Professional Documents

Culture Documents

Backstab 02

Uploaded by

souranilsenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Backstab 02

Uploaded by

souranilsenCopyright:

Available Formats

1

BACKSTAB02

SEASON 7, ISSUE 2

PARTHASARATHI MAJUMDER RISHABH GHELANI KUNAL BAJAJ

BACKSTAB | SEASON 7, ISSUE 2

2

CONTENTS

Sl.

No. Particulars Page No.

1. How to interpret financial statements 3-16

2. Roles and responsibilities of financial institutions in India 17-29

3. How to deal with NPAs 30-39

4. Electoral Process in India 40-53

5. Overview of Indian start up culture 54-62

BACKSTAB | SEASON 7, ISSUE 2

3

BACKSTAB | SEASON 7, ISSUE 2

4

1. HOW TO INTERPRET THE FINANCIAL STATEMENTS

1.1 FINANCIAL STATEMENTS

Financial statements are a collection of a business’ financial information for a given

period of time at a given point in time. They indicate the health of a company by showing

the financial position, performance, and the changes in the financial position of the

business, which is then used by readers in making various economic decisions.

The financial statements typically include the following:

• A Balance Sheet or a statement of financial position, which shows a detailed

information about a business’ assets, liabilities and shareholder’s equity.

• An income statement or a statement of profit & loss, which shows how much

revenue was earned by a business in the given time period.

• A cash flow statement or a statement of cash flows, which shows the various

inflows and outflows of cash recorded by a business.

• An equity statement, or a statement of changes in equity, which reports the

changes in equity during the given period.

Financial

Statements

a collection of a

business' financial

information

Balance Sheet Income Statement Cash Flow Changes in equity

Statement

BACKSTAB | SEASON 7, ISSUE 2

5

1.2 INTERPRETING A BALANCE SHEET

A Balance Sheet is a statement that reports the financial position of a business at a point

in time. It lays out the balances of a company’s assets, liabilities, and equity as on a given

date. It is based upon the accounting equation that at all times, the assets of the company

equal its liabilities and equity.

𝐴𝑠𝑠𝑒𝑡𝑠 = 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 + 𝐸𝑞𝑢𝑖𝑡𝑦

The balance sheet allows the users of financial statements to make various decisions about

the company that cannot be found out from the income statement of a company. A

business may be very profitable, but a look at the balance sheet would tell us how

exactly did it become profitable, and whether it would be able to sustain its profitability

for long. A rented apartment, for example, may facilitate a large amount of profit, but

a look at the Balance Sheet would tell us that the profit was only because Rs. 1,00,00,000

was invested into the company. Similarly, a factory may show huge losses, but a look at

the Balance Sheet would tell us that the business owns a lot of valuable equipment,

inventory and property that can be sold at a later date. The balance sheet, thus, provides

the overall strength and capacity of a business at a point in time.

The balance sheet (as per Schedule III of the Companies Act, 2013) is divided into two

halves:

• Equity and Liabilities, presented first, above the assets or the left side of a page

(in case of balance sheets other than as per Schedule III for non-companies)

• Assets, presented below equity and liabilities or the right side of a page (in case

of non-companies)

Let’s take a closer look at these terms:

• Equity: It represents the interest of the shareholders in an organization; or in other

words, the degree of ownership of the shareholders in the assets, after deducting

all the liabilities associated with it. It includes the profits carried forward by the

organization or retained by it for reinvestment into the organization. Equity can

also be called the net worth of an organization, which is nothing but the difference

between assets and liabilities.

𝐸𝑞𝑢𝑖𝑡𝑦 (𝑁𝑒𝑡 𝑊𝑜𝑟𝑡ℎ) = 𝐴𝑠𝑠𝑒𝑡𝑠 − 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

• Liabilities: Liabilities are the debts or obligations owed by the company, to its

owners or outsiders, that originate during the course of doing business. Liabilities

BACKSTAB | SEASON 7, ISSUE 2

6

help fulfil the immediate cash requirements of the company in case finance is not

available to the business. They are vital to an organization because they are used

to finance operations and pay for large expansions. Liabilities include loans,

debentures, accounts payable, etc.

• Assets: Assets represent what the company owns, and what it expects to own in

the future. They are the items of value that help the organization to earn future

economic benefits. Assets help the organization to operate smoothly and earn

revenue. In a balance sheet, assets are sorted according to their capability of

turning into liquid cash, with the most illiquid assets mentioned first, like buildings,

and the most liquid assets mentioned last, like cash and bank balances.

Interpreting the Equity + Liability side

Proforma Balance Sheet of Delete Consulting Co. as at 31.03.2017

Balance as at

Sl. Balance as at

No.

Notes 31.03.2017

Particulars 31.03.2016 (Rs.)

(Rs.)

EQUITY & LIABILITIES

1. Shareholder’s funds

a. Share Capital 15,00,000 10,00,000

b. Reserves & Surplus 2,00,000 1,50,000

c. Money received against - -

share warrants

2. Share application money pending - -

allotment

3. Non-current liabilities

a. Long term borrowings 3,00,000 4,50,000

b. Deferred tax liabilities - -

c. Other long-term liabilities 1,00,000 1,00,000

d. Long term provisions 4,00,000 3,00,000

4. Current liabilities

a. Short-term borrowings 10,00,000 8,00,000

b. Trade payables 7,50,000 6,00,000

c. Other current liabilities 70,000 1,00,000

d. Short term provisions 80,000 80,000

Total 44,00,000 35,80,000

Shareholder’s funds (Equity)

✓ Share Capital: It consists of all the funds that the company has raised

through the issue of shares – both common and preference shares.

BACKSTAB | SEASON 7, ISSUE 2

7

Preference shares are those which are to be paid dividend, as well as

repaid back in case of bankruptcy in preference to the common shares.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑆ℎ𝑎𝑟𝑒 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑔𝑒𝑛𝑒𝑟𝑎𝑙𝑙𝑦 𝑖𝑚𝑝𝑙𝑖𝑒𝑠 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ℎ𝑎𝑠 𝑖𝑠𝑠𝑢𝑒𝑑 𝑛𝑒𝑤 𝑠ℎ𝑎𝑟𝑒𝑠

𝑑𝑢𝑟𝑖𝑛𝑔 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑. 𝐼𝑛 𝑡ℎ𝑒 𝑔𝑖𝑣𝑒𝑛 𝐵𝑎𝑙𝑎𝑛𝑐𝑒 𝑆ℎ𝑒𝑒𝑡 𝑜𝑓 𝐷𝑒𝑙𝑒𝑡𝑒 𝐶𝑜𝑛𝑠𝑢𝑙𝑡𝑖𝑛𝑔, 𝑖𝑡 𝑐𝑎𝑛 𝑏𝑒 𝑖𝑛𝑡𝑒𝑟𝑝

− 𝑟𝑒𝑡𝑒𝑑 𝑡ℎ𝑎𝑡 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ℎ𝑎𝑠 𝑖𝑠𝑠𝑢𝑒𝑑 𝑠ℎ𝑎𝑟𝑒𝑠 𝑤𝑜𝑟𝑡ℎ 𝑅𝑠. 5,00,000 𝑑𝑢𝑟𝑖𝑛𝑔 2016 − 17

✓ Reserves & Surplus: Reserves are usually money earmarked by the company

for specific purposes. Surplus refers to all the profits earned by the

company. Examples of reserves may be:

General Reserve – retained earnings of a company kept aside out of profits

to meet some future obligations; Securities Premium Reserve – the amount

received by the company over the face value of its shares; Capital Reserve –

amount set aside by the company for future capital investment projects.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑅𝑒𝑠𝑒𝑟𝑣𝑒𝑠 & 𝑆𝑢𝑟𝑝𝑙𝑢𝑠 𝑎𝑐𝑐𝑜𝑢𝑛𝑡 𝑖𝑚𝑝𝑙𝑖𝑒𝑠 𝑡ℎ𝑒 𝑎𝑑𝑑𝑖𝑡𝑖𝑜𝑛 𝑜𝑓 𝑝𝑟𝑜𝑓𝑖𝑡𝑠 𝑡𝑜 𝑡ℎ𝑒

𝑠𝑎𝑚𝑒, 𝑜𝑟 𝑎𝑛 𝑎𝑑𝑑𝑖𝑡𝑖𝑜𝑛 𝑡𝑜 𝑜𝑛𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑅𝑒𝑠𝑒𝑟𝑣𝑒𝑠 𝑎𝑐𝑐𝑜𝑢𝑛𝑡. 𝐼𝑛 𝑡ℎ𝑒 𝑔𝑖𝑣𝑒𝑛 𝑒𝑥𝑎𝑚𝑝𝑙𝑒, 𝑎𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒

𝑖𝑛 𝑅𝑠. 50,000 𝑚𝑎𝑦 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒 𝑡ℎ𝑒 𝑎𝑑𝑑𝑖𝑡𝑖𝑜𝑛 𝑜𝑓 𝑝𝑟𝑜𝑓𝑖𝑡𝑠 𝑡𝑜 𝑡ℎ𝑒 𝑎𝑐𝑐𝑜𝑢𝑛𝑡 𝑜𝑟 𝑡ℎ𝑒 𝑎𝑑𝑑𝑖𝑡𝑖𝑜𝑛 𝑡𝑜

𝑜𝑛𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑟𝑒𝑠𝑒𝑟𝑣𝑒𝑠.

