Professional Documents

Culture Documents

Ekonomi Internasional UTS 2016 - 2017 FIthr

Ekonomi Internasional UTS 2016 - 2017 FIthr

Uploaded by

Luthfiana Rahma0 ratings0% found this document useful (0 votes)

21 views1 pageOriginal Title

Ekonomi-Internasional-UTS-2016_2017-FIthr

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageEkonomi Internasional UTS 2016 - 2017 FIthr

Ekonomi Internasional UTS 2016 - 2017 FIthr

Uploaded by

Luthfiana RahmaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Ujian

Tengah Semester (Midterm Exam)

Semester Gasal 2016/2017

Mata Kuliah Ekonomi Internasional

Pengajar: Fithra Faisal Hastiadi

Open Book and Open Notes

180 Menit

1. “If there were free migration and truly open borders, workers from the lower-wage

countries would stream into the higher-wage countries. These new arrivals would compete

for jobs, accept work for lower pay, and force the existing jobholders to accept either lower

wages or unemployment. Precisely for this reason, no one accepts or supports the notion of

free immigration. “We do, however, accept and support the notion of free trade, which has

the same effect. Instead of exporting workers to the United States, lower-wage countries

simply import our jobs and industries to their workers. As the higher-wage nation suffers

cutbacks in production, failures of companies, and losses of jobs, the market dictates that

workers accept lower wages and a reduced standard of living to match the lower-wage

foreign competition.” – Professor John Culbertson, University of Wisconsin, writing in the

Harvard Business Review, September-October 1986. Explain the economic reasoning in this

argument and assess its validity. (25 points)

2. The United States has gotten a head start in producing scientific word processing software,

and now supplies the world market. There are external economies of scale in the software

industry. Investors in India believe India has the natural comparative advantage in software

production, and insist that India is worse off under free trade than under autarky. In the

space below, please draw a very carefully-labeled graph that illustrates a situation in which

the Indian investors are only half correct: although India has a natural comparative

advantage in producing this software, India nevertheless is better off importing software

from the country that got the head start in the industry (United States) than in autarky. (25

points)

3. Is free trade a sufficient condition for growth and poverty alleviation in developing

countries? Critically evaluate how recent trade liberalization experience in some Asian

countries has influenced their economic growth and poverty.

4. “Consider two countries producing the same good with the same constant returns to scale

production function, relating output to homogeneous capital and labor inputs. ... the Law of

Diminishing Returns implies that the marginal product of capital is higher in the less

productive (i.e., in the poorer) economy. If so, then if trade in capital good is free and

competitive, new investment will occur only in the poorer economy, and this will continue to

be true until capital-labor ratios, and hence wages and capital returns, are equalized.” –

Robert E. Lucas, American Economic Review, 1990. Within the set-up of Lucas' statement –

output produced by capital and labor with constant returns to scale and the same

technology being accessible to all countries – how can our models of international trade

explain why capital flows do not occur the way Lucas argues they should?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Frosio QuestionsDocument3 pagesFrosio QuestionsAS Dev100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Half Brother ExcerptDocument21 pagesHalf Brother ExcerptI Read YA50% (2)

- Hypothyroidism: Causes, Incidence, and Risk FactorsDocument5 pagesHypothyroidism: Causes, Incidence, and Risk FactorsPhineas KangoreNo ratings yet

- You Can Stabilize Motion With The Warp Stabilizer EffectDocument5 pagesYou Can Stabilize Motion With The Warp Stabilizer EffectMonastere De la NativiteNo ratings yet

- HUAWEI SAE-HSS9820 归属用户服务器: IPLOOK NetworksDocument7 pagesHUAWEI SAE-HSS9820 归属用户服务器: IPLOOK NetworksIPLOOK TechnologiesNo ratings yet

- Consumer Bill - SNGPLDocument1 pageConsumer Bill - SNGPLKhalid YousafNo ratings yet

- CHAPTER 4 Feasibility Study For Dance StudioDocument11 pagesCHAPTER 4 Feasibility Study For Dance StudioAlexander0% (1)

- Arudha Lagna Interpretation Tips - Mariocean@gmail - Com - GmailDocument2 pagesArudha Lagna Interpretation Tips - Mariocean@gmail - Com - GmailMariana Santos100% (1)

- Waste Management Strategies of Class Advisers of Pag-Asa National High School For The SY: 2018-2019Document12 pagesWaste Management Strategies of Class Advisers of Pag-Asa National High School For The SY: 2018-2019ShekinahNo ratings yet

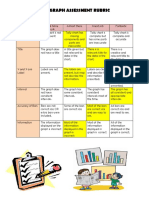

- Shelby Bar Graph Assessment RubricDocument1 pageShelby Bar Graph Assessment Rubricapi-360512521No ratings yet

- P4 Maths Booklet B 3.0Document15 pagesP4 Maths Booklet B 3.0Bernard ChanNo ratings yet

- ASCP Training Manual v1.2Document87 pagesASCP Training Manual v1.2xslogic100% (2)

- A Study of Ralph Vaughan Williamss An Oxford Elegy and EpithaDocument159 pagesA Study of Ralph Vaughan Williamss An Oxford Elegy and EpithagustavoalbertomaseraNo ratings yet

- ProfeeDocument7 pagesProfeeRose Ann P. LamonteNo ratings yet

- Xteer Offer 3q 2015Document2 pagesXteer Offer 3q 2015api-199203074No ratings yet

- Week2 Lab and AssessmentDocument7 pagesWeek2 Lab and AssessmentreslazaroNo ratings yet

- Astm D2967.20571 PDFDocument3 pagesAstm D2967.20571 PDFMariano Emir Garcia OdriozolaNo ratings yet

- Witty Royal School ExamsDocument7 pagesWitty Royal School ExamsJovin ComputersNo ratings yet

- Iexpenses Overview 1Document48 pagesIexpenses Overview 1rcp.generalNo ratings yet

- 320D FMDocument2 pages320D FMFabio AlvesNo ratings yet

- Troilus and Criseyde by Chaucer, Geoffrey, 1343?-1400Document168 pagesTroilus and Criseyde by Chaucer, Geoffrey, 1343?-1400Gutenberg.org100% (1)

- 1500 ITT Training QuestionsDocument166 pages1500 ITT Training QuestionsMallikarjun Reddy ChagamreddyNo ratings yet

- Motorola I760, iDEN I850 Field Service ManualDocument112 pagesMotorola I760, iDEN I850 Field Service ManualmegaadyNo ratings yet

- Lab Report 2Document5 pagesLab Report 2Shiela Jane SebugeroNo ratings yet

- Tata AIG Motor Premium Quote - 3184 - QT - 22 - 6200502905Document2 pagesTata AIG Motor Premium Quote - 3184 - QT - 22 - 6200502905Raman ParasharNo ratings yet

- Transportation Management ModuleDocument58 pagesTransportation Management Modulecathy palomoNo ratings yet

- DSC Lc100piDocument2 pagesDSC Lc100piWlady Mena100% (1)

- Unit8 Percentages ProportionalityDocument11 pagesUnit8 Percentages Proportionalitygiggia02No ratings yet

- Chapter 9-Center of Gravity and Centroids-OdatDocument74 pagesChapter 9-Center of Gravity and Centroids-OdatMohammed Al-OdatNo ratings yet

- Sop PraptiDocument6 pagesSop PraptiRikhil NairNo ratings yet