Professional Documents

Culture Documents

Allowable Deductions

Uploaded by

LC IlaganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allowable Deductions

Uploaded by

LC IlaganCopyright:

Available Formats

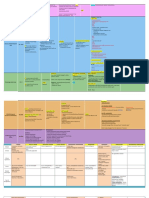

ALLOWABLE DEDUCTIONS 3.

Between the grantor and fiduciary

-amount subtracted allowed at the option of the c) Taxes

taxpayer

- taxes proper only; national or local, must be

INDIVIDUAL incurred, connected with the taxpayer’s trade

ITEMIZED OSD PHHI Not deductible:

Mixed Income / / i. PH Income tax

Corporation / / ii. Estate and donor’s tax

Compensation */ iii. VAT

iv. Penalties/Surcharges

OSD - allowed to individual taxpayers except NRA; v. Special Assessment

not required to file ITR

vi. Income taxes imposed by foreign country

*Individual - 40% of gross sales

Deductible:

*Corporation - 40% of gross income

i. Import /Customs duties

ii. Excise taxes

Itemized Deductions - listing; appears in the income

iii. Occupational/Professional Tax

statement; those who can claim OSD can also claim

itemized iv. Documentary stamp tax

a) Expenses v. Privileges & License taxes

a) Ordinary - regularly; necessary - needed vi. Business Taxes - percentage tax

b) Amount must be reasonable vii. Local/business/municipal taxes

c) Directly attributable viii. Vehicle registration fees

d) Incurred and paid d) Losses

i. Capital expenditure - current and future -total loss - BV of loss asset

ii. Revenue expenditure - current -partial loss - BV of the asset at the time of loss vs.

replacement cost *LOWER

-EAR (Entertainment, Amusement, Recreation)

*deduct scrap value and recoverable

-ceiling:

amount from insurance if there is any

-0.50% of net sales - engaged in sales of

a) Actually sustained during the taxable year

goods

b) Loss must be that of the taxpayer

-1% of net income - exercise of profession

c) Not compensated for by insurance or other

b) Interest

forms of indemnity

a) Subject to limitation 33% of interest income of

d) Declaration of loss must be submitted in not

loan deposited

less than 30 days nor more than 90 days of

b) In full amount discovery of such loss

a) Interest on Unpaid Taxes/ Interest on Tax i. Business losses and losses from theft

Deliquency

ii. Casualty losses

i. Interest payment on script(liab) dividend

iii. NOLCO

ii. Interest payment on deposits

iv. Other types of losses

iii. Interest payment on bonds

e) Bad debts

c) Non deductible

- debts arising from worthlessness or

i. Cash basis uncollectibility

ii. Related taxpayer a) Must be an existing debt; valid, legal &

demandable

1. Between family members

b) Must be ascertain to be worthless

2. Between Individuals who owns more

than 50% of OS f) Depreciation

-straight line

g) Depletion

-same as depreciation; on wasting assets or

natural resources

h) Charitable/other contribution

-limitations; Individual - 10%

Corporation - 5%

*based on income before contribution; limitation

vs. actual *LOWER = deductible amount

a) Deductible in Full

i. Donations to PH Govt for specific

purposes (education, health, youth,

sports dev., human settlements, science,

culture, economic development

ii. To foreign insitutions

iii. To NGOs

iv. Special Laws

v. Red Cross

b) Subject to Limitations

i. For public purposes

ii. Domestic corp. For religious, charitable,

scientific, youth, sport development, cultural,

rehab of veterans, to NGO’s

c) Non deductible

i) Research and development

a) Outright expense

b) Capitalized cost - 5years or 60 months

j) Pension trust

If Current pension contribution - deductible in full

Past pension contribution - divide by 10 yrs

k) *PHHI

You might also like

- CFAS - Chapter5 - Ilagan, LC Brienne T.Document5 pagesCFAS - Chapter5 - Ilagan, LC Brienne T.LC IlaganNo ratings yet

- 60 Days::waiver/written consent:Amlc:Dosri:Human Sec ActDocument4 pages60 Days::waiver/written consent:Amlc:Dosri:Human Sec ActLC IlaganNo ratings yet

- LAW 3 DefensesDocument2 pagesLAW 3 DefensesLC IlaganNo ratings yet

- A Segment of The Boy GeneralDocument9 pagesA Segment of The Boy GeneralLC IlaganNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)