Professional Documents

Culture Documents

2.1 Statement of Comprehensive Income

Uploaded by

Graceila CalopeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2.1 Statement of Comprehensive Income

Uploaded by

Graceila CalopeCopyright:

Available Formats

Mindanao State University

College of Business Administration and Accountancy

DEPARTMENT OF ACCOUNTANCY

Marawi City

STATEMENT OF COMPREHENSIVE INCOME

Accounting 123

Name: _______________________________, CPA Section: _________ Score: __________

TRUE OR FALSE. Write A if the statement is correct and B if the statement is wrong. Erasures

are strictly not allowed.

_______1. Comprehensive income is an increase in economic benefit during the accounting

period in the form of inflow or increase in asset or decrease in liability that results in

increase in equity, other than contribution from equity participants.

_______2. Other comprehensive income comprises items of income and expense including

reclassification adjustments that are not recognized in profit or loss as required or

permitted by PFRSs and does not include dividends paid to shareholders.

_______3. An entity, whether presenting a single of statement of comprehensive income or a

separate income statement and statement of comprehensive income, must present

a statement of changes in equity.

_______4. Comprehensive income and net income are not synonymous.

_______5. Reclassification adjustments are amounts reclassified to other comprehensive

income in the current period but were recognized in profit or loss in the current or

previous period.

_______6. An entity presenting a natural income statement shall disclose additional

information on the nature of expenses including depreciation, amortization and

employee benefit cost.

_______7. PAS 1 does not require the use of cost of sales method even if this presentation

often provides more relevant information to users than the nature of expense

method.

_______8. Conceptually, net income is a measure of wealth.

_______9. The transaction approach to income measurement underlies financial accounting

and reporting.

_______10. The term comprehensive income must be reported on the face of the income

statement.

_______11. Under the transaction approach, the financial statement effects of business events

are classified as revenue, gains, expenses and losses which are used to measure

and define income.

_______12. A loss on disposal of a non-current asset is an example of an expense.

_______13. The physical capital transaction approach requires adoption of the current cost

measurement basis.

_______14. Under the physical capital concept, such as operating capability, capital is

regarded as the productive capacity of the entity whereas under the financial

capital concept, such as invested money, capital is synonymous with the net

assets or equity of the entity.

_______15. Profit is any amount over and above that required to maintain the capital at the

beginning of the period.

_______16. Under a strict transaction approach to income measurement, adjustment of

inventory to lower of cost or net realizable value when net realizable value is below

cost is not considered a transaction and should not be included in the

determination of net income.

_______17. A transaction that is material in amount, unusual in nature and infrequent in

occurrence shall be presented separately as a component of income from

continuing operations net of applicable income tax.

_______18. An entity has two options in presenting comprehensive income. The entity may

present a single income statement or a separate income statement and statement

of comprehensive income.

Page | 1 Prepared by: MSB

_______19. The financial performance of an entity is primarily measured in terms of the level of

income earned by the entity through the effective and efficient utilization of its

resources.

_______20. The income statement covers a period unlike a statement of financial position

which is prepared as of a given date or particular moment in time.

_______21. Unrealized gain or loss on investments in equity instruments measured at fair value

though profit or loss is not an example of other comprehensive income.

_______22. Income includes both the revenue that arises from the ordinary course of

operations and the gains resulting from incidental transactions.

_______23. Extraordinary items are no longer allowed to be presented as part of the income

statement and statement of comprehensive income.

_______24. No cost of sales line item is presented when using the nature of expense method.

_______25. Comprehensive income excludes prior period errors and the effects of changes in

accounting policies.

_______26. The financial performance of an entity is determined using two approaches namely,

financial capital approach and physical capital approach.

_______27. The purpose of the statement of comprehensive income is to provide a more

comprehensive information on financial performance measured more broadly than

the income as traditionally computed.

_______28. The statement of retained earnings is no longer a required basic statement.

_______29. The statement of changes in equity is a formal statement that shows the

movements in the elements and components of stockholders’ equity.

