Professional Documents

Culture Documents

Business Combination at The Date of Acquisition

Uploaded by

Claire CadornaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combination at The Date of Acquisition

Uploaded by

Claire CadornaCopyright:

Available Formats

Business Combination at the Date of Acquisition

Business combination is a transaction or other event in which an acquirer obtains control of one or more businesses.

Business combinations may be in the following forms:

1. Merger (A + B = A / B)

2. Consolidation (A + B = C)

3. Stock Acquisition

Accounting for Business Combination

An entity shall account for each business combination by applying the acquisition method. Applying the acquisition

method requires:

(1) identifying the acquirer;

(2) determining the acquisition date;

(3) recognizing and measuring the identifiable assets acquired, the liabilities assumed and any non-controlling interest in

the acquiree; and

(4) recognizing and measuring goodwill or a gain from a bargain purchase.

Measurement Period

The measurement period is the period after the acquisition date during which the acquirer may adjust the provisional

amounts recognized for a business combination.

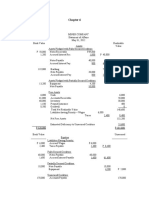

PROBLEM I

On January 2, 2020, P Company purchased the net assets of S Company by paying P850,000 cash and issuing shares of stocks at

P3,110,000 fair market value. Book value and fair value data on the Statement of Financial Position on January 2, 2020 are as follows:

P Company S Company

Book Value Fair Value Book Value Fair Value

Cash 4,600,000 4,600,000 300,000 300,000

Accounts Receivable 1,000,000 1,000,000 980,000 980,000

Inventory 1,500,000 1,300,000 710,000 600,000

Building, net 1,800,000 1,460,000 1,520,000 1,064,000

Goodwill 90,000 80,000

Total 8,900,000 8,360,000 3,600,000 3,024,000

Liabilities 1,000,000 1,000,000 570,000 570,000

Share Capital 1,600,000 600,000

Share Premium 900,000 960,000

Retained Earnings 5,400,000 1,470,000

Total 8,900,000 3,600,000

P incurred and paid legal and brokerage fees of P25,600 for business combination; share issue costs of P23,000 indirect acquisition

costs. It is determinable that contingency fee of P11,800 would be paid within the year.

1. The total assets after the business combination is

2. The total shareholder’s equity after the business combination is

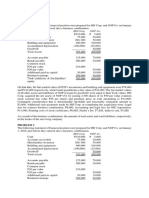

PROBLEM II

A condensed Statement of Financial Position of Cable Company at August 1, 2020 and related fair value are presented below:

Book Value Fair Value

Current Assets 368,000 404,500

Plant Assets 592,500 690,000

Patent (net) 58,500 48,000

Total 1,019,000

Current Liabilities 107,500 107,500

Long-term debt 280,000 297,500

Share capital, P20 par 210,000

Retained earnings 421,500

Total 1,019,000

On August 1, 2020, Sky Corporation issued 10,700 shares of its P24 par value ordinary share (current fair value is P33 per share)

and P145,000 cash for the net assets of Cable Company. Of the 47,500 out of pocket costs paid by the acquirer on acquisition

date, P26,500 was indirect cost and the remainder were legal fees and finders fees related to business combination.

1. How much is the net increase in the stockholders’ equity in the books of the surviving company as a result of business

combination?

PROBLEM III

P Company acquired 75% of S Company’s ordinary share for P510,000 cash. At that date, S Company reports identifiable assets

with book value of P1,040,000 and a fair value of P1,280,000 and it has liabilities with book value and a fair value of P716,000. How

much is the goodwill or (gain on acquisition) arising on consolidation if NCI is measured at fair value and that control premium of

P30,000 included in the purchase price?

PROBLEM IV

On January 7, 2017, Rey Co. acquired a 40% interest in Joanne Co. for P4,800,000. Rey already held a 25% interest which had

been acquired for P1,600,000 but which was valued at P1,920,000 at January 7, 2017. The fair value of non-controlling interest(NCI)

at January 7, 2015 was P2,400,000, and the fair value of the identifiable net assets of Joanne Co. was P8,400,000. How much is the

goodwill to be recognized as a result of business combination?

