Professional Documents

Culture Documents

Integrated Case. 5-42 First National Bank Time Value of Money Analysis PDF

Uploaded by

Abdullah YusufOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Integrated Case. 5-42 First National Bank Time Value of Money Analysis PDF

Uploaded by

Abdullah YusufCopyright:

Available Formats

Integrated Case

5-42

First National Bank

Time Value of Money Analysis

You have applied for a job with a local bank. As part of its evaluation process,

you must take an examination on time value of money analysis covering the

following questions.

A. Draw time lines for (1) a $100 lump sum cash flow at the end of Year

2, (2) an ordinary annuity of $100 per year for 3 years, and (3) an

uneven cash flow stream of -$50, $100, $75, and $50 at the end of

Years 0 through 3.

ANSWER: [Show S5-1 through S5-4 here.] A time line is a graphical

representation that is used to show the timing of cash flows. The

tick marks represent end of periods (often years), so time 0 is today;

Time 1 is the end of the first year, or 1 year from today; and so on.

0 1 2 Year

I/YR%

| | | Lump sum

100 Cash flow

0 1 2 3

I/YR%

| | | | Annuity

100 100 100

0 1 2 3

I/YR%

| | | | Uneven cash flow stream

-50 100 75 50

A lump sum is a single flow; for example, a $100 inflow in Year

2, as shown in the top time line.

Chapter 5: Time Value of Money Integrated Case 1

An annuity is a series of equal cash flows occurring over equal

intervals, as illustrated in the middle time line.

An uneven cash flow stream is an irregular series of cash flows

that do not constitute an annuity, as in the lower time line. -50

represents a cash outflow rather than a receipt or inflow.

B. (1) What’s the future value of $100 after 3 years if it earns 10%, annual

compounding?

ANSWER: [Show S5-5 through S5-7 here.] Show dollars corresponding to

question mark, calculated as follows:

0 1 2 3

10%

| | | |

100 FV = ?

After 1 year:

FV1 = PV + I1 = PV + PV(I) = PV(1 + I) = $100(1.10) = $110.00.

Similarly:

FV2 = FV1 + I2 = FV1 + FV1(I)

= FV1(1 + I) = $110(1.10) = $121.00

= PV(1 + I)(1 + I) = PV(1 + I)2.

FV3 = FV2 + I3 = FV2 + FV2(I)

= FV2(1 + I) = $121(1.10) = $133.10

= PV(1 + I)2(1 + I) = PV(1 + I)3.

In general, we see that:

FVN = PV(1 + I)N,

So FV3 = $100(1.10)3 = $100(1.3310) = $133.10.

2 Integrated Case Chapter 5: Time Value of Money

Note that this equation has 4 variables: FVN, PV, I/YR, and N. Here,

we know all except FVN, so we solve for FVN. We will, however, often

solve for one of the other three variables. By far, the easiest way to

work all time value problems is with a financial calculator. Just plug

in any three of the four values and find the fourth.

Finding future values (moving to the right along the time line) is

called compounding. Note that there are 3 ways of finding FV3:

Regular calculator:

1. $100(1.10)(1.10)(1.10) = $133.10.

2. $100(1.10)3 = $133.10.

Financial calculator:

This is especially efficient for more complex problems, including

exam problems. Input the following values: N = 3, I/YR = 10, PV

= -100, PMT = 0, and solve for FV = $133.10.

Spreadsheet:

Spreadsheet programs are ideally suited for solving time value of

money problems. The spreadsheet can be set up using the

specific FV spreadsheet function or by entering a FV

formula/equation.

B. (2) What’s the present value of $100 to be received in 3 years if the

interest rate is 10%, annual compounding?

Answer: [Show S5-8 through S5-10 here.] Finding present values, or

discounting (moving to the left along the time line), is the reverse of

compounding, and the basic present value equation is the reciprocal

of the compounding equation:

Chapter 5: Time Value of Money Integrated Case 3

0 1 2 3

| 10% | | |

PV = ? 100

FVN = PV(1 + I)N transforms to:

N

FVN 1 N

PV = N

= FVN = FVN (1 + I )

(1 + I) 1+I

Thus:

3

1

PV = $100 = $100(0.7513) = $75.13.

