Professional Documents

Culture Documents

CIR Vs Hantex Digest

CIR Vs Hantex Digest

Uploaded by

Jason Buena0 ratings0% found this document useful (0 votes)

8 views2 pagesCom vs Hantex

Original Title

151325313-CIR-vs-Hantex-Digest

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCom vs Hantex

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesCIR Vs Hantex Digest

CIR Vs Hantex Digest

Uploaded by

Jason BuenaCom vs Hantex

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

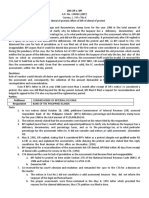

COMMISSION OF INTERNAL REVENUE vs. HANTEX TRADING CO.

, INC

G.R. No. 136975. March 31, 2005

Facts:

Hantex Trading Co is a company organized under the Philippines. It is engaged in the

sale of plastic products, it imports synthetic resin and other chemicals for the

manufacture of its products. For this purpose, it is required to file an Import Entry and

Internal Revenue Declaration (Consumption Entry) with the Bureau of Customs under

Section 1301 of the Tariff and Customs Code. Sometime in October 1989, Lt. Vicente

Amoto, Acting Chief of Counter-Intelligence Division of the Economic Intelligence and

Investigation Bureau (EIIB), received confidential information that the respondent had

imported synthetic resin amounting to P115,599,018.00 but only declared

P45,538,694.57. Thus, Hantex receive a subpoena to present its books of account

which it failed to do. The bureau cannot find any original copies of the products

Hantex imported since the originals were eaten by termites. Thus, the Bureau relied

on the certified copies of the respondent’s Profit and Loss Statement for 1987 and

1988 on file with the SEC, the machine copies of the Consumption Entries, Series of

1987, submitted by the informer, as well as excerpts from the entries certified by

Tomas and Danganan. The case was submitted to the CTA which ruled that Hantex

have tax deficiency and is ordered to pay, per investigation of the Bureau. The CA

ruled that the income and sales tax deficiency assessments issued by the petitioner

were unlawful and baseless since the copies of the import entries relied upon in

computing the deficiency tax of the respondent were not duly authenticated by the

public officer charged with their custody, nor verified under oath by the EIIB and the

BIR investigators.

Issue:

Whether or not the final assessment of the petitioner against the respondent for

deficiency income tax and sales tax for the latter’s 1987 importation of resins and

calcium bicarbonate is based on competent evidence and the law.

Held:

Section 16 of the NIRC of 1977, as amended, provides that the Commissioner of

Internal Revenue has the power to make assessments and prescribe additional

requirements for tax administration and enforcement. Among such powers are those

provided in paragraph (b), which provides that “Failure to submit required returns,

statements, reports and other documents. – When a report required by law as a basis

for the assessment of any national internal revenue tax shall not be forthcoming

within the time fixed by law or regulation or when there is reason to believe that any

such report is false, incomplete or erroneous, the Commissioner shall assess the

proper tax on the best evidence obtainable.” This provision applies when the

Commissioner of Internal Revenue undertakes to perform her administrative duty of

assessing the proper tax against a taxpayer, to make a return in case of a taxpayer’s

failure to file one, or to amend a return already filed in the BIR. The “best evidence”

envisaged in Section 16 of the 1977 NIRC, as amended, includes the corporate and

accounting records of the taxpayer who is the subject of the assessment process, the

accounting records of other taxpayers engaged in the same line of business,

including their gross profit and net profit sales. Such evidence also includes data,

record, paper, document or any evidence gathered by internal revenue officers from

other taxpayers who had personal transactions or from whom the subject taxpayer

received any income; and record, data, document and information secured from

government offices or agencies, such as the SEC, the Central Bank of the Philippines,

the Bureau of Customs, and the Tariff and Customs Commission. However, the best

evidence obtainable under Section 16 of the 1977 NIRC, as amended, does not

include mere photocopies of records/documents. The petitioner, in making a

preliminary and final tax deficiency assessment against a taxpayer, cannot anchor

the said assessment on mere machine copies of records/documents. Mere

photocopies of the Consumption Entries have no probative weight if offered as proof

of the contents thereof. The reason for this is that such copies are mere scraps of

paper and are of no probative value as basis for any deficiency income or business

taxes against a taxpayer.

