Professional Documents

Culture Documents

Economy & GGG, SQGLP

Uploaded by

AmirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economy & GGG, SQGLP

Uploaded by

AmirCopyright:

Available Formats

Pakistan’s current economic challenge is new to none …….

which is evident from the phases our

economy has faced over the years. However, economic revival is all set to bolster up the indicators in

the future where the currency will stabilize along with inflation levels peaking out. The drainage of

foreign exchange reserves is also projected to settle down supporting the economic growth in the

country. The cyclical movements can be observed from the 5 phases the economy has survived with

basic economic indicators impacting the growth.

Current Account deficit is set to stabilize in the future along with foreign exchange reserves

being replenished back.

Inflation & interest rates are expected to normalize after peaking out supporting the economic

trajectory towards positive levels in the future.

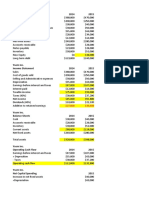

GDP growth is expected to zoom out from 2.4% to 5% in the 5-year forward growth outlook

aiding in economic revival and stabilization of the economy.

This economic revival will ultimately help increase the household consumption where recovery in Real

household consumption patterns appear to be strong, ultimately yielding the benefit to National Foods

Pakistan whose per capita consumption is all set to follow an upward trajectory taking the the total

spices, sauces and condiments industry to PKR xxbn by 2025.

Buying good companies at great (bargain) price or buying great companies at

good (reasonable) price are the two options for investors at large.

From an investment perspective, we have analyzed NATF under two models used by the Motilal Oswal

group (MOSL) under the wealth creation studies.

Great, Good, Gruesome research emphasizes the importance of what makes a company Great, Good,

or Gruesome for investment perspective:

*Brief overview of the 8 factors pertaining to National Food: Nature of Business to Dividend Payout.

Thus, the company stands out as a good investment at a great price with moderate to high return & high

capital safety – referring to the matrix. (I have to correct the matrix as the NATF logo is placed in the

wrong place)

Numeric included in the Assessment Matrix – 10 Year CAGR’s. (To be briefly explained)

Next Slide

To make money in stocks you must have the vision to see them, the courage to buy them

and the patience to hold them. Patience is the rarest of the three.

– Thomas Phelps in 100 to 1 In The Stock Market

100X Stocks - SQGLP alchemy is used by MOSL to describe what makes great investments. MOSL

claims that the five compounding factors are Size (of enterprise), Performance (of business and

management), Growth (in earnings), Longevity (of performance and growth) and Price (favorable value).

Analyzing NATF under this framework we see ….

*High Quality High Growth company referring to the matrix.

A brief description of Size (Sales Graph), Quality (Awards & Management), Growth (PAT & PBT), Price &

Longevity ultimately concluding National Food as a company with strong SQGLP alchemy making it an

attractive investment.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Entrepreneusrhip Assignment Syed AmirDocument7 pagesEntrepreneusrhip Assignment Syed AmirAmirNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Importance of Digital MarketingDocument4 pagesImportance of Digital MarketingAmirNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Argumentative Essay - EditedDocument3 pagesArgumentative Essay - EditedAmirNo ratings yet

- AI Smart City Draf - EditedDocument5 pagesAI Smart City Draf - EditedAmirNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Unity Health AssignmentDocument12 pagesUnity Health AssignmentAmirNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Argumentative EssayDocument3 pagesArgumentative EssayAmir100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- NUST Business School Investment Portfolio Management Final ProjectDocument34 pagesNUST Business School Investment Portfolio Management Final ProjectAmirNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Financial Planning ForecastingDocument25 pagesFinancial Planning ForecastingHassaan KhalidNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Substantive Procedures For Evaluation of LoansDocument3 pagesSubstantive Procedures For Evaluation of LoansChristian PerezNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Blog CmsDocument10 pagesBlog Cmsstan.jonasNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- ABM1-Accounting Concepts and PrinciplesDocument16 pagesABM1-Accounting Concepts and PrinciplesKassandra KayNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Homi Nath - Project Final 2-RESUBMITTEDDocument20 pagesHomi Nath - Project Final 2-RESUBMITTEDHomi NathNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Investment Behavior of Women: A Conceptual StudyDocument8 pagesInvestment Behavior of Women: A Conceptual StudyDr. KavitaNo ratings yet

- International Capital FlowsDocument12 pagesInternational Capital FlowsnazNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CH 11Document21 pagesCH 11cushin200950% (8)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Contract of Lease FormDocument3 pagesContract of Lease FormHal JordanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Investor Analysis of Mutualfund in Jhavery PVT Ltd.Document53 pagesInvestor Analysis of Mutualfund in Jhavery PVT Ltd.Chintan PavsiyaNo ratings yet

- SMChap 010Document58 pagesSMChap 010testbankNo ratings yet

- Insurance Note Taking GuideDocument2 pagesInsurance Note Taking Guideapi-252392987No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PNB AR 2007 With BH NamesDocument152 pagesPNB AR 2007 With BH NamesShingie0% (1)

- Among The Interesting Facts of Italy Are: 1.the Average Italian Consumes 60 Liters of Wine and 30 Kilograms, or 66 Pounds, of Pasta Per YearDocument1 pageAmong The Interesting Facts of Italy Are: 1.the Average Italian Consumes 60 Liters of Wine and 30 Kilograms, or 66 Pounds, of Pasta Per YearGreciaEstefanyNo ratings yet

- Current Stakeholders - Shareholders: Liquidity RatioDocument3 pagesCurrent Stakeholders - Shareholders: Liquidity RatioPutra EvoNo ratings yet

- Laporan Keuangan Ace Hardware 2017-Q2 PDFDocument53 pagesLaporan Keuangan Ace Hardware 2017-Q2 PDFBang BegsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Executive Summary My ReportDocument1 pageExecutive Summary My ReportNirob Hasan VoorNo ratings yet

- Ch06 TB Hoggetta8eDocument16 pagesCh06 TB Hoggetta8eAlex Schuldiner93% (14)

- 7 - Entrepreneural FinancingDocument29 pages7 - Entrepreneural FinancingJay Fab0% (1)

- Cost of Cap More QuestionsDocument4 pagesCost of Cap More QuestionsAnipa HubertNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- ACH Reversal Request FormDocument1 pageACH Reversal Request FormRei HimuraNo ratings yet

- Forms BrgyDocument13 pagesForms BrgyErlinda LagunaNo ratings yet

- ReceiptDocument1 pageReceiptdharmesh.suratiNo ratings yet

- UTF FactsheetDocument2 pagesUTF Factsheetfor muthuNo ratings yet

- Cash Flows and Financial Statements at YsomDocument4 pagesCash Flows and Financial Statements at YsomKrishna Sharma0% (1)

- Management of Funds Entire SubjectDocument85 pagesManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Exam 1 PDFDocument4 pagesExam 1 PDFFiraa'ool YusufNo ratings yet

- MY Project - WCM of Tata Steel LTD and SAILDocument22 pagesMY Project - WCM of Tata Steel LTD and SAILrakeshraj mahakud50% (2)

- Safari Bag Bill PDFDocument1 pageSafari Bag Bill PDFUjjwalPratapSinghNo ratings yet

- Far 09 Government GrantsDocument9 pagesFar 09 Government GrantsJoshua UmaliNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)