1.10

The same methods (regular calculator, financial calculator, and

spreadsheet program) used for finding future values are also used to

find present values, which is called discounting.

Using a financial calculator input: N = 3, I/YR = 10, PMT = 0,

FV = 100, and then solve for PV = $75.13.

C. What annual interest rate would cause $100 to grow to $125.97 in 3

years?

ANSWER: [Show S5-11 here.]

0 1 2 3

| | | |

-100 125.97

$100(1 + I) $100(1 + I)2 $100(1 + I)3

FV = $100(1 + I)3 = $125.97.

Using a financial calculator; enter N = 3, PV = -100, PMT = 0, FV =

125.97, then press the I/YR button to find I/YR = 8%.

Calculators can find interest rates quite easily, even when

periods and/or interest rates are not whole numbers, and when

4 Integrated Case Chapter 5: Time Value of Money

uneven cash flow streams are involved. (With uneven cash flows,

we must use the “CFLO” function, and the interest rate is called the

IRR, or “internal rate of return;” we will use this feature in capital

budgeting.)

D. If a company’s sales are growing at a rate of 20% annually, how

long will it take sales to double?

ANSWER: [Show S5-12 here.] We have this situation in time line format:

0 1 2 3 3.8 4

20%

| | | | | |

-1 2

Say we want to find out how long it will take us to double our money

at an interest rate of 20%. We can use any numbers, say $1 and $2,

with this equation:

FVN = $2 = $1(1 + I)N = $1(1.20)N.

We would plug I/YR = FV

20, PV = -1, PMT = 0,

2

and FV = 2 into our

calculator, and then

press the N button to

find the number of 1

years it would take 1

3.8

(or any other beginning

amount) to double

when growth occurs 0 1 2 3 4

Year

at a 20% rate. The answer is 3.8 years, but some calculators will

round this value up to the next highest whole number. The graph

also shows what is happening.

Chapter 5: Time Value of Money Integrated Case 5

Optional Question

A farmer can spend $60/acre to plant pine trees on some marginal land. The

expected real rate of return is 4%, and the expected inflation rate is 6%. What

is the expected value of the timber after 20 years?

ANSWER: FV20 = $60(1 + 0.04 + 0.06)20 = $60(1.10)20 = $403.65 per acre.

We could have asked: How long would it take $60 to grow to

$403.65, given the real rate of return of 4% and an inflation rate of

6%? Of course, the answer would be 20 years.

E. What’s the difference between an ordinary annuity and an annuity

due? What type of annuity is shown here? How would you change it

to the other type of annuity?

0 1 2 3

| | | |

0 100 100 100

ANSWER: [Show S5-13 here.] This is an ordinary annuity—it has its payments

at the end of each period; that is, the first payment is made 1 period

from today. Conversely, an annuity due has its first payment today.

In other words, an ordinary annuity has end-of-period payments,

while an annuity due has beginning-of-period payments.

The annuity shown above is an ordinary annuity. To convert it

to an annuity due, shift each payment to the left, so you end up with

a payment under the 0 but none under the 3.

F. (1) What is the future value of a 3-year, $100 ordinary annuity if the

annual interest rate is 10%?

6 Integrated Case Chapter 5: Time Value of Money

ANSWER: [Show S5-14 here.]

0 1 2 3

10%

| | | |

100 100 100

110

121

$331

Go through the following discussion. One approach would be to

treat each annuity flow as a lump sum. Here we have

FVAN = $100(1) + $100(1.10) + $100(1.10)2

= $100[1 + (1.10) + (1.10)2] = $100(3.3100) = $331.00.

Future values of annuities may be calculated in 3 ways: (1) Treat the

payments as lump sums. (2) Use a financial calculator. (3) Use a

spreadsheet.

F. (2) What is its present value?

ANSWER: [Show S5-15 here.]

0 1 2 3

10%

| | | |

100 100 100

90.91

82.64

75.13

248.68

The present value of the annuity is $248.68. Here we used the lump

sum approach, but the same result could be obtained by using a

calculator. Input N = 3, I/YR = 10, PMT = 100, FV = 0, and press

the PV button.

