Professional Documents

Culture Documents

Inspection Report of Scam-Hit PMC Bank Yet To Be Finalised

Uploaded by

mikjaggOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inspection Report of Scam-Hit PMC Bank Yet To Be Finalised

Uploaded by

mikjaggCopyright:

Available Formats

Business News › Industry › Banking/Finance › Banking Search for News, Stock Quotes & NAV's

Benchmarks Stock Screener Search, Select & Invest in Top Stocks FEATURED FUNDS 5Y RETURN Stock Analysis, IPO, Mutual

Funds, Bonds & More

Nifty CLOSED Top Growth Stocks with Mid-Cap HDFC Mid-Cap Opportunities 10.21 %

Stocks Regular Payout Growth Stocks Direct Plan-Growth

12,080.85 -45.05 INVEST NOW Market Watch

★★★★★

Inspection report of scam-hit PMC Bank yet to be finalised:

RBI

BY PTI | DEC 29, 2019, 01.53 PM IST Post a Comment

NEW DELHI: The inspection report on the financial position of the scam-hit Punjab and

Maharashtra Co-operative (PMC) Bank as on March 31 this year is yet to be finalised, the Big Change:

The end of Five-Year Plans: All you need to know

Reserve Bank of India has said.

Replying to an RTI query, it said preliminary findings of the RBI indicated large-scale irregularities in the bank, warranting supersession

of its board of directors and imposition of all inclusive directions of the Banking Regulation Act, 1949.

"The inspection report is yet to be finalised as inspection of the bank with respect to its financial position as on March 31, 2019, is under

progress," the central bank said in response to the RTI application field by this PTI journalist.

The RBI declined to give copies of two complaints received by it regarding "irregularities" in the bank and the action taken on them,

citing exemption clause in the transparency law that bars disclosure of information that would impede the process of investigation or

prosecution of offenders.

Based on the complaint vide letter dated September 17, wherein the complainant had alleged that the PMC Bank committed some

irregularities, the RBI on September 19 commenced statutory inspection of the bank on its financial position as on March 31, it said.

"In view of the ongoing investigation into the bank's affairs by various authorities, an exemption is sought from disclosing the information

under Section 8 (1) (g) and 8 (1) (h) of the Right to Information Act, 2005," the RBI said.

The Section 8 (1) (g) bars information "the disclosure of which would endanger the life or physical safety of any person or identify the

source of information or assistance given in confidence for law enforcement or security purposes".

The other section exempts disclosure of "information which would impede the process of investigation or apprehension or prosecution of

offenders".

The RBI was asked to share copies of complaints of any alleged irregularities in the PMC bank and the action taken on each one of

them.

"We have received two complaints," the central bank said, without giving the details of the second complaint.

The multi-state co-operative bank has been under the RBI restriction since September 23, after the central bank had found financial

irregularities, including huge under-reporting of loans and non-performing assets to real estate developer HDIL to the tune of Rs 6,500

crore, against its entire assets of Rs 8,880 crore, using hundreds of dummy accounts.

The central bank had sacked the board of the bank and appointed an administrator.

The RBI said it has received complaints forwarded to it by the Finance Ministry for comments or direct reply to the complainants.

"We have so far not received any written communication from the Finance Ministry apart from complaints received by them forwarded to

us for comments/direct reply to complainant," it said.

Stay on top of business news with The Economic Times App. Download it Now!

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Goodbye India, Hello IPL - MS Dhoni Set To 'Rule The Roost' in UAE - Times of IndiaDocument5 pagesGoodbye India, Hello IPL - MS Dhoni Set To 'Rule The Roost' in UAE - Times of IndiamikjaggNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Uddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiaDocument3 pagesUddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiamikjaggNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

