Professional Documents

Culture Documents

Accounting

Uploaded by

thejuluistv llanto0 ratings0% found this document useful (0 votes)

4 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesAccounting

Uploaded by

thejuluistv llantoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Chapter I: Introduction to Accounting Accountancy in the Philippines

The seeds of Philippines accountancy as a

What is Accounting? recognized profession were planted on March 17,

Accounting is the process of identifying, 1928, when Act No. 3105 was approved by the 6th

measuring, and communicating economic Legislature entitled:

information to permit informed judgments “An Act Regulating the Practice of Public

and decisions by users of information (AAA). Accounting; Creating the Board of Accountancy;

It is a system that measures business Providing for Examination, for the Granting of

activities, processes given information into Certificates, and the Registration of Certified Public

reports, and communicates findings to Accountants, for the Suspension or Revocation of

decision makers (PICPA) Certificates; and for Other Purposes.”

Since then, both the profession and the body that

Nature of Accounting regulates it (BOA) have grown rapidly. From 43

Accounting is the language of business. It is registered accountants in 1923, the number of CPAs

the tool used to communicate financial information to has grown to over 190,000 as at today.

users of economic/business entity.

Don Vicente Fabella- First Filipino CPA in the

Accountants Accounting Users United States (Passed the Milwaukee,

Wisconsin CPA Board Exams in 1915), and

Economic/Business Entity- Any organization that founder of Jose Rizal University in 1919.

uses resources to achieve its goals and objectives. Belen Enrile-Gutierrez- First Filipina CPA

Two types: and one of the seven original trustees of FEU

For-profit- entities who generate in 1933.

income from their operation.

Nonprofit- entities who carry out On May 13, 2004, Republic Act No. 9298, known

charitable operation. as the “Philippine Accountancy Act of 2004” was

Users of Information- Group of persons who are signed into law by President Gloria Macapagal-

interested in the financial information of the Arroyo repealing the Presidential Decree No. 692,

business. There are two kinds of users—External the Revised Accountancy Law. It is the governing

and Internal. law that regulates the practice of accountancy in the

Philippines since.

History & Origin of Accounting Function of Accounting in Business

Scholars believe that accounting originates The primary function of accounting is to provide

from the early ancient civilizations. quantitative financial information that is useful in

Scribes in ancient Egypt were known to keep making economic decision. These financial

thorough records of the inventory of goods information are expressed and stated in a set of

for the pharaoh. reports called Financial Statements.

In Mesopotamia, records of commerce had Five major kinds of Financial Statements:

been inscribed on clay tables. Statement of Comprehensive Income- Also

known as Profit/Loss Statement and Income

However, it was not until the 14th century that Statement. It shows the result of the

a system of bookkeeping was introduced. company’s performance as a result of

Luca Pacioli- Fanciscan friar and a mathematician operations at a particular period of time.

who published the “Summa de Arithmetica, Statement of Changes in Equity- Provides

Geometria, Proportioni et Proportionalita information about the entity’s financial and

(Everything about Arithmetic, Geometry, and investing activities. This includes

Proportion)” in 1949 which introduced the double- investments and withdrawals of owners.

entry bookkeeping. He is then called the Father of Statement of Financial Position- Presents the

Double-Entry Bookkeeping”. entity’s assets, liabilities, and capital at a

given point in time.

Statement of Cash Flows-Provides

information about the entity’s cash inflows

and outflows resulting from its operations, technological advancements to better

investments, and financing. perform their work.

Notes to Financial Statements- Provides

additional information to help explain specific Core Values of Accountants (AICPA)

items in the record.