Chapter 5: Time Value of Money Integrated Case 7

F. (3) What would the future and present values be if it was an annuity

due?

ANSWER: [Show S5-16 and S5-17 here.] If the annuity were an annuity due,

each payment would be shifted to the left, so each payment is

compounded over an additional period or discounted back over one

less period.

In our situation, the future value of the annuity due is $364.10:

FVA3 Due = $331.00(1.10)1 = $364.10.

This same result could be obtained by using the time line:

$133.10 + $121.00 + $110.00 = $364.10.

The best way to work annuity due problems is to switch your

calculator to “beg” or beginning or “due” mode, and go through the

normal process. Note that it’s critical to remember to change back to

“end” mode after working an annuity due problem with your

calculator.

In our situation, the present value of the annuity due is

$273.55:

PVA3 Due = $248.68(1.10)1 = $273.55.

This same result could be obtained by using the time line:

$100 + $90.91 + $82.64 = $273.55.

G. A 5-year $100 ordinary annuity has an annual interest rate of 10%.

(1) What is its present value?

8 Integrated Case Chapter 5: Time Value of Money

ANSWER: [Show S5-18 here.]

0 1 2 3 4 5

10%

| | | | | |

100 100 100 100 100

90.91

82.64

75.13

68.30

62.09

379.08

The present value of the annuity is $379.08. Here we used the lump

sum approach, but the same result could be obtained by using a

calculator. Input N = 5, I/YR = 10, PMT = 100, FV = 0, and press

the PV button.

G. (2) What would the present value be if it was a 10-year annuity?

ANSWER: [Show S5-19 here.] The present value of the 10-year annuity is

$614.46. To solve with a financial calculator, input N = 10, I/YR =

10, PMT = 100, FV = 0, and press the PV button.

G. (3) What would the present value be if it was a 25-year annuity?

ANSWER: The present value of the 25-year annuity is $907.70. To solve with a

financial calculator, input N = 25, I/YR = 10, PMT = 100, FV = 0,

and press the PV button.

G. (4) What would the present value be if this was a perpetuity?

ANSWER: The present value of the $100 perpetuity is $1,000. The PV is solved

by dividing the annual payment by the interest rate: $100/0.10 =

$1,000.

Chapter 5: Time Value of Money Integrated Case 9

H. A 20-year-old student wants to save $3 a day for her retirement.

Every day she places $3 in a drawer. At the end of each year, she

invests the accumulated savings ($1,095) in a brokerage account

with an expected annual return of 12%.

(1) If she keeps saving in this manner, how much will she have

accumulated at age 65?

ANSWER: [Show S5-20 and S5-21 here.] If she begins saving today, and sticks

to her plan, she will have saved $1,487,261.89 by the time she

reaches 65. With a financial calculator, enter the following inputs: N

= 45, I/YR = 12, PV = 0, PMT = -1095, then press the FV button to

solve for $1,487,261.89.

H. (2) If a 40-year-old investor began saving in this manner, how much

would he have at age 65?

ANSWER: [Show S5-22 here.] This question demonstrates the power of

compound interest and the importance of getting started on a regular

savings program at an early age. The 40-year old investor will have

saved only $146,000.59 by the time he reaches 65. With a financial

calculator, enter the following inputs: N = 25, I/YR = 12, PV = 0, PMT

= -1095, then press the FV button to solve for $146,000.59.

H. (3) How much would the 40-year-old investor have to save each year to

accumulate the same amount at 65 as the 20-year-old investor?

ANSWER: [Show S5-23 here.] Again, this question demonstrates the power of

compound interest and the importance of getting started on a

regular savings program at an early age. The 40-year old investor

will have to save $11,154.42 every year, or $30.56 per day, in order

10 Integrated Case Chapter 5: Time Value of Money

to have as much saved as the 20-year old investor by the time he

reaches 65. With a financial calculator, enter the following inputs: N

= 25, I/YR = 12, PV = 0, FV = 1487261.89, then press the PMT

button to solve for $11,154.42.