_______30. Dividends paid shall be recognized in the statement of comprehensive income.

_______31. A loss on disposal of asset shall be recognized in the statement of changes in

equity.

_______32. Profit is the residual amount that remains after expenses have been deducted from

income.

_______33. Allocation of profit or loss and total comprehensive income attributable to non-

controlling interests and owners of the parent shall be disclosed on the face of the

income statement and statement of comprehensive income.

_______34. Comprehensive income less other comprehensive income equals the profit or loss

for a given period.

_______35. Under PAS 1, the holders of instruments classified as equity are simply known as

“owners.”

SHORT PROBLEMS. Compute for the amounts asked by each problem. Final answers should

be written on the space provided. Write your solutions in a separate sheet of paper. Erasures

are strictly not allowed.

PROBLEM 1: Brock Company reports operating expenses according to their function within the

entity. The adjusted trial balance on December 31, 2011, included the following expense and

loss accounts:

Accounting and audit fees P 100,000

Advertising 275,000

Freight out 125,000

Doubtful accounts expense 90,000

Freight in 300,000

Interest on bonds issued 130,000

Loss on sale of long-term investment 270,000

Officers’ salaries and bonuses 1,245,000

Rent for office space 190,000

Sales salaries and commissions 800,000

Legal fees 175,000

Interest on inventory loan 260,000

Insurance 450,000

Income tax expense

Depreciation of building (1/3 of which is occupied

by the sales department and the rest by the

entity’s officers and staff) 900,000

1. How much should be classified as general and administrative expenses by Brock?

Answer: ___________________________

Page | 2 Prepared by: MSB

2. How much should be classified as distribution costs by Brock?

Answer: ___________________________

PROBLEM 2: Selected information from the accounting records of Vigor Company for 2011 is

as follows:

Net accounts receivable, January 1 P 1,800,000

Net accounts receivable, December 31 2,000,000

Accounts receivable turnover 5 times

Inventory, January 1 2,200,000

Inventory, December 31 2,400,000

Inventory turnover 4 times

3. How much is Vigor Company’s purchases?

Answer: ___________________________

4. How much is Vigor Company’s gross profit?

Answer: ___________________________

PROBLEM 3: The following information was taken from Armenia Company’s accounting

records for the current year:

Decrease in raw materials inventory P 500,000

Increase in goods in process inventory 800,000

Decrease in finished goods inventory 1,000,000

Raw materials purchased 20,000,000

Indirect labor – factory 600,000

Freight in 400,000

Factory supervisor’s salary 100,000

Direct labor payroll 5,000,000

Freight out 200,000

Depreciation – factory building 1,000,000

Utilities (2/3 applicable to factory building and 1/3

to office building) 3,000,000

Depreciation – office building 800,000

Indirect materials – factory 750,000

Insurance on (2/3 applicable to factory building

and 1/3 to office building) 990,000

Advertising 150,000

Loss on inventory writedown 225,000

5. What is Armenia’s cost of goods manufactured?

Answer: ___________________________

6. What is Armenia’s cost of goods sold?

Answer: ___________________________

PROBLEM 4: The financial records of Ronalyn Company were destroyed by fire at the end of

the current year. However, certain statistical data related to the income statement are available.

Interest expense P 20,000

Cost of goods sold 2,700,000

Sales discount 200,000

The beginning inventory was P400,000 and decreased 20% during the year. Administrative

expenses are 20% of cost of goods sold but only 9% of net sales. Four-fifths of the operating

expenses relate to sale activities.

