Professional Documents

Culture Documents

TAXATION Finals Reviewer

TAXATION Finals Reviewer

Uploaded by

JunivenReyUmadhayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

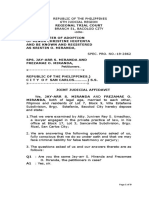

TAXATION Finals Reviewer

TAXATION Finals Reviewer

Uploaded by

JunivenReyUmadhayCopyright:

Available Formats

TAXATION

FINALS REVIEWER

PROF. LOREBETTE GRANDEA

1ST SEMESTER SY 2016-2017

C. Situs of Taxation and Double Taxation

1. Meaning of situs

- Situs of taxation literally means the place of taxation. The basic rule is that the state where the

subject to be taxed has a situs may rightfully levy and collect the tax; and the situs is necessarily in

the state which has jurisdiction or which exercises dominion over the subject in question. Within

the territorial jurisdiction, the taxing authority may determine situs.

- Factors that Determine Situs:

1. Nature of the tax;

2. Subject matter of the tax (person, property, act or activity)

3. Possible protection and benefit that may accrue both to the government and the taxpayer;

4. Citizenship of the taxpayer

5. Residence of the taxpayer

6. Source of income

2. Situs of subjects of taxation

KIND OF TAX SITUS

Personal or Community Tax Residence or domicile of the taxpayer

Real Property Tax Location of the property (lex rei sitae)

Personal Property Tax TANGIBLE: where it is physically located or permanently

kept (Lex Rei Sitae) although the owner resides in another

jurisdiction.

INTANGIBLE: General Rule: Domicile of the owner.

Mobilia sequuntur personam (movables follow the person)

Exceptions:

1. When property has acquired a business situs in

another jurisdiction; or

2. When the law provides for the situs of the subject of

tax (eg. Sec 104, NIRC)

Business Tax VAT- Where transaction is made

Sale of Real Property- where the real property is located

Personal Property- Where the personal property was sold

Excise or Privilege Tax Where the act is performed or where occupation is pursued

Sales Tax Where the sale is consummated

REVIEWER BY: ELAH V

1

Income Tax Consider: (1) citizenship, (2) residence,

(3) source of income (Sec 42, 23, NIRC of 1997)

Filipino Resident- Taxable within and outside Philippines

Filipino Non-Resident- Taxable within Phil. But not outside

Phil

Alien resident- Taxable within Phil. But not outside Phil

Alien Non-Resident- Taxable within Phil. But not outside

Phil

Transfer Tax Residence or citizenship of the taxpayer

or location of the property

Donor’s Tax Location of the property

and the citizenship of the donor (Sec 98, NIRC 1997)

Estate Tax Location and citizenship of the decedent.(Sec 85, NIRC)

Franchise Tax state which granted the franchise

Sec. 42, 104

** the following intangible properties are considered as properties with a situs in the Philippines:

a. Franchise which must be exercised in the Philippines

b. Shares, obligations or bonds issued by any corporation or sociedad anonima organized or

constituted in the Philippines in accordance with its laws.

c. Shares, obligations or bonds issued by any foreign corporation 85% of business which is located

in the Philippines

d. Shares, obligations, or bonds issued by any foreign corporation if such shares, obligations or

bonds have acquired a business situs in the Philippines; and

e. Shares or rights in any partnership business or industry established in the Philippines.

CIR v. British Overseas Airway Corp., supra.

The source of an income is the property, activity or service that produced the income. 8 For the source

of income to be considered as coming from the Philippines, it is sufficient that the income is derived

from activity within the Philippines. In BOAC's case, the sale of tickets in the Philippines is the activity

that produces the income. The tickets exchanged hands here and payments for fares were also made

here in Philippine currency. The site of the source of payments is the Philippines. The flow of wealth

proceeded from, and occurred within, Philippine territory, enjoying the protection accorded by the

Philippine government. In consideration of such protection, the flow of wealth should share the

burden of supporting the government.

REVIEWER BY: ELAH V

2

- An international airline, like NOAC, which has appointed a ticket sales agent in the Philippines

and which allocates fares received to various airlines on the basis of their participation in the

services rendered, although BOAC does not operate any airplane in the Philippines, is a resident

foreign corporation subject to tax on income received from Philippine sources.

CIR v. Japan Airlines, supra.

"The absence of flight operations to and from the Philippines is not determinative of the source of

income or the situs of income taxation. x x x The test of taxability is the `source'; and the source of an

income is that activity x x x which produced the income (Howden & Co., Ltd. vs. Collector of Internal

Revenue, 13 SCRA 601 [1965]). Unquestionably, the passage documentations in these cases were sold

in the Philippines and the revenue therefrom was derived from a business activity regularly pursued

within the Philippines. x x x The word `source' conveys one essential Idea, that of origin, and the

origin of the income herein is the Philippines

- JAL made PAL its sales ticket agent in the Philippines. For the source of income to be

considered coming from the Philippines, it is sufficient that the income is derived from the

activities within this country regardless of the absence of flight operations within Philippine

territory.

Wells Fargo Bank v. Collector, 70 Phil 325 (1940)

- The actual situs of the shares of stock is in the Philippines, the corporation being domiciled

therein. And besides, the certificates of stock have remained in this country up to the time

when the decedent died in California, and they were in possession of Syrena Mckee. For all

practical purposes, then, Syrena Mckee had legal title to the certificates of stock held in trust

for the true owner thereof.

-

- In other words, the owner residing in California has extended here her activities with

respect to her intangibles so as to avail herself of the protection and benefits of the Philippine

Laws. Accordingly, the jurisdiction of the Philippine government to tax must be upheld.

-

- In cases where the owner of intangibles confines his activity to the place of his domicile it has

been found convenient to substitute a rule for a reason by saying that his intangibles are taxed at

their situs and not elsewhere, or perhaps less artificially, by invoking the maxim mobilia sequuntur

personam. Which means only that it is the identify owner at his domicile which gives jurisdiction

to tax. But when the taxpayer extends his activities with respect to his intangibles, so as to avail

himself of the protection and benefit of the laws of another state, in such a way as to bring his

person or properly within the reach of the tax gatherer there, the reason for a single place of

taxation no longer obtains, and the rule even workable substitute for the reasons may exist in any

particular case to support the constitutional power of each state concerned to tax. Whether we

regard the right of a state to tax as founded on power over the object taxed.

Through dominion over tangibles or over persons whose relationships are source of intangibles

rights, or on the benefit and protection conferred by the taxing sovereignty, or both, it is

undeniable that the state of domicile is not deprived, by the taxpayer's activities elsewhere, of its

constitutional jurisdiction to tax, and consequently that there are many circumstances in which

more than one state may have jurisdiction to impose a tax and measure it by some or all of the

taxpayer's intangibles. Shares or corporate stock be taxed at the domicile of the shareholder and

also at that of the corporation which the taxing state has created and controls; and income may be

REVIEWER BY: ELAH V

3

taxed both by the state where it is earned and by the state of the recipient's domicile. Protection,

benefit, and power over the subject matter are not confined to either state.

Tan v. del Rosario, supra.

- All subjects of taxation similarly situated are to be treated alike both in privileges confirmed

and liabilities imposed.

The view can easily become myopic, however, when the law is understood, as it should be, as

only forming part of, and subject to, the whole income tax concept and precepts long obtaining under

the National Internal Revenue Code. To elaborate a little, the phrase "income taxpayers" is an all

embracing term used in the Tax Code, and it practically covers all persons who derive taxable

income.

The law, in levying the tax, adopts the most comprehensive tax situs of nationality and residence

of the taxpayer (that renders citizens, regardless of residence, and resident aliens subject to income

tax liability on their income from all sources) and of the generally accepted and internationally

recognized income taxable base (that can subject non-resident aliens and foreign corporations to

income tax on their income from Philippine sources). In the process, the Code classifies taxpayers

into four main groups, namely: (1) Individuals, (2) Corporations, (3) Estates under Judicial Settlement

and (4) Irrevocable Trusts (irrevocable both as to corpus and as to income).