Competence- It is one’s ability to perform

Core Competencies of Accountants high quality work in a capably, efficient, and

Core competencies are a unique appropriate manner (AICPA). A professional

combination of human skills, knowledge, and accountant should perform professional

technology that provides value and result to the services with due care, competence, and

users (AICPA). diligence and has a continuing duty to

maintain professional knowledge and skill at

Communication Skills- Accountants make a level required to ensure that a client or

financial reports and translate these to help employer receives the advantage of

the users of accounting information easily competent professional service based on up-

digest them. They need to have good to-date developments in practice, legislation,

communication skills to effectively and techniques.

understand the explicit and implied needs of Continuing Education and Lifelong Learning-

their clientele. Without this skill, an Learning does not stop at school or when

accountant will not be able to properly accountants have already received their

convey the meaning of accounting certification. The business world is changing

information to other people in the business. every moment and the only way to adapt to

Leadership Skills- A leader is someone who the changing business environment is to

can influence, inspire, and motivate others to learn new things every time.

achieve results. Accountants need to have Objectivity- Accountants are entrusted with

this set of skills because the information that information and their responsibility is to deal

they provide to people in the business is with information without personal bias and

used to make wise decision. ensure that this will be free from distortions.

Strategic and Critical Thinking Skills-Critical Integrity- It is conducting oneself with

thinkers are problem solvers, and being able honesty and professional ethics.

to think critically is important in accounting. In Accountants, especially the certified ones,

the field, accountants are faced with many owe it to the public that the accounting

challenges, one of which is linking the data information they provide is true and accurate.

gathered to arrive at an insightful advice Attuned to Broad Business Issues-

toward strategic decision making. Accountants must be in tune with the overall

Ability to Focus- Accountant’s primary realities of the business (AICPA). They must

objective is to provide financial information to have a deep understanding of the business

its users. If they were unable to focus, they environment in the local and global settings.

will be sidetracked to other unimportant This understanding will lead them to a sound

concerns that will hinder them from achieving interpretation of financial information.

their goal.

Ability to Interpret Converging Information- Fundamental Principles that Must Be Observed

Accountants must continuously deal with By Accountants (PICPA)

wide range and varying information to

provide insightful interpretations that are Integrity- A professional accountant should

timely and of value. be straightforward and honest in performing

Adeptness with Technology- The current professional services.

technological trends and inventions are Objectivity- A professional accountant

reshaping business functions and activities should be fair and should not allow prejudice

nowadays. It is important then that or bias, conflict of interest, or influence of

accountants continuously develop a working others to override objectivity.

and strategic knowledge of these

Professional Competence and Due Care- A

professional accountant should perform

professional services with due care,

competence, and diligence. He/She has a

continuing duty to maintain professional

knowledge and skill at a level required to

ensure that a client or employer receives the

advantage of competent professional service

based on up-to-date developments in

practice, legislation, and techniques.

Confidentiality- Accountants should respect

the confidentiality of information acquired

during the course of performing professional

services and should not use or disclose any

such information without proper and specific

authority or unless there is a legal or

professional right or duty to disclose it.

Professional Behavior- A professional

accountant should act in a manner consistent

with the good reputation of the profession

and refrain from any conduct which might

bring discredit to the profession.

Technical Standards- A professional

accountant should carry out professional

services in accordance with the relevant

technical and professional standards.

He/She should conform to the technical and

professional standards of the Board of

Accountancy (BOA) or Professional

Regulation Commission (PRC), Securities

and Exchange Commission (SEC), Auditing

and Assurance Standard Council (AASC),

Accounting Standards Council (ASC), and

other relevant legislation.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Financial Reporting and Analysis Revsine 6th Edition Solutions ManualDocument5 pagesFinancial Reporting and Analysis Revsine 6th Edition Solutions Manualmichaelharvey16101989bkm100% (42)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EC3099 Industrial Economics PDFDocument42 pagesEC3099 Industrial Economics PDFmagnifiqueheart80% (5)

- Marketplace Success GuideDocument42 pagesMarketplace Success GuideRoberto Omar Morante Villarreal100% (1)

- Design ThinkingDocument35 pagesDesign ThinkingNIKET GUPTANo ratings yet

- Project Report On Corrugated Boxes (Automatic Plant)Document6 pagesProject Report On Corrugated Boxes (Automatic Plant)EIRI Board of Consultants and PublishersNo ratings yet

- The Economic Base of Accra Ghana PDFDocument16 pagesThe Economic Base of Accra Ghana PDFfornaraNo ratings yet