✓ Money received against share warrants: Share warrants are instruments

that show the holder of the same has ownership of the shares of the

company. They are similar to share certificates except that the money on

sale of shares shall be payable to the holder of the share warrant,

irrespective of the fact whether the holder is the real holder or not. Any

money received by selling share warrants of the company is termed as

money received against share warrants.

Non-current liabilities

These are long term financial obligations of a company that are not due within the

present accounting year.

✓ Long term borrowings: These, as the name implies, are the loans and

advances received by a company that are not to be paid back within the

present accounting year.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑙𝑜𝑛𝑔 𝑡𝑒𝑟𝑚 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔𝑠 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒 𝑡ℎ𝑎𝑡 𝑎 𝑙𝑜𝑎𝑛 ℎ𝑎𝑠 𝑏𝑒𝑒𝑛 𝑡𝑎𝑘𝑒𝑛 𝑖𝑛 𝑡ℎ𝑒

𝑙𝑎𝑠𝑡 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑖𝑛𝑔 𝑦𝑒𝑎𝑟, 𝑤ℎ𝑒𝑟𝑒𝑎𝑠, 𝑎 𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒 𝑡ℎ𝑒 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔 ℎ𝑎𝑠 𝑏𝑒𝑒𝑛 𝑟𝑒𝑝𝑎𝑖𝑑.

𝐼𝑛 𝑡ℎ𝑒 𝑔𝑖𝑣𝑒𝑛 𝑒𝑥𝑎𝑚𝑝𝑙𝑒, 𝑡ℎ𝑒 𝑎𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔𝑠 ℎ𝑎𝑣𝑒 𝑟𝑒𝑑𝑢𝑐𝑒𝑑 𝑏𝑦 𝑅𝑠. 1,50,000. 𝑇ℎ𝑖𝑠

𝑤𝑜𝑢𝑙𝑑 𝑏𝑒 𝑜𝑛 𝑎𝑐𝑐𝑜𝑢𝑛𝑡 𝑜𝑓 𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑜𝑓 𝑙𝑜𝑎𝑛 𝑢𝑝𝑡𝑜 𝑡ℎ𝑎𝑡 𝑎𝑚𝑜𝑢𝑛𝑡.

BACKSTAB | SEASON 7, ISSUE 2

8

✓ Deferred tax liabilities: are tax liabilities a company may postpone paying

until sometime in the future, often to encourage activities for public’s good.

✓ Other long-term liabilities: These may include items such as deferred credits,

customers deposits or some estimated tax liabilities.

✓ Long term provisions: Provisions are amounts set aside by a company to pay

for anticipated future losses. These may be general or specific in nature,

specific when they are set aside for one particular event only.

An increase in provision indicates an increase in the amount set aside,

whereas, a decrease in the same indicates the use of previously created

provisional funds.

Current Liabilities: These are short term financial obligations of a company, that

are to be due within the current financial year.

✓ Short term borrowings: As the name implies, these are borrowings that are

to be repaid within the current financial year.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑠ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔𝑠 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒𝑠 𝑡ℎ𝑎𝑡 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 𝑏𝑜𝑟𝑟𝑜𝑤𝑒𝑑 𝑓𝑢𝑛𝑑𝑠

𝑡ℎ𝑎𝑡 𝑎𝑟𝑒 𝑡𝑜 𝑏𝑒 𝑟𝑒𝑝𝑎𝑖𝑑 𝑤𝑖𝑡ℎ𝑖𝑛 12 𝑚𝑜𝑛𝑡ℎ𝑠, 𝑎𝑛𝑑 𝑎 𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒𝑠 𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡.

✓ Trade payables: These are the amounts owed to a supplier for goods or

services, where the amount is not paid immediately, but is billed to be paid

in future.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑡𝑟𝑎𝑑𝑒 𝑝𝑎𝑦𝑎𝑏𝑙𝑒𝑠 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒𝑠 𝑚𝑜𝑟𝑒 𝑔𝑜𝑜𝑑𝑠 𝑤𝑒𝑟𝑒 𝑝𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑑 𝑏𝑦 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦

𝑜𝑛 𝑐𝑟𝑒𝑑𝑖𝑡, 𝑟𝑎𝑡ℎ𝑒𝑟 𝑡ℎ𝑎𝑛 𝑝𝑎𝑖𝑑 𝑓𝑜𝑟 𝑖𝑚𝑚𝑒𝑑𝑖𝑎𝑡𝑒𝑙𝑦. 𝐴 𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛𝑑𝑖𝑐𝑖𝑎𝑡𝑒𝑠 𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑜𝑓

𝑑𝑢𝑒𝑠 𝑡𝑜 𝑡ℎ𝑒 𝑠𝑢𝑝𝑝𝑙𝑖𝑒𝑟𝑠.

✓ Other current liabilities: Other current liabilities is a balance sheet entry

used by companies to group together current liabilities that are not assigned

to common liabilities such as debt obligations or accounts payable.

✓ Short term provisions: These are provisions created to account for current

speculative losses or other purposes.

BACKSTAB | SEASON 7, ISSUE 2

9

Interpreting the Asset side

Sl. Particulars Notes Balance as Balance as

No. at at

31.03.2017 31.03.2016

(Rs.) (Rs.)

1. Non-current assets

a. Fixed assets 14,00,000 9,32,000

b. Non-current investments 3,00,000 3,00,000

c. Long term loans and advances 4,00,000 1,00,000

2. Current assets

a. Current investments 50,000 25,000

b. Inventory 5,50,000 4,75,000

c. Trade receivables 7,00,000 8,00,000

d. Cash and cash equivalent 9,26,000 8,68,000

e. Short term loans and advances 74,000 80,000

Total 44,00,000 35,80,000

Non-current assets

✓ Fixed Assets: Fixed assets are tangible, long-term assets not intended for

sale that are used by an organization in its operations to generate

income.

These include land, building, machinery equipment, furniture, etc.

𝐴𝑛 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑖𝑛 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠 𝑖𝑛𝑑𝑖𝑐𝑎𝑡𝑒𝑠 𝑎𝑐𝑞𝑢𝑖𝑠𝑖𝑡𝑖𝑜𝑛 𝑜𝑓 𝑛𝑒𝑤 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠, 𝑤ℎ𝑒𝑟𝑒𝑎𝑠 𝑎

𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 𝑚𝑎𝑦 𝑖𝑚𝑝𝑙𝑦 𝑒𝑖𝑡ℎ𝑒𝑟 𝑠𝑎𝑙𝑒 𝑜𝑓 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠, 𝑜𝑟 𝑗𝑢𝑠𝑡 𝑡ℎ𝑒 𝑎𝑚𝑜𝑢𝑛𝑡 𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑒𝑑 𝑜𝑓𝑓

𝑡ℎ𝑒 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠. 𝑇ℎ𝑒 𝑎𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝑑𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝑐𝑎𝑛 𝑏𝑒 𝑎𝑠𝑐𝑒𝑟𝑡𝑎𝑖𝑛𝑒𝑑 𝑓𝑟𝑜𝑚

𝑡ℎ𝑒 𝑆𝑡𝑎𝑡𝑒𝑚𝑒𝑛𝑡 𝑜𝑓 𝑜𝑓 𝑃𝑟𝑜𝑓𝑖𝑡 & 𝐿𝑜𝑠𝑠.

✓ Non-current investments: These are the investments held by the company

whose full value will not be realized within the current accounting year.

Examples of non-current investments include investments in other companies,

intangible assets such as goodwill, intellectual property, etc.

✓ Long term loans and advances: These are the money lent by the company

to other companies, or its employees, that won’t be realized in the current

accounting year.

Current assets

BACKSTAB | SEASON 7, ISSUE 2

10

✓ Current investments: These are investments held by the company which are

expected to be converted into cash within a year.

✓ Inventory: Inventory includes raw materials, work-in-progress, and finished

goods that are ready or will be ready to sold as part of the company’s

normal business.