3. Multiplicity of Situs, Collector v. de Lara, 102 Phil 813 (1958)

- General rule that personal property, like shares of stock in the Phil., is taxable at the domicile of

the owner (Miller) under the doctrine of mobilia sucuuntur persona.

- The decedent, being a non –resident of the Phil. The only property subject to estate and

inheritance taxes are those shares of stock issued by Phil. Corps.

- Under the Tax Code section 122, the decedent is entitled to tax exemption granted to non0

residents under the provision of multiple taxation, which otherwise subject the decedent’s

intangible property to the inheritance tax, on in his place of residence and domicile and the place

where those properties are found.

-

- Republic Act No. 1253; When estate of decedent entitled to benefits of the act.- In as much the

decedent not only suffered deprivations of the war, but was killed by the Japanese military forces,

his estate is entitled to the benefits of RA 153, which passed for the benefit of veterans, guerillas,

or victims of Japanese atrocities. Consequently, the interest and other increments imposed on the

decedent’s estate should not be paid.

-

- The Supreme Court did not subject to estate and inheritance taxes the shares of stock issued by

Philippine corporations which were left by a non-resident alien after his death. Considering that he

is a resident of a foreign country, his estate is entitled to exemption from inheritance tax on the

intangible personal property found in the Philippines. This exemption is granted to non-residents

to reduce the burdens of multiple taxation, which otherwise would subject a decedent’s intangible

personal property to the inheritance tax both in his place of residence and domicile and the place

where those are found.

This is, therefore, an exception to the decision of the Supreme Court in Wells Fargo v. CIR. This

has since been incorporated in Sec. 104 of the NIRC.

REVIEWER BY: ELAH V

4

Multiplicity of situs, or the taxation of the same income or intangible subjects in several taxing

jurisdictions, arises from various factors:

1. The variance in the concept of domicile for tax purposes;

2. Multiple distinct relationships that may arise with respect to intangible personal

property; or

3. The use to which the property may have been devoted all of which may receive the

protection of the laws of jurisdictions other than the domicile of the owner thereto.

The remedy to avoid or reduce the consequent burden in case of multiplicity of situs is either to:

1. Provide exemptions or allowance of deduction or tax credit for foreign taxes; or

2. Enter into tax treaties with other States.

4. Double Taxation

a. Meaning

- Means taxing twice the same taxpayer for the same tax period upon the same thing or activity,

when it should be taxed but once, for the same purpose and with the same kind of character tax.

CIR v. S.C. Johnson and Son, Inc., 309 SCRA 87 (1999)

- The entitlement of the 10% rate by U.S. firms despite the absence of a matching credit (20% for

royalties) would derogate from the design behind the most favored nation clause to grant equality

of international treatment since the tax burden laid upon the income of the investor is not the same

in the two countries. The similarity in the circumstances of payment of taxes is a condition for the

enjoyment of most favored nation treatment precisely to underscore the need for equality of

treatment.

- We accordingly agree with petitioner that since the RP-US Tax Treaty does not give a matching

tax credit of 20 percent for the taxes paid to the Philippines on royalties as allowed under the RP-

West Germany Tax Treaty, private respondent cannot be deemed entitled to the 10 percent rate

granted under the latter treaty for the reason that there is no payment of taxes on royalties under

similar circumstances.

- International juridical double taxation is defined as the imposition of comaparable taxes in two or

more states on the same subject matter and for identical periods.

- Double taxation usually take splace when a person is resident of a contracting state and derives

income from, or owns capital in, the other contracting state and both states impose tax on that

income or capital.

b. Double taxation in its broad sense

Villanueva v. City of Iloilo, supra.

- The contention that the plaintiffs-appellees are doubly taxed because they are paying the real estate

taxes and the tenement tax imposed by the ordinance in question is also devoid of merit. It is a

well-settled rule that a license tax may be levied upon a business or occupation although the land

or property used in connection therewith is subject to property tax. The State may collect an ad

valorem tax on property used in a calling, and at the same time impose a license tax on that

calling, the imposition of the latter kind of tax being in no sense a double tax.

REVIEWER BY: ELAH V

5

In order to constitute double taxation in the objectionable or prohibited sense the same property

must be taxed twice when it should be taxed but once; both taxes must be imposed on the same

property or subject-matter, for the same purpose, by the same State, Government, or taxing

authority, within the same jurisdiction or taxing district, during the same taxing period, and they

must be the same kind or character of tax. It has been shown that a real estate tax and the

tenement tax imposed by the ordinance, although imposed by the same taxing authority, are not

of the same kind and character.

At all events, there is no constitutional prohibition against double taxation in the Philippines.

ELEMENTS:

• Taxing twice

• By the same taxing authority

• Within the same jurisdiction or taxing district

• For the same purpose

• In the same taxing period

• The same subject or object

• Of the same kind or character of tax.

b. Constitutionality of double taxation

City of Baguio v. de Leon, supra.

- The argument against double taxation may not be invoked where one tax is imposed by the state

and the other imposed by the city, it being widely recognized that there is nothing inherently

obnoxious in the requirement that license fees or taxes be exacted with respect to the same

occupation, calling or activity by both the state and a political subdivision thereof. Where congress

has clearly expressed its intention, the statute must be sustained even though double taxation

results.

Pepsi Cola Bottling v. City of Butuan, supra.

- An ordinance imposing sales tax on agents/consignee selling merchandise from outside dealers

does not amount to double taxation. Double taxation, in general, is not forbidden by our

fundamental law. However, the ordinance is arbitrary to other member of the same taxable class

hence the law violates the rule of uniformity in taxation. There is no constitutional prohibition

against double taxation in the Philippines. It is something not favored but is permissible, provided

that the other constitutional requirements is not thereby violated

Sanchez v. Collector, 97 Phil 687 (1955)

- A license tax may be levied upon a business or occupation although the land or property used

therein is subject to property tax. The state may collect an ad volarem tax on property used in a

calling, and at the same time impose a license tax on the pursuit of that calling, the imposition of

the later kind of tax that being no sense as double tax.

City of Mla. v. Interisland Gas Service, 99 Phil 847 (1956)

REVIEWER BY: ELAH V

6

- There is no double taxation because 1) the fees paid by the defendant under Ordinance No. 3259

— for the storage, installation, use and transportation of compressed inflammable gases — was

charged by way of license fees, in the exercise of the police power of the State, not under its

inherent power of taxation; and (2) double taxation is not prohibited in our Constitution.

Cpa. General de Tabacos v. City of Mla., supra.

- Both license fee and a tax may be imposed on the same business or occupation, or for selling the

same article, this is not being a violation of the rule against double taxation.

That Tavacalera is being subjected to double taxation is more apparent than real. As already

stated,what is collected under Ordinance no. 3358 is a license fee

D. Means of Avoiding and Minimizing the Burden of Taxation

1. Shifting of tax burden

Shifting- the transfer of the burden of a tax by the original payer or the one on whom the tax was

assessed or imposed to someone else. What is transferres is not the payment of the tax but the

burden of the tax.

All indirect taxes may be shifted; direct taxes cannot be shifted.

a. Ways of shifting the tax burden

1) FORWARD SHIFTING

- When the burden of the tax is transferred from a factor of production through the

factors of distribution until it finally settles on the ultimate purchaser or consumer.

Example:

- Manufacturer or producer may shift tax assessed to wholesaler, who in turn shifts it to

the retailer, who also shifts it to the final purchaser or consumer

-VAT, Percentage Tax

2) BACKWARD SHIFTING

- When the burden of the tax is transferred from the consumer or purchaser through the

factors of distribution to the factors of production.