You might also like

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionJack HererNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Activity #3 Separate and Consolidated FS - Date of AcquisitionDocument4 pagesActivity #3 Separate and Consolidated FS - Date of AcquisitionLorelie I. RamiroNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument4 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Acc 310 - M004Document12 pagesAcc 310 - M004Edward Glenn BaguiNo ratings yet

- Chapter-3 Homework CashDocument5 pagesChapter-3 Homework CashKenneth Christian WilburNo ratings yet

- 02 Cash and Cash Equivalents PDFDocument19 pages02 Cash and Cash Equivalents PDFReyn Saplad PeralesNo ratings yet

- Solution Chapter 6Document17 pagesSolution Chapter 6Mazikeen DeckerNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Auditing Practice Problem 6Document2 pagesAuditing Practice Problem 6Jessa Gay Cartagena TorresNo ratings yet

- Quantity Schedule: Cost Accounted For As FollowsDocument5 pagesQuantity Schedule: Cost Accounted For As FollowsJoshua CabinasNo ratings yet

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Palmones, Jayhan Grace M. QuizDocument6 pagesPalmones, Jayhan Grace M. QuizjayhandarwinNo ratings yet

- Afar Quiz 5 Probs Subsequent To Acqui DateDocument13 pagesAfar Quiz 5 Probs Subsequent To Acqui DatejajajaredredNo ratings yet

- 520-FinalllDocument38 pages520-FinalllHatake KakashiNo ratings yet

- Activity #1Document5 pagesActivity #1Lyka Nicole DoradoNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisApril JurialNo ratings yet

- This Study Resource Was: National College of Business and ArtsDocument8 pagesThis Study Resource Was: National College of Business and ArtsGinoong OsoNo ratings yet

- CPAR - Corp LiqDocument4 pagesCPAR - Corp LiqMarvic CabangunayNo ratings yet

- AC414 - Audit and Investigations II - Audit of Non-Current AssetsDocument21 pagesAC414 - Audit and Investigations II - Audit of Non-Current AssetsTsitsi AbigailNo ratings yet

- Financial Statements: Problem 14-1: True or FalseDocument13 pagesFinancial Statements: Problem 14-1: True or FalseMichael Brian TorresNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingKrizia Mae FloresNo ratings yet

- LTCCDocument2 pagesLTCCN JoNo ratings yet

- Auditing Theory Finals PDF FreeDocument11 pagesAuditing Theory Finals PDF FreeMichael Brian TorresNo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Consolidated Financial Statements - Acquistion DateDocument52 pagesConsolidated Financial Statements - Acquistion DateXavier AresNo ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- PUP Review Handout 1 OfficialDocument3 pagesPUP Review Handout 1 OfficialDonalyn CalipusNo ratings yet

- TransportationDocument20 pagesTransportationMimiNo ratings yet

- Intermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementDocument15 pagesIntermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementMJ Legaspi0% (1)

- Module No. 1 - Week 1 Businessn CombinationDocument5 pagesModule No. 1 - Week 1 Businessn CombinationJayaAntolinAyusteNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNo ratings yet

- This Study Resource Was: Problem 2Document6 pagesThis Study Resource Was: Problem 2Shiela MayNo ratings yet

- Cost Concepts, Classification and Segregation: M.S.M.CDocument7 pagesCost Concepts, Classification and Segregation: M.S.M.CAllen CarlNo ratings yet

- Generally Accepted Auditing StandardsDocument29 pagesGenerally Accepted Auditing StandardsCarlito B. BancilNo ratings yet

- Afar 01 Partnership Formation OperationsDocument7 pagesAfar 01 Partnership Formation OperationsMikael James VillanuevaNo ratings yet

- Parco CorporationDocument2 pagesParco CorporationWawex DavisNo ratings yet

- CH 02 PDFDocument24 pagesCH 02 PDFAurcus JumskieNo ratings yet

- Chapter 9Document13 pagesChapter 9ppantin0430No ratings yet

- Audit of Current LiabilitiesDocument3 pagesAudit of Current LiabilitiesEva Dagus100% (1)

- Installment SalesDocument2 pagesInstallment SalesNeil Christian LiwanagNo ratings yet

- Acctg For Business Combination - Second Evaluation PDFDocument2 pagesAcctg For Business Combination - Second Evaluation PDFDebbie Grace Latiban Linaza100% (1)

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Derivatives and TranslationDocument3 pagesDerivatives and TranslationVienna Corrine Q. AbucejoNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Business Combination at The Date of AcquisitionDocument1 pageBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- Accounting+for+Business+Combination+HO+No 1Document7 pagesAccounting+for+Business+Combination+HO+No 1secretary.feujpia2324No ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Your First CFO: The Accounting Cure for Small Business OwnersFrom EverandYour First CFO: The Accounting Cure for Small Business OwnersRating: 4 out of 5 stars4/5 (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Accounting All-in-One For Dummies, with Online PracticeFrom EverandAccounting All-in-One For Dummies, with Online PracticeRating: 3 out of 5 stars3/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)