Professional Documents

Culture Documents

A9Recuk87 m1j6qd Gfo

A9Recuk87 m1j6qd Gfo

Uploaded by

ScribbbbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A9Recuk87 m1j6qd Gfo

A9Recuk87 m1j6qd Gfo

Uploaded by

ScribbbbCopyright:

Available Formats

materially from the forward-looking statements in this presentation, including but not limited to the factors, risks and

uncertainties regarding the Company’s

business described in the “Risk Factors” section of the Company’s annual report on Form 10-K that it will file with the Securities and Exchange

Commission (the “SEC”), in addition to the Company’s subsequent filings with the SEC. These filings identify and address other important risks and

uncertainties that could cause the Company’s actual events and results to differ materially from those contained in the forward-looking statements. Forward-

looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as

required by law, the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Use of Non-GAAP Financial Measures

This press release references Adjusted EBITDA, a non-GAAP financial measure. The Company defines Adjusted EBITDA as earnings before interest

expense, taxes, depreciation and amortization, stock-based compensation, and certain other items the Company believes are not indicative of its core

operating performance. Adjusted EBITDA is not a substitute for or superior to measures of financial performance prepared in accordance with generally

accepted accounting principles in the United States (GAAP) and should not be considered as an alternative to any other performance measures derived in

accordance with GAAP.

The Company believes that presenting Adjusted EBITDA provides useful supplemental information to investors about the Company in understanding and

evaluating its operating results, enhancing the overall understanding of its past performance and future prospects, and allowing for greater transparency with

respect to key financial metrics used by its management in financial and operational-decision making. However, there are a number of limitations related to

the use of non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may

use other measures to calculate their financial performance, and therefore any non-GAAP measures the Company uses may not be directly comparable to

similarly titled measures of other companies.

A reconciliation of Adjusted EBITDA to net loss for the three months and years ended December 31, 2019 and 2018, respectively, are set forth below:

Amounts in thousands ($) Three Months Ended Dec. 31 Twelve Months Ended Dec. 31

2019 2018 2019 2018

Net Loss $ (72,799) $ (45,717) $ (210,935) $ (138,139)

Income Tax Expense (Benefit) (61) 32 62 147

Interest Expense 34 2 36 10

Depreciation & Amortization 2,079 1,552 6,999 5,807

EBITDA (70,747) (44,131) (203,838) (132,175)

Cash Incentive Plan Disbursement* 9,867 — 9,867 —

Non-capitalized Transaction Costs** 3,577 — 4,692 —

Stock-Based Compensation 2,535 — 2,535 —

Adjusted EBITDA (54,768) (44,131) (186,744) (132,175)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

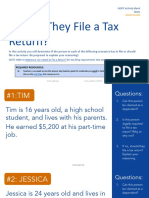

- PLAY - Should They File A Tax ReturnDocument9 pagesPLAY - Should They File A Tax ReturnAlanna100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Old SchemeDocument4 pagesOld SchemeUTTAM AGRAWALNo ratings yet

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- 2.form of Appeal ACIR - MDocument4 pages2.form of Appeal ACIR - Mwasim nisarNo ratings yet

- Chapter - 1 Computation of Tax LiabilityDocument6 pagesChapter - 1 Computation of Tax LiabilityNitin RajNo ratings yet

- Form 440 Emo Ird Gov TTDocument5 pagesForm 440 Emo Ird Gov TTTamira LalchandNo ratings yet

- Let Us Recapitulate: I. Tax Deduction at SourceDocument16 pagesLet Us Recapitulate: I. Tax Deduction at SourceVishalNo ratings yet

- Draft Work Order For Tree ShiftingDocument2 pagesDraft Work Order For Tree Shiftingsunil kumarNo ratings yet

- Domestic Travelling Expense Statement (1) TPDocument2 pagesDomestic Travelling Expense Statement (1) TPISGECFAB YARD2No ratings yet

- Test 8 (QP)Document5 pagesTest 8 (QP)iamneonkingNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software ProductKartik RajputNo ratings yet

- Cea New Forms 7CPC GaikDocument5 pagesCea New Forms 7CPC GaikUday AmarNo ratings yet

- AprDocument1 pageAprkallinath nrNo ratings yet

- Final Income Statement AnalysisDocument2 pagesFinal Income Statement AnalysisMohammad TalhaNo ratings yet

- FINAL G#5 Elaborate 3.4 Cases On RITDocument9 pagesFINAL G#5 Elaborate 3.4 Cases On RITGwyn Lopez100% (1)

- Special Journals - Quiz 38Document7 pagesSpecial Journals - Quiz 38Joana TrinidadNo ratings yet

- Quiz BeeDocument127 pagesQuiz BeeCharisse MaticNo ratings yet

- Bailey Corporation Recently Reported The Following Income Statement Dollars AreDocument1 pageBailey Corporation Recently Reported The Following Income Statement Dollars AreMuhammad ShahidNo ratings yet

- Alka Kumari Sinha: ParticularsDocument6 pagesAlka Kumari Sinha: ParticularsCa Nishikant mishraNo ratings yet

- Tax Base Tax RtaeDocument6 pagesTax Base Tax RtaeSittielyka PampanganNo ratings yet

- Multiple Choice Questions 1 The Base Account For A Vertical AnalysisDocument3 pagesMultiple Choice Questions 1 The Base Account For A Vertical AnalysisAmit PandeyNo ratings yet

- CLWTAXN NotesDocument7 pagesCLWTAXN NotesErin Leigh Marie SyNo ratings yet

- Chap 9 Tax CorrectedDocument9 pagesChap 9 Tax CorrectedAdah Micah PlarisanNo ratings yet

- CBDT E-Receipt For E-Tax PaymentDocument1 pageCBDT E-Receipt For E-Tax PaymentSreedhar RaoNo ratings yet

- Olmstead Corporation S Capital Structure Is As Follows The Following Additional InformationDocument1 pageOlmstead Corporation S Capital Structure Is As Follows The Following Additional InformationHassan JanNo ratings yet

- Profit Planning Breakeven Point - UnitsDocument3 pagesProfit Planning Breakeven Point - UnitsAnn louNo ratings yet

- 15th Business Presentation For NACSTACCSDocument14 pages15th Business Presentation For NACSTACCSDavid MythNo ratings yet

- Public Notice 20 of 2021 First Quarter Provisional Income TaxDocument3 pagesPublic Notice 20 of 2021 First Quarter Provisional Income TaxTim StockwellNo ratings yet