You might also like

- CH 11Document55 pagesCH 11Bhavin purohitNo ratings yet

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- CIR v. Isabela Cultural Corp.Document4 pagesCIR v. Isabela Cultural Corp.kathrynmaydevezaNo ratings yet

- CIR vs. Ayala Securities Corp., GR No. L-29485Document1 pageCIR vs. Ayala Securities Corp., GR No. L-29485Alyza Montilla BurdeosNo ratings yet

- Case DigestDocument6 pagesCase DigestGabriel Jhick SaliwanNo ratings yet

- CIR Vs Cebu Toyo CorpDocument3 pagesCIR Vs Cebu Toyo Corplance100% (2)

- CIR Vs Fisher Case DigestDocument1 pageCIR Vs Fisher Case Digestjodelle11No ratings yet

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (5)

- Domingo vs. Garlitos Case DigestDocument1 pageDomingo vs. Garlitos Case DigestAdhara CelerianNo ratings yet

- (Sapp) Slide f3 AccaDocument212 pages(Sapp) Slide f3 AccaHàn HươngNo ratings yet

- Admin Assistant III IPCRFDocument4 pagesAdmin Assistant III IPCRFRhon T. Bergado100% (5)

- Sport NZ Template Financial Policies and Procedures: Section 5: Operating Expenditure & Payables Policy 1: PayrollDocument3 pagesSport NZ Template Financial Policies and Procedures: Section 5: Operating Expenditure & Payables Policy 1: PayrollShinil NambrathNo ratings yet

- Performance and Potential Management Final - SCDLDocument858 pagesPerformance and Potential Management Final - SCDLsinduchari50% (2)

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- CIR v. Hantex Trading (Digest)Document4 pagesCIR v. Hantex Trading (Digest)Tini GuanioNo ratings yet

- CIR V BurmeisterDocument1 pageCIR V BurmeisterMark Wong delos ReyesNo ratings yet

- Case 4 CIR Vs Fortune TobaccoDocument1 pageCase 4 CIR Vs Fortune TobaccolenvfNo ratings yet

- 26 Contex Vs CIRDocument2 pages26 Contex Vs CIRIvan Romeo100% (1)

- CIR vs. Magsaysay Lines Inc DigestDocument2 pagesCIR vs. Magsaysay Lines Inc Digestmisscyu100% (1)

- CIR v. Fitness by DesignDocument4 pagesCIR v. Fitness by DesignJesi CarlosNo ratings yet

- Fernandez vs. FernandezDocument1 pageFernandez vs. FernandezKitchie San PedroNo ratings yet

- Silkair v. CIR - Case DigestDocument1 pageSilkair v. CIR - Case DigestRobehgene Atud-JavinarNo ratings yet

- Bonifacia Sy Po Vs CTADocument2 pagesBonifacia Sy Po Vs CTACarl Montemayor50% (2)

- BIR vs. CA, Spouses ManlyDocument1 pageBIR vs. CA, Spouses ManlyMich PadayaoNo ratings yet

- CIR v. Pascor Realty and Development DigestDocument1 pageCIR v. Pascor Realty and Development DigestKristineSherikaChy100% (1)

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- Cir vs. Toshiba Information Equipment (Phils.), Inc.Document2 pagesCir vs. Toshiba Information Equipment (Phils.), Inc.brendamanganaan100% (2)

- CIR vs. Burmeister 153205Document1 pageCIR vs. Burmeister 153205magenNo ratings yet

- 1smied Vs CirDocument2 pages1smied Vs CirBam BathanNo ratings yet

- San Roque Power Corporation Vs CirDocument2 pagesSan Roque Power Corporation Vs Cirleslansangan100% (3)

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- Smart Communications vs. Municipality of MalvarDocument3 pagesSmart Communications vs. Municipality of MalvarClark Edward Runes Uytico0% (1)

- Bpi V Cir DigestDocument3 pagesBpi V Cir DigestkathrynmaydevezaNo ratings yet

- Tax 2 Digest (0406) GR 108576 012099 Cir Vs CaDocument3 pagesTax 2 Digest (0406) GR 108576 012099 Cir Vs CaAudrey Deguzman100% (1)