7. Ignoring income tax, what is the net income for the current year?

Answer: ___________________________

PROBLEM 5: Thorpe Company reported net income of P9,750,000 for the current year. The

auditor raised questions about the following amounts that had been excluded from net income:

Page | 3 Prepared by: MSB

Unrealized loss on foreign currency translation P 320,000

Gain on early extinguishment of bonds payable 200,000

Adjustment of profit of prior year for error on

depreciation (gross of tax of 30%) 150,000

Loss from fire 450,000

Equity in earnings of Cinn Company – 40% 1,000,000

Dividend received from Cinn Company 300,000

Revaluation surplus 400,000

8. What is the corrected amount of net income?

Answer: ___________________________

PROBLEM 6: Witt Company, an entity engaged in the manufacture of bicycles incurred the

following during the current year:

Loss from major strike by employees P 350,000

Gain from condemnation of asset 300,000

Loss from abandonment of equipment used in

business 250,000

9. In the income statement, what is the total amount of infrequent losses and gains that

must be excluded from income from continuing operations?

Answer: ___________________________

10. What amount should be presented as net extraordinary gains or losses?

Answer: ___________________________

PROBLEM 7: The following information is provided by Puerto Rico, Inc. for the current year:

Sales P 2,500,000

Cost of goods sold 1,200,000

Distribution costs 250,000

General and administrative expenses 450,000

Interest expense 150,000

Gain on early extinguishment of long-term debt 50,000

Correction of error, net of tax – debit 75,000

Investment income – equity method 88,000

Gain on expropriation 25,000

Income tax expense 50,000

Dividends declared 130,000

Foreign translation adjustment – credit 85,000

Unusual and infrequent gains 300,000

Casualty loss 150,000

Finance charges on factoring of receivables 110,000

Loss on sale of investments 65,000

11. What amount should be reported by Puerto Rico as income from continuing operations?

Answer: ___________________________

12. At what amount should finance costs be reported by Puerto Rico?

Answer: ___________________________

PROBLEM 8: The adjusted trial balance of Dahlia Company included the following accounts for

the current year:

Sales P 2,700,000

Interest revenue 1,100,000

Gain on sale of equipment 350,000

Revaluation surplus during the year 550,000

Share of profit of associate 250,000

Cost of goods sold 150,000

Finance costs 175,000

Distribution costs 188,000

Page | 4 Prepared by: MSB

Administrative expenses 125,000

Translation loss on foreign operation 150,000

Income tax expense 130,000

Impairment loss 185,000

Unrealized gain on financial assets at fair value

through other comprehensive income 300,000

13. What amount should be presented as other comprehensive income?

Answer: ___________________________

14. What is Dahlia’s total comprehensive income?

Answer: ___________________________

PROBLEM 9: Mara Company provided the following net of tax figures for the current year:

Pension liability adjustment recognized in other

comprehensive income – credit P 60,000

Unrealized gain on financial assets at fair value

through other comprehensive income 300,000

Reclassification adjustment for gain on sale of

securities included in net income 50,000

Share warrants outstanding 80,000

Net income 1,540,000

15. What is the comprehensive income of Mara Company for the current year?

Answer: ___________________________

“Nothing in this world has ever been accomplished

without passion, faith and hard work.”

Anonymous

Page | 5 Prepared by: MSB

You might also like

- Seatwork 01 Statement of Income Answer KeyDocument3 pagesSeatwork 01 Statement of Income Answer KeyTshina Jill BranzuelaNo ratings yet

- FINALDocument3 pagesFINALSherlene Antenor SolisNo ratings yet

- FABM2 Quarter 1 Module and WorksheetsDocument27 pagesFABM2 Quarter 1 Module and WorksheetsHeart polvos100% (1)

- ACC 109 QUIZ: CASH FLOWS, ERRORS AND EVENTSDocument6 pagesACC 109 QUIZ: CASH FLOWS, ERRORS AND EVENTSJonela VintayenNo ratings yet

- Work Book of Corporate Financial Accounting 23-04-2022Document33 pagesWork Book of Corporate Financial Accounting 23-04-2022SWAPNIL JADHAVNo ratings yet

- BASIC FINANCE qm1Document3 pagesBASIC FINANCE qm1Erica GaytosNo ratings yet

- R17 Understanding Income Statements IFT NotesDocument21 pagesR17 Understanding Income Statements IFT Notessubhashini sureshNo ratings yet

