Professional Documents

Culture Documents

CTC - Salary Calculator

CTC - Salary Calculator

Uploaded by

Revappa Yedde0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

CTC- Salary calculator.xls

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageCTC - Salary Calculator

CTC - Salary Calculator

Uploaded by

Revappa YeddeCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

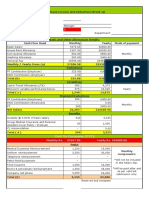

Yearly & Monthly Break Up of Salary for F.Y.

2008-09

Basic 50%

HRA 20%

Medical 10%

Misc. 1%

Conveyance 6%

Education. (13% - E P F + ESIC)

Particulars Yearly Grand Totals Monthly Monthly

Salary Break Salary Total

up

Annual CTC without Bonus & L. T. A. 6 57 360 54 780

Basic 3 28 680 27 390

H. R. A. 1 31 472 10 956

Misc. Allowance 6 574 548

Medical Allowance 65 736 5 478

Conveyance Allowance 39 442 3 287

Education Allowance 76 097 6 341

Mobile and Car Expense ( On Actual)

*Gratuity

**Superannuation

Gross Salary (A) 6 48 000 54 000 (A)

Performance Bonus + L.T.A. 8 000

Less : Deduction (B)

PF - Employers Contribution 12% of basic or

Rs. 780/- whichever is less 9 360 780

P.F. ( Employees Contribution 12% of Basic or

Rs 780/- whicever is less) 9 360 780

ESIC - Employers Contribution 4.75% of

Gross Salary. -

ESIC - Employees Contribution 1.75% of

Gross Salary. -

Professional Tax 2 500 11 860 200 980 (B)

Net Salary Payable (A-B) 6 36 140 53 020 (A-B)

Conveyance Re-imbursement

You might also like

- Terms of Employment 2018Document11 pagesTerms of Employment 2018Dinesh Yadav100% (2)

- Salary Breakup Calculator Excel 1Document2 pagesSalary Breakup Calculator Excel 1Rajinder KumarNo ratings yet

- CTC Break UpDocument100 pagesCTC Break UpnareshNo ratings yet

- Sample Salary - 10lacDocument1 pageSample Salary - 10lacManpreet Kour100% (1)

- Employee Joining FormDocument2 pagesEmployee Joining FormArun Kumar100% (1)

- June SalaryDocument1 pageJune Salaryaruna nadagouniNo ratings yet

- Review Letter - Oct 19 - Chandan TatiDocument2 pagesReview Letter - Oct 19 - Chandan Tatimadali sivareddyNo ratings yet

- Employee Joining FormDocument2 pagesEmployee Joining FormSwapnashree Das100% (2)

- Annexure A - Applicant Information & Declaration FormDocument8 pagesAnnexure A - Applicant Information & Declaration FormAnonymous rYZyQQot55No ratings yet

- Offer Letter - Nafisa 1Document9 pagesOffer Letter - Nafisa 1surinder sangarNo ratings yet

- Ahmedabad: Drive India Enterprise Solution LTDDocument5 pagesAhmedabad: Drive India Enterprise Solution LTDshah_rahul1981No ratings yet

- Employment Application Form Tata ProjectsDocument6 pagesEmployment Application Form Tata ProjectsSheezan Khan0% (1)

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300No ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Salary Breakup Calculator ExcelDocument3 pagesSalary Breakup Calculator ExcelBabita KumariNo ratings yet

- CTC Break-Up PDFDocument5 pagesCTC Break-Up PDFJatinder SadhanaNo ratings yet

- CTC Break Up - PGDM 1Document16 pagesCTC Break Up - PGDM 1piyush rawatNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Excel Payroll AdministrationDocument12 pagesExcel Payroll AdministrationBen AsamoahNo ratings yet

- Annexure II Details of AllowancesDocument4 pagesAnnexure II Details of AllowancesPravin Balasaheb GunjalNo ratings yet

- Appointment Salary BreakupDocument1 pageAppointment Salary BreakupPhani KumarNo ratings yet

