Professional Documents

Culture Documents

TX 34PB2ND-2

Uploaded by

sunshine0 ratings0% found this document useful (0 votes)

13 views1 pageOriginal Title

TX_34PB2ND-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageTX 34PB2ND-2

Uploaded by

sunshineCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

;2

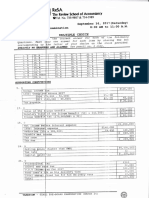

,1l 6. Emi.r-ates Airlrriesr dR i:lterna-.iona I air carrier, lifted passengers,

:\ \ excess baggage, cargo anci/or rnai I f rom Pjani la . I t had a sj^ap_o_ygr in

Dgbai. The .passengers r.Jere trans ferr:ed to another plane belonqring to

fr-iiit"" whj ch brought t-he pdSSr:'.rig€IS to Rome. In computing the Gross

rhl lippine billinqs, j-t

1- shal1 incl-ude the gr(,ss of revenue on its flight from Manila

to Rome.

II - -ehal1 include tite (';ross of revenue on its flight from Manila

to Dubai.

rrv'.. F"Drb,\".91 a. only r is correct

\.+U0frq

' Sf0h,t9ib. onry rr is correct.

c. Both I and II are cori:ecrt

d- Either 1 or II is correct

n-1 International carrier:s that do no.t. have f light to aFd f rom the

'f philippirres but nonetlre'-ess earn j.ncome from ot-her activities in the

country:

a. wilt be subject tc 2 \4 Z spec-ial race.

b. will be subject. tc l0ji i:eguJ,ar rate.

c. will be subject to iicl--Li 2 4 ea special rate and 30? regular rate.

d. wil} not be subjecl t-o t,nj.l-ippi.ne income tax.

n8

t, The following are p€j4e__€egl:- instances of accumulation of profits

v Dgygna Jhg-reas+o3Cp.*|e.- needs of a business and indicative of purpose to

avoid income tax upon sfiareho-Lders exceptr:

a. Inve-stnqnt of substanlial. earrrings and profits of the corporation in

,r-riirelalespbusiness

'- or irr sr-ock or securities of unrelated business

b . G-ve s tment i r<6"1r,gt an<l c the r rISlg-=lS sS s e cu r i t i e s

c. Accumulation of earrrings in e.xqgsjl__9I.--i;QO-a-s!_!gig.qp gg.p"LL,aJ--, not

otherwise intendeci for the reasonable needs of the business as

defi-ned in the Rer;ulatiot-rs

d. None of the choices

v v. A non-stock, non-profit organization that enjoys exemptLo;t from income

tax is required:

a. to file and annualriglgr11g! under oath on or before April

1q

b. to file quarterly ancJ annual return just like any other

corporations.

c. not to file any r:et-urn whatsoever.

d. file annual returrr orrly.

^1 10 Any amount paid specifically, either as advances or reimbursements

for traveling, representation and other bona fide ordinary and

necessary expenses incurred or reasonably expected to be i,ncurred by

the employee ln the performance of his duties are not compensation

i r4tti\.,, subject tso withholding if:

i',t',,'/.'" -rT\ I - It is ordinary and necessary travel.ing and representation or

entertainment expenses p;rid or incurred by the employee in the

pursuit of the trade, business or professi.on-

rtctli/]Piini II The employee i s required to account or liquidete for the

expenses in accordance with specific requirements of

substantiation for eich category or expenses pursuanc to

provision of Lhe Tax Code.

a. Only I is correct

l^ Only I1 is correct

Both I and II are r:or:rect

d- Neither f n.or II is co-r-'rect

nnn nn nnr\ Fviii-lllmTnll /Dnm^u a, \ /f-,\

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- MS 34PB2ND-7Document1 pageMS 34PB2ND-7sunshineNo ratings yet

- MS 34PB1ST-6Document1 pageMS 34PB1ST-6sunshineNo ratings yet

- 7wbva-: First Examination A.MDocument1 page7wbva-: First Examination A.MJims Leñar CezarNo ratings yet

- Aud 34PB2ND-10Document1 pageAud 34PB2ND-10sunshineNo ratings yet

- Aud 34PB1ST-14Document1 pageAud 34PB1ST-14sunshineNo ratings yet

- MS 34PB1ST-3Document1 pageMS 34PB1ST-3sunshineNo ratings yet

- Charpter 11 MANAGING THE QUALITY OF CONSULTING ENGAGEMENTDocument18 pagesCharpter 11 MANAGING THE QUALITY OF CONSULTING ENGAGEMENTsunshineNo ratings yet