✓ Trade receivables: Trade receivables refer to the customers who have not

cleared their dues with the company yet for the goods or services bought

by them.

✓ Cash and cash equivalent: These refer to the assets of a company that are

cash, or can immediately be converted into cash. Example of cash and cash

equivalents include bank accounts, marketable securities, commercial paper,

treasury bills, etc.

✓ Short term loans and advances: These are the amount lent by the company

to the outsiders or its employees that are expected to be realized in the

current year.

BACKSTAB | SEASON 7, ISSUE 2

11

1.3 INTERPRETING THE STATEMENT OF PROFIT & LOSS

Particulars Notes Figures for Figures for

the year the year

ended ended

31.03.2017 31.03.2016

(Rs.) (Rs.)

1. Revenue from operations

2. Other income

3. Total Revenue (1+2)

4. Expenses:

Cost of material consumed

Purchases of stock-in-trade

Changes in inventory of finished

goods, work-in-progress and stock-in-

trade

Employee benefit expense

Finance cost

Depreciation and amortization

expense

Other expenses

Total expenses

5. Profit before exceptional and

extraordinary items and tax (3-4)

6. Exceptional items

7. Profit before extraordinary items and

tax (5-6)

8. Extraordinary items

9. Profit before tax (7-8)

10. Tax expense

11. Profit / (Loss) for the period

✓ Revenue from operations is the primary source of income earned by the

company from its customers for goods sold or services rendered. An increase in

revenue from operations may occur due to 2 reasons – an increase in sales of

goods or services, or an increase in the selling price of goods or services.

✓ Other income includes revenue earned from all other sources such as interest

from loans and advances, dividends from investments, profit from sale of fixed

assets, etc.

BACKSTAB | SEASON 7, ISSUE 2

12

✓ Cost of material consumed means the sum of all the cost spent on raw material,

store, and consumed to arrive at a final finished goods. An increase in cost of

material consumed may imply increase in the usage of raw material, or an increase

in the cost of raw material.

✓ Purchases of stock-in-trade is the purchases of finished goods made by the

company towards conducting its day to day business.

✓ Changes in inventory of finished goods, raw material and stock-in-trade refers to

the difference between the opening stock as on 31.03.2016 and closing stock as

on 31.03.2017. A negative figure indicates that the company has produced more

goods this year than the last year, and vice versa.

✓ Employee benefit expenses are indirect means of compensating workers, over and

above the normal wages or salaries that they receive. These include insurances for

the workers, incentives, retirement benefits, etc.

✓ Finance cost includes costs such as interests and other costs that an entity incurs in

connection with borrowing of funds for building and purchasing of assets. These

are also known as borrowing costs.

✓ Depreciation and amortization expenses are the non-cash expenses incurred by

the company due to the using of tangible as well as intangible fixed assets. Fixed

assets have a finite life, and over time with their usage, their value falls due to

wear and tear. Amortization expenses are the costs of using intangible assets such

as goodwill, over time.

✓ Other expenses are all those costs incurred in running the business that cannot be

categorized in any of the above mentioned heads. These are generally the

expenses unrelated to the core business of the entity.

✓ Exceptional items are unusually large and uncommon transactions incurred by the

company that need to be recorded in financial statements as prescribed by GAAP.

Even though they may be a part of ordinary business, they need to be recorded

due to their sheer size and frequency.

✓ Extraordinary items are those gains or losses incurred by the company which are

unusual or infrequent in nature. They occur as a result of unforeseen and atypical

events.

BACKSTAB | SEASON 7, ISSUE 2

13

✓ Profit before tax is the difference between the total revenue and all the operating

expenses of a company before accounting for income taxes.

✓ Profit after tax is the final profit earned by a company after accounting for all

the expenses incurred at a business including taxes. This is the actual net profit of

the company.

1.4 INTERPRETING THE CASH FLOW STATEMENT

❖ Cash flow from operating activities includes cash from all the activities that are

conducted by an organization as part of its day to day business operations in a

given period. It typically includes the net income carried forward from the

income statement, adjustments to the same, as well as the changes in working

capital of the organization.

Examples of cash flow from operations include: cash receipts from the sale of

goods and the rendering of services; cash receipts from fees, commission and

other revenue; cash payments to suppliers for goods; cash payments to

employees, and so on.

There are two methods to obtain cash flow from operations:

a. Direct method

b. Indirect method.

In the direct method, cash flow from operations is calculated as below:

The relevant information is obtained by adjusting sales, cost of sales, and

other items in the profit and loss statement for:

a) Changes during the period in inventory, operating receivables and

payables;

b) Other non-cash items such as depreciation on fixed assets, amortization

of intangible assets, preliminary expenses written off, loss or gain on

sale of fixed assets, etc.

c) Other items for which the cash effects are investing or financing cash

flows. Examples include interest received and paid, dividend received

and paid, etc. which are related to financing or investing activities are

shown separately in the cash flow statement.

The direct method provides information which may be useful in estimating future

cash flows and which is not available under the indirect method.

The indirect method of calculating changes in cash flow from operating activities

is more popular in practice than the direct method. Under this method, the net

cash from operating activities is determined by the adjustment of profit or loss

BACKSTAB | SEASON 7, ISSUE 2

14

from the income statement instead of adjusting individual items appearing in the

profit or loss statement. The net profit is adjusted for the following:

a) Changes during the period in inventories, and operating receivables and

payables;

b) Non-cash items such as depreciation and amortization; and

c) All other items for which the cash effects are either investing or financing cash

flows.

For a company to be healthy, the cash from operating activities should be positive, but

the quality of the cash is just as important.

❖ Cash flow from investing activities are those that are related to the acquisition

and disposal of long term assets, non-operating current assets and investments

which results in outflow of cash. Disposal of assets results in inflow of cash,

whereas acquisition results in outflow of cash.

❖ Cash flow from financing activities are those activities that typically relate to the

changes in the capital structure of a company. These activities include redemption

of shares, repayment of borrowings, borrowings affected by the enterprise.

Issue of shares/debentures result in inflow of cash, redemption of

shares/debentures result in outflow of cash, and so on.

BACKSTAB | SEASON 7, ISSUE 2

15

1.5 SOME IMPORTANT RATIOS

BACKSTAB | SEASON 7, ISSUE 2

16

BACKSTAB | SEASON 7, ISSUE 2

17

BACKSTAB | SEASON 7, ISSUE 2

18

2. MAJOR FINANCIAL INSTITUTIONS OF INDIA

2.1 RESERVE BANK OF INDIA

The Reserve Bank of India, which commenced its operations on 1 April, 1935,

is the apex financial institution of India which regulates other commercial banks

in the country along with other important financial services such as foreign

exchange services, control of inflation, and ensuring monetary stability. In

addition to these, the RBI has played an active developmental role particularly

in the agriculture and rural sectors. Over the years, these functions have

evolved in tandem with national and global developments. The Bank today

focuses, among other things, on maintaining price and financial stability;

ensuring credit flow to productive sectors of the economy; managing supply of

good currency notes within the country; and supervising and taking a lead in

development of financial markets and institutions.

Major functions of RBI include:

▪ Banker to banks and lender of the last resort

RBI does not serve the common man, it only serves as a bank to the

government and other commercial banks. Commercial banks are

required to keep a certain amount (~20%) as a reserve with the RBI in

the form of cash or gold before lending any money to its customers

BACKSTAB | SEASON 7, ISSUE 2

19

(Statutory Liquidity Ratio). Commercial banks are also required to keep

around 4% of its deposits with the RBI as cash reserves, known as the

Cash Reserve Ratio. CRR limits the ability of the banks to pump more

money into the economy, whereas SLR is used to limit the expansion of

bank credit to ensure the solvency of banks.

RBI also acts as the lender of the last resort to the commercial banks.

When a bank is found to be on the losing side, RBI helps the commercial

banks by lending them some money at a certain interest rate, to protect

the interests of the customers and shareholders.

▪ Banker to Central and State Governments

RBI acts as a banker to Central and State governments. The Central as

well as all the State governments are required to maintain a certain

amount to money as deposits with the RBI. This amount varies from State

to State, depending on the economic activity and the budget of the

State. As banker to the Government, the Reserve Bank works out the

overall funds position and sends daily advice showing the balances in

its books, Ways and Means Advances granted to the government and

investments made from the surplus fund. The daily advices are followed

up with monthly statements. The Reserve Bank also manages public debt

on behalf of the Central and the State Governments. It involves issue of

new rupee loans, payment of interest and repayment of these loans and

other operational matters such as debt certificates and their registration.

