Professional Documents

Culture Documents

I Tax Calculation 19-20

I Tax Calculation 19-20

Uploaded by

arindam hatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I Tax Calculation 19-20

I Tax Calculation 19-20

Uploaded by

arindam hatiCopyright:

Available Formats

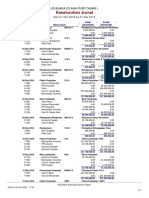

INCOME TAX CALCULATION (F.Y.

2019-20) FOR WB TEACHERS ONLY (FOR PERSONAL USE)

Fixed HRA Spouse then My HRA = 6000 Family HRA = 6000 PH (Y/N) N No of July Increments (0 / 1 / 2) 1 0 0

ROPA 19 HRA Spouse then My HRA = 12000 Family HRA = 12000 ELIGIBLE FOR MEDICAL ALLOWANCE (Y / N) Y Prepared by: WETHETEACHERS.IN

Basic Pay SP/CA/ Gross HOUSE RENT PAID

Period Band Pay GP AGP DA HRA MA P. Tax P. Fund SAVINGS DETAILS AMOUNT 0 0

(See Below) TICA/AR Total PER MONTH

March 0 0 0 0 0 0 LIFE INSURANCE PREM Grosss Sal 0

April 0 0 0 0 0 0 0 0 0 0 0 SUKANYA SAMMRIDHI Relief U/S 10(13A) 0

May 0 0 0 0 0 0 0 0 0 0 0 PLI Balance 0

June 0 0 0 0 0 0 0 0 0 0 0 NSC P. Tax 0

July 0 0 0 0 0 0 0 0 0 0 0 HBL PRINCIPAL Net Sal (excl SD 50k) -50,000

August 0 0 0 0 0 0 0 0 0 0 0 CHILD TUITION FEE Chapter VI (-80C) 0

September 0 0 0 0 0 0 0 0 0 0 0 PPF SAVINGS (80C) 0

October 0 0 0 0 0 0 0 0 0 0 0 MUTUAL FUNDS HBL INTEREST (80EE)

November 0 0 0 0 0 0 0 0 0 0 0 NPS [80CCD(1B)] RELIEF, IF ANY Tax Calculation for

December 0 0 0 0 0 0 0 0 0 0 0 H.EDN. PREM (80E) OTHER INCOME Income >5L to 10L

January (ROPA 2019) 1 0 0 0 0 0 0 0 INTT ON SAV. A/C (80TTA) TAXABLE INCOME -50,000 -550,000 0

February (ROPA 2019) 0 0 0 0 0 0 0 0 MEDICLAIM (80D) Tax 0 0 0

Arrear, if any Limit for Bonus & Eligibility 30000 N 4,000 0 0 DONATION (80G) ED Cess 0 0 0

Total 0 0 0 0 0 0 0 0 0 0 0 Chapter VI Total Deduction 0 Tax Payable 0 0

1. Fill the cells highlighted in yellow color

or left blank BP Calculation for 10/20 Yrs Increment (2nd July to 31st Dec)

2. If you want to get u/s 10 releief then replace the zero with house rent/month Days in Month 31 Days (for Current BP) Basic (Part) BASIC (MONTHLY)

other wise keep the zero. Current Basic 8 0

0 23

0

3. if spouse is salaried person and ur HRA is FIXED @6000/- then put HRA of Spouse Next month BP 0

4. cells in light yellow colour are editable. Put 8 if DoJ = 9

5. ROPA 2019 Basic Pay must be tallied with 6th PC Calculator.

ANNUAL SALARY STATEMENT FOR THE F.Y. 2019-20 & A.Y. 2020-21

Name of the Employee: PAN:

Name of the School/Madrasah: Designation:

Pay Band, Scale & Grade Pay (ROPA 09 ): Pay Level (ROPA 19):

AR/CA/ Loan Re- Over- Total

Month Basic Pay DA HRA MA Gross Pay P Tax P Fund Net Pay TDS

TICA covery drawn Deduction

March - - - - - - - - - - - -

April - - - - - - - - - - - -

May - - - - - - - - - - - -

June - - - - - - - - - - - -

July - - - - - - - - - - - -

August - - - - - - - - - - - -

September - - - - - - - - - - - -

October - - - - - - - - - - - -

November - - - - - - - - - - - -

December - - - - - - - - - - - -

January - - - - - - - - - - - -

February - - - - - - - - - - - -

ARREAR -

BONUS -

TOTAL - - - - - - - - - - - - -

Signature of the Employee Signature of the Head of Instituion

www.wetheteachers.in V1.0

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- PPDocument2 pagesPPSNG RYKNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Problem 1Document12 pagesProblem 1anushka roseeawon50% (2)