- ACC 113 - SAS - Day - 2Document8 pagesACC 113 - SAS - Day - 2Joy QuitorianoNo ratings yet

- 3 RdquarterDocument7 pages3 RdquarterRylan Yani OlshpNo ratings yet

- Angadanan National High School 3rd quarter Examination ReviewDocument7 pagesAngadanan National High School 3rd quarter Examination ReviewRylan Yani OlshpNo ratings yet

- LM02 Analyzing Income Statements IFT NotesDocument19 pagesLM02 Analyzing Income Statements IFT NotesClaptrapjackNo ratings yet

- Acctg 13Document23 pagesAcctg 13Fatima ZaharaNo ratings yet

- Auditing ProblemsDocument12 pagesAuditing ProblemsTricia Nicole DimaanoNo ratings yet

- Fabm2 Law q1 Week 1 To 9Document21 pagesFabm2 Law q1 Week 1 To 9Karen, Togeno CabusNo ratings yet

- True or False Statements and Accounting ConceptsDocument5 pagesTrue or False Statements and Accounting ConceptsJamii Dalidig MacarambonNo ratings yet

- Financial Accounting and Analysis (D)Document17 pagesFinancial Accounting and Analysis (D)sushainkapoor photoNo ratings yet

- Test Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, WarfieldDocument12 pagesTest Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, Warfielda384600180No ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & Analysisdeval mahajanNo ratings yet

- Assignment 14 Ok TDocument10 pagesAssignment 14 Ok TJu RaizahNo ratings yet

- Final Long Quiz - FM203Document3 pagesFinal Long Quiz - FM203Sherlene Antenor SolisNo ratings yet

- Accountancy, Business and Management August 2-3, 2018: Mindanao Mission Academy Business FinanceDocument2 pagesAccountancy, Business and Management August 2-3, 2018: Mindanao Mission Academy Business FinanceHLeigh Nietes-Gabutan100% (1)

- Department of Education: Sablayan National Comprehensive High SchoolDocument1 pageDepartment of Education: Sablayan National Comprehensive High SchoolRia Dela CruzNo ratings yet

- C AE26 MODULE 5 Corporations in GeneralDocument7 pagesC AE26 MODULE 5 Corporations in GeneralBaek hyunNo ratings yet

- Ncome: Components of Profit or LossDocument3 pagesNcome: Components of Profit or LossJonathan VidarNo ratings yet

- InstallmentDocument40 pagesInstallmentMich Salvatorē50% (2)

- IMI.04 Installment AccountingDocument17 pagesIMI.04 Installment AccountingWilsonNo ratings yet

- Income Statement SectionsDocument34 pagesIncome Statement SectionsRabie Haroun100% (1)

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Installment Home Branch Liquidation LT Constn ContractsDocument47 pagesInstallment Home Branch Liquidation LT Constn ContractsbigbaekNo ratings yet

- Chapter 2 Abm 3Document9 pagesChapter 2 Abm 3Joan Mae Angot - Villegas50% (2)

- Quiz#3 - SCFDocument3 pagesQuiz#3 - SCF11 ABM 2A -TORREMOCHANo ratings yet

- Managerial Accounting1Document33 pagesManagerial Accounting1MM-Tansiongco, Keino R.No ratings yet

- Intermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadDocument109 pagesIntermediate Accounting Reporting and Analysis 1st Edition Wahlen Test Bank DownloadEdna Nunez100% (18)

- FL-Answers AFARDocument13 pagesFL-Answers AFARRisalyn BiongNo ratings yet

- Installment AcctgDocument22 pagesInstallment AcctgMacie MenesesNo ratings yet

- ACC 113 - SAS - Day - 15Document11 pagesACC 113 - SAS - Day - 15Joy QuitorianoNo ratings yet

- SHS Self-Learning Kit Prepares Cash Flow StatementDocument13 pagesSHS Self-Learning Kit Prepares Cash Flow StatementLiam Aleccis Obrero CabanitNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- PART 5 - Statement of Comprehensive Income and Its ElementsDocument6 pagesPART 5 - Statement of Comprehensive Income and Its ElementsHeidee BitancorNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Fundamentals of Accountancy Income StatementsDocument22 pagesFundamentals of Accountancy Income Statementskhaizer matias100% (1)