▪ Currency management

The RBI is the sole authority to issue currencies in India other than the

one-rupee notes and small coins which are issued by the Government of

India. The bulk of the currency is in the form of paper notes which are

currently issued in the denominations of Rs. 2, 5, 10, 20, 50, 100, 200,

500, 2000. The RBI also follows a minimum reserve system whereby it

keeps a certain percentage of the total money issued as a gold and

foreign exchange reserve.

▪ Monetary policy

Monetary policy consists of the actions of a Central Bank that are aimed

towards maintenance of money supply by way of targeting inflation

rates, interest rates to ensure price stability in the country. The primary

objective of monetary policy is price stability while keeping in mind the

objective of growth. There are several instruments used by the RBI that

are used to implement monetary policy in India. These include:

i. Repo Rate is the rate at which the RBI lends money to the

commercial banks against government securities.

BACKSTAB | SEASON 7, ISSUE 2

20

ii. Reverse Repo Rate is the rate at which the RBI borrows money

from the commercial banks on the other hand.

iii. Bank rate is the rate at which the RBI charges interests on the

amount it lends to the commercial banks and other financial

intermediaries.

iv. Open market operations refer to the buying and selling of

government securities in the open market in order to expand or

contract the money supply in the economy.

v. Cash Reserve Ratio

vi. Statutory Liquidity Ratio

▪ Management of foreign exchange reserves

The RBI is the custodian of foreign exchange reserves of the country and

is vested with the responsibility of managing their investment. The RBI

ensures safety, liquidity, and returns as part of its policies related to the

foreign exchange reserve management. The RBI invests in following

kinds of instruments:

1) Deposits with Bank for International Settlements and other central

banks

2) Deposits with foreign commercial banks

3) Debt instruments representing sovereign or sovereign-guaranteed

liability of not more than 10 years of residual maturity

4) Other instruments and institutions as approved by the Central Board

of the Reserve Bank in accordance with the provisions of the Act

5) Certain types of derivatives

The RBI also manages the currency exchange rates which fluctuate on a

daily basis.

BACKSTAB | SEASON 7, ISSUE 2

21

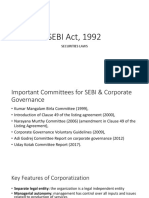

2.2 SECURITIES AND EXCHANGE BOARD OF INDIA

Securities and Exchange Board of India (SEBI) was established in the year 1988

and was given statutory powers on 30 January, 1992 through the SEBI Act of

1992. The Preamble of the Securities and Exchange Board of India describes

the basic functions of the Securities and Exchange Board of India as "...to

protect the interests of investors in securities and to promote the development

of, and to regulate the securities market and for matters connected there with

or incidental there to". It plays a vital role in maintaining a stable and efficient

financial market.

The main objects of SEBI include the regulation of stock exchanges and ensure

safe investments, and to prevent fraudulent practices by striking a balance

between business and its statutory regulations.

Purpose and role of SEBI:

The main purpose of SEBI is to be responsive to the needs of three groups which

constitute the market:

▪ The issuers of securities are provided with a market place in which they

can raise finance easily.

▪ The investors are protected by way of supplying them with accurate and

correct information.

BACKSTAB | SEASON 7, ISSUE 2

22

▪ The market intermediaries are provided with a competitive and

professional environment.

Major functions of SEBI:

The major functions of SEBI are divided into three categories:

a. Protective functions

b. Developmental functions

c. Regulatory functions

Protective functions are performed by the SEBI to protect the interests

of all the investors in the market and provide safety in investment.

As part of its protective functions, following are undertaken:

• It checks on price rigging

Price rigging refers to the manipulation of prices of securities

with the main objective of inflating or deflating the prices. SEBI

prohibits such activities as it leads to misleading of investors.

• It prohibits insider trading

Insiders refer to any person connected with the company such

as directors, promoters, etc. These people have sensitive

information relating to the company which they can use to

make a profit. SEBI keeps a stringent check when insiders buy

the securities and prohibits such insider trading.

• Prohibits fraudulent and unfair practices

SEBI does not allow companies to make misleading statements

which may induce the investors into buying or selling of their

shares.

• SEBI also educates investors so that they are able to evaluate

the securities of various companies and invest in the most

profitable ones.

Developmental functions are performed by the SEBI to

promote and develop activities in the stock market and

increase the business of the stock exchange. The following

functions are performed under this category:

• Promotion of the training of intermediaries of the securities

market.

• Promote activities of the stock exchange by introducing

flexible methods such as internet trading.

BACKSTAB | SEASON 7, ISSUE 2

23

• Initial public offering of shares is permitted through the stock

exchange.

Regulatory functions are performed by the SEBI to regulate

the business in stock exchange. The following activities are

undertaken under this:

(i) SEBI has framed rules and regulations and a code of conduct

to regulate the intermediaries such as merchant bankers,

brokers, underwriters, etc.

(ii) These intermediaries have been brought under the

regulatory purview and private placement has been made

more restrictive.

(iii) SEBI registers and regulates the working of stock brokers,

sub-brokers, share transfer agents, trustees, merchant bankers

and all those who are associated with stock exchange in any

manner.

(iv) SEBI registers and regulates the working of mutual funds

etc.

(v) SEBI regulates takeover of the companies.

(vi) SEBI conducts inquiries and audit of stock exchanges.

BACKSTAB | SEASON 7, ISSUE 2

24

2.3 INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY

Insurance Regulatory and Development Authority of India was constituted by

the Insurance Regulatory and Development Authority Act, 1999, an Act passed

by the Government of India. It was constituted to regulate and develop the

insurance and re-insurance business in India.

Major functions of IRDA include:

▪ Protecting policyholder’s interests

▪ issue to the applicant a certificate of registration, renew, modify,

withdraw, suspend or cancel such registration

▪ protection of the interests of the policy holders in matters concerning

assigning of policy, nomination by policy holders, insurable interest,

settlement of insurance claim, surrender value of policy and other terms

and conditions of contracts of insurance

▪ specifying requisite qualifications, code of conduct and practical training

for intermediary or insurance intermediaries and agents

▪ specifying the code of conduct for surveyors and loss assessors

▪ promoting efficiency in the conduct of insurance business

▪ regulating investment of funds by insurance companies

▪ levying fees and other charges for carrying out the purposed of the IRDA

Act of 1999.

BACKSTAB | SEASON 7, ISSUE 2

25

2.4 FORWARD MARKETS COMMISSION

Forward Market Commission is a statutory body set up under Forward

Contracts (Regulation) Act, 1952. It is a regulatory body for commodity futures

market in India.

The Forward Markets Commission was merged with the Securities and

Exchange Board of India on 28th September, 2015.

The functions of the Forward Markets Commission are as follows:

(a) To advise the Central Government in respect of the recognition or the

withdrawal of recognition from any association or in respect of any other

matter arising out of the administration of the Forward Contracts (Regulation)

Act 1952.

(b) To keep forward markets under observation and to take such action in

relation to them, as it may consider necessary, in exercise of the powers

assigned to it by or under the Act.

(c) To collect and whenever the Commission thinks it necessary, to publish

information regarding the trading conditions in respect of goods to which any

of the provisions of the Act is made applicable, including information regarding

supply, demand and prices, and to submit to the Central Government,

periodical reports on the working of forward markets relating to such goods;

BACKSTAB | SEASON 7, ISSUE 2

26

(d) To make recommendations generally with a view to improving the

organization and working of forward markets;

(e) To undertake the inspection of the accounts and other documents of any

recognized association or registered association or any member of such

association whenever it considers it necessary.

2.5 PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

The Pension Fund Regulatory and Development Authority was established by the

Government of India on 23rd August, 2003. PFRDA is an organization to promote old

age income security by establishing, developing and regulating pension funds, to protect

the interests of subscribers to schemes of pension funds and for matters connected

therewith or incidental thereto.

The major functions of PFRDA are:

▪ Promote pension scheme in the country by fostering mandatory as well as voluntary

pension schemes in order to serve the old age income needs of retired personnel

▪ National Pension System, both tier 1 and tier 2 are under the purview of PFRDA

and are dictated by the same

▪ PFRDA performs the function of appointing various intermediate agencies like

Pension Fund Managers, Central Record Keeping Agency (CRA) etc.

▪ Educating the general public and stakeholders about the importance of pension.

▪ Training of intermediaries that perform the task of popularizing and educating

people about the importance of pension.

BACKSTAB | SEASON 7, ISSUE 2

27

▪ Addressing grievances related to various pension schemes in the country.

▪ Addressing and resolving disputes between various intermediaries like banks and

between customers and intermediaries.