Example:

- Consumer or purchaser may shift tax imposed on him to retailer by purchasing only after

the price is reduced, and from the latter to the wholesaler, or finally to the manufacturer or

producer.

3) ONWARD SHIFTING

- When the tax is shifted two or more times either forward or backward

Example:

- Thus, a transfer from the seller to the purchaser involves one shift; from the producer to

the wholesaler, then to retailer, we have two shifts; and if the tax is transferred again to the

purchaser by the retailer, we have three shifts in all.

REVIEWER BY: ELAH V

7

b. Taxes that can be shifted

1. VAT

2. Percentage Tax

3. Excise Tax

Sec. 105-VAT

Only indirect taxes may be shifted: VAT, professional tax, amusement tax, customs duties

c. Meaning of impact and incidence of taxation

Impact of taxation is the point on which a tax is originally imposed. In so far as the law is concerned, the

taxpayer is the person who must pay the tax to the government. He is also termed as the statutory

taxpayer-the one on whom the tax is formally assessed. He is the subject of the tax.

Incidence of taxation is that point on which the tax burden finally rests or settles down. It takes place

when shifting has been effected from the statutory taxpayer to another.

The impact is the initial phenomenon, the shifting is the intermediate process, and the incidence is

the result. Impact is the imposition of the tax; shifting is the transfer of the tax; while incidence is the

setting or coming to rest of the tax. (e.g. impact in a sales tax is on the seller who shifts the burden to the

customer who finally bears the incidence of the tax.

2. Tax evasion

- Is the use by the taxpayer of illegal or fraudulent means to defeat or lessen the payment of a tax. It

is also known as “tax dodging; deliberate reduction of income that has been received.

Elements of tax evasion

Tax evasion connotes the integration of three factors:

1. The end to be achieved. Example: the payment of less than that known by the taxpayer to be

legally due, or in paying no tax when such is due.

2. An accompanying state of mind described as being “evil, in bad faith, willful, or deliberate and

not accidental.”

3. A course of action (or failure of action) which is unlawful.

Republic v. Gonzales, 13 SCRA 633 (1965)

- Failure to declare true income for 2 consecutive years is evidence of fraud.

- The provision relied upon by the appellant plainly contemplates limiting the exemption from the

licenses, fees and taxes enumerated therein to the right to establish Government agencies,

including concessions, and to the merchandise or services sold or dispensed by such agencies. The

income tax, which is certainly not on the right to establish agencies or on the merchandise or

services sold or dispensed thereby, but on the owner or operator of such agencies, is logically

excluded

REVIEWER BY: ELAH V

8

- Since fraud is a state of mind, it need not be proved by direct evidence but may be inferred from

the circumstances of the case. The failure of the appellant to declare for taxation purposes his true

and actual income derived from his furniture business for two consecutive years is an indication of

his fraudulent intent to cheat the Government of its taxes.

Sec. 254

Attempt to Evade or Defeat Tax-Any person willfully attempts in any manner to evade or defeat any tax

imposed under this code of the payment thereon shall, in addition to other penalties provided by law,

upon conviction thereof, be punished by a fine of not less then Php 30,000.00 but not more than Php

100,000.00 and suffer imprisonment of not less than 2 years but not more than 4 years. Provided, that the

conviction or acquittal obtained under this Section shall not be a bar to the filing of a civil suit for the

collection of taxes.

3. Tax avoidance

- The exploitation by the taxpayer of legally permissible alternative tax rates or methods of

assessing taxable property or income in order to avoid or reduce tax liability. It is politely called

“tax minimization” and is not punishable by law.

Ways of avoiding tax

1. Shifting

2. Capitalization

3. Evasion

4. Exemption

5. Transformation- method of escape in taxation whereby the manufacturer or producer

upon whom the tax has been imposed pays the tax and endeavors to recoup himself by

improving hisprocess of production thereby turning out his units of products at a lower

cost. The taxpayer escapes by a transformation of the tax into a gain through the medium

production.

6. Avoidance

Note: With the exception of evasion, all are legal means of avoiding taxes.

Delpher Traders Corp. v. IAC, 157 SCRA 349 (1988)

- The Supreme Court upheld the estate planning scheme resorted to by the Pacheco family in

converting their property to shares of stock in a corporation which they themselves owned and

controlled. By virtue of the deed of exchange, the Pacheco co-owners saved on inheritance taxes.

The Supreme Court said the records do not point to anything wrong and objectionable about this

estate planning scheme resorted to. The legal right of the taxpayer to decrease the amount of what

otherwise could be his taxes or altogether avoid them by means which the law permits cannot be

doubted.

Yutivo v. CTA, 1 SCRA 160 (1961)

- A corp. cannot be said to have been organized as a tax evasion device when there was no tax to

evade.

REVIEWER BY: ELAH V

9

- Fraudulent tax evasion. The intention to minimize taxes, when used in the context of fraud, must

be proven by clear and convincing evidence amounting to more than mere preponderance. It

cannot be justified by mere speculation. This is because fraud is never lightly to be presumed.

- Concept of Tax Evasion. Tax evasion connotes fraud through the use of pretenses and forbidden

devices to lessen or defeat tax.

- A taxpayer has the legal right to decrease the amount of what otherwise would be his taxes or

altogether avoid them by means which the law permits. Any legal means used by the taxpayer to

reduce taxes are all right. Therefore, a man may perform an act that he honestly believes to be

sufficient to exempt him from taxes. He does not incur fraud thereby even if the act is thereafter

found to be insufficient.

- Mere understatement of tax in itself does not prove fraud.

4. Exemption from taxation

a. meaning of exemption from taxation

- It is the grant of immunity to particular persons or corporations or to persons or corporations of a

particular class from a tax which persons and corporations generally within the same state or

taxing district are obliged to pay. It is an immunity or privilege; it is freedom from a financial

charge or burden to which others are subjected. It is strictly construed against the taxpayer.

- Taxation is the rule; exemption is the exception. He who claims exemption must be able to justify

his claim or right thereto, by a grant expressed in terms “too plain to be mistaken and too

categorical to be misinterpreted.” If not expressly mentioned in the law, it must at least be within

its purview by clear legislative intent.

Principle Governing Exemptions

In the construction of tax statutes, exemptions are not favored and are construed strictissimi juris

against the taxpayer.

One who claims exemption should prove by convincing proof that he is exempted.

Taxation is the rule and exemption is the exemption

Exemption is not presumed

Constitutional grants of tax exemption are self executing

Tax exemption are personal and cannot be delegated.

Exemption generally covers direct tax, unless otherwise provided.

Exemption is allowed only if there is a clear provision there for.

It is not necessarily discriminatory as long as there is a reasonable foundation or rational basis.

Exemptions are not presumed, but when public property is involved, exemption is the rule and

taxation is the exemption.

Greenfield v. Meer, 77 Phil 394 (1946)

- with the passing of LGC which grant taxing power to the Local Government, all exemptions

granted to all persons, whether natural or juridical, including those which in the future might be

granted, are withdrawn unless the law granting the exemption expressly states that the exemption

also applies to local taxes.

REVIEWER BY: ELAH V

10

PLDT v. City of Davao, 363 SCRA 522 (2001)

- Tax exemption. The tax code provision withdrawing the tax exemption was not construed as

prohibiting future grants of exemptions from all taxes.

- The grant of taxing powers to local government units under the Constitution and the Local

Government Code does not affect the power of Congress to grant exemptions to certain persons,

pursuant to a declared national policy. The legal effect of the Constitution grant to local

governments simply means that in interpreting statutory provisions on municipal taxing powers,

doubts must be resolved in favor of the municipal corporations.

- The tax exemption must be expressed in the statutue in clear language that leaves no doubt of the

intention of the legislature to grant such exemption. And, even if it is granted, the exemption must

be interpreted in strictissimi juris against the taxpayer and liberally in favor of the taxing authority.