I. What is the present value of the following uneven cash flow stream?

The annual interest rate is 10%.

0 1 2 3 4 Years

| | | | |

0 100 300 300 -50

ANSWER: [Show S5-24 and S5-25 here.] Here we have an uneven cash flow

stream. The most straightforward approach is to find the PVs of each

cash flow and then sum them as shown below:

0 1 2 3 4 Years

10%

| | | | |

0 100 300 300 -50

90.91

247.93

225.39

(34.15)

530.08

Note that the $50 Year 4 outflow remains an outflow even when

discounted. There are numerous ways of finding the present value

of an uneven cash flow stream. But by far the easiest way to deal

with uneven cash flow streams is with a financial calculator.

Calculators have a function that on the HP-17B is called “CFLO,” for

“cash flow.” Other calculators could use other designations such as

CF0 and CFj, but they explain how to use them in the manual.

Anyway, you would input the cash flows, so they are in the

Chapter 5: Time Value of Money Integrated Case 11

calculator’s memory, then input the interest rate, I/YR, and then

press the NPV or PV button to find the present value.

J. (1) Will the future value be larger or smaller if we compound an initial

amount more often than annually (e.g., semiannually, holding the

stated (nominal) rate constant)? Why?

ANSWER: [Show S5-26 here.] Accounts that pay interest more frequently than

once a year, for example, semiannually, quarterly, or daily, have

future values that are higher because interest is earned on interest

more often. Virtually all banks now pay interest daily on passbook

and money fund accounts, so they use daily compounding.

J. (2) Define (a) the stated (or quoted or nominal) rate, (b) the periodic

rate, and (c) the effective annual rate (EAR or EFF%).

ANSWER: [Show S5-27 and S5-28 here.] The quoted, or nominal, rate is

merely the quoted percentage rate of return, the periodic rate is the

rate charged by a lender or paid by a borrower each period (periodic

rate = INOM/M), and the effective annual rate (EAR) is the rate of

interest that would provide an identical future dollar value under

annual compounding.

J. (3) What is the EAR corresponding to a nominal rate of 10% compounded

semiannually? Compounded quarterly? Compounded daily?

ANSWER: [Show S5-29 through S5-31 here.] The effective annual rate for

10% semiannual compounding, is 10.25%:

M

1 + I NOM

EAR = Effective annual rate =

– 1.0.

M

12 Integrated Case Chapter 5: Time Value of Money

If INOM = 10% and interest is compounded semiannually, then:

2

0.10

EAR = 1 + – 1.0 = (1.05)2 – 1.0

2

= 1.1025 – 1.0 = 0.1025 = 10.25%.

For quarterly compounding, the effective annual rate is 10.38%:

(1.025)4 – 1.0 = 1.1038 – 1.0 = 0.1038 = 10.38%.

Daily compounding would produce an effective annual rate of

10.52%.

J. (4) What is the future value of $100 after 3 years under 10%

semiannual compounding? Quarterly compounding?

ANSWER: [Show S5-32 here.] Under semiannual compounding, the $100 is

compounded over 6 semiannual periods at a 5.0% periodic rate:

INOM = 10%.

MN 2 (3 )

I 0.10

FVN = 1 + NOM = $100 1 +

M 2

= $100(1.05)6 = $134.01.

Quarterly: FVN = $100(1.025)12 = $134.49.

The return when using quarterly compounding is clearly higher.

Another approach here would be to use the effective annual rate

and compound over annual periods:

Semiannually: $100(1.1025)3 = $134.01.

Quarterly: $100(1.1038)3 = $134.49.

Chapter 5: Time Value of Money Integrated Case 13

K. When will the EAR equal the nominal (quoted) rate?

ANSWER: [Show S5-33 here.] If annual compounding is used, then the

nominal rate will be equal to the effective annual rate. If more

frequent compounding is used, the effective annual rate will be

above the nominal rate.

L. (1) What is the value at the end of Year 3 of the following cash flow

stream if interest is 10%, compounded semiannually? (Hint: You

can use the EAR and treat the cash flows as an ordinary annuity or

use the periodic rate and compound the cash flows individually.)