- TX 34PB1ST-6Document1 pageTX 34PB1ST-6sunshineNo ratings yet

- MS 34PB1ST-3Document1 pageMS 34PB1ST-3sunshineNo ratings yet

- H08 Pre TestDocument6 pagesH08 Pre TestJason Saberon QuiñoNo ratings yet

- TX 34PB2ND-5Document1 pageTX 34PB2ND-5sunshineNo ratings yet

- TX 34PB1ST-5Document1 pageTX 34PB1ST-5sunshineNo ratings yet

- TX 34PB2ND-10Document1 pageTX 34PB2ND-10sunshineNo ratings yet

- TX 34PB2ND-4 PDFDocument1 pageTX 34PB2ND-4 PDFsunshineNo ratings yet

- TX 34PB1ST-9Document1 pageTX 34PB1ST-9sunshineNo ratings yet

- TX 34PB1ST-8Document1 pageTX 34PB1ST-8sunshineNo ratings yet

- TX 34PB2ND-13Document1 pageTX 34PB2ND-13sunshineNo ratings yet

- TX 34PB1ST-3Document1 pageTX 34PB1ST-3sunshineNo ratings yet

- TX 34PB2ND-5Document1 pageTX 34PB2ND-5sunshineNo ratings yet

- TX 34PB2ND-10Document1 pageTX 34PB2ND-10sunshineNo ratings yet

- TX 34PB2ND-10Document1 pageTX 34PB2ND-10sunshineNo ratings yet

- TX 34PB2ND-12Document1 pageTX 34PB2ND-12sunshineNo ratings yet

- Nil Pre-TestDocument6 pagesNil Pre-TestsunshineNo ratings yet

- TX 34PB1ST-8Document1 pageTX 34PB1ST-8sunshineNo ratings yet

- TX 34PB1ST-2Document1 pageTX 34PB1ST-2sunshineNo ratings yet

- TX 34PB1ST-6Document1 pageTX 34PB1ST-6sunshineNo ratings yet

- TX 34PB1ST-2Document1 pageTX 34PB1ST-2sunshineNo ratings yet

- TRAIN PresentationDocument17 pagesTRAIN PresentationApril Mae Niego MaputeNo ratings yet

- TX 34PB1ST-1Document1 pageTX 34PB1ST-1sunshineNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1Document46 pagesChapter 1Aravinthan ThamasegaranNo ratings yet

- Chapter 1 Overview of AccountingDocument16 pagesChapter 1 Overview of Accountingbassmastah78% (9)

- Fiscal Aspects of Aviation Management: Robert W.KapsDocument5 pagesFiscal Aspects of Aviation Management: Robert W.KapsAbcdefNo ratings yet

- Ratio Analysis - CEAT Tyres LTDDocument18 pagesRatio Analysis - CEAT Tyres LTDagrawal.ace911450% (2)

- Letter PDFDocument3 pagesLetter PDFDENISE BERTSCHNo ratings yet

- Short Intro To M&ADocument103 pagesShort Intro To M&AShivangi MaheshwariNo ratings yet

- PDF File JournalDocument5 pagesPDF File Journalritesh rachnalifestyleNo ratings yet

- Indian Real Estate DisruptersDocument6 pagesIndian Real Estate DisruptersGogreat pollNo ratings yet

- Merchant Banking 2Document68 pagesMerchant Banking 2city cyberNo ratings yet

- Gassner - Coming Clean - Feb08Document2 pagesGassner - Coming Clean - Feb08michaelgassnerNo ratings yet

- NISM Caselet 4Document8 pagesNISM Caselet 4Harish MadanNo ratings yet

- 2.0 Price Action Chart Patterns (Eng & Hindi) VersionDocument81 pages2.0 Price Action Chart Patterns (Eng & Hindi) VersionSuman Saha25% (8)

- Same Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandDocument2 pagesSame Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandVignesh RaghunathanNo ratings yet

- LESSON 10 Business TransactionsDocument8 pagesLESSON 10 Business TransactionsUnamadable UnleomarableNo ratings yet

- FY19 Green BookDocument283 pagesFY19 Green Bookandre yoke himawanNo ratings yet

- Negative and Positive Effects of Foreign Direct InvestmentDocument11 pagesNegative and Positive Effects of Foreign Direct InvestmentHarsha PremNo ratings yet

- FIS Announcement - New York, NY - Jan 7-9Document2 pagesFIS Announcement - New York, NY - Jan 7-9Center for the Advancement of Public IntegrityNo ratings yet

- Tutorial Letter 202/1/2020: Financial Accounting Concepts, Principles and ProceduresDocument8 pagesTutorial Letter 202/1/2020: Financial Accounting Concepts, Principles and ProceduresKatlego SelekaneNo ratings yet

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Private EquityDocument26 pagesPrivate EquitySumitasNo ratings yet

- Doc. 153-1 - Affidavit of R. Lance FloresDocument13 pagesDoc. 153-1 - Affidavit of R. Lance FloresR. Lance FloresNo ratings yet

- MGMT2023 Lecture 7 BOND VALUATION - Parts I IIDocument66 pagesMGMT2023 Lecture 7 BOND VALUATION - Parts I IIIsmadth2918388No ratings yet

- Simon Cash Machine1Document12 pagesSimon Cash Machine1TerryNo ratings yet

- University of Lagos: School of Postgraduate StudiesDocument17 pagesUniversity of Lagos: School of Postgraduate StudiesAguda Henry OluwasegunNo ratings yet

- TOYOTA Statements 2017-2019Document12 pagesTOYOTA Statements 2017-2019JieZheng JZNo ratings yet

- Ba113 Final OutputDocument142 pagesBa113 Final OutputCunanan, Malakhai JeuNo ratings yet

- Chief Sustainability Officers at Work (Excerpt)Document15 pagesChief Sustainability Officers at Work (Excerpt)arunah subramaniamNo ratings yet

- John James Charitable Trust - Organisation Application FormDocument14 pagesJohn James Charitable Trust - Organisation Application FormIssa AdiemaNo ratings yet

- Amity University Kolkata IfmDocument8 pagesAmity University Kolkata IfmPinki AgarwalNo ratings yet

- Foresight Africa:: Top Priorities For The Continent in 2016Document110 pagesForesight Africa:: Top Priorities For The Continent in 2016Astou CisséNo ratings yet