVE STE 5A

2226 AVALON ST ORANGE, CA 92867-4759

COSTA MESA, CA 92627-1620 Phone Number: (949) 574-9262

Agent Number: 170493

Email: ONESTOPINS4U@GMAIL.COM

Vehicle Number: 3 1999 TOYT CAMRY LE/XLE VIN: JT2BG22K7X0356771

24 Hour Claims Hotline: 1-800-332-3226

A formal auto ID card will be issued. If not received in 30 days please contact your agent.

Safeco Insurance Company of America

You might also like

- HistoriaDocument1 pageHistoriaqadam guiilenNo ratings yet

- Help PDFDocument4 pagesHelp PDFAditya SinghNo ratings yet

- Demographics.a r7EEdWdVW9LvoI zYUdQ.20170810.20171107.UN001Document141 pagesDemographics.a r7EEdWdVW9LvoI zYUdQ.20170810.20171107.UN001qadam guiilenNo ratings yet

- Alefato HebreoDocument35 pagesAlefato Hebreoqadam guiilenNo ratings yet

- Alefato HebreoDocument35 pagesAlefato Hebreoqadam guiilenNo ratings yet

- 72 Names Chart EngDocument1 page72 Names Chart EngCa Casas Istória RiaNo ratings yet

- Manual de ShabbatDocument1 pageManual de Shabbatqadam guiilenNo ratings yet

- EspnDocument1 pageEspnqadam guiilenNo ratings yet

- Titlelos 10 MandamientosDocument1 pageTitlelos 10 MandamientosHilel Lxa YahNo ratings yet

- M LB Encr NDocument14 pagesM LB Encr Nqadam guiilenNo ratings yet

- Readme PDFDocument1 pageReadme PDFqadam guiilenNo ratings yet

- Canales Latinos18Document7 pagesCanales Latinos18qadam guiilenNo ratings yet

- This Week in Band... 92115Document1 pageThis Week in Band... 92115qadam guiilenNo ratings yet

- Shalom UDocument8 pagesShalom Uqadam guiilenNo ratings yet

- ListaDocument5 pagesListaqadam guiilenNo ratings yet

- Deportes 1.3Document2 pagesDeportes 1.3qadam guiilen100% (1)

- Lista 5Document9 pagesLista 5qadam guiilenNo ratings yet

- GabrielDocument2 pagesGabrielqadam guiilenNo ratings yet

- 72 Names Chart EngDocument1 page72 Names Chart EngCa Casas Istória RiaNo ratings yet

- MiaDocument32 pagesMiaqadam guiilenNo ratings yet

- Deportes SebasDocument1 pageDeportes Sebasqadam guiilenNo ratings yet

- Lista 7Document45 pagesLista 7qadam guiilenNo ratings yet

- Deportes 1.3Document2 pagesDeportes 1.3qadam guiilen100% (1)

- Congress CH 10Document34 pagesCongress CH 10qadam guiilenNo ratings yet

- Latinos EscogidosDocument1 pageLatinos Escogidosqadam guiilenNo ratings yet

- Lisra 4Document13 pagesLisra 4qadam guiilenNo ratings yet

- Canales TV PagaDocument1 pageCanales TV Pagaqadam guiilenNo ratings yet

- AgostoDocument3 pagesAgostoqadam guiilenNo ratings yet

- Peliculas de TodoDocument8 pagesPeliculas de Todoqadam guiilenNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Natural ZnO Sunscreen SPF 30Document1 pageNatural ZnO Sunscreen SPF 30rahayu wirayantiNo ratings yet

- Filipinas Marble CorporationDocument1 pageFilipinas Marble CorporationAllan Cj SangkateNo ratings yet

- Southern National Bank of North Carolina v. Federal Resources Corporation Kenyon Home Furnishings, LTD., and James W. Pearce Elizabeth Contogiannis Steve Palinkas, 911 F.2d 724, 4th Cir. (1990)Document6 pagesSouthern National Bank of North Carolina v. Federal Resources Corporation Kenyon Home Furnishings, LTD., and James W. Pearce Elizabeth Contogiannis Steve Palinkas, 911 F.2d 724, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- New ProblemDocument5 pagesNew ProblemEnoch RNo ratings yet

- 1 Oblicon RealFamDocument31 pages1 Oblicon RealFamEfrean BianesNo ratings yet

- Christian - Spa Bureau of ImmigrationDocument2 pagesChristian - Spa Bureau of ImmigrationMark AbiloNo ratings yet

- 6.2 Labour Law IIDocument6 pages6.2 Labour Law IIDevvrat garhwalNo ratings yet

- 15439rr04 12Document16 pages15439rr04 12Sy HimNo ratings yet

- BSI-TR-03162 - EnglishDocument31 pagesBSI-TR-03162 - EnglishCesar Augusto Villanueva RodriguezNo ratings yet

- 2 Sem SyllabusDocument3 pages2 Sem SyllabusShubham Jain ModiNo ratings yet

- Prestige Cost CalculatorDocument2 pagesPrestige Cost CalculatornpriyadarshiNo ratings yet

- Philippineschrono 06Document3 pagesPhilippineschrono 06Jocelle DemaalaNo ratings yet

- MomentumDocument10 pagesMomentumBatisane Kantsu MathumoNo ratings yet

- B120791636 47143254 PDFDocument1 pageB120791636 47143254 PDFsuresh2250No ratings yet

- CR Certificate (1465731)Document6 pagesCR Certificate (1465731)rampartnersbusinessllcNo ratings yet

- Constitutional Law Reviewer Jech TiuDocument52 pagesConstitutional Law Reviewer Jech TiuJech TiuNo ratings yet

- ITMP Policy Addendum Ver.12Document5 pagesITMP Policy Addendum Ver.12Piyush MishraNo ratings yet

- Saima Wazed WikiDocument3 pagesSaima Wazed WikiMichaelStevansNo ratings yet

- Course in Real Analysis 1st Junghenn Solution ManualDocument38 pagesCourse in Real Analysis 1st Junghenn Solution Manualmitchellunderwooda4p4d100% (15)

- Capital Budgeting Cash FlowsDocument35 pagesCapital Budgeting Cash FlowsBilal JuttNo ratings yet

- Ground RulesDocument2 pagesGround RulespulithepogiNo ratings yet

- Superposition TheoremDocument9 pagesSuperposition TheoremAditya SinghNo ratings yet

- Tupan AnnoucementDocument4 pagesTupan Annoucementmizukangen2021No ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- Nse4 Infraestructura 351-387Document37 pagesNse4 Infraestructura 351-387leydis GarciaNo ratings yet

- Chapter Ii - Construction and Interpretation Chapter Iv - Adherence To, or Departure From, Language ofDocument16 pagesChapter Ii - Construction and Interpretation Chapter Iv - Adherence To, or Departure From, Language ofCJNo ratings yet

- SPPL 07 02 PDFDocument17 pagesSPPL 07 02 PDFFattia SyafiraNo ratings yet

- Invoice No.: 10068722025019159244 Invoice No.: 10068722025019159244Document1 pageInvoice No.: 10068722025019159244 Invoice No.: 10068722025019159244Muhammad Rashid Instructor (Computer Science) IET KhairpurNo ratings yet

- Undertaking by Imran RashidDocument2 pagesUndertaking by Imran Rashidfyza imranNo ratings yet

- App-5 - Position Info Business Support Dept. HeadDocument2 pagesApp-5 - Position Info Business Support Dept. HeadBashar AbuirmailehNo ratings yet