PLDT v. City of Davao, G.R. 143867, March 25, 2003

- Legal effect of the constitutional grant to local governments simply means that in interpreting

statutory provisions on municipal taxing powers, doubts must be resolved in favor of municipal

corporations.

- . It is next contended that, in any event, a special law prevails over a general law and that the

franchise of petitioner giving it tax exemption, being a special law, should prevail over the LGC,

giving local governments taxing power, as the latter is a general law. Petitioner further argues

that as between two laws on the same subject matter which are irreconcilably inconsistent, that

which is passed later prevails as it is the latest expression of legislative will.

i. compared with tax remission, condonation

- There is a tax condonation or remission when the State desists or refrains from exacting, inflicting

or enforcing something as well as to reduce what has already been taken. The condonation of a tax

liability is equivalent to and is in the nature of a tax exemption. Thus, it should be sustained only

when expressed in the law.

Tax exemption, on the other hand, is the grant of immunity to particular persons or corporations of

a particular class from a tax of which persons and corporations generally within the same state or

taxing district are obliged to pay. Tax exemptions are not favored and are construed strictissimi

juris against the taxpayer.

Juan Luna Subd. V. M. Sarmiento, 91 Phil 371 (1952)

- The word “remit” means to desist or refrain from exacting, inflicting or enforcing something as

well as to restore what has already been taken. The remission of taxes due and payable to the

exclusion of taxes already collected does not constitute unfair discrimination. Such a set of taxes is

a class by itself and the law would be open to attack as class legislation only if all taxpayers

belonging to one class were not treated alike.

REVIEWER BY: ELAH V

11

Surigao Corp. Min. v. Collector, 9 SCRA 728 (1963)

- Condonation of tax liability. The condonation of a tax liability is equivalent and is in the nature of

tax exemption. Being so, it should be sustained only when expressed in explicit terms, and it

cannot ne extended beyond the plain meaning of those terms.

- Where the law clearly refers to the condonation of unpaid taxes, it is held that t cannot be extended

to authorize the refund of paid taxes.

- In suit for the recovery of the payment of taxes as having been illegally or erroneously collected,

the burden is upon the taxpayer to establish the facts which show the illegality of the tax or that the

determination thereof is erroneous.

ii. tax amnesty

- A tax amnesty partakes of an absolute forgiveness or waiver by the Government of its right to

collect what otherwise would be due it, and in this sense, prejudicial thereto, particularly to give

tax evaders, who wish to relent and are willing to reform a chance to do so and become a part of

the new society with a clean slate.

Commissioner v. CA and ROH Auto, 240 SCRA 368 (1995)

- EO 41 has been designed to be in the nature of a general grant of tax amnesty subject only to the

cases specifically excepted by it.

- We agree with both the CA and the CTA that EO41 is quite explicit and requires hardly anything

beyond a simple application of its provisions. If, as the commissioner argues, EO41 had not been

intended to include 1981-1985 tax liabilities already assessed prior to 23 August 1986, the law

could have simply so provided in its exclusionary clauses.it did not.

People v. Castaneda, 165 SCRA 327 (1988)

- Compliance with all requirements for availmnet of tax amnesty under PD370 would have the

effect of condoning not only the income tax liabilities but also all internal revenue taxes, including

increments or penalties on account of non-payment as well as all criminal, civil or administrative

liabilities.

- Construction of tax amnesty. Still further, a tax amnesty much like a tax exemption is never

favored nor presumed in law and if granted by statute, the terms of the amnesty like that of a tax

exemtion must be construed strictly against the taxpayer and liberally in favor of the taxing

authority. Valencia’s payment of the special 15% tax must be regarded as legally ineffective.

Pascual v. CIR, 166 SCRA 560 (1988)

- 2 isolated transactions is not a case of partnership, hence petitioners are not liable for corporate

income tax. As they have availed of the benefits of tax amnesty as individual taxpayers in these

transactions, they are relieved of any further tax liability arising therefrom.

REVIEWER BY: ELAH V

12

Republic v. IAC, 196 SCRA 335 (1991)

- Tax amnesty defined. Even assuming that the deficiency tax assessment of P17117.08 against the

Pastor spouses were correct, since the latter have already paid almost the equivalent amount to the

Government by way of amnesty taxes under PD No. 213, and were granted not merely an

exemption, but an amnesty for their past tax failings, the Government is estopped from collecting

the difference between the deficiency tax assessment and the amount already paid by them as

amnesty tax. A tax amnesty, being a general pardon or intentional overlooking by the State of its

authority to impose penalties on persons otherwise guilty of evasion or violation of a revenue or

tax law, partakes of an absolute forgiveness or waiver by the Government of its right to collect

what otherwise would be due it and in this sense, prejudicial thereto, particularly to give tax

evaders, who wish to repent and are willing to reform a chance to do so and thereby become a part

of the new society with a clean slate.

CIR v. Marubeni Corp., 372 SCRA 576 (2001)

- EOS 41 and 61 are tax amnesty issuances. A tax amnesty is a general pardon or intentional

overlooking by the State of its authority to impose penalties on persons otherwise guilty of evasion

or violation of a revenue or tax laws. It partakes of an absolute forgiveness or waiver by the

government of its right to collect what is due it and to give tax evaders who wish to relent a chance

to start with a clean slate. A tax amnesty, much like a tax exemption, is never favored nor

presumed in law. If granted, the terms of the amnesty, like that of a tax exemption, must be

construed strictly against the taxpayer and liberally in favor of the taxing authority. For the right of

taxation is inherent in government. The State cannot strip itself of the most essential power of

taxation by doubtful words. He who claims an exemption (or an amnesty) from the common

burden must justify his claim by the clearest grant of organic or state law. It cannot be allowed to

exist upon a vague implication. If a doubt arises as to the intent of the legislature, that doubt must

be resolved in favor of the state.

iii. VAT zero-rating, Sec. 106 (A) (2)

R.A. 7716 (An act restructuring the value added tax (vat) system, widening its tax based and enhancing

its administration and for these purposes amending and repealing the relevant provisions of the national

internal revenue code, as amended, and for other purposes.)

"(b) transactions subject to zero-rate. — The following services performed in the Philippines by VAT-

registered persons shall be subject to 0%:

"(1) Processing, manufacturing or repacking goods for other persons doing business outside the

Philippines which goods are subsequently exported, where the services are paid for in acceptable foreign

currency and accounted for in accordance with the rules and regulations of the Bangko Sentral ng

Pilipinas (BSP).

"(2) Services other than those mentioned in the preceding sub-paragraph, the consideration for which is

paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of

the Bangko Sentral ng Pilipinas (BSP).

"(3) Services rendered to persons or entities whose exemption under special laws or international

agreements to which the Philippines is a signatory effectively subjects the supply of such services to zero

rate.

"(4) Services rendered to vessels engaged exclusively in international shipping; and

REVIEWER BY: ELAH V

13

"(5) Services performed by subcontractors and/or contractors in processing, converting, or manufacturing

goods for an enterprise whose export sales exceed seventy percent (70%) of total annual production.

Sec. 106 (A)(2) The following sales by VAT-registered persons shall be subject to zero percent (0%)

rate:

(a) Export Sales. - The term "export sales" means:

(1) The sale and actual shipment of goods from the Philippines to a foreign country,

irrespective of any shipping arrangement that may be agreed upon which may influence

or determine the transfer of ownership of the goods so exported and paid for in

acceptable foreign currency or its equivalent in goods or services, and accounted for in

accordance with the rules and regulations of the Bangko Sentral ng Pilipinas (BSP);

(2) Sale of raw materials or packaging materials to a nonresident buyer for delivery to a

resident local export-oriented enterprise to be used in manufacturing, processing, packing

or repacking in the Philippines of the said buyer's goods and paid for in acceptable

foreign currency and accounted for in accordance with the rules and regulations of the

Bangko Sentral ng Pilipinas (BSP);

(3) Sale of raw materials or packaging materials to export-oriented enterprise whose export

sales exceed seventy percent (70%) of total annual production;

(4) Sale of gold to the Bangko Sentral ng Pilipinas (BSP); and

(5) Those considered export sales under Executive Order NO. 226, otherwise known as the

Omnibus Investment Code of 1987, and other special laws.