BACKSTAB | SEASON 7, ISSUE 2

28

Relation between the major financial institutions

As we read above, RBI is the central bank of our country; SEBI is the securities market

regulator; FMC, which is now merged with SEBI, is the futures commodity market

regulating body of India; IRDA is the insurance and reinsurance business regulating

authority; and PFRDA regulates the pension funds. Even though these regulatory bodies

have completely different functions from each other, they do, however, overlap when it

comes to certain decisions made in the economy.

There have been a number of instances where RBI and SEBI have been at loggerheads

with each other with respect to a decision taken by one of them. In March of 2016, for

example, RBI intervened in the trading of HDFC Bank shares after the overseas holding

was breached. The RBI had asked the foreign investors to not complete the executed

trades. Typically, foreign investment limits are monitored at the end of the day. But on

February 17, when the window was opened for fresh purchases in HDFC Bank Stock, RBI

started collecting the data from stock exchanges, custodians and market participants at

frequent intervals. This was followed by a protest from SEBI. They ruled that such

intervention leads to a market frenzy, the innocent investors are hurt in the process and

hence, the market sanctity is compromised.

BACKSTAB | SEASON 7, ISSUE 2

29

Similarly, in the last quarter of 2017, a SEBI proposal to make listed firms disclose

defaults on their loans within a day of it happening was stuck because RBI had

reservations about the SEBI proposal. RBI's defence for the same was that the banks were

the biggest stakeholders in default data and that such data is not meant for public use.

Another spat had occurred between the SEBI and IRDA in 2003, when the insurance

regulator had raised objection over SEBI’s proposal to allow insurance companies to

become proprietary trading members for debt trading in stock exchanges.

On March 24, 2011, the Government of India set up a body to review and rewrite the

legal-institution architecture of the Indian financial structure. This body was called the

Financial Sector Legislative Reforms Commission (FSLRC). The commission was headed by

a former judge of the Supreme Court of India, Justice BN Srikrishna, along with an eclectic

mix of experts from various fields including economics, finance, law, etc. The panel

proposed a regulatory architecture that would merge FMC, SEBI, IRDA and PFRDA into

a new unified agency. RBI would continue to exist, however.

BACKSTAB | SEASON 7, ISSUE 2

30

BACKSTAB | SEASON 7, ISSUE 2

31

3. HOW SHOULD BANKS DEAL WITH NPA

1.DEFINITION:-

All advances given by banks are termed “assets”, as they generate income

for the bank by way of interest or installments. However, a loan turns bad if

the interest or installment remains unpaid even after the due date — and

turns into a nonperforming asset, or NPA, if it remains unpaid for a period of

more than 90 days.

According to a July 2014 RBI circular, all advances where interest and/or

installment of principal remains due for more than 90 days, would be

classified as a “nonperforming asset”. In case of overdraft or cash credit, if

the outstanding balance remains continuously in excess of the sanctioned

limit/drawing power for more than 90 days, it would be classified as an

NPA.

In fact, if any amount to be received by the bank remained overdue for

more than 90 days, it is classified as an NPA.

BACKSTAB | SEASON 7, ISSUE 2

32

2. CLASSIFICATION OF NPAS:-

Assets of a bank are classified in terms of its repayment status. Standard

assets, substandard assets, doubtful assets and loss assets are classifications

of asset quality.

For a bank, classification of assets into different categories should be done

taking into account credit weaknesses and the extent of dependence on

collateral security for realization of dues.

a)Standard Asset is one which does not disclose any problems and which

does not carry more than normal risk attached to the business. Such an asset

should not be an NPA.

b) Substandard asset would be one, which has remained NPA for a period

less than or equal to 12 months.

c)An asset would be classified as Doubtful if it has remained in the sub-

standard category for a period of more than 12 months.

d)A Loss Asset is an NPA for a period of more than 36 months is treated as

a lost asset. Such asset has been identified by the bank or internal or

external auditors or by the RBI inspection but the amount has not been

written off wholly. In other words, such an asset is considered

uncollectible.Loss assets should be written off. If loss assets are permitted to

remain in the books for any reason, 100 percent of the outstanding should

be provided for. This means that full amount of the loss assets should be kept

from some other sources like profit of the bank to meet the loss.The

mechanism of Provisioning is done to address the asset quality deterioration

for a bank’s assets. The worse is the assets’ quality; higher will be the

provisioning coverage ratio. Banks should make provision against sub-

standard assets, doubtful assets and loss assets in a differential manner.

BACKSTAB | SEASON 7, ISSUE 2

33

3. WAYS OF REDUCING NPA:-

1.STRINGENT NPA RULES:-The government has over the years enacted and

tweaked stringent rules to recover assets of defaulters.The Securitisation and

Reconstruction of Financial Assets and Enforcement of Security Interest Act or

Sarfaesi Act of 2002 was amended in 2016 as it took banks years to

recover the assets.Experts have pointed out that the NPA problem has to be

tackled before the time a company starts defaulting. This needs a risk

assessment by the lenders and red-flagging the early signs of a possible

default.

2. RBI’s LOAN STRUCTURING SCHEMES:-RBI has over the past few

decades come up with a number of schemes such as corporate debt

restructuring (CDR), formation of joint lenders’ forum (JLF), flexible structuring

for long-term project loans to infrastructure (or 5/25 Scheme), strategic debt

restructuring (SDR) scheme and sustainable structuring of stressed assets

(S4A) to check the menace of NPAs.In many cases, the companies have

failed to make profits and defaulted even after their loans were

restructured.

3. AMENDMENT OF THE BANKING REGULATION LAW:-The Banking Regulation Act

may be amended to give RBI more powers to monitor bank accounts of big

defaulters.The amendment in the banking law will enable setting up of a committee to

oversee companies that have been the biggest defaulters of loans.RBI wants stricter

rules for joint lenders’ forum (JLF) and oversight committee (OC) to curb NPAs.While the

present law allows the government to direct RBI to carry out inspection of a lender,

there is no provision for setting up oversight committees.Also, there could be changes in

the laws, which will bar a bank to extend loans to a defaulting company that has failed

to repay to other banks.

4. WRITING OFF NPA’S:-In the past few quarters, most of the banks especially

PSU lenders, have reported a sharp fall in profits as they set aside hefty amounts

for losses on account of NPAs, which eroded their profits.Given the gravity of the

BACKSTAB | SEASON 7, ISSUE 2

34

problem, the government may ask banks to go for more “hair cut” or write offs

for NPAs.The government and RBI may also come up with a one-time settlement

scheme for top defaulters before initiating stringent steps against them.The

finance ministry and RBI are also considering setting up of a “bad bank” to deal

with the problem of non-performing loans, as it has been suggested by chief

economic adviser Arvind Subramanian in the Economic Survey.Reserve Bank

deputy governor Viral Acharya has also floated the twin concept of Private Asset

Management Company (PAMC) and National Asset Management Company

(NAMC) for resolution of stressed assets.With rule changes and strict regulations,

banks may be asked to restructure about 50 large NPA accounts by December,

2017.

5. SARFESI ACT:-The Securitisation and Reconstruction of Financial Assets and

Enforcement of Security Interest Act, 2002 (SARFAESI) empowers Banks /

Financial Institutions to recover their non-performing assets without the intervention

of the Court.The Act provides three alternative methods for recovery of non-

performing assets, namely: -

• Securitisation

• Asset Reconstruction

• Enforcement of Security without the intervention of the Court.

The provisions of this Act are applicable only for NPA loans with outstanding above Rs.

1.00 lac. NPA loan accounts where the amount is less than 20% of the principal and

interest are not eligible to be dealt with under this Act.

Non-performing assets should be backed by securities charged to the Bank by way of

hypothecation or mortgage or assignment. Security Interest by way of Lien, pledge,

hire purchase and lease not liable for attachment under sec.60 of CPC, are not covered

under this Act

The Act empowers the Bank:

(i.) To issue demand notice to the defaulting borrower and guarantor, calling upon them

to discharge their dues in full within 60 days from the date of the notice.

(ii.) To give notice to any person who has acquired any of the secured assets from the

borrower to surrender the same to the Bank.

(iii.) To ask any debtor of the borrower to pay any sum due or becoming due to the

borrower.

BACKSTAB | SEASON 7, ISSUE 2

35

(iv.) Any Security Interest created over Agricultural Land cannot be proceeded with.

If on receipt of demand notice, the borrower makes any representation or raises any

objection, authorised officer shall consider such representation or objection carefully

and if he comes to the conclusion that such representation or objection is not acceptable

or tenable, he shall communicate the reasons for non acceptance within one week of

receipt of such representation or objection.

