Professional Documents

Culture Documents

SKFD Elite Life II 7 Feb

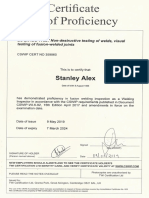

Uploaded by

Stanley AlexOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SKFD Elite Life II 7 Feb

Uploaded by

Stanley AlexCopyright:

Available Formats

Features of ICICI Pru Elite Life II

ICICI Pru Elite Life II is a plan which is designed to give you life cover and help you grow your

wealth over the long-term

This policy is unit linked which means that the benefits you receive will depend on the

performance of the fund(s) you have selected.

This document has been designed to help you understand your policy better by explaining

some of its features. The complete details of the features is available in the Policy Document

which has been sent as an attachment to the Welcome email. Do go through that document as

well to get a complete understanding of your policy.

1 How does this policy work?

At the time of entering this policy, you would have made three important choices:

The premium that you will pay

The number of years for which you will pay premium i.e. Premium Payment Term

The number of years after which your policy matures i.e. Policy Term

Since your policy benefits primarily depend on these three factors, please make sure

that these details are mentioned correctly in your Policy Certificate. You need to pay

the premium amount for the Premium Payment Term.

Your premium will get invested in a fund of your choice. Your investment will grow as per the returns earned by the

fund(s) chosen by you. On completion of the Policy Term, the Fund Value at that point in time will be paid to you.

2 What fund options do I have?

This policy comes with a suite of 7 funds. Depending on your investment preference you can

choose one or more funds from these 7. You can also switch from one fund to another. You can

make unlimited switches, free of cost.

If you don t want to choose a specific fund, you can opt for:

Automatic Transfer Strategy - Refer to section 5.1 of your Policy Document for more details

Lifecycle based portfolio strategy - Refer to section 5.1 of your Policy Document for more

details

Over time, the Fund Value reflects the returns earned by the fund(s) selected by you.

3 What are the benefits that I get from this policy?

Maturity Benefit: At the end of your Policy Term, you will get your Fund Value as the Maturity Benefit. Your Fund

Value will be determined by the returns earned by the fund(s) you have selected.

There are 2 aspects that can help increase your Fund Value:

Loyalty Additions: Starting from the 6th year onwards, we will add 0.30% every year to

your Fund Value if you stay invested for that year. This increases to 0.50% from the 11th

year onwards. Apart from staying invested, if you also pay your premium for that year,

you will get an additional 0.25%.

Wealth Boosters: Starting from the 10th year onwards, we will add 1.50% to your

Fund Value once every 5 years. For example, if your Policy Term is 30 years, you will

get this in the 10th, 15th, 20th, 25th and the 30th year.

Loyalty additions and Wealth Boosters enhance your Maturity Benefit. So stay invested

and pay all your premiums to get these benefits. You can choose to get your Maturity Benefit as a lump-sum or

spread over a period of time.

Life Insurance Benefit: In this policy, if the person whose life is covered dies during the

Policy Term, we will pay the person specified in your policy (the Nominee ) a lump-sum,

which is commonly known as the Death Benefit.

This amount would be the maximum of the following 3 sums:

A. Sum Assured This amount would be specified in your Policy Certificate

B. Fund Value at the time of death

C. 105% of total premiums paid till the time of death

The Nominee or any other family member can initiate the process of receiving this amount by visiting

www.iciciprulife.com/public/Life-Claims/Claim-Process.htm

Partial Withdrawal Benefit: In case of any sudden requirement of money, you can withdraw

money from your Fund Value. This feature is called Partial Withdrawal. You can make a

partial withdrawal after 5 years. In any year, you can withdraw up to 20% of your Fund

Value. Do note that making a Partial withdrawal will have an impact on your sum assured.

Please refer to clause 3.9 of your Policy Document for further details.

4 What are the charges I pay?

Premium Allocation Charge: is deducted from the premium you pay. This charge is

calculated as a percentage of premium. For example, if you pay premium annually, the

RG ES charge will be:

CHA Year 1 to 3 Year 4 and 5 Year 6 onwards

` 4% 4% 2%

For One pay policies, the premium allocation charge is 3%.For more details on this

charge, please refer section 1 of your Policy Document.

Policy Administration Charge: is levied every month for the first five years of your Policy Term. For Regular and

Five pay policies, the charge is ` 400 per month and for One pay policies, it is ` 60 per month.