(b) Foreign Currency Denominated Sale. - The phrase "foreign currency denominated sale" means sale

to a nonresident of goods, except those mentioned in Sections 149 and 150, assembled or manufactured in

the Philippines for delivery to a resident in the Philippines, paid for in acceptable foreign currency and

accounted for in accordance with the rules and regulations of the Bangko Sentral ng Pilipinas (BSP).

(c) Sales to persons or entities whose exemption under special laws or international agreements to which

the Philippines is a signatory effectively subjects such sales to zero rate.

iii. exclusions, deductions, Sec. 32 (B), 34

EXCLUSION

Exclusion refers to income received or earned but is not taxable as income because it is exempted

by law or by treaty. Such tax-free income is not to be included in the income tax return unless

information regarding it is specifically called for.

NIRC Sec. 32 (B) Exclusions from Gross Income. - The following items shall not be included in gross

income and shall be exempt from taxation under this title:

1. Proceeds from life insurance

2. Amount received by insured as return of premium

3. Gifts, bequests and devises

4. Compensation for injuries or sickness

5. Income exempt under treaty

6. Retirement benefits, pensions, gratuities, etc.

7. Income derived by foreign government

8. Income derived by the Philippine Government or its political subdivisions

REVIEWER BY: ELAH V

14

9. Prizes and awards made primarily in recognition of religious, charitable, scientific, educational,

artistic, literary or civic achievement.

10. Prizes and awards in sports competitions sanctioned by the national sports associations

11. 13th month pay and other benefits not exceeding P30,000.00. Applies both to public and private

employees.

12. GSIS, SSS, Medicare and other contributions

13. Gains from the sale of bonds, debentures or other certificate of indebtedness. 5 eyars or more. If

maturity is less than 5 years, it is taxable.

14. Gains from redemption of shares in mutual fund. It must be emanate from the mutual fund.

DEDUCTIONS FROM GROSS INCOME

Deductions are items or amounts which the law allows to be deducted under certain conditions

from gross income in order to arrive at taxable income.

NIRC SEC. 34. Deductions from Gross Income. - Except for taxpayers earning compensation income

arising from personal services rendered under an employer-employee relationship where no deductions

shall be allowed under this Section other than under subsection (M) hereof, in computing taxable income

subject to income tax under Sections 24 (A); 25 (A); 26; 27 (A), (B) and (C); and 28 (A) (1), there shall

be allowed the following deductions from gross income;

1. Expenses

2. Interest

3. Taxes

4. Losses

5. Bad debts

6. Depreciation

7. Depletion of oil and gas wells and mines

8. Charitable and other contributions

9. Research and development

10. Pension trusts

11. Premium payments on health and/or hospitalization insurance of an individual taxpayer

Deduction v. exemption

Deduction is an amount allowed by law to be subtracted from gross income to arrive at taxable

income. Exemption from taxation is the grant of immunity to particular persons or corporations or to

persons or corporations of a particular class from a tax which others generally within the same taxing

district are obliged to pay.

Deduction v. exclusion

Deduction is an amount allowed by law to be subtracted from gross income to arrive at taxable

income. Exclusion refers to income received or earned but is not taxable as income because exempted by

law or by treaty. Such tax-free income is not to be included in the income tax return unless information

regarding it is specifically called for. [Section 61, Revenue Regulation 2]

Basic principles governing deductions

1. The taxpayer seeking a deduction must point to some specific provisions of the statute

authorizing the deduction; and

2. He must be able to prove that he is entitled to the deduction authorized or allowed.

Kinds of deductions

1. Itemized deduction which is available to individual and corporate taxpayers

REVIEWER BY: ELAH V

15

2. Optional standard deduction which is available to individual taxpayers only, except a non-

resident alien.

3. Special deductions which is available, in addition to the itemized deductions, to certain

corporations, i.e. insurance companies and propriety educational corporations.

Time within which to claim deduction

1. As a rule, if a taxpayer does not, within a year, deduct certain of his expenses, losses, interests,

taxes, or other charges, he cannot deduct them from the income of the next or any succeeding

year.

2. If he keeps his books on the cash receipts basis, the expenses are deductible in the year they are

paid.

3. If on the actual basis, then in the year they are incurred, whether paid or not.

Who may not avail of deductions form gross income?

1. Citizens and resident aliens whose income is purely compensation income.

* They are allowed personal and additional exemptions and deduction for premium payments on

health and hospitalization insurance.

2. Non-resident aliens not engaged in trade or business in the Philippines

3. Non-resident foreign corporations.

Some rules on deduction

Itemized deduction may apply to corporate tax payer as well as individual taxpayer.

A corporation may avail only of the deduction from (1) to (10): premium payments on health

and/or hospitalization insurance is deductible only by an individual taxpayer.

A corporation may avail only of the itemized deductions: an individual, except a non-resident

alien, may elect the itemized deductions or the optional standard deduction.

Thus, the optional standard deduction is not available to corporations.

An individual earning purely compensation income is not allowed itemized deductions, except

premium payments on health and/or hospitalization insurance. In addition, he is also granted

personal and additional exemptions.

An individual, who earns income other than purely compensation income, is allowed personal

additional exemptions in addition to the itemized deductions or the optional standard deductions.

Two kinds of deduction available to individuals, except a non-resident alien

1. Itemized deduction

2. Optional standard deduction

Note: Optional standard deduction is not available to corporations.

b. Kinds of tax exemption

Express or implied, total or partial

Kinds of Tax Exemption According to Manner of Creation

1) Express or affirmative exemption

When certain persons, property or transactions are, by express provision, exempted from all certain taxes,

either entirely or in part, may be made by provisions of the Constitution, statutes, treaties, ordinances,

franchises, or contracts.

REVIEWER BY: ELAH V

16

2) Implied exemption or exemption by omission

When a tax is levied on certain classes of persons, properties, or transactions without mentioning the other

classes.. Every tax statute, in a very real sense, ameks eemptions since all those not mentioned are

deemed exempted. The omission amy be either accidental or intentional.

Exemptions are not presumed, but when public property is involved, exemption is the rule, and taxation

the exemption.

3) Contractual

Agreed to by the taxing authority in contracts lawfully entered into them under enabling laws.

(i.e.: treaty, licensing ordinance)

The legislature of a State may, in the absence of special restrictions in its constitution, make a

valid contract with a corp. in respect to taxation, and that such contract can be enforced against the State

at the instance of the corporation. In the real sense of the term and where the non-impairment clause of

the Constitution can rightly be invoked, this includes those agreed to by the taxing authority in contracts,

such as those contained in government bonds or debentures, lawfully entered into by them under enabling

laws in which the government, acting in its private capacity, shed its cloak of authority and waives its

governmental immunity.

These contractual tax exemptions, however, are not to be confused with tax exemptions granted

under franchises. A franchise partakes the nature of a grant which is beyond the purview of the non-

impairment clause of the Constitution.

Kinds of Tax Exemption According to Scope or Extent

1) TOTAL—when certain persons, property or transactions are exempted, expressly or impliedly from all

taxes.

2) PARTIAL—when certain persons, property or transactions are exempted, expressly or impliedly from

certain taxes, either entirely or in part.

Exemption from direct tax, from indirect tax

A law granting exemption from direct tax does not exempt the subject form indirect tax.

Does the provision in a statute granting exemption from all taxes include indirect taxes?

No. As a general rule, indirect taxes are not included in the grant of such exemption unless it is

expressly stated.