A borrower / guarantor aggrieved by the action of the Bank can file an appeal with

DRT and then with DRAT, but not with any civil court. The borrower / guarantor has to

deposit 50% of the dues before an appeal with DRAT.

If the borrower fails to comply with the notice, the Bank may take recourse to one or

more of the following measures:

(i) Take possession of the security

(ii) Sale or lease or assign the right over the security

(iii) Manage the same or appoint any person to manage the same

4.RBI’s NEW RULE TO FIX THE NPA PROBLEM:-

As per the RBI directive, banks will now have to agree to a common approach for

restructuring or recovery of each non-performing loan (NPL). The common approach will

be the one adopted by the lead bank, along with a few more banks so as to meet the

thresholds of 60% of lenders by value and 50% by number. The desirability of this

approach assumes that the interests of all banks need to be aligned with or subsumed

within the interest of the lead bank. It is doubtful that the smaller banks would be

happy with this measure for the simple reason that if the same was true, all the

members of the JLF would have anyway agreed with the lead lender and a

prescription by the RBI would not have been required in the first place. Having said

that, this seems to be a fair approach to the extent that the JLF can now move forward

with majority support.

When a troubled asset, like a power project, underlying an NPL, is to be revived or

transacted with an asset reconstruction company (ARC), the fundamental requirement

for an optimal decision process is the data on the costs and benefits involved in the

process. The parties involved would need to have reliable data to put their money on

the table. The required data would include the operational, financial, and regulatory

pay-offs from the power project, post-restructuring or recovery actions. While the data

is more easily available for an operational project, it is not so for an under-construction

BACKSTAB | SEASON 7, ISSUE 2

36

project. For example, the projected operational and financial performance for a

thermal project depends on multiple variables like the power purchase agreement

(PPA), fuel supply agreement (FSA), environmental clearance status, timelines for

construction, etc. Each of these variables is prone to uncertainties.

In the absence of reliable data regarding the elements of the pay-off to the banks,

each bank would adopt a stance that is aligned with its risk appetite and preferences.

It is known that the process of the bank getting back its dues through the legal recovery

process is usually slow, uncertain, and value destructive. There is no market clearing

mechanism to serve as a guide for the pricing decisions in the restructuring or recovery

to be done by the banks. This leads to a widening of the bid-ask spreads, reflecting the

uncertainty in the pricing of risk in the transaction. As a result, the transaction either

does not get consummated or if forced to consummate, leads to a sub-optimal situation

for certain stakeholders. Till now the absence of an agreement within the JLF reflected

the former and in the revised circumstances, the forced agreement within the JLF will

reflect the latter.

5.CURRENT NPA SCENARIO: -

Total bad loans of India's 38 listed commercial banks have crossed Rs 8 lakh crore at

the end of June quarter. This chunk now accounts for nearly 11 percent of the total

loans given by the banking industry.

Over 90 percent of these sticky assets are on the books of government-owned banks.

These banks constitute about 70 percent of the total banking industry, in terms of assets,

meaning the government will have to bear the burden of massive capital requirements

of crisis-ridden industry. Higher bad loans require banks to set aside more money in

terms of provisions. The provision amount varies on a case to case basis.

In recent years, Non-performing assets (NPAs) have emerged as a major headache for

the government and the Reserve Bank of India (RBI). Clearly, both the RBI and

government woke up to the problem too late. The government has so far failed to

infuse the required capital for state-run banks.

The Modi government has time and again blamed the previous UPA-regime for the bad

loan mess, saying NPAs are a legacy issue. It is not yet clear whether the government is

seized of the enormity of the problem. Indeed, the government has taken steps to

address the bad loan problem like the NPA ordinance giving the central bank more

power to direct banks to take action against loan defaulters and passage of Insolvency

and Bankruptcy Code (IBC).

BACKSTAB | SEASON 7, ISSUE 2

37

While these steps are welcome, these are unlikely to help overcome the bad loan

problem in the immediate future. It will take years before banks can get rid of NPAs

accumulated over the years on account of multiple factors. The following seven charts

give us various aspects of India's bad loan crisis.

The Asset Quality Review (AQR) initiated by RBI under former governor Raghuram

Rajan and implemented from Q3 of FY16 resulted in a massive jump in gross NPAs. The

figure more than doubled to Rs 8.29 lakh crore in June 2017 compared with Rs 3.51

lakh crore in September 2015, an addition of Rs 4.78 lakh crore in just seven quarters.

In the first two quarters of implementation of these guidelines, the sector has seen Rs

2.45 lakh crore jump in gross NPAs. While in December 2015 quarter, gross NPAs

surged by Rs 1 lakh crore, in March 2016 quarter this portion went up by another Rs

1.44 lakh crore. The RBI bad loan clean up process cannot be blamed for the

escalation of NPAs, as it only forced banks to report the actual NPAs that were so far

hidden in their balance sheets. At some point, this process had to be started.

Public sector banks (PSBs), which accounted for 90 percent of the total gross

NPAs of the banking sector, has seen their gross NPAs jumping past Rs 7

lakh crore in June 2017 quarter. In the past seven quarters, it jumped by Rs

4.18 lakh crore or 133 percent to Rs 7.33 lakh crore in June 2017 quarter

from Rs 3.14 lakh crore in September 2015 quarter.

State Bank of India (SBI), India's largest lender by assets, tops the bad loan chart. The

bank has Rs 1.88 lakh crore of gross NPAs as on 30 June 2017. The figures now

includes NPAs of five of its associates after the merger. SBI's combine gross NPAs

surged by 150 percent or Rs 1.13 lakh crore to Rs 1.88 lakh crore in the June

quarter from Rs 75,068 crore in September 2015.

Punjab National Bank (PNB) comes second in the list with Rs 57,721 crore gross NPAs,

followed by Bank of India (Rs 51,019 crore), IDBI Bank (Rs 50,173 crore) and Bank of

Baroda (Rs 46,173 crore).

Among 17 private banks, Jammu & Kashmir Bank tops the bad loan table with gross

NPAs of 10.79 percent of its total advances as of 30 June 2017. ICICI Bank figures

second in the list with 7.99 percent bad loans and Kerala-based Dhanalaxmi Bank

follows next recording 5.62 percent of its loans as bad in the June quarter.

BACKSTAB | SEASON 7, ISSUE 2

38

6.INSOLVENCY AND BANKRUPTCY CODE-A PANACEA TO NPA:-

Insolvency & Bankruptcy Code is likely to play an important role in addressing the non-

performing assets (NPA) of the banking sector. The banking sector is facing issues due

to the bad loans on its books, which have created a risk of capital erosion. NPAs have

also constrained the banks' ability to lend. Credit is an important ingredient of economic

growth and the lack of credit could lead to economic contraction. It's not just public

sector banks that are staring a mountain of NPAs - private sector banks are also taking

a hit.

As many as 21 listed PSU banks have a combined gross NPAs of Rs 7.3 lakh crore at

the end of Sep 2017 quarter. They grew by more than 27% as compared to Sep

2016 quarter. SBI has the highest share of bad loans (25.4%), followed by Punjab

National Bank (7.8%) and IDBI Bank (7%). The average Gross NPA ratio - the ratio of

bad loans to total advances - of PSU banks has seen a spike, from 12.04% in Sep

2016 to 14.4% in September 2017.

Although private sector NPAs do not seems to be that huge compared to public sector

banks, in terms of growth they have surpassed public sector banks. As many as 17

listed private sector banks have combined gross NPA of Rs 1.06 lakh crore at the end

of Sep 2017 quarter. That represents a growth in NPAs of more than 40%, compared

to September 2016 quarter. ICICI Bank has the highest share of gross NPAs (41.8%),

followed by Axis Bank (25.8%) & HDFC Bank (7.2%) at the end of Sep 2017 quarter.

The average gross NPA ratio for private sector banks jumped from 3.6% in September

2016 to 4% in September 2017.

The IBC seeks strict time-bound initiation of corrective action even at the stage of the

very first default either to the bank or to the business counter parties. By ensuring

certainty and clarity in all aspects of the process, the code hopes to achieve speedy

resolution, higher recoveries and, in course of time, encourage lenders to go in for

higher levels of debt financing.

The IBC seeks to consolidate scattered and unstructured jurisprudence on insolvency

prevalent in various Acts, like the Presidency Towns Insolvency Act, 1909, Sick Industrial

Companies Act, 1985, Limited Liability Partnership Act, 2008, Companies Act, 2013,

etc. A committee has been formed recently under the chairmanship of the secretary,

Union ministry of corporate affairs, for a comprehensive review of the IBC, including

cross-border insolvency, development and regulation of information utilities and

instances of insolvencies in group companies. There is, anyway, bound to be a whirlwind

of judicial pronouncements on various interpretational issues that should result in the

development of robust IBC jurisprudence in the days to come.