0 2 4 6 Periods

| | | | | | |

0 100 100 100

ANSWER: [Show S5-34 through S5-36 here.]

0 2 4 6 Periods

| 5% | | | | | |

100 100 100.00

110.25 = $100(1.05)2

121.55 = $100(1.05)4

$331.80

Here we have a different situation. The payments occur annually,

but compounding occurs each 6 months. Thus, we cannot use

normal annuity valuation techniques.

14 Integrated Case Chapter 5: Time Value of Money

L. (2) What is the PV?

ANSWER: [Show S5-37 here.]

0 2 4 6 Periods

5%

| | | | | | |

100 100 100

$ 90.70

82.27 PV = 100(1.05)-4

74.62

$247.59

To use a financial calculator, input N = 3, I/YR = 10.25, PMT = 100,

FV = 0, and then press the PV key to find PV = $247.59.

L. (3) What would be wrong with your answer to Parts L(1) and L(2) if you

used the nominal rate, 10%, rather than the EAR or the periodic

rate, INOM/2 = 10%/2 = 5% to solve the problems?

ANSWER: INOM can be used in the calculations only when annual compounding

occurs. If the nominal rate of 10% were used to discount the

payment stream, the present value would be overstated by $272.32

– $247.59 = $24.73.

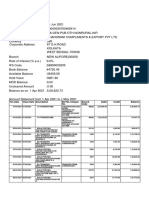

M. (1) Construct an amortization schedule for a $1,000, 10% annual

interest loan with 3 equal installments.

(2) What is the annual interest expense for the borrower and the annual

interest income for the lender during Year 2?

ANSWER: [Show S5-38 through S5-44 here.] To begin, note that the face

amount of the loan, $1,000, is the present value of a 3-year annuity

at a 10% rate:

Chapter 5: Time Value of Money Integrated Case 15

0 1 2 3

10%

| | | |

-1,000 PMT PMT PMT

1 2 3

1 1 1

PVA3 = PMT + PMT + PMT

1+I 1+I 1+I

$1,000 = PMT(1 + I)-1 + PMT(1 + I)-2 + PMT(1 + I)-3.

We have an equation with only one unknown, so we can solve it to

find PMT. The easy way is with a financial calculator. Input N = 3,

I/YR = 10, PV = -1000, FV = 0, and then press the PMT button to get

PMT = 402.1148036, rounded to $402.11.

Amortization Schedule:

Beginning Payment of Ending

Period Balance Payment Interest Principal Balance

1 $1,000.00 $402.11 $100.00 $302.11 $697.89

2 697.89 402.11 69.79 332.32 365.57

3 365.57 402.13* 36.56 365.57 0.00

*Due to rounding, the third payment was increased by $0.02 to cause the ending

balance after the third year to equal $0.

Now make the following points regarding the amortization

schedule:

The $402.11 annual payment includes both interest and principal.

Interest in the first year is calculated as follows:

1st year interest = I Beginning balance = 0.1 $1,000 = $100.

The repayment of principal is the difference between the $402.11

annual payment and the interest payment:

1st year principal repayment = $402.11 – $100 = $302.11.

16 Integrated Case Chapter 5: Time Value of Money

The loan balance at the end of the first year is:

1st year ending balance = Beginning balance – Principal repayment

= $1,000 – $302.11 = $697.89.

We would continue these steps in the following years.

Notice that the interest each year declines because the beginning

loan balance is declining. Since the payment is constant, but the

interest component is declining, the principal repayment portion

is increasing each year.

The interest component is an expense that is deductible to a

business or a homeowner, and it is taxable income to the lender.

If you buy a house, you will get a schedule constructed like ours,

but longer, with 30 12 = 360 monthly payments if you get a 30-

year, fixed-rate mortgage.

The payment may have to be increased by a few cents in the final

year to take care of rounding errors and make the final payment

produce a zero ending balance.

The lender received a 10% rate of interest on the average

amount of money that was invested each year, and the $1,000

loan was paid off. This is what amortization schedules are

designed to do.

Most financial calculators have amortization functions built in.