REVIEWER BY: ELAH V

17

Atlas Fertilizer v. Commissioner, 100 SCRA 556( 1980)

- The approval by the Sec. of Finance of the corporation application for tax exemption under RA

3050 can be presumed as proof that the articles imported by the taxpayer will be used exclusively

by the taxpayer for the purpose for which the application ws filed.

- Considering the administrative requirements before articles under tax-free importation may be

withdrawn from customs custody, it can be presumed, from an importer’s having been

successfully withdrawn its merchandise from custom’s warehouse, it having an approved

certificate of tax exemption previously granted by the Secretary of Finance, that the authority to

import the goods in question as tax-free was legally secured.

- A taxpayer which has an approved certificate of exemption under RA 901 which grants partial tax

exemption who applies for similar tax exemption under RA 3050 which grants complete tax

exemption on imports cannot be said to have abandoned its partial tax exemption for articles

imported under RA 901. It is entitled to full tax exempt status.

Commissioner v. Phil. Ace Line, 25 SCRA 912 (1968)

- NATURE OF TAX EXEMPTION. Every tax exemption implies a waiver of the right to collect

what otherwise would be due to the government. In this sense, it is prejudicial thereto.

- RATIONALE OF TAX EXEMPTION. The avowed purpose of a tax exemption is some public

benefit or interest, which the lawmaking body considers sufficient to offset the monetary loss

entailed in the grant of the exemption.

- There is no constitutional injunction against granting tax exemptions to particular persons. It is not

unusual to grant to specific individuals or entities legislative franchise with tax exemptions. What

the fundamental law forbids is the denial of equal protection, such as through unreasonable

discrimination or classification.

- There is no difference between grant of tax exemption to end users and the extension of the grant

to those whose contracts of purchase and sale were made before said date under the Reparation

law.

Com. v. RTN Mining, 202 SCRA 137 (1991); 207 SCRA 549 (1992)

- (1991). All doubts must be resolved in favor of the taxing authority and that tax exemptions ( or

tax refunds for that matter) must be strictly construed and can only be given force when the grant

is clear and categorical.

- (1992). In Insular Lumber Co. v CTA, the Court held that the authorized partial refund under Sec.

5 of RA No. 1435 partakes of the nature of a tax exemption and therefore cannot be allowed unless

granted in the most explicit and categorical language. Since the grant of refund privileges must be

strictly construed against the taxpayer, the basis for the refund shall be the amounts deemed paid

under Sec. 1 and 2 of RA No. 1435.

REVIEWER BY: ELAH V

18

Caltex v. COA, supra.

- Tax exemptions as a general rule are construed strictly against the grantee and liberally in favor of

the taxing authority. The burden of proof rests upon the party claiming exemption to prove that it

is in fact covered by the exemption so claimed. The party claiming exemption must therefore be

expressly mentioned in the exempting law or at least be within its purview by clear legislative

intent.

c. Nature of the power to grant tax exemption

1. National government

The power to grant tax exemptions is an attribute of sovereignty for the power to

prescribe who or what persons or property shall be taxed implies the power to prescribe who or

what persons or property shall be taxed implies the power to prescribe who or what persons or

property shall not be taxed.

2. Local governments

Municipal corporations are clothed with no inherent power to tax or to grant tax exemptions. But

the moment the power to impose a particular tax is granted, they also have the power to grant

exemptions therefrom unless forbidden by some provision of the Constitution or the law.

The legislature may delegate its power to grant tax exemptions to the same extent that it may

exercise the power to exempt.

Basco v. PAGCOR, supra.

- The power to tax of municipal corporations must always yield to a legislative act of Congress

which is superior, having been passed by the State itself. Municipal corporations are mere

creatures of Congress which has the power to create and abolish municipal corporations due to its

general legislative powers. If Congress can grant the power to tax, it can also provide for

exemptions or even take back the power.

- Congress has the power of control over local governments; if Congress can grant a municipal

corporation the power to tax certain matters, it can also provide for exemptions or even take back

the power.

Maceda v. Macaraig, (1993) supra.

- In the case of property owned by the state or a city or other public corporations, the express

exception should not be construed with the same degree of strictness that applies to exemptions

contrary to the policy of the state, since as to such property “exception is the rule and taxation the

exception.”

d. Rationale for tax exemption

Rationale for granting tax exemptions

• Its avowed purpose is some public benefit or interest which the lawmaking body considers sufficient to

offset the monetary loss entailed in the grant of the exemption.

REVIEWER BY: ELAH V

19

• The theory behind the grant of tax exemptions is that such act will benefit the body of the people. It is

not based on the idea of lessening the burden of the individual owners of property.

Davao Light v. Com., 22 SCRA 122 (1972)

- The provisions of Sec. 2 of RA 358 granting tax exemption to the NPC, taken in the light of the

existing legislation affecting the NPC, notably RA 357, must be construed as intended to benefit

only the NPC, the lawmakers expecting that by relieving said corporation of tax obligations, the

NPC would be enabled to pay easily its indebtedness it is certain to incur. In granting such tax

exemption, the government actually waived its right to collect taxes from the NPC in order to

facilitate the liquidation by said corporation of its liabilities, and the consequential release by the

government itself from its obligation in the transactions entered into by the President on behalf of

the NPC.

Tan Kim Kee v. CTA, 7 SCRA 670 (1963)

- The legislative intent to increase revenue by widening the coverage of taxable subjects is evident

under RA 1612, and by it the exempt agricultural products I sevident under RA 1612, and by it the

exempt agricultural products were only those that remain in their original form, and have not

undergone the process of manufacture.

NPC v. RTC Presiding Judge, Cagayan de Oro, 190 SCRA 477 (1990)

- Pet. Alleges that what has been withdrawn is its exemption from taxes, duties and fees which are

payable to the national government while its exemption from taxes, duties and fees payable to

government branches, agencies and instrumentalities remains unaffected. Considering that real

property taxes are payable to the local government, NAPOCOR maintains that it is exempt

therefrom. We find the above argument untenable. It reads into the law a distinction that is not

there. It is contrary to the clear intent of the law to withdraw from all units of government;

including GOCC their exemptions from all kinds of taxes. Had it been otherwise, then the law

would have said so. Not having distinguished as to the kinds of tax exemptions withdrawn, the

plain meaning is that all tax exemptions are covered. Where the law does not distinguish, neither

must we. Xxx Moreover, PD 1931 entitled “DIRECTING THE RATIONALIZATION OF DUTY

AND TAX EXEMPTION PRIVILEGES GRANTED TO GOCC AND OTHER UNITS OF

GOVERNMENT’ which was passed on June 11, 1984, categorically states: “WHEREAS. PD

1177 has already expressly repealed the grant of tax privileges to any GOCC and all other units of

government. Thus, any dubiety on NAPOCOR’s liability to pay taxes, duties and fees should be

considered unequivocably resolved by the above provision.

Chavez v. PCGG, supra.

- In a compromise agreement between the Philippine Government, represented by the PCGG, and

the Marcos heirs, the PCGG granted tax exemptions to the assets which will be apportioned to the

Marcos heirs. The Supreme Court ruled that the PCGG has absolutely no power to grant tax

exemptions, even under the cover of its authority to compromise ill gotten wealth cases. The grant

of tax exemptions is the exclusive prerogative of Congress.

- In fact, the Supreme Court even stated that Congress itself cannot grant tax exemptions in the case

at bar because it will violate the equal protection clause of the Constitution.

REVIEWER BY: ELAH V

20

Davao Gulf v. CIR, 293 SCRA 76 (1998)

- A tax cannot be imposed unless it is supported by the clear and express language of a statute; on

the other hand, once the tax is unquestionably imposed, “a claim of exemption from tax payments

must be clearly shown and based on language in the law too plain to be mistaken.” Since the

partial refund authorized under Sec. 5, RA 1435, is in the nature of a tax exemption, it must be

construed strictissimi juris against the grantee. Hence, petitioner’s claim for refund based on

specific taxes it actually paid must expressly be granted in a statute stated in a language too clear

to be mistaken.