BACKSTAB | SEASON 7, ISSUE 2

39

On the positive side, we are witnessing that debtors are now reconciling with the

‘creditor in control’ scenario, with the committee of creditors (CoC) becoming all-

powerful in the resolution process. It is, therefore, incumbent on this CoC to be fair to all

stakeholders in the stressed company. After all, a company is an amalgam of

stakeholders and its corporate governance norms are expected to maximize the value

of its assets and balance the interests of all entities linked to the company. The IBC

supports this by generally preferring resolution over liquidation.

The success of the IBC is dependent on the alacrity with which the government, courts,

tribunals and Insolvency and Bankruptcy Board of India (IBBI) respond to early-stage

issues arising in their domain, post implementation.

BACKSTAB | SEASON 7, ISSUE 2

40

BACKSTAB | SEASON 7, ISSUE 2

41

4 ELECTION PROCESS IN INDIA:

Elections in India are considered to be the very backbone of the Indian democracy. Being

a Parliamentary Republic, the citizens of India are trusted with the responsibility to choose

the head of the country as well as of the state. There are both General and State elections

that are held in the country based on the Federal structure of the Indian Republic. The

elections in India often transcend from being a mere political activity to a high publicized

and often sensationalized national event, with clear cultural ramifications. The entire

nation seems to suddenly come to life at the onset of the elections, particularly the

General Elections. Even the assembly elections, which determine the state government,

are events of great significance. All state elections are closely observed throughout the

nation. Often the results of the state elections are considered to be clear indications of

the mood of the nation.

BACKSTAB | SEASON 7, ISSUE 2

42

The Election Commission of India

The Election Commission is the apex body that conducts the elections in India. Both the

general and the assembly elections in India are held in accordance with the clear rules

laid down by the Election Commission of India. The Election Commission or the EC

comprises high-ranking government officials and is formed under the guidelines of the

Indian Constitution. The EC is a highly powerful body and is granted with a great degree

of autonomous powers to successfully conduct the elections. Even the judiciary resists from

intervening while the electoral process is on. The work of the Election Commission typically

starts with the announcement of various important dates and deadlines related to the

election, including the dates for voter registration, the filing of nominations, counting and

results. Its activities continue throughout the time-period, when the elections are conducted

in the country. The fact that elections across the country are held in phases and not at the

same time extends the period of its work. The responsibilities of the EC finally concludes

with the submission of the results of the elections.

I.ELECTION PROCESS

BACKSTAB | SEASON 7, ISSUE 2

43

A. Formation of Constituencies:

The Constitution lays down that after the completion of each census the allocation of seats

in the Lok Sabha to States shall be readjusted. Similarly, the constituencies for elections

to the legislative assemblies are also readjusted.

However, 42nd Amendment Act (1976) provided that until the figures for the first census

after the year 2000 have been published, it shall not be necessary to readjust the

allocation of seats to the States in the Lok Sabha.

B. Filling of Nominations:

The nomination of candidates is an important part of the election process. The regulations

require that the candidate or the person who proposes his name file the nomination

papers with the Returning Officer. In order to be chosen a member of the Rajya Sabha

or the State Legislative Council, a person must be not less than 30 years of age.

For election to the Lok Sabha or the State Legislative Assembly, a person should have

attained an age of 25 years. A person is disqualified for being chosen as a member of

any House,

if he holds any office of profit under the Government of India or of any State (The

offices of Ministers or Deputy Ministers are not regarded as offices of profit for this

purpose)

if he is of unsound mind and stands so declared by a competent court

if he is an un-discharged insolvent

if he has ceased to be a citizen of India

if he is so disqualified under any law made by Parliament.

The Representation of the People act, as amended from time to time disqualifies a person

from the membership of a Legislature:

if he has been found guilty of certain election offenses or corrupt practices in election

if he has been convicted and sentenced to transportation or to imprisonment for not

less than two years.

if he has been dismissed from government service for corruption or disloyalty to the

State.

BACKSTAB | SEASON 7, ISSUE 2

44

In 1988 many other offenses, such as cruelty towards women, were in-cluded among

those which would cause disqualification for standing for election. But none of these

disqualifications operates for a period of more than six years from the date of such

conviction.

C. Scrutiny of Nominations:

The Returning Officer scrutinizes the nomination papers very carefully. When someone is

dissatisfied, he is officially stopped from contesting election for six years. The candidates

can withdraw their nomination papers even after they have been found in order.

Every candidate standing for election to the Lok Sabha or to State Legislative Assembly

has to make a security deposit of Rs. 10,000 arid Rs. 5,000 respectively. In case the

candidate belongs to any of the Scheduled Castes or Tribes, the security deposit is

reduced by half.

The security deposit of such candidates as having obtained less than one-sixth of the total

number of valid votes polled is forfeited.

D. Election Campaign:

BACKSTAB | SEASON 7, ISSUE 2

45

Techniques of the election campaign and the tools employed by the parties and the

independent candidates are many:

(i) Election Manifesto:

The parties issue their Election Manifestoes. A Manifesto is a Statement of great

significance. It is “a formal Statement of the Programme and objectives of a political

party” It deals with issues such as restructuring of Centre-State relations, guarantees to

religious or linguistic minorities, justice, and judicial reforms, fiscal reform, economic

growth, social justice, problems of the handicapped, health, nutrition, education,

defense and world peace. The Mani-festo contains programs and promises, with a view

to attracting the largest number of voters.There is a limit set by the Election Comission to

spend in their campaign. Election Commission recently raised the expenditure limits for

Lok Sabha elections from Rs 40 lakh to Rs 70 lakh for each Lok Sabha constituency in

bigger states and from Rs 22 lakh to Rs 54 lakh in smaller states.

BACKSTAB | SEASON 7, ISSUE 2

46

(ii) Electioneering (Activities and Techniques to Persuade

Voters):

The parties and the candi-dates usually make use of these techniques in order to carry

their message to the voters

(a) public meetings and rallies are organized and processions were taken out. The

party leaders, espe-cially the crowd pullers, are assigned the task to address public

meetings;

(b) the street corner meetings are held;

(c) the candidates, along with the influential persons of the area, do door-to- door

canvassing;

(d) new slogans are coined to attract the masses;

(e) advertisements are re-leased to the press (the popular daily and weekly

newspapers); and

(f) the Radio and the Televi-sion are pressed into service to broadcast the speeches and

panel-discussions of leaders of various parties.

BACKSTAB | SEASON 7, ISSUE 2

47

Nowadays electronic media plays the most effective role in creating people’s

awareness about programs of the political parties. The party leaders give a series of

interviews to newspapers and television agencies. Wide coverage is being given to all

these events at regular intervals.

E. Polling Process:

The election campaign must be stopped 48 hours before the time when poll concludes

on the polling day.

Presiding Officer supervises the whole of the polling process and ensures that all

persons working under him adhere to the electoral norms and practices.

BACKSTAB | SEASON 7, ISSUE 2

48

The voter records his vote either by placing the seal-mark against the name of the

candidate he wants to vote for or by pressing the button of the voting machine.

F. Counting of Votes and Declaration of Results:

After the polling has ended the ballot boxes or the voting machines are sealed and

carried under custody to the counting stations. Then the process of counting the votes

begins. In 1979, the practice of booth-wise counting of ballot paper was revived.

It was done in the instance of the parties which insisted on knowing the voting pattern so

that they could woo the voters and work vigorously in the areas where they were weak.

Booth-wise counting was preferred for one more reason.

The parties felt that by doing so it would be easier to detect rigging and take necessary

action. However, there is no hard and fast rule as to the counting of votes and the Election

authorities are free to mix up the ballot papers from all the booths if they feel that it

ensured secrecy with regard to the pattern of voting. The candidate who obtains the

highest number of votes is declared elected.

G. Election Disputes:

The Constitution had originally provided for the appointment of Election Tribunals for

deciding disputes arising in connection with elections. The Nineteenth Amendment Act

(1966) abolished this provision and laid down that the election disputes would be

decided by the High Courts. After every election a lot of disputes arises. The issue over

the reliability of the electronic voting machine (EVM), which has been in use in elections

across India since 1999, has been brought up repeatedly.

For a larger part, most parties have maintained that the machines have been rigged to

favour results towards the BJP. Both BJP and the Election Commission have continuously

asserted that the machines cannot be tampered with.

