Professional Documents

Culture Documents

Problems On Leverages

Problems On Leverages

Uploaded by

DeepakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems On Leverages

Problems On Leverages

Uploaded by

DeepakCopyright:

Available Formats

Class Room Problems on Leverages

Problem 1: Calculate the Degree of Operating Leverage from the following data

Sales 1,00,000 Units @ Rs 2 per Unit

Variable Cost Per Unit Rs 0.70

Fixed Cost Rs 1,00,000

Problem 2: Calculate the Financial Leverage from following data

Sales 1,00,000 Units@ Rs 4 per unit

Variable Cost Per Unit Rs 1.40 per unit

Fixed Costs Rs 2,00,000

Interest Charges Rs 8,000

Problem 4: Calculate the financial Leverage under the following financial Plan

Particulars Plan A Plan B Plan C

Equity Share Capital 2,00,000 1,00,000 3,00,000

10% Debt Capital 2,00,000 3,00,000 1,00,000

Operating 40,000 40,000 40,000

Profit(EBIT)

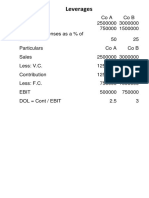

Problem 5: Kumar company has sales of Rs. 25,00,000. Variable cost of Rs. 12,50,000 and fixed

cost of Rs. 50,000 and debt of Rs. 12,50,000 at 8% rate of interest. Calculate combined

leverage.

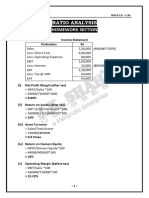

Problem 6: From the following information available for the four companies, calculate: (i)

EBIT; (ii) EPS;(iii) Operating leverage; (iv) Financial Leverage.

Particulars P Q R S

Selling Price Per Unit 15 20 25 30

Variable Cost per Unit 10 15 20 25

Quantity(No's) 20,000 25,000 30,000 40,000

Fixed Cost(Rs) 30,000 40,000 50,000 60,000

Interest(Rs) 15,000 25,000 35,000 40,000

Tax Rate(%) 40 40 40 40

No. of equity shares 5,000 9,000 10,000 12,000

You might also like

- Financial Leverage QuestionsDocument2 pagesFinancial Leverage QuestionsjeganrajrajNo ratings yet

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakNo ratings yet

- Leverages PDFDocument7 pagesLeverages PDFVaishnavi ShigvanNo ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- Assignment 4 (Leverage)Document2 pagesAssignment 4 (Leverage)dangerous saifNo ratings yet

- Apr 18 Management Acc 2Document4 pagesApr 18 Management Acc 2Harish KapoorNo ratings yet

- Sem IV CFA SolutionDocument10 pagesSem IV CFA SolutionFaheem KwtNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Work Sheet 3 & 4 Business FinanceDocument3 pagesWork Sheet 3 & 4 Business FinancePrateek YadavNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even AnalysisRachit DixitNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- Problems On Marginal CostingDocument7 pagesProblems On Marginal Costingrathanreddy2002No ratings yet

- Total Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityDocument29 pagesTotal Assets Net Income Total Debt Interest Expense Income Tax Expense Total Owners EquityshabNo ratings yet

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Business Risk:: Invesdted Capital Is Difference Between Total Assets and Working CapitalDocument5 pagesBusiness Risk:: Invesdted Capital Is Difference Between Total Assets and Working Capitaldua tanveerNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Unit 2 LeveragesDocument4 pagesUnit 2 Leveragesbhargavayg1915No ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Jaya College of Arts and Science Department of ManagDocument4 pagesJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- Wa0002Document3 pagesWa0002abdfaz951No ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- Assignment Answer Sheet: Name: Subject: Assignment IiDocument6 pagesAssignment Answer Sheet: Name: Subject: Assignment IiAravindh ArulNo ratings yet

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Review Questions Principles of Cost Accounting - 070850Document7 pagesReview Questions Principles of Cost Accounting - 070850Daniel JuliusNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Module 6 Leverage QuestionsDocument3 pagesModule 6 Leverage QuestionsJayashree ChakrapaniNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshNo ratings yet

- Leverages ProblemsDocument4 pagesLeverages Problemsk,hbibk,n0% (1)

- Interim and Segment Reporting 2Document3 pagesInterim and Segment Reporting 2JuvilynNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Unit - 5-1Document12 pagesUnit - 5-1MOHAIDEEN THARIQ MNo ratings yet

- CA India Financial ManagementDocument30 pagesCA India Financial Managementomkumardepani070805No ratings yet

- Applying The Hubbert FormulaDocument3 pagesApplying The Hubbert FormulaShrestha NiwasNo ratings yet

- E5.18 Contribution Margin Per Unit Fixed ExpensesDocument5 pagesE5.18 Contribution Margin Per Unit Fixed ExpensesK59 Lai Hoang SonNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- AFM ProblemsDocument4 pagesAFM ProblemskuselvNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- PDF RemoverDocument6 pagesPDF RemoversurajNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Problems On Cash Management Baumol ModelsDocument1 pageProblems On Cash Management Baumol ModelsDeepak100% (1)

- Problems On Working CapitalDocument2 pagesProblems On Working CapitalDeepakNo ratings yet

- Problems On Capital BudgetingDocument2 pagesProblems On Capital BudgetingDeepakNo ratings yet

- NBFCDocument12 pagesNBFCDeepakNo ratings yet

- Mutual FundsDocument30 pagesMutual FundsDeepakNo ratings yet

- Managerial Economics I ModuleDocument129 pagesManagerial Economics I ModuleDeepakNo ratings yet