Professional Documents

Culture Documents

Untitled - 0010

Untitled - 0010

Uploaded by

DEWFJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled - 0010

Untitled - 0010

Uploaded by

DEWFJCopyright:

Available Formats

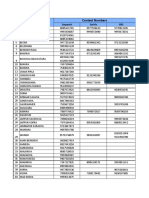

Chart B—For Children and Other Dependents (See Who Qualifies as later.

)

If your parent (or someone else) can claim you as a dependent, use this chart to see if you must file a return.

In this chart, unearned income includes taxable interest, ordinary dividends, and capital gain distributions. It also includes

unemployment compensation, taxable social security benefits, pensions, annuities, and distributions of unearned income from a trust.

Earned income includes salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the

total of your unearned and earned income.

Single dependents. Were you either age 65 or older or blind?

□ No. You must file a return if any of the following apply.

• Your unearned income was over $1,100.

• Your earned income was over $12,200.

• Your gross income was more than the larger of—

• $1,100, or

• Your earned income (up to $11,850) plus $350.

□ Yes. You must file a return if any of the following apply.

• Your unearned income was over $2,750 ($4,400 if 65 or older and blind).

• Your earned income was over $13,850 ($15,500 if 65 or older and blind).

• Your gross income was more than the larger of—

• $2,750 ($4,400 if 65 or older and blind), or

• Your earned income (up to $11,850) plus $2,000 ($3,650 if 65 or older and blind).

Married dependents. Were you either age 65 or older or blind?

□ No. You must file a return if any of the following apply.

• Your unearned income was over $1,100.

• Your earned income was over $12,200.

• Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

• Your gross income was more than the larger of—

• $1,100, or

• Your earned income (up to $11,850) plus $350.

□ Yes. You must file a return if any of the following apply.

• Your unearned income was over $2,400 ($3,700 if 65 or older and blind).

• Your earned income was over $13,500 ($14,800 if 65 or older and blind).

• Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.

• Your gross income was more than the larger of—

• $2,400 ($3,700 if 65 or older and blind), or

• Your earned income (up to $11,850) plus $1,650 ($2,950 if 65 or older and blind).

- 10-

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mep CompaniesDocument10 pagesMep CompaniesparimalaseenivasanNo ratings yet

- Shamanic Trance PosturesDocument2 pagesShamanic Trance PosturesHoward G Charing100% (2)

- Wolves in Sheeps Clothing Iserbyt 1995 CTD 52pgs EDU - SMLDocument52 pagesWolves in Sheeps Clothing Iserbyt 1995 CTD 52pgs EDU - SMLpterodaktilNo ratings yet

- Proposed Tyre Processing Plant at MowbrayDocument242 pagesProposed Tyre Processing Plant at MowbrayThe Examiner100% (1)

- GP Contact List UpdatedDocument2 pagesGP Contact List Updatedakshaymnnit100% (1)

- Buce vs. CADocument1 pageBuce vs. CAKim Medrano100% (1)

- The Long-Distance Teammate: Read or Listen OfflineDocument9 pagesThe Long-Distance Teammate: Read or Listen OfflinePathway Peers (PP)No ratings yet

- Preliminary Pageant ContractDocument1 pagePreliminary Pageant ContractOhiogayprideNo ratings yet

- Word Formation 1Document3 pagesWord Formation 1MonicaNo ratings yet

- Does Media Violence Cause Violent BehaviorDocument6 pagesDoes Media Violence Cause Violent BehaviorShanza qureshiNo ratings yet

- Maker Studios LawsuitDocument50 pagesMaker Studios LawsuitLew HarrisNo ratings yet

- Balthazar DessertDocument1 pageBalthazar DesserteatlocalmenusNo ratings yet

- Vikalp Final ReportDocument75 pagesVikalp Final ReportSumit BansalNo ratings yet

- Hughes C.E. Stevens A. 2010 What Can We Learn From The Portuguese Decriminalisation of Illicit DrugsDocument24 pagesHughes C.E. Stevens A. 2010 What Can We Learn From The Portuguese Decriminalisation of Illicit DrugsFernando Lynch100% (1)

- Customer Satisfaction & Reverse Logitics in E-Commerce - The Case of Klang ValleyDocument9 pagesCustomer Satisfaction & Reverse Logitics in E-Commerce - The Case of Klang ValleySharwiniRajenthiranNo ratings yet

- Electric Cars: The Sustainable Method of TransportationDocument4 pagesElectric Cars: The Sustainable Method of TransportationVinay RohraNo ratings yet

- Dubai FlyerDocument10 pagesDubai Flyertfpalo4No ratings yet

- Theology of The Body Session 2. Purity of HeartDocument60 pagesTheology of The Body Session 2. Purity of HeartFr Samuel Medley SOLT100% (3)

- EE337 Assignment 7Document4 pagesEE337 Assignment 7Мар'яна ТарасNo ratings yet

- State Enterprise - Poltava Regional Scientific and Technical Center of Standardization, Metrology and Certification - ElectronDocument2 pagesState Enterprise - Poltava Regional Scientific and Technical Center of Standardization, Metrology and Certification - ElectronMultitech InternationalNo ratings yet

- HR Director Resume SampleDocument4 pagesHR Director Resume Sampletbrhhhsmd100% (1)

- Sanitary Line Layout Waterline Layout Storm Drainage LayoutDocument1 pageSanitary Line Layout Waterline Layout Storm Drainage LayoutajNo ratings yet

- Cecchino Dei BracciDocument3 pagesCecchino Dei BraccixfaixalxNo ratings yet

- Se Ion: Base Past Past Portugue Form Tense Participle TranslatDocument3 pagesSe Ion: Base Past Past Portugue Form Tense Participle TranslatGustavo Carnevali MendesNo ratings yet

- CE LawsDocument13 pagesCE LawsCatherine MartinezNo ratings yet

- Examiner's Report: P7 Advanced Audit and Assurance December 2017Document4 pagesExaminer's Report: P7 Advanced Audit and Assurance December 2017Lukas CNo ratings yet

- The United Nations Development Program's: Quick WinsDocument10 pagesThe United Nations Development Program's: Quick WinsHill A. D.No ratings yet

- Report NameIncident 1685266164334Document2 pagesReport NameIncident 1685266164334David RojasNo ratings yet

- The Conspiracy of Silence in Henry V Author(s) : Karl P. Wentersdorf Source: Shakespeare Quarterly, Summer, 1976, Vol. 27, No. 3 (Summer, 1976), Pp. 264-287 Published By: Oxford University PressDocument25 pagesThe Conspiracy of Silence in Henry V Author(s) : Karl P. Wentersdorf Source: Shakespeare Quarterly, Summer, 1976, Vol. 27, No. 3 (Summer, 1976), Pp. 264-287 Published By: Oxford University PressDoris TAONo ratings yet

- Afrasiab Khan Resume and Achievment Letter - SCMDocument2 pagesAfrasiab Khan Resume and Achievment Letter - SCMaizy_786No ratings yet