Amidst controversy over the alleged tampering of Electronic Voting Machines (EVMs) in

the Assembly elections this year, the Union Cabinet led by Prime Minister Narendra Modi

had earlier approved a proposal to buy 16,15,000 Voter Verifiable Paper Audit Trail

(VVPAT) units for use in the General Elections 2019. Each VVPAT unit were to cost around

Rs 19,650 and the total cost of procurement would be around Rs 3173.47 crore

(excluding taxes and freight as applicable) over a period of two years.

A Voter-verified paper audit trail (VVPAT) unit provides feedback to voters using EVMs

for voting. The VVPAT functions as an independent verification system for EVMs and

allows voters to verify that their votes are cast as intended. It also serves as an additional

barrier to changing or destroying votes.

BACKSTAB | SEASON 7, ISSUE 2

49

II.TYPES OF ELECTIONS IN INDIA

A. Lok Sabha Elections:

After every five years, the entire country gears up to decide their representatives in the

Lower House of Parliament. For Lok Sabha elections (or General Elections), the country is

split into different constituencies, and the winner is elected from each constituency.

As per Article 324 of the Indian Constitution, the power of superintendence, direction,

and control of the conduct of elections is vested with the Election Commission of India. In

its efforts to ensure smooth conduct of the mammoth electoral exercise, the commission is

assisted by two Deputy Election Commissioners, who are appointed from the national civil

services.

BACKSTAB | SEASON 7, ISSUE 2

50

B. Rajya Sabha Elections:

Unlike Lok Sabha, the members of Rajya Sabha are not directly elected by the

electorates. The elections to the Upper House of the Parliament happen through the

Legislative Assembly of each state by using the single transferable vote system.

Out of the maximum strength of 250 members, 238 are elected by the legislative

assemblies and 12 are nominated by the President of India. The representatives of states

and Union Territories in the Rajya Sabha are elected by the elected members of the

Legislative Assemblies in accordance with the system of proportional representation. With

one-third of its members retiring every two years, the elections to Rajya Sabha happen

at respective intervals.

BACKSTAB | SEASON 7, ISSUE 2

51

C. State Legislature Elections:

Elections to the Legislative Assembly (Vidhan Sabha) are conducted in the same way the

Lok Sabha elections are carried out. Electorates consisting of citizens in a state above the

age of 18 votes for their state representatives. Each legislative Assembly is formed for

a five-year term following which all seats again go to the polls.

The elections to Legislative Council (Vidhan Parishad) replicate the same process as that

of Rajya Sabha, wherein the representatives are chosen by the members of the lower

house. Besides, the Governor also nominates certain members from the field of art,

science, literature, social service, and co-operative movement. The elections to these

legislative councils are held under the system of proportional representation.

At the state level, the entire electoral process is monitored and supervised by the Election

Commission. The Chief Electoral Officer (CEO) of the state has the responsibility of

ensuring that the polling takes place as per the constitutional provisions. The CEO is

helped by a team of supporting staff.

BACKSTAB | SEASON 7, ISSUE 2

52

D. Presidential and Vice-Presidential Elections:

The President is indirectly elected by an electoral college consisting of the elected

members of Lok Sabha, Rajya Sabha and the members of the legislative assemblies of

every state and union territory. The presidential election is conducted before the present

president’s term gets over.

As per the provision of Article 55 of Indian Constitution, a uniformity has to be maintained

in the scale of representation of the different states. Hence, the election of the President

is held in accordance with the system of proportional representation and the voting

happens through a secret ballot.

The Vice-President is elected by a direct vote of all members of Lok Sabha and Rajya

Sabha. The system of proportional representation is followed and the votes are cast

through a secret ballot. It’s the Election Commission that conducts the election to the office

of the Vice-President.

BACKSTAB | SEASON 7, ISSUE 2

53

Elections form the backbone of democracy wherein people elect their political

representatives and decide the composition of the government. Holding free and fair

elections on a state and national level is integral to upholding the principles of

democratic set up in India. From parliamentary elections to the presidential polls, India

goes through the electoral process at regular intervals.

BACKSTAB | SEASON 7, ISSUE 2

54

BACKSTAB | SEASON 7, ISSUE 2

55

5. OVERVIEW OF CULTURE OF INDIAN START UPS

1.DEFINITION:-

A startup is a young company that is just beginning to develop. Startups are

usually small and initially financed and operated by a handful of founders or one

individual. These companies offer a product or service that is not currently being

offered elsewhere in the market, or that the founders believe is being offered in

an inferior manner. A startup company (startup or start-up) is an entrepreneurial

venture which is typically a newly emerged, fast-growing business that aims to meet

a marketplace need by developing a viable business model around an innovative

product, service, process or a platform. A startup is usually a company designed to

effectively develop and validate a scalable business model. A startup company is

a newly formed business with particular momentum behind it based on perceived

demand for its product or service. The intention of a startup is to grow rapidly as

a result of offering something that addresses a particular market gap.

BACKSTAB | SEASON 7, ISSUE 2

56

2.SOURCES OF FUNDING:-

• Self-funding from your savings (if you have it) is always preferred.

Advantages: no time going hat-in-hand to investors and you don't have to

relinquish any control in your company.

• Friends and family. Tap your inner circle before expanding your horizons. As

a rule of thumb, professional investors like to see real skin in the game--your

own, of that of people who trust you.

• Loans or lines of credit. If your company needs only a temporary or small

infusion of cash, try for a Small Business Administration loan (offered at a lower

interest rate because it is guaranteed by the government) or a bank line of

credit.

• Incubators. A start-up incubator is a company, university or other organization

that ponies up resources--laboratories, office space, consulting, cash, marketing-

-in exchange for equity in young companies when they are most vulnerable

• Form a partnership. A more established company may have a strategic interest

in helping to develop your product---and be willing to advance funding to make

it happen. I know several companies that develop customized social networks

for large enterprises, with the expectation of using that funding and experience

to compete in the consumer market some day. Licensing may not be as sexy as

being a consumer brand, but it will cost you a lot less.

• Commit to a major customer Some customers would be willing to cover your

development costs in order to be able to buy your product before the rest of

the world can. Their advantage: control over your production process (to make

sure it meets their requirements) and the promise of dedicated support. Even

large companies look to their best customers to fund new projects--this is the

essence of good business development.

BACKSTAB | SEASON 7, ISSUE 2

57

3.START UP INDIA-GOVERNMENT PROGRAMME:-

• Startup India campaign is based on an action plan aimed at promoting bank financing

for start-up ventures to boost entrepreneurship and encourage start ups with jobs

creation. The campaign was first announced by Prime Minister Narendra Modi in his

15 August 2015 address from the Red Fort.[1] It is focused on to restrict role of States

in policy domain and to get rid of "license raj" and hindrances like in land permissions,

foreign investment proposal, environmental clearances. It was organized by

Department of Industrial Policy and Promotion (DIPP).[2] A startup is an entity that is

headquartered in India which was opened less than seven years ago and has an annual

turnover less than ₹25 crore (US$3.9 million).[3] The government has already launched

iMADE, an app development platform aimed at producing 1,000,000 apps and

PMMY, the MUDRA Bank, a new institution set up for development and refinancing

activities relating to micro units with a refinance Fund of ₹200 billion (US$3.1 billion).

It’s key initiatives for providing a conducive environment for start ups are as follows:-

• Single Window Clearance even with the help of a mobile application

• 10,000 crore fund of funds

• Reduction in patent registration fee

• Modified and more friendly Bankruptcy Code to ensure 90-day exit window

• Freedom from mystifying inspections for 3 years

• Freedom from Capital Gain Tax for 3 years

• Freedom from tax in profits for 3 years

• Self-certification compliance

• Innovation hub under Atal Innovation Mission

• Starting with 5 lakh schools to target 10 lakh children for innovation

programme

• new schemes to provide IPR protection to start-ups and new firms

• encourage entrepreneurship.

• Stand India across the world as a start-up hub.

It includes the involvement of government and various educational institutions:-

• MINISTRY OF HUMAN RESOURCE DEVELOPMENT

• NATIONAL INSTITUTE OF TECHNOLOGY

• INDIAN INSTITUTE OF TECHNOLOGY

• INDIAN INSTITUTE OF SCIENCE EDUCATION AND RESEARCH

• NATIONAL INSTITUTE OF PHARMACEUTICAL EDUCATION AND RESEARCH

• RESERVE BANK OF INDIA

BACKSTAB | SEASON 7, ISSUE 2

58

• NATIONAL INSTITUTE OF TECHNOLOGY SILCHAR

It has attracted investments from Soft Bank which has its headquarters in Japan and

invested 2 billion dollars into Indian start ups.Google declared to launch a startup,

based on the highest votes in which the top three startups will be allowed to join