- COA Nitric Acid 68Document1 pageCOA Nitric Acid 68Noviyanti Violita Hamisi100% (1)

- Brochure For: Unified Guidelines For Selection of Petrol Pump DealershipDocument24 pagesBrochure For: Unified Guidelines For Selection of Petrol Pump DealershipAbhinav YadavNo ratings yet

- Invoice: Tesla Norway ASDocument1 pageInvoice: Tesla Norway ASThomas LingottNo ratings yet

- Section 4 Accounting Fraud and Auditor Legal Liability - 1Document3 pagesSection 4 Accounting Fraud and Auditor Legal Liability - 1CorneliusNo ratings yet

- Case Study MGT657 Fatin Nur Shahira Jono 2019359357 PDFDocument6 pagesCase Study MGT657 Fatin Nur Shahira Jono 2019359357 PDFLuqmanulhakim JohariNo ratings yet

- English Essay: Revised Scheme and Syllabus For CSS Competitive ExaminationDocument22 pagesEnglish Essay: Revised Scheme and Syllabus For CSS Competitive Examinationabc fdsNo ratings yet

- Ebit-Eps Analysis: Operating EarningsDocument27 pagesEbit-Eps Analysis: Operating EarningsKaran MorbiaNo ratings yet

- Rights of Unpaid SellerDocument19 pagesRights of Unpaid Sellers_87045489No ratings yet

- Acyasr2 - Unit Iii - Audit of ReceivablesDocument4 pagesAcyasr2 - Unit Iii - Audit of ReceivablesLoise Marie DeJesusNo ratings yet

- Retail Store Solution BrochureDocument3 pagesRetail Store Solution BrochureAnanda Agung PrasetyoNo ratings yet

- Seal ContractsDocument3 pagesSeal Contractstrantdlinh10No ratings yet

- CA-Inter Costing May 2022 Marathon-1 18th May 2022 by Anshul AgrawalDocument50 pagesCA-Inter Costing May 2022 Marathon-1 18th May 2022 by Anshul Agrawalpittujb2002No ratings yet

- Chapter 11Document11 pagesChapter 11poNo ratings yet

- VAT Refund Directive 24-2008 (English)Document5 pagesVAT Refund Directive 24-2008 (English)YoNo ratings yet

- Name: Jay Bhagat Roll No.: 19BCL047 Department of Civil EngineeringDocument5 pagesName: Jay Bhagat Roll No.: 19BCL047 Department of Civil EngineeringJAY BHAGATNo ratings yet

- Lit 207 HodDocument8 pagesLit 207 Hodmanueljames608No ratings yet

- DECEMBER 2019 Surplus Record Machinery & Equipment DirectoryDocument717 pagesDECEMBER 2019 Surplus Record Machinery & Equipment DirectorySurplus RecordNo ratings yet

- Financial Inclusion FinalDocument54 pagesFinancial Inclusion FinalSOHAM DESAINo ratings yet

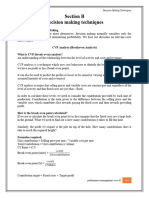

- Section B. Decision Making Techniques - TutorDocument73 pagesSection B. Decision Making Techniques - TutorNirmal ShresthaNo ratings yet

- Philippine Christian University: Preliminary ExaminationDocument5 pagesPhilippine Christian University: Preliminary Examinationleo pigafetaNo ratings yet

- CASE Burberry's Reinventing Its Global MarketingDocument2 pagesCASE Burberry's Reinventing Its Global MarketingSubhaan NiazNo ratings yet

- Goodwill & PSR Final Revision SPCCDocument43 pagesGoodwill & PSR Final Revision SPCCHeer SirwaniNo ratings yet

- Vi Sem Bba Internship GuidelinesDocument8 pagesVi Sem Bba Internship GuidelinesPradeep PNo ratings yet

- 10th Tamil 1st Rev 2023 Thiruvallur QPDocument4 pages10th Tamil 1st Rev 2023 Thiruvallur QPDevapriyaNo ratings yet