- Using The IVI (Innovation Value Institute) IT CMF (IT Capability Maturity Framework) To Develop A Business Oriented Information Technology StrategyDocument35 pagesUsing The IVI (Innovation Value Institute) IT CMF (IT Capability Maturity Framework) To Develop A Business Oriented Information Technology StrategyAlan McSweeneyNo ratings yet

- Kepner TregoeDocument16 pagesKepner TregoeOmar El MokhtariNo ratings yet

- Competition Law Notes: UNIT I: IntroductionDocument34 pagesCompetition Law Notes: UNIT I: Introduction2050101 A YUVRAJNo ratings yet

- Cost of Capital 2Document29 pagesCost of Capital 2BSA 1A100% (2)

- Reviewer MasDocument99 pagesReviewer MasChi Chi Na75% (4)

- CromaDocument2 pagesCromaSatender KumarNo ratings yet

- Transfer Register All: Bangladesh Krishi BankDocument13 pagesTransfer Register All: Bangladesh Krishi Bankabdul kuddusNo ratings yet

- GONDA, ANN JERLYN - Financial Risk ManagementDocument40 pagesGONDA, ANN JERLYN - Financial Risk ManagementAngel GondaNo ratings yet

- Project Appraisal Practitioner Guide (Part 1 For Chapter 1, Part 6 For Chapter 2 and Annexure 7A1 For Chapter 8)Document385 pagesProject Appraisal Practitioner Guide (Part 1 For Chapter 1, Part 6 For Chapter 2 and Annexure 7A1 For Chapter 8)đwsaNo ratings yet

- GSTC Industry Criteria For Hotels With Indicators Dec 2016Document11 pagesGSTC Industry Criteria For Hotels With Indicators Dec 2016Alejo VargasNo ratings yet

- Universty of Gonder: College of Business and EconomicsDocument9 pagesUniversty of Gonder: College of Business and EconomicsJossi AbuleNo ratings yet

- Trắc-nghiệm-Frederic S. Mishkin Economics of Money Banking-1-1Document49 pagesTrắc-nghiệm-Frederic S. Mishkin Economics of Money Banking-1-1Tuấn Anh Trần CôngNo ratings yet

- Road and Building Department From Ahmedabad - GujaratDocument4 pagesRoad and Building Department From Ahmedabad - GujaratHussain ShaikhNo ratings yet

- Opex RatioDocument4 pagesOpex RatioAbdullateefNo ratings yet

- E-Bulletin Foundation Sept 2019Document45 pagesE-Bulletin Foundation Sept 2019Vijay SharmaNo ratings yet

- HandoutsDocument2 pagesHandoutsJoshuaMolinoPanambitanNo ratings yet

- Behavioral Effects of Tax Withholding On Tax Compliance: Implications For Information InitiativesDocument45 pagesBehavioral Effects of Tax Withholding On Tax Compliance: Implications For Information InitiativeshenfaNo ratings yet

- SSRN Id3000712Document69 pagesSSRN Id3000712joaoNo ratings yet

- Company LawDocument6 pagesCompany LawTremaine AllenNo ratings yet

- Keseluruhan Jurnal: Ud Buana (Diana Puspitasari)Document3 pagesKeseluruhan Jurnal: Ud Buana (Diana Puspitasari)diana puspitasariNo ratings yet

- Fy2024 Budget Book Final Proposed 3.7.23 3Document78 pagesFy2024 Budget Book Final Proposed 3.7.23 3Dave BondyNo ratings yet

- 71 3e2c9505Document110 pages71 3e2c9505JohnNo ratings yet

- FILOIL GAS COMPANY INC. (Retail Division) Filoil Ticao Daily Shift Report Date: Shift: Time: Attendant: - Oic Mechanical Reading Close OpenDocument4 pagesFILOIL GAS COMPANY INC. (Retail Division) Filoil Ticao Daily Shift Report Date: Shift: Time: Attendant: - Oic Mechanical Reading Close OpenAnnie Gler B. AlmosaraNo ratings yet

- Ministry of Finance - Sri Lanka - Annual Report - 2017Document412 pagesMinistry of Finance - Sri Lanka - Annual Report - 2017lkwriterNo ratings yet

- Japan and PencilDocument27 pagesJapan and Pencilpinotage83No ratings yet

- Bangladesh Is A Large Contributor To The Global Textile IndustryDocument8 pagesBangladesh Is A Large Contributor To The Global Textile IndustryVvajahat AliNo ratings yet

- ACC109-P2-Exam: Problem SolvingDocument18 pagesACC109-P2-Exam: Problem SolvingRosemarie VillanuevaNo ratings yet

- Details of The Entrepreneur:: Total Project CostDocument5 pagesDetails of The Entrepreneur:: Total Project CostSahaSantanuNo ratings yet