Chapter 5: Time Value of Money Integrated Case 17

You might also like

- FM Case - First National BankDocument32 pagesFM Case - First National BankBilal Shakil Qureshi100% (3)

- Morton Handley & CompanyDocument4 pagesMorton Handley & Companybusinessdoctor23No ratings yet

- Lecture 9 - Allied Components Case SolutionDocument4 pagesLecture 9 - Allied Components Case SolutionMs ShoaibNo ratings yet

- Time Value of Money Solutions PDFDocument12 pagesTime Value of Money Solutions PDFIoana DragneNo ratings yet

- Western Money Management IncDocument8 pagesWestern Money Management IncNavid Al Galib50% (2)

- Western Money Management Inc PDFDocument12 pagesWestern Money Management Inc PDFMariaAngelicaMargenApe100% (1)

- Quantitative Demand Analysis Answers To Questions and ProblemsDocument16 pagesQuantitative Demand Analysis Answers To Questions and Problemsmajid asadullah100% (1)

- A Case Study of D'Leon IncDocument13 pagesA Case Study of D'Leon IncTimNo ratings yet

- Financial Markets Week 2 3Document9 pagesFinancial Markets Week 2 3Jericho DupayaNo ratings yet

- Relevant Costing Problem SolutionsDocument12 pagesRelevant Costing Problem Solutionssindhuja21100% (1)

- Managerial EconomicsDocument10 pagesManagerial EconomicsFarhan HaseebNo ratings yet

- First National Bank - Case AnalysisDocument7 pagesFirst National Bank - Case AnalysisJoshua Miller100% (1)

- Bond ValuationDocument24 pagesBond ValuationFadhlanMuhtadiNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsDocument22 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsGhina ShaikhNo ratings yet

- Assignment Module 1Document4 pagesAssignment Module 1Geo NacionNo ratings yet

- E Time Value of Money AutosavedDocument56 pagesE Time Value of Money AutosavedChariz AudreyNo ratings yet

- End Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument4 pagesEnd Beginning of Year of Year: Liquidity of Short-Term Assets Related Debt-Paying Abilityawaischeema100% (1)

- HRM Case Study - Red - LobsterDocument1 pageHRM Case Study - Red - Lobsteramitbharadwaj70% (1)

- COBECON Practice Exercise 4 - #S 1, 2, 3, 13Document3 pagesCOBECON Practice Exercise 4 - #S 1, 2, 3, 13Van TisbeNo ratings yet

- Citrus Products Inc - Case Analysis - Final ExamDocument17 pagesCitrus Products Inc - Case Analysis - Final ExamAhmed BeramNo ratings yet

- Working Capital Management - BrighamDocument34 pagesWorking Capital Management - BrighamAldrin ZolinaNo ratings yet

- Financial Planning and ForecastingDocument3 pagesFinancial Planning and ForecastingPrima FacieNo ratings yet

- 1.3.2.1 Elaborate Problem Solving AssignmentDocument17 pages1.3.2.1 Elaborate Problem Solving AssignmentYess poooNo ratings yet

- Analysis and Interpretation of Financial Statements: What's NewDocument16 pagesAnalysis and Interpretation of Financial Statements: What's NewJanna Gunio50% (2)

- 0 1Document4 pages0 1Sayantan HalderNo ratings yet

- Chapter 12 SolutionsDocument92 pagesChapter 12 SolutionsCrystal Brown100% (1)

- EXERCISE ON ADJUSTING ENTRIES - Corrected VersionDocument2 pagesEXERCISE ON ADJUSTING ENTRIES - Corrected VersionRoy BonitezNo ratings yet

- Chap 6 Notes AFMDocument30 pagesChap 6 Notes AFMAngel RubiosNo ratings yet

- Tugas Manajemen Keuangan II (P13-9, P13-12, P13-17)Document7 pagesTugas Manajemen Keuangan II (P13-9, P13-12, P13-17)L RakkimanNo ratings yet

- Cost of Redeemable Preference SharesDocument3 pagesCost of Redeemable Preference SharesChithra NairNo ratings yet

- Dake Corporation's manufacturing costs analysisDocument9 pagesDake Corporation's manufacturing costs analysisWarda Tariq0% (1)

- Strategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Document6 pagesStrategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Zahid UsmanNo ratings yet

- Introduction To Budgets and Preparing The Master Budget Coverage of Learning ObjectivesDocument44 pagesIntroduction To Budgets and Preparing The Master Budget Coverage of Learning Objectivesahmed100% (1)

- Bond After-Tax Yield CalculatorDocument7 pagesBond After-Tax Yield CalculatorJohnNo ratings yet

- Wet 'n Wild's Season Pass Pricing StrategyDocument13 pagesWet 'n Wild's Season Pass Pricing StrategyGildas MemevegniNo ratings yet

- Chapter 05: Operating and Financial Leverage Break-Even AnalysisDocument54 pagesChapter 05: Operating and Financial Leverage Break-Even AnalysisPrince Alexis GarciaNo ratings yet

- Managerial Economics Lecture NotesDocument45 pagesManagerial Economics Lecture Notessherryl cao100% (1)

- 310 CH 10Document46 pages310 CH 10Cherie YanNo ratings yet

- Taguchi Loss Functions and Reliability CalculationsDocument4 pagesTaguchi Loss Functions and Reliability Calculationsgeyb away100% (2)

- Accounting For Merchandising Operations Chapter 6 Test Questions PDFDocument31 pagesAccounting For Merchandising Operations Chapter 6 Test Questions PDFDe Torres JobelNo ratings yet

- Lecture 6 - Coleman Case SolutionDocument3 pagesLecture 6 - Coleman Case SolutionMs ShoaibNo ratings yet

- 3rd Sem Finance True and False PDFDocument14 pages3rd Sem Finance True and False PDFMausam GhimireNo ratings yet

- Managerial Accounting FoundationsDocument49 pagesManagerial Accounting FoundationsSyed Atiq TurabiNo ratings yet

- Walmart Mexico's Renewable Energy InvestmentsDocument4 pagesWalmart Mexico's Renewable Energy InvestmentsLizcel CastillaNo ratings yet

- Cash Flow StatementsDocument15 pagesCash Flow StatementsMaryjoy CuyosNo ratings yet

- Chapter-10: Valuation & Rates of ReturnDocument22 pagesChapter-10: Valuation & Rates of ReturnTajrian RahmanNo ratings yet

- PhamAnh Assignment 4Document4 pagesPhamAnh Assignment 4Phạm Ngọc Anh0% (1)

- Case 17 Risk and ReturnDocument6 pagesCase 17 Risk and Returnnicole33% (3)

- Comparative Financial Ratios For Airline Industry in The PhilippinesDocument11 pagesComparative Financial Ratios For Airline Industry in The PhilippinesMarlene Regalado100% (1)

- EBIT-EPS Analysis Maximizes Shareholder ValueDocument27 pagesEBIT-EPS Analysis Maximizes Shareholder ValueKaran MorbiaNo ratings yet

- FM AssignmentDocument12 pagesFM AssignmentNurul Ariffah100% (1)

- CH 5-Time Value of Money-Gitman - pmf13 - ppt05 GeDocument94 pagesCH 5-Time Value of Money-Gitman - pmf13 - ppt05 Gekim taehyung100% (1)

- Chapter 11 PDFDocument66 pagesChapter 11 PDFSyed Atiq TurabiNo ratings yet

- BeechyChap21 PDFDocument51 pagesBeechyChap21 PDFkeo phommaNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument52 pagesCash Flow Estimation and Risk AnalysisHeather Cabahug100% (1)

- Ch.4 - 13ed TVMMasterDocument111 pagesCh.4 - 13ed TVMMastermarlon ventulanNo ratings yet

- Time Value of Money: Future Value Present Value Annuities Rates of Return AmortizationDocument55 pagesTime Value of Money: Future Value Present Value Annuities Rates of Return Amortizationfaheem qureshiNo ratings yet

- Report Group C (M02)Document19 pagesReport Group C (M02)Huynh Anh Thu B1901863No ratings yet

- 1.3 Time Value of MoneyDocument27 pages1.3 Time Value of Moneyafiman1725No ratings yet