- Seatwork No. 3 Comprehensive IncomeDocument5 pagesSeatwork No. 3 Comprehensive IncomeHoney Rose AncianoNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- 7 The Accounting Equation (4 Pages)Document4 pages7 The Accounting Equation (4 Pages)Danica MamontayaoNo ratings yet

- VIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingDocument11 pagesVIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingZeeNo ratings yet

- Chapter 15Document88 pagesChapter 15YukiNo ratings yet

- Study Guide For Module 9 (Marketing)Document4 pagesStudy Guide For Module 9 (Marketing)mattheweberhard2No ratings yet

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomeRandom AcNo ratings yet

- At 7Document7 pagesAt 7Joshua GibsonNo ratings yet

- Income Statement SimDocument5 pagesIncome Statement Simjustwon100% (1)

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- FABM 2 - Midterm ExamDocument6 pagesFABM 2 - Midterm ExamJessica Esmeña100% (1)

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Final Examination AK (60 COPIES)Document9 pagesFinal Examination AK (60 COPIES)Sittie Ainna A. UnteNo ratings yet

- Audit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZDocument3 pagesAudit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZShaz NagaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Chapter 13 T or FDocument1 pageChapter 13 T or FGraceila CalopeNo ratings yet

- Multiple Choice Financial ManagementDocument2 pagesMultiple Choice Financial ManagementGraceila CalopeNo ratings yet

- ACCOUNTS RECEIVABLE TRUE OR FALSEDocument1 pageACCOUNTS RECEIVABLE TRUE OR FALSEGraceila CalopeNo ratings yet

- Multiple ChoiceProblems Financial ManagementDocument3 pagesMultiple ChoiceProblems Financial ManagementGraceila CalopeNo ratings yet

- Chapter 13 T or FDocument1 pageChapter 13 T or FGraceila CalopeNo ratings yet

- Chapter 13 T or FDocument1 pageChapter 13 T or FGraceila CalopeNo ratings yet

- Revenue and Other ReceiptsDocument6 pagesRevenue and Other ReceiptsGraceila CalopeNo ratings yet

- Financial Assets GuideDocument3 pagesFinancial Assets GuideGraceila CalopeNo ratings yet

- Internal StrengthDocument2 pagesInternal StrengthGraceila CalopeNo ratings yet

- Internal StrengthDocument2 pagesInternal StrengthGraceila CalopeNo ratings yet

- Space Matrix For The Coca-Cola Company (TCCC) Financial Position (FP) RatingsDocument4 pagesSpace Matrix For The Coca-Cola Company (TCCC) Financial Position (FP) RatingsGraceila CalopeNo ratings yet

- Space Matrix For The Coca-Cola Company (TCCC) Financial Position (FP) RatingsDocument4 pagesSpace Matrix For The Coca-Cola Company (TCCC) Financial Position (FP) RatingsGraceila CalopeNo ratings yet

- Petty Cash Fund GuidelinesDocument3 pagesPetty Cash Fund GuidelinesGraceila CalopeNo ratings yet

- Revenue and Other ReceiptsDocument6 pagesRevenue and Other ReceiptsGraceila CalopeNo ratings yet

- Transfer Pricing and Pricing DecisionDocument1 pageTransfer Pricing and Pricing DecisionGraceila CalopeNo ratings yet

- Q2 Sce, Sci AkDocument6 pagesQ2 Sce, Sci AkGraceila CalopeNo ratings yet

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopeNo ratings yet

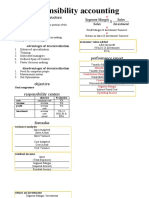

- Responsibility Accounting: Organizational StructureDocument1 pageResponsibility Accounting: Organizational StructureGraceila CalopeNo ratings yet