Fund Management Charge (FMC): is a percentage of your Fund Value. FMC for Money Market Fund is 0.75%

p.a. For the remaining 6 funds that you can choose from in this policy, the FMC is 1.35% p.a.

Mortality Charge: This is the cost of your life insurance cover. This will vary depending on your Fund Value and

the life insurance cover that the policy offers.

5 What happens if I pay premiums for lesser number of years than

what I had chosen or decide to close the policy prematurely?

It is in your best interest that you pay premiums and stay invested for the number of years

as selected by you. If you stop paying premiums or close your policy, you will lose

benefits such as Loyalty Additions and Wealth Boosters, amongst others.

If you close your policy after completion of 5 years, your Fund Value will be paid out to

you and your policy will be closed.

If you close your policy before completion of 5 years, then there can be a lot of scenarios

depending on how many years you have paid premiums, whether you intend to resume

paying premiums later etc.

For complete details on the various scenarios, please refer to section 4 of your Policy

Document.

© 2014, ICICI Prudential Life Insurance Co. Ltd. Registered Address: ICICI Prulife Towers, 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400025.

Reg No: 105. Insurance is the subject matter of the solicitation. UIN: 105L141V01. Comp/doc/Feb/2014/1115.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Aws D1.1 D1.1M-2010Document569 pagesAws D1.1 D1.1M-2010Abraham Aby100% (4)

- Pressure Vessel Exm QuestionsDocument4 pagesPressure Vessel Exm QuestionsJithuJohn100% (1)

- Astm A123 PDFDocument2 pagesAstm A123 PDFবিপ্লব পাল67% (6)

- Vetassess - Stage 2 - Assessment Guide - FA PDFDocument14 pagesVetassess - Stage 2 - Assessment Guide - FA PDFStanley AlexNo ratings yet

- Technical AramcoDocument10 pagesTechnical AramcoAbhishek NagNo ratings yet

- Asme SectionsDocument56 pagesAsme SectionsalperbogaNo ratings yet

- Asme SectionsDocument56 pagesAsme SectionsalperbogaNo ratings yet

- Asme b16 9 2003Document50 pagesAsme b16 9 2003alokbdas100% (1)

- Exam - 2Document12 pagesExam - 2Stanley Alex100% (3)

- Symbol of Weld PDFDocument28 pagesSymbol of Weld PDFSyarif IrwantoNo ratings yet

- Exam - 3Document11 pagesExam - 3Stanley Alex100% (1)

- Exam - 4Document14 pagesExam - 4Stanley Alex100% (1)

- Exam - 5Document13 pagesExam - 5Stanley AlexNo ratings yet

- National Metal and Engineering Industry Competency Standards Implementation Guide (1999)Document111 pagesNational Metal and Engineering Industry Competency Standards Implementation Guide (1999)Stanley AlexNo ratings yet

- ATTC Fact Sheet Welder First ClassDocument6 pagesATTC Fact Sheet Welder First ClassStanley AlexNo ratings yet

- MEM12023A Perform Engineering Measurements: Release: 1Document9 pagesMEM12023A Perform Engineering Measurements: Release: 1Stanley AlexNo ratings yet

- Fact Sheet - Welder First Class PDFDocument4 pagesFact Sheet - Welder First Class PDFStanley AlexNo ratings yet

- Mem R2.0 PDFDocument3,726 pagesMem R2.0 PDFStanley Alex0% (2)

- MEM Companion Volume Implementation Guide - Release 1.1Document23 pagesMEM Companion Volume Implementation Guide - Release 1.1Stanley AlexNo ratings yet

- The Travel Itinerary PDFDocument2 pagesThe Travel Itinerary PDFStanley AlexNo ratings yet

- MEM R2 Companion Volume Implementation Guide 2019Document192 pagesMEM R2 Companion Volume Implementation Guide 2019Stanley AlexNo ratings yet

- PTEA Test TipsDocument43 pagesPTEA Test TipsKopi BrisbaneNo ratings yet

- 01 Samss 010 PDFDocument11 pages01 Samss 010 PDFAnonymous hBBam1nNo ratings yet

- Cswip 3.1Document1 pageCswip 3.1Stanley AlexNo ratings yet

- 01 Samss 010 PDFDocument11 pages01 Samss 010 PDFAnonymous hBBam1nNo ratings yet