Maceda v. Macaraig, (1993) supra.

- The NPC is tax-exempt from all forms of taxes based on the history of statutes granting it tax

exemption privileges. One common theme in all these laws is that the NPC must be enabled to pay

its indebtedness, at any one time, and US$4 Billion in total foreign loans at any one time. The

NPC must be and has to be exempt from all forms of taxes if this goal is to be achieved. By virtue

of PD 938, NPC’s capital stock was raised to P8Billion. It must be remembered that to pay for the

government share in its capital stock PD 758 was issued mandating that P200 M would be

appropriated annually to cover the said unpaid subscription of the Government in NPC’s

authorized capital stock. And significantly one of the sources of this annual appropriation of P200

m is TAX MONEY accruing to the General Fund of the Government. It does not stand to reason

then that former Pres. Marcos would order P200 M to be taken partially or totally from tax money

to be used to pay the Government subscription in the NPC, on one hand, and then order the NPC

to pay all its indirect taxes, on the other.

Tolentino v. Sec. of Finance,(1995) supra.

- By granting exemptions, the State does not forever waive the exercise of its sovereign prerogative.

Now it is contended by the PPI that by removing the exemption of the press from the VAT while

maintaining those granted to others, the law discriminates against the press. At any rate, it is

averred, “even nondiscriminatory taxation of constitutionality guaranteed freedom is

unconstitutional.” With respect to the first contention, it would suffice to say that since the law

granted the press privilege, the law could take back the privilege anytime without offense to the

Constitution. The reason is simple: by granting exemptions, the State does not forever waive the

exercise of its sovereign prerogative.

e. Nature of tax exemption

1. It is a mere personal privilege of the grantee.

2. It is generally revocable by the government unless the exemption is founded on a contract which

is contract which is protected from impairment.

3. It implies a waiver on the part of the government of its right to collect what otherwise would be

due to it, and so is prejudicial thereto.

4. It is not necessarily discriminatory so long as the exemption has a reasonable foundation or

rational basis.

5. It is not transferable except if the law expressly provides so.

REVIEWER BY: ELAH V

21

Tolentino v. Sec. of Finance, (1995) supra.

- “ It is inherent in the power to tax that the State be free to select the subjects of taxation, and it has

been repeatedly held that ‘inequalities which result from a singling out of one particular class for

taxation, or exemption infringe no constitutional limitation. “

PLDT v. City of Davao, (2001) supra.

- The fact is that the term exemption in Sec. 23 is too general. A cardinal rule in StaCon is that

legislative intent must be ascertained from a consideration of the statute as a whole and not merely

of a particular provision.

- In sum, it does not appear that, in approving sec. 23 of RA No. 7925, Congress intended it to

operate as a blanket tax exemption to all telecommunications entities. Applying the rule of strict

construction of laws granting tax exemptions and the rule that doubts should be resolved in favor

of municipal corporations in interpreting statutory provisions on municipal taxing powers, we hold

that 23 of RA 7925 cannot be considered as having amended petitioners franchise so as to entitle it

to exemption from the imposition of local franchise taxes.

Maceda v. Macaraig, (1991) supra.

- The rule of strict construction of statutes granting tax exemptions does not apply in the case of

exemptions in favor of a governmental political subdivision or instrumentality.

Phil. Acetylene v. Commissioner, supra.

- A tax exemption must be strictly construed. An exemption will not be considered conferred unless

the terms under which it is granted clearly and distinctly show that such was the intention of the

parties.

Wonder Mech v. CTA, 64 SCRA 555 (1975)

- There is no way to dispute the cardinal rule in taxation that exemptions therefrom are highly

disfavored in law and he who claims tax exemption must be able to justify his claim or right.

- Tax exemption must be clearly expressed and cannot be established by implication. Exemption

from a common burden cannot be permitted to exist upon vague implication.

Atlas Fertilizer v. Com., supra.

- The Secretary of Finance was convinced that the equipment imported were not only needed for

exclusive use in the manufacture of fertilizer but the same were actually used therefore thus

approving the application for exemption without adducing evidence that he is entitled for

exemption.

f. Laws granting tax exemption, incentives

i. Constitution

Sec. 28 (3), Art. VI and Sec. 4 (3, 4), Art. XIV, 1987 Constitution

Sec. 28 (3), Art. VI, Constitution .” (Property Tax Exemption).

REVIEWER BY: ELAH V

22

“Charitable institutions, churches and personages or convents appurtenant thereto, mosques, non-profit

cemeteries, and all lands, buildings, and improvements, actually, directly, and exclusively used for

religious, charitable, or educational purposes shall be exempt from taxation

Sec. 4 (3, 4), Art. XIV, 1987 Constitution (Income tax, Property Tax, and Donor’s Tax exemption)

“All revenues and assets of non-stock, non-profit educational institutions used actually, directly, and

exclusively for educational purposes shall be exempt from taxes and duties. Upon the dissolution or

cessation of the corporate existence of such institutions, their assets shall be disposed of in the manner

provided by law.” Sec.4, (3)

“Subject to the conditions prescribed by law, all grants, endowments, donations or contributions used

actually, directly, and exclusively for educational purposes shall be exempt from tax. Sec. 4, (4)

Abra Valley v. Aquino, supra.

- The test of exemption from taxation is the use of the property for the purpose mentioned in the

Constitution. The term “exclusively uses” does not necessarily means total or absolute use for

religious, charitable, educational purposes. Even if the property is incidentally and necessarily

used for the accomplishment of the said purposes, tax exemption will apply.

ii. tax statutes

Sec. 30, 32 (B), 106, 199 Exemption Granted by NIRC (R.A. 7716)

SEC. 30. Exemptions from Tax on Corporations. - The following organizations shall not be taxed

under this Title in respect to income received by them as such:

(A) Labor, agricultural or horticultural organization not organized principally for profit;

(B) Mutual savings bank not having a capital stock represented by shares, and cooperative bank without

capital stock organized and operated for mutual purposes and without profit;

(C) A beneficiary society, order or association, operating for the exclusive benefit of the members such as

a fraternal organization operating under the lodge system, or mutual aid association or a nonstock

corporation organized by employees providing for the payment of life, sickness, accident, or other

benefits exclusively to the members of such society, order, or association, or nonstock corporation or their

dependents;

(D) Cemetery company owned and operated exclusively for the benefit of its members;

(E) Nonstock corporation or association organized and operated exclusively for religious, charitable,

scientific, athletic, or cultural purposes, or for the rehabilitation of veterans, no part of its net income or

asset shall belong to or inures to the benefit of any member, organizer, officer or any specific person;

(F) Business league chamber of commerce, or board of trade, not organized for profit and no part of the

net income of which inures to the benefit of any private stock-holder, or individual;

(G) Civic league or organization not organized for profit but operated exclusively for the promotion of

social welfare;

(H) A nonstock and nonprofit educational institution;

REVIEWER BY: ELAH V

23

(I) Government educational institution;

(J) Farmers' or other mutual typhoon or fire insurance company, mutual ditch or irrigation company,

mutual or cooperative telephone company, or like organization of a purely local character, the income of

which consists solely of assessments, dues, and fees collected from members for the sole purpose of

meeting its expenses; and

(K) Farmers', fruit growers', or like association organized and operated as a sales agent for the purpose of

marketing the products of its members and turning back to them the proceeds of sales, less the necessary

selling expenses on the basis of the quantity of produce finished by them;

Notwithstanding the provisions in the preceding paragraphs, the income of whatever kind and character of

the foregoing organizations from any of their properties, real or personal, or from any of their activities

conducted for profit regardless of the disposition made of such income, shall be subject to tax imposed

under this Code.