- Iloilo Bottlers V City of IloiloDocument2 pagesIloilo Bottlers V City of IloiloJaz Sumalinog100% (2)

- CIR Vs Aurelio Reyes, G.R. No. L-8685, January 31, 1957Document1 pageCIR Vs Aurelio Reyes, G.R. No. L-8685, January 31, 1957Alan GultiaNo ratings yet

- Systra Philippines vs. Cir G.R. No. 176290 September 21, 2007Document2 pagesSystra Philippines vs. Cir G.R. No. 176290 September 21, 2007Armstrong BosantogNo ratings yet

- Cir Vs Bank of Commerce DigestDocument1 pageCir Vs Bank of Commerce DigestMimmi ShaneNo ratings yet

- Collector Vs BenipayoDocument2 pagesCollector Vs BenipayoArnold JoseNo ratings yet

- 22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestDocument2 pages22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestHarleneNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- CIR Vs Cebu Toyo CorporationDocument2 pagesCIR Vs Cebu Toyo Corporationjancelmido1100% (2)

- Batch 2 - Digested Cases in TaxationDocument20 pagesBatch 2 - Digested Cases in Taxationnikkolad100% (2)

- RCBC Vs CIR, GR No. 168498, April 24, 2007Document1 pageRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonNo ratings yet

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Document1 pageCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoNo ratings yet

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- CIR vs. Filinvest Development Corp.Document2 pagesCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- CIR Vs Japan AirlinesDocument1 pageCIR Vs Japan AirlinesJR BillonesNo ratings yet

- 25.d Vda. de San Agustin vs. CIR (G.R. No. 138485 September 10, 2001) - H DigestDocument1 page25.d Vda. de San Agustin vs. CIR (G.R. No. 138485 September 10, 2001) - H DigestHarleneNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- People v. Sandiganbayan DIGESTDocument4 pagesPeople v. Sandiganbayan DIGESTkathrynmaydeveza100% (1)

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- CIR V Fitness by DesignDocument3 pagesCIR V Fitness by Designsmtm06100% (4)

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- GR No. 157594 Toshiba vs. CIRDocument2 pagesGR No. 157594 Toshiba vs. CIRMaryanJunko100% (1)

- Cyanamid Philippines vs. CADocument2 pagesCyanamid Philippines vs. CAj guevarraNo ratings yet

- CIR Vs Acesite - Taxation 2 DigestDocument2 pagesCIR Vs Acesite - Taxation 2 DigestGem S. Alegado33% (3)

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- CIR v. Gotamco Sons - DigestDocument3 pagesCIR v. Gotamco Sons - DigestLizzette Dela PenaNo ratings yet

- Fort Boni V CIRDocument3 pagesFort Boni V CIREduard Doron FloresNo ratings yet

- Cir V Benguet DigestDocument1 pageCir V Benguet DigestAgnes GamboaNo ratings yet

- Cir Vs HantexDocument2 pagesCir Vs HantexMichael C. Payumo100% (1)

- Hantex DigestDocument1 pageHantex DigestmnduqueNo ratings yet

- CIR vs. Hantex Trading, G.R. No. 136975 (2005)Document2 pagesCIR vs. Hantex Trading, G.R. No. 136975 (2005)Mia100% (1)

- Sy Po vs. CTADocument4 pagesSy Po vs. CTAVan John MagallanesNo ratings yet

- Balance Sheet Accounts Assets: Account Code Account TitleDocument17 pagesBalance Sheet Accounts Assets: Account Code Account TitleZiazel ThereseNo ratings yet

- Rana Digest - PropertyDocument6 pagesRana Digest - PropertyZiazel ThereseNo ratings yet

- Victorias Milling Vs Municipality of VictoriasDocument9 pagesVictorias Milling Vs Municipality of VictoriasZiazel Therese100% (1)

- The Court of Last ResortDocument6 pagesThe Court of Last ResortZiazel ThereseNo ratings yet

- Institutions Shall Include The Study of The Constitution As Part of The Curricula."Document7 pagesInstitutions Shall Include The Study of The Constitution As Part of The Curricula."Ziazel ThereseNo ratings yet

- Court of Last ResortDocument20 pagesCourt of Last ResortZiazel ThereseNo ratings yet