- Lecture 2 Time Value of MoneyDocument52 pagesLecture 2 Time Value of MoneyMuhammad YahyaNo ratings yet

- The Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Document37 pagesThe Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Uday TomarNo ratings yet

- ICICI v/s HDFC Bank Services ComparisonDocument8 pagesICICI v/s HDFC Bank Services ComparisonShubham DesaiNo ratings yet

- Effect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)Document24 pagesEffect of Electronic Banking On The Economic Growth of Nigeria (2009-2018)The IjbmtNo ratings yet

- Transaction Status-1Document7 pagesTransaction Status-1parmanNo ratings yet

- IBC - CuentadeCheques-Confiscado - Juez LuisArmandoJerezanoTreviñoDocument6 pagesIBC - CuentadeCheques-Confiscado - Juez LuisArmandoJerezanoTreviñoLa Otra OpiniónNo ratings yet

- Report on MERCHANT BANKINGDocument6 pagesReport on MERCHANT BANKINGNirbhay AroraNo ratings yet

- Muhammad Asif Siddiqui: Cell #: 0333-7931205Document4 pagesMuhammad Asif Siddiqui: Cell #: 0333-7931205Akram KhanNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceRaju RoyNo ratings yet

- TVM 2021Document58 pagesTVM 2021mahendra pratap singhNo ratings yet

- Customer No.: 23959343 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument4 pagesCustomer No.: 23959343 IFSC Code: DBSS0IN0811 MICR Code: Branch Addressmamatha vemulaNo ratings yet

- IFM 2017 Final Exam-Solution-SampleDocument12 pagesIFM 2017 Final Exam-Solution-SampleApiwat Benji PradmuangNo ratings yet

- Bitcoin Explained Free Presentation (Cute!)Document48 pagesBitcoin Explained Free Presentation (Cute!)David L100% (1)

- Merchant BankingDocument27 pagesMerchant Bankingapi-3865133100% (13)

- Fraud Prevention and Risk: Protecting Your Procurement Card ProgramDocument31 pagesFraud Prevention and Risk: Protecting Your Procurement Card Programkrishnamohan111No ratings yet

- Jasleen Kaur Report NewDocument85 pagesJasleen Kaur Report NewDaman Deep Singh ArnejaNo ratings yet

- Bank ManagementDocument198 pagesBank ManagementSooraj Kallooppara0% (1)

- BSP Circular No. 925-16Document77 pagesBSP Circular No. 925-16Helena HerreraNo ratings yet

- Top Largest Central Bank Rankings by Total AssetsDocument24 pagesTop Largest Central Bank Rankings by Total AssetsMayank AhujaNo ratings yet

- Your Combined StatementDocument10 pagesYour Combined StatementN N100% (1)

- The Impact of Covid in The Banking SectorDocument18 pagesThe Impact of Covid in The Banking SectorAbenezer BirhanuNo ratings yet

- Julio Cesar Inquillay Quispe: Bill To FORDocument5 pagesJulio Cesar Inquillay Quispe: Bill To FORJULIO INQUILLAYNo ratings yet

- MITC Registration Form V10Document2 pagesMITC Registration Form V10mcompendioNo ratings yet

- Ilusorio VS CaDocument2 pagesIlusorio VS CaaxvxxnNo ratings yet

- Covered Bonds: Background and Policy Issues: Edward V. MurphyDocument16 pagesCovered Bonds: Background and Policy Issues: Edward V. MurphyAmanda StricklandNo ratings yet

- PDICDocument16 pagesPDICBrian Jonathan ParaanNo ratings yet

- Future Value InggrisDocument2 pagesFuture Value InggrisDian AgustinaNo ratings yet

- Project ReportDocument74 pagesProject ReportSachin SinghNo ratings yet

- UPI in IndiaDocument47 pagesUPI in Indiaasde100% (2)

- Legal Notice 8441363 1-7b8ae25223f76cd0Document2 pagesLegal Notice 8441363 1-7b8ae25223f76cd0Yash SharmaNo ratings yet

- Map of Microfinance DistributionDocument42 pagesMap of Microfinance Distributionsidharth13041993No ratings yet