NIRC Sec. 32 (B) Exclusions from Gross Income. - The following items shall not be included in gross

income and shall be exempt from taxation under this title:

1. Proceeds from life insurance

2. Amount received by insured as return of premium

3. Gifts, bequests and devises

4. Compensation for injuries or sickness

5. Income exempt under treaty

6. Retirement benefits, pensions, gratuities, etc.

7. Income derived by foreign government

8. Income derived by the Philippine Government or its political subdivisions

9. Prizes and awards made primarily in recognition of religious, charitable, scientific, educational,

artistic, literary or civic achievement.

10. Prizes and awards in sports competitions sanctioned by the national sports associations

11. 13th month pay and other benefits not exceeding P30,000.00. Applies both to public and private

employees.

12. GSIS, SSS, Medicare and other contributions

13. Gains from the sale of bonds, debentures or other certificate of indebtedness. 5 eyars or more. If

maturity is less than 5 years, it is taxable.

14. Gains from redemption of shares in mutual fund. It must be emanate from the mutual fund

Sec. 106 (A)(2) The following sales by VAT-registered persons shall be subject to zero percent (0%)

rate:

(a) Export Sales. - The term "export sales" means:

(b) Foreign Currency Denominated Sale. -

(c) Sales to persons or entities whose exemption under special laws or international agreements to which

the Philippines is a signatory effectively subjects such sales to zero rate.

NIRC SEC. 199. Documents and Papers Not Subject to Stamp Tax

(a) Policies of insurance or annuities made or granted by a fraternal or beneficiary society, order,

association or cooperative company, operated on the lodge system or local cooperation plan and

organized and conducted solely by the members thereof for the exclusive benefit of each member and not

for profit.

REVIEWER BY: ELAH V

24

(b) Certificates of oaths administered to any government official in his official capacity or of

acknowledgment by any government official in the performance of his official duties, written appearance

in any court by any government official, in his official capacity; certificates of the administration of oaths

to any person as to the authenticity of any paper required to be filed in court by any person or party

thereto, whether the proceedings be civil or criminal; papers and documents filed in courts by or for the

national, provincial, city or municipal governments; affidavits of poor persons for the purpose of proving

poverty; statements and other compulsory information required of persons or corporations by the rules

and regulations of the national, provincial, city or municipal governments exclusively for statistical

purposes and which are wholly for the use of the bureau or office in which they are filed, and not at the

instance or for the use or benefit of the person filing them; certified copies and other certificates placed

upon documents, instruments and papers for the national, provincial, city, or municipal governments,

made at the instance and for the sole use of some other branch of the national, provincial, city or

municipal governments; and certificates of the assessed value of lands, not exceeding Two hundred pesos

(P200) in value assessed, furnished by the provincial, city or municipal Treasurer to applicants for

registration of title to land.

Sec. 159 and 234, R. A. 7160(Exemption Granted by the Local Taxing Authority)

Sec. 159, R.A. 7160. Community Tax Exemptions

SEC. 159. Exemptions. – The following are exempt from the community tax:

(1) Diplomatic and consular representatives; and

(2) Transient visitors when their stay in the Philippines does not exceed three (3) months

Real Property Tax Exemption R.A. 7160 (Local Government Code)

Section 234. Exemption From Real Property Tax

(a) Real property owned by the Republic of the Philippines or any of its political subdivisions

except when the beneficial use thereof has been granted for consideration or otherwise to a taxable

person.

(b) Charitable institutions, churches, parsonages, or convents appurtenant thereto, mosques, non-

profit or religious cemeteries, and all lands, buildings, and improvements actually, directly and

exclusively used for religious, charitable, or educational purposes.

(c) All machineries and equipment that are actually, directly and exclusively use by local water

utilities and

government-owned or controlled corporations engaged in supply and distribution of water and/or

generation and transmission of electric power.

(d) All real property owned by duly registered cooperatives as provided for under Republic Act No.

6938.

(e) Machinery and equipment used for pollution control and environmental protection.

Sec. 105, Tariff and Customs Code (TCC)

iv. special laws

R. A. 7549. An act exempting all prizes and awards gained from local and international sports

tournaments and competitions from the payment of income and other forms of taxes and for other

purposes

SECTION 1. All prizes and awards granted to athletes in local and international sports tournaments and

competitions held in the Philippines or abroad and sanctioned by their respective national sports

REVIEWER BY: ELAH V

25

associations shall be exempt from income tax: provided, that such prizes and awards given to said athletes

shall be deductible in full from the gross income of the donor: provided, further, that the donors of said

prizes and awards shall be exempt from the payment of donor's tax.

The benefits herein provided shall cover the XVIth Southeast Asian Games (SEA Games) held in Manila

from November 25 to December 5, 1991.

Com. v. Phil Ace Line, supra.

- Goods obtained by the respondent shall be subject to compensating tax since sec. 14 of R.A. 1789

exempts only custom duties, consular fees and the special import tax.

- R.A. 1789- An act prescribing the national policy in the procurement and utilization of reparations

and development loans from japan, creating a reparations commission to implement the policy,

providing funds therefor, and for other purposes.

- Section 14. Exemption from Tax. All reparations goods obtained by the government shall be

exempt from the payment of all duties, fees and taxes. Reparations goods obtained by private

parties shall be exempt only from the payment of customs duties, consular fees and the special

import tax.

iv. treaties

RP-US Tax Treaty

RP-Germany Tax Treaty

Com. v. S. C. Johnson, supra.

- Respondent was subjected to 25% withholding tax on royalty payments which he contested

claiming that it is entitled to “The Most Favored Nation” Tax Rate of 10% on royalties as provided

in the RP-US Tax treaty in relation to the RP-West Germany Tax Treaty.

- According to petitioner, the taxes upon royalties under the RP-US Tax Treaty are not paid under

circumstances similar to those in the RP-West Germany Tax Treaty since there is no provision for

a 20 percent matching credit in the former convention and private respondent cannot invoke the

concessional tax rate on the strength of the most favored nation clause in the RP-US Tax Treaty.

Petitioner's position is explained thus:

- Under the foregoing provision of the RP-West Germany Tax Treaty, the Philippine tax paid on

income from sources within the Philippines is allowed as a credit against German income and

corporation tax on the same income. In the case of royalties for which the tax is reduced to 10 or

15 percent according to paragraph 2 of Article 12 of the RP-West Germany Tax Treaty, the credit

shall be 20% of the gross amount of such royalty. To illustrate, the royalty income of a German

resident from sources within the Philippines arising from the use of, or the right to use, any patent,

trade mark, design or model, plan, secret formula or process, is taxed at 10% of the gross amount

of said royalty under certain conditions. The rate of 10% is imposed if credit against the German

income and corporation tax on said royalty is allowed in favor of the German resident. That means

the rate of 10% is granted to the German taxpayer if he is similarly granted a credit against the

income and corporation tax of West Germany. The clear intent of the "matching credit" is to soften

the impact of double taxation by different jurisdictions.

REVIEWER BY: ELAH V

26

- The RP-US Tax Treaty contains no similar "matching credit" as that provided under the RP-West

Germany Tax Treaty. Hence, the tax on royalties under the RP-US Tax Treaty is not paid under

similar circumstances as those obtaining in the RP-West Germany Tax Treaty. Therefore, the

"most favored nation" clause in the RP-West Germany Tax Treaty cannot be availed of in

interpreting the provisions of the RP-US Tax Treaty.

Reagan v. CIR, 30 SCRA 968 (1969)

- The Clark Air Force Base is not a foreign soil or territory for purposes of income tax legislation.

There is nothing in the Military Bases Agreement that lends support to such assertion. It has not

become foreign soil or territory. The Philippine’s jurisdictional rights therein, certainly not

excluding the power to tax, have been preserved.