- Civpro Case DigestsDocument21 pagesCivpro Case DigestsZiazel ThereseNo ratings yet

- Community-Based Forest ManagementDocument7 pagesCommunity-Based Forest ManagementZiazel ThereseNo ratings yet

- Case Digest - Hyatt Industrial Manufacturing Corp. Vs Ley ConstructionDocument3 pagesCase Digest - Hyatt Industrial Manufacturing Corp. Vs Ley ConstructionZiazel ThereseNo ratings yet

- Rule On Mandatory Legal Aid ServiceDocument6 pagesRule On Mandatory Legal Aid ServiceZiazel ThereseNo ratings yet

- Claim: You Should Use A Hearing AidDocument4 pagesClaim: You Should Use A Hearing AidZiazel ThereseNo ratings yet

- Chapter 13 Auditing and Assurance ServicesDocument26 pagesChapter 13 Auditing and Assurance ServicesEdwin Gunawan100% (2)

- Ejournal of Tax ResearchDocument21 pagesEjournal of Tax ResearchhenfaNo ratings yet

- Shraddha Dharadhar - Cost AuditorDocument16 pagesShraddha Dharadhar - Cost AuditorShraddha DharadharNo ratings yet

- Rmo 27-2010 Reinvigorated Rate ProgramDocument7 pagesRmo 27-2010 Reinvigorated Rate ProgramKris CalabiaNo ratings yet

- Funacc Final HandoutsDocument5 pagesFunacc Final HandoutsTracy AguirreNo ratings yet

- Substantive Procedures For Inventory Held at ThirdDocument4 pagesSubstantive Procedures For Inventory Held at ThirdDila Estu KinasihNo ratings yet

- Doucment List 17025Document6 pagesDoucment List 17025রাসেল আহমেদNo ratings yet

- 1 2 1 - FDD - FTM - General Ledger - V06Document39 pages1 2 1 - FDD - FTM - General Ledger - V06Rahul RaviNo ratings yet

- Chapter 18Document49 pagesChapter 18John TomNo ratings yet

- Assessment ProcedureDocument47 pagesAssessment ProcedureHoor FatimaNo ratings yet

- Budget Execution, Monitoring and Reporting Sec. 1. Scope. This Chapter Prescribes The Guidelines in Monitoring, Accounting, and Reporting ofDocument4 pagesBudget Execution, Monitoring and Reporting Sec. 1. Scope. This Chapter Prescribes The Guidelines in Monitoring, Accounting, and Reporting ofimsana minatozakiNo ratings yet

- Accountability in EducationDocument9 pagesAccountability in Educationsamuel petrosNo ratings yet

- Unit 21: Small Business EnterprisDocument5 pagesUnit 21: Small Business Enterprischandni0810No ratings yet

- Bva 3Document7 pagesBva 3najaneNo ratings yet

- Strategy To Clear CA Inter May 24 - Exit Seminar Final PDFDocument43 pagesStrategy To Clear CA Inter May 24 - Exit Seminar Final PDFyourname51419No ratings yet

- GST Sections DetailsDocument7 pagesGST Sections DetailsAbhishek JainNo ratings yet

- Auditing Theory: CPA ReviewDocument12 pagesAuditing Theory: CPA ReviewThan TanNo ratings yet

- Doug Davidson AnnouncementDocument9 pagesDoug Davidson AnnouncementTony OrtegaNo ratings yet

- F.2. Basic Bank Documents and Terminologies Related To BankDocument28 pagesF.2. Basic Bank Documents and Terminologies Related To BankSecret DeityNo ratings yet

- Standard Operating Procedures For Mess ManagementDocument2 pagesStandard Operating Procedures For Mess Managementshaikhsamsaeed786No ratings yet

- Annex 7 Letter of CommitmentDocument2 pagesAnnex 7 Letter of CommitmentfabbvaseNo ratings yet

- ZOOM SnowbooardsDocument21 pagesZOOM SnowbooardsJane Chung0% (1)

- Feedback - MOCKP1D2Document22 pagesFeedback - MOCKP1D2Raman ANo ratings yet

- Accounting and Organizational StructureDocument6 pagesAccounting and Organizational StructureBediru TarekegnNo ratings yet