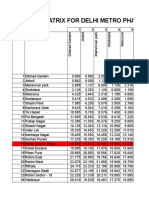

- MajlisPark SouthCampus Fare 14318Document266 pagesMajlisPark SouthCampus Fare 14318mikjaggNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Uddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiaDocument3 pagesUddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiamikjaggNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- India Becomes 5th Largest Economy, Overtakes UK, France - ReportDocument2 pagesIndia Becomes 5th Largest Economy, Overtakes UK, France - ReportmikjaggNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- India Vs New Zealand 1st Test Live Score Updates - Kiwi Bowlers Test Cheteshwar Pujara, Mayank Agarwal - Times of IndiaDocument8 pagesIndia Vs New Zealand 1st Test Live Score Updates - Kiwi Bowlers Test Cheteshwar Pujara, Mayank Agarwal - Times of IndiamikjaggNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- IPL 2020 - Meet The Teams - Can Chennai Super Kings Draw Level With Mumbai Indians - Times of IndiaDocument10 pagesIPL 2020 - Meet The Teams - Can Chennai Super Kings Draw Level With Mumbai Indians - Times of IndiamikjaggNo ratings yet

- Uddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiaDocument3 pagesUddhav's New Allies Ask Him To Review Stand On CAA-NPR - Times of IndiamikjaggNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Consultancy Fee Guidelines As Approved by The Council On February 6, 2012 PDFDocument11 pagesConsultancy Fee Guidelines As Approved by The Council On February 6, 2012 PDFወይከ ፈተኽNo ratings yet

- A Summary of Key Financial RatiosDocument4 pagesA Summary of Key Financial Ratiosroshan24No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- FICCI Plastic Industry For InfrastructureDocument48 pagesFICCI Plastic Industry For InfrastructuremikjaggNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ronaldinho and Owen For IFL 2014Document2 pagesRonaldinho and Owen For IFL 2014mikjaggNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Problem Solving Grand Slam 7 Steps To Master Training Deck PDFDocument27 pagesProblem Solving Grand Slam 7 Steps To Master Training Deck PDFEnrique SG100% (2)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- M&A GuideDocument59 pagesM&A GuidemikjaggNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Fluidized Bed ReactorDocument20 pagesFluidized Bed ReactormarraezNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Fab 4 of Indian Cricket To Get Rs 1Document1 pageFab 4 of Indian Cricket To Get Rs 1mikjaggNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Kumar Sanu List of Songs-AllDocument2 pagesKumar Sanu List of Songs-Allmikjagg67% (3)

- Ronaldinho and Owen For IFL 2014Document2 pagesRonaldinho and Owen For IFL 2014mikjaggNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Balwinder Singh Famous Ho Gaya - Movie ReviewDocument1 pageBalwinder Singh Famous Ho Gaya - Movie ReviewmikjaggNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bang 1Document1 pageBang 1mikjaggNo ratings yet

- 60 Persons Have Lost Their EyesightDocument1 page60 Persons Have Lost Their EyesightmikjaggNo ratings yet

- Tune Meri Jaana EmptinessDocument1 pageTune Meri Jaana EmptinessmikjaggNo ratings yet

- Enter Mukesh Ambani's Twins: Isha, Akash Now Board DirectorsDocument1 pageEnter Mukesh Ambani's Twins: Isha, Akash Now Board DirectorsmikjaggNo ratings yet

- Katiyabaaz Movie ReviewDocument1 pageKatiyabaaz Movie ReviewmikjaggNo ratings yet

- Analysis of Bollywood Movie Bang BangDocument1 pageAnalysis of Bollywood Movie Bang BangmikjaggNo ratings yet

- HAIDER: Music ReviewDocument1 pageHAIDER: Music ReviewmikjaggNo ratings yet

- A Little Wordsmith Par ExcellenceDocument1 pageA Little Wordsmith Par ExcellencemikjaggNo ratings yet

- Ind Vs WI KochiDocument1 pageInd Vs WI KochimikjaggNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Couple Trouble - Theatre Play ReviewDocument2 pagesCouple Trouble - Theatre Play ReviewmikjaggNo ratings yet

- International Treaty Ilo-Convention-C155 1981 EngDocument9 pagesInternational Treaty Ilo-Convention-C155 1981 EngAlketa ZakaNo ratings yet

- Tutorial 2: Auditors Legal Liabilities MCQDocument7 pagesTutorial 2: Auditors Legal Liabilities MCQcynthiama7777No ratings yet

- Designing Recruitment, Selection & Talent Management Model Tailored To Meet UNJSPF's Business Development NeedsDocument13 pagesDesigning Recruitment, Selection & Talent Management Model Tailored To Meet UNJSPF's Business Development NeedspingajaxNo ratings yet

- Commissioner of Internal Revenue vs. Avon Products Manufacturing, IncDocument3 pagesCommissioner of Internal Revenue vs. Avon Products Manufacturing, IncFrancis PunoNo ratings yet

- November 2019 Transactions: Date Account Titles and Explanations Debit CreditDocument5 pagesNovember 2019 Transactions: Date Account Titles and Explanations Debit CreditVirginia TownzenNo ratings yet

- The Birth of Filipino NationalismDocument104 pagesThe Birth of Filipino NationalismDrofits GamingNo ratings yet

- Introduction and Overview of IBCDocument3 pagesIntroduction and Overview of IBCArushi JindalNo ratings yet

- New Mayo LectureDocument73 pagesNew Mayo LectureDanielZamoraNo ratings yet

- HSE WEEKLY REPORT Februari Week Ke 13Document19 pagesHSE WEEKLY REPORT Februari Week Ke 13richo naiborhuNo ratings yet

- Hume On TrustDocument3 pagesHume On TrustWaldemar M. ReisNo ratings yet

- Easyparcel ERB447663431MYDocument1 pageEasyparcel ERB447663431MYHanaaoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Vietnam War Notes With TimelineDocument27 pagesVietnam War Notes With TimelineLuNo ratings yet

- PHD Synopsis THE PROTECTION OF WOMEN'S RIGHTS IN INDIA A LEGAL STUDYDocument17 pagesPHD Synopsis THE PROTECTION OF WOMEN'S RIGHTS IN INDIA A LEGAL STUDYSon AdamNo ratings yet

- Application Form For Provisional Certification Bodies (1) - India GHP India HACCPDocument6 pagesApplication Form For Provisional Certification Bodies (1) - India GHP India HACCPMonica SinghNo ratings yet

- LP With VIDEO, Agac-Ac, Rey Mark Teaching Strategies Video DemonstrationDocument8 pagesLP With VIDEO, Agac-Ac, Rey Mark Teaching Strategies Video DemonstrationRey Mark F Agac-acNo ratings yet

- District Selection Trial 2023 Part 2Document2 pagesDistrict Selection Trial 2023 Part 2sanurakshit007No ratings yet

- Toshiba CaseDocument14 pagesToshiba CaseCapNo ratings yet

- Full Download Essentials of Contract Law 2nd Edition Frey Solutions ManualDocument13 pagesFull Download Essentials of Contract Law 2nd Edition Frey Solutions Manualswooning.sandman.xjadd2100% (38)

- VCS Project Description Template v4.0Document18 pagesVCS Project Description Template v4.0Gabriel de Moura MachadoNo ratings yet

- Petty Cash Payment VoucherDocument6 pagesPetty Cash Payment VoucherArafathNo ratings yet

- Journal Geec 2Document21 pagesJournal Geec 2Zaim ImanNo ratings yet

- Boatman Ricci Statement 11760 To "Office of The Mayor" of The City of Naples - 2-22-21Document2 pagesBoatman Ricci Statement 11760 To "Office of The Mayor" of The City of Naples - 2-22-21Omar Rodriguez OrtizNo ratings yet

- II.11 - Cornelio PDFDocument11 pagesII.11 - Cornelio PDFAnna Patricia NuqueNo ratings yet

- Evaluating Collaborative Public-Private Partnerships - The Case of Toronto's Smart CityDocument13 pagesEvaluating Collaborative Public-Private Partnerships - The Case of Toronto's Smart CityBusri BusriNo ratings yet

- Underground To Canada BookletDocument54 pagesUnderground To Canada Bookletapi-496609111100% (1)

- Modernism NotesDocument10 pagesModernism NotesKonstantina ToulaNo ratings yet

- Anonas ColDocument4 pagesAnonas ColRichardVillanuevaNo ratings yet

- JaroszewskiGenderfluidOrAttack PDFDocument14 pagesJaroszewskiGenderfluidOrAttack PDFItsBird TvNo ratings yet

- Audit Management: Capabilities: What It Takes To Mature Audit ManagementDocument3 pagesAudit Management: Capabilities: What It Takes To Mature Audit ManagementRizkhy RamadhaniNo ratings yet

- Indian Constitution: Preamble Fundamental Rights and Duties Directive PrinciplesDocument8 pagesIndian Constitution: Preamble Fundamental Rights and Duties Directive PrinciplesAman KumarNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)