- CTC - Salary CalculatorDocument4 pagesCTC - Salary Calculatorboopathi.nNo ratings yet

- Master CTC Calculator & Salary Hike CalculatorDocument6 pagesMaster CTC Calculator & Salary Hike Calculatorvirag_shahsNo ratings yet

- CTC AssignmentDocument5 pagesCTC AssignmentAbhishek VermaNo ratings yet

- Salary Breakup (Salary Structure)Document3 pagesSalary Breakup (Salary Structure)Srikanth Reddy KomatlaNo ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureDocument6 pagesSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeNo ratings yet

- Salary Break Up HRDocument4 pagesSalary Break Up HRnaman156No ratings yet

- Indian CTC FormatDocument3 pagesIndian CTC FormatVasanth Kumar V0% (1)

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Neha Soni - Pune - Offer of EmploymentDocument10 pagesNeha Soni - Pune - Offer of EmploymentRahul JagdaleNo ratings yet

- BSNL Salary SlipDocument1 pageBSNL Salary Slipempirecot100% (1)

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Salary Statement SmitDocument1 pageSalary Statement SmitSmit PatoliyaNo ratings yet

- Umesh Kumar-Offer LetterDocument2 pagesUmesh Kumar-Offer LetterUMESH KUMARNo ratings yet

- Pooja Offer LetterDocument5 pagesPooja Offer LetterVAIJANATH ADANENo ratings yet

- Udipta Energy & Equipment Pvt. LTDDocument3 pagesUdipta Energy & Equipment Pvt. LTDParesh NayakNo ratings yet

- Employee Details FormDocument2 pagesEmployee Details FormVilhas DesaiNo ratings yet

- Quikchex CTC CalculatorDocument8 pagesQuikchex CTC CalculatoriamgodrajeshNo ratings yet

- CTC Break Up For Appointment LetterDocument4 pagesCTC Break Up For Appointment LetterWall Street Forex (WSFx)No ratings yet

- Employee Benefits IndiaDocument2 pagesEmployee Benefits Indiabaskarbaju1No ratings yet

- Components % Age Monthly AnnualDocument7 pagesComponents % Age Monthly Annualtarique1189040No ratings yet

- Offshore Increment Letter2014Document2 pagesOffshore Increment Letter2014Ashok Taneja0% (2)

- Accenture LetterDocument1 pageAccenture LettersdrfNo ratings yet

- HikeDocument1 pageHikeSapan KumarNo ratings yet

- EMPLYEE JOINING FORM-2003 FormatDocument4 pagesEMPLYEE JOINING FORM-2003 FormatBhavesh VijayvargiyaNo ratings yet

- Payslip MarDocument1 pagePayslip Marabhijitj0555No ratings yet

- Rohan CTCDocument1 pageRohan CTCRohanNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Annual Performance Review - 2015-16: (Subject To IT Deduction)Document1 pageAnnual Performance Review - 2015-16: (Subject To IT Deduction)Vaibhavi Amit ShahNo ratings yet

- Salary Slip January 2024Document2 pagesSalary Slip January 2024MILAN BEHERANo ratings yet

- Name: Abhishek Kumar Employee ID: 162225: Fixed Compensation Variable Compensation Total Cash CompensationDocument3 pagesName: Abhishek Kumar Employee ID: 162225: Fixed Compensation Variable Compensation Total Cash CompensationManish KumarNo ratings yet

- Tcs Offer Letter - MergedDocument39 pagesTcs Offer Letter - Mergednishanegi9375No ratings yet

- Abcd Shweta Final PDFDocument76 pagesAbcd Shweta Final PDFriyaNo ratings yet

- Salary Slip FebDocument1 pageSalary Slip FebDee JeyNo ratings yet

- Form T: Wages Slip/Leave CardDocument2 pagesForm T: Wages Slip/Leave CardMuhammad AfzaalNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Salary Breakup SheetDocument6 pagesSalary Breakup SheetSathvika SaaraNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet