Professional Documents

Culture Documents

Cashless Economy-Reality or Pipe Dream - Odt

Uploaded by

Renuka Khatkar0 ratings0% found this document useful (0 votes)

10 views2 pagesOriginal Title

Cashless_economy-Reality_or_pipe_dream.odt

Copyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesCashless Economy-Reality or Pipe Dream - Odt

Uploaded by

Renuka KhatkarCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

You are on page 1of 2

Cashless economy- Reality or pipe dream?

Aditya gogoi

Immediately after the announcement of demonetisation policy at the

midnight hours of 8th of November, there is a major halt on overall activities of

trade and business. With people scrambling to exchange their old currencies,

the use of plastic money like debit card end credit card as well as the use of

internet banking being touted as the way forward. Even the Prime minister

Narendra Modi and Finance Minister Arun Jaitley urging public to “go digital”

and thereby trying to initiat the tragic and painful process of converting the

nation into a cashless economy. Now, what does exactly mean by a cashless

economy? It is nothing but a system of using plastic money- debit card and

credit card- and digital services through intrnet at the transaction place instead

of using physical cash currencies.

The premier question arises after the announcement of the agenda of

“cashless economy” and “go digital” is that, has Indian Economy attained that

stage of maturity to enter into a regime of cashless system. The available data

makes enough sense to put a straight forward “No” as the aswer to this million

dollar question.

Cards are used in three ways: to make payment online, to withdraw and

deposit cash at ATMs and for swiping at point of sale (POS) terminals at

marchant establishment. But, moving the cash transaction to plastic money

would require a large penetration of POS terminals across India. Increase in

number of school doesnot mean increase in number of educated people.

Likewise increase in the number of cards on use is not the reflection of the

numbers of Indian using these cards. A large number of people, especially in

urban Indian, have multiple cards. POS terminals use mobile internet to enable

transaction. Mobile internet pentration remains very fragile in rural India.

Furthermore, per-transaction bank charge also makes the online transaction

costlier than the cah transaction. Adding salt to the wound, lower financial

literacy among poor and rural population turns it problematic to push the use

of plastic money and digital transaction facility on wider scale. The RBI data

itself revealed that the businesses where transactions are mostly made by

women and poorer section of public, are tended to use plastic money in a lower

volume.

There are many other reasons why people prefer cash and this may have

nothing to do with sinisetr motives like hoarding or ammassing ill-gotten

wealth. Cash transactions are not necessarily immoral transaction. The wonder

of cah is that it just works smoothly. Even the remotest location of India, where

the government mght not present with all its armoury, it writ runs in the forms

currency that people use to do business on a daily basis. One generally donot

expect a small vegetable seller of a remote village sitting with a card swiping

machine within his afford.

The informal sector, which accounts 45% of the nation’s Gross Domestic

Product (GDP) and more than 80% of the total employment generated, rides

mostly on cash. Drying up of cash only aggravates the damage across the

informal sector as well as the small and mediam scale industry segment. The

activities in trade and manufacturing bodies have been reported a drope by

almost 50% after the monetary shock.

The economic cost of money supply crunch and the difficulties in using

plastic money on a larger scale across a wide geography in India makes it

detrimental for India to go cashless. Given the Indian reality, telling people to

go cashless is just like telling them to have cake when breads are unavailable.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- WhatsApp Groups Tracking - 3Document3 pagesWhatsApp Groups Tracking - 3Renuka KhatkarNo ratings yet

- Unit 2Document12 pagesUnit 2Renuka KhatkarNo ratings yet

- Scan Doc by CamScannerDocument1 pageScan Doc by CamScannerRenuka KhatkarNo ratings yet

- Understanding Research Process StagesDocument25 pagesUnderstanding Research Process StagesthensureshNo ratings yet

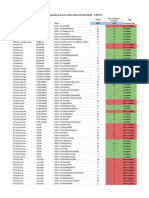

- Group D CRF Pendency List at 3.45 PM On 3.4.2020 PDFDocument14 pagesGroup D CRF Pendency List at 3.45 PM On 3.4.2020 PDFRenuka KhatkarNo ratings yet

- Group D CRF Pendency List at 3.45 PM On 3.4.2020Document14 pagesGroup D CRF Pendency List at 3.45 PM On 3.4.2020Renuka KhatkarNo ratings yet

- Directorate of Ayush, Haryana (Government of Haryana) : Advertisement For RecruitmentDocument8 pagesDirectorate of Ayush, Haryana (Government of Haryana) : Advertisement For RecruitmentRenuka KhatkarNo ratings yet

- Amended List of The Officers For Monitoring of E-Learning and Follow-UpDocument1 pageAmended List of The Officers For Monitoring of E-Learning and Follow-UpRenuka KhatkarNo ratings yet

- 600computer MCQDocument132 pages600computer MCQRenuka KhatkarNo ratings yet

- Corona Report No of EmployeeDocument2 pagesCorona Report No of EmployeeRenuka KhatkarNo ratings yet

- 2.0 History of IpDocument10 pages2.0 History of IpRenuka KhatkarNo ratings yet

- Constituion Micro LevelDocument12 pagesConstituion Micro LevelRenuka KhatkarNo ratings yet

- Ip Panorama 3 Learning Points PDFDocument34 pagesIp Panorama 3 Learning Points PDFRenuka KhatkarNo ratings yet

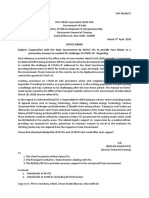

- Office Order Subject: Cooperation With The State Government by Nstis/ Itis To Provide Face Masks As A Preventive Measure To Combat The Challenge of Covid-19 - RegardingDocument8 pagesOffice Order Subject: Cooperation With The State Government by Nstis/ Itis To Provide Face Masks As A Preventive Measure To Combat The Challenge of Covid-19 - RegardingRenuka KhatkarNo ratings yet

- Wipo Pub 1012-Chapter2 PDFDocument24 pagesWipo Pub 1012-Chapter2 PDFHana AfifahNo ratings yet

- Intellual Property RightDocument25 pagesIntellual Property RightsinghalshilpiNo ratings yet

- Presented By: Anvita M. Pharm (IP)Document40 pagesPresented By: Anvita M. Pharm (IP)Renuka KhatkarNo ratings yet

- Scientific Research Methodologies and Techniques: Unit 11: Intellectual Unit 11: Intellectual Property RightsDocument27 pagesScientific Research Methodologies and Techniques: Unit 11: Intellectual Unit 11: Intellectual Property RightsManohar_3020No ratings yet

- Patenting Under PCTDocument3 pagesPatenting Under PCTRenuka KhatkarNo ratings yet

- 7 step patent process in India from filing to grantDocument15 pages7 step patent process in India from filing to grantRenuka KhatkarNo ratings yet

- Patenting Under PCT PDFDocument3 pagesPatenting Under PCT PDFRenuka Khatkar100% (1)

- Principles of Drug Delivery in <40 CharactersDocument42 pagesPrinciples of Drug Delivery in <40 CharactersSureshCoolNo ratings yet

- Research Problem: Mr. Jayesh PatidarDocument42 pagesResearch Problem: Mr. Jayesh PatidarRenuka KhatkarNo ratings yet

- Research Problem: Dr. Maheswari JaikumarDocument38 pagesResearch Problem: Dr. Maheswari JaikumarMourian AmanNo ratings yet

- Acid Attackson Womenin IndiaDocument4 pagesAcid Attackson Womenin IndiaRenuka KhatkarNo ratings yet

- Biomaterials Science and Engineering PDFDocument468 pagesBiomaterials Science and Engineering PDFmuk_hawkNo ratings yet

- Patent Filing ProcedureDocument34 pagesPatent Filing ProcedureANILNo ratings yet

- Piis014067361362228x PDFDocument10 pagesPiis014067361362228x PDFRenuka KhatkarNo ratings yet

- Attachment and Sale Under The Code of Civil ProcedureDocument21 pagesAttachment and Sale Under The Code of Civil Procedurelnagasrinivas0% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)