Professional Documents

Culture Documents

Your 2020 Social Security Cost of Living Increase 2019

Uploaded by

henryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your 2020 Social Security Cost of Living Increase 2019

Uploaded by

henryCopyright:

Available Formats

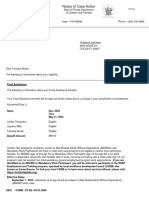

Your 2020 Social Security Cost of Living Adjustment

BNC#: 19B1555C60072

JUAN T GONZALEZ

2665 S BRUCE ST APT 99

LAS VEGAS NV 89169-1749

Your Social Security benefits will increase by 1.6% in 2020 because of a rise in the cost

of living. You can use this letter as proof of your benefit amount if you need to apply for

food, rent, or energy assistance. You can also use it to apply for bank loans or for other

business. Keep this letter with your important financial records.

How Much Will I Get And When?

• Your monthly amount (before deductions) is $445.60

• The amount we deduct for Medicare Medical Insurance is $142.60

(If you did not have Medicare as of November 22, 2019, or if

someone else pays your premium, we show $0.00.)

• The amount we deduct for your Medicare Prescription Drug Plan

is $0.00

(We will notify you if the amount changes in 2020. If you did not

elect withholding as of November 1, 2019, we show $0.00.)

• The amount we deduct for voluntary Federal tax withholding is $0.00

(If you did not elect voluntary tax withholding as of

November 22, 2019, we show $0.00.)

• After we take any other deductions, you will receive $303.00

on or about January 3, 2020.

If you disagree with any of these amounts, you must write to us within 60 days from the

date you receive this letter. Or visit www.ssa.gov/non-medical/appeal to appeal online.

We would be happy to review the amounts.

If you receive a paper check and want to switch to an electronic payment, please visit

the Department of the Treasury's Go Direct website at www.godirect.org online.

What If I Have Questions?

• Visit our website at www.socialsecurity.gov

• Call us toll-free at 1-800-772-1213 (TTY 1-800-325-0778)

• Contact your nearest Social Security office

10416 S EASTERN AVENUE

HENDERSON NV 89052

See Next Page

19B1555C60072 Page 2 of 3

Other Help For Seniors

Call the Eldercare Locator service of the U.S. Administration on Aging at

1-800-677-1116 or visit www.eldercare.acl.gov to learn about a wide variety of services

that may be helpful to you.

What If I Work In 2020?

If you are at full retirement age (now age 66) or older for all of 2020, you may keep all of

your benefits no matter how much you earn.

If you are younger than full retirement age at any time in 2020, there is a limit to how

much you can earn before we reduce your benefits. Continuing to work could result in

withholding some of your benefits. However, we would adjust your benefit amount once

you reach full retirement age to account for the months of withheld benefits. Also, we

use your 35 highest years of earnings to calculate your benefits. If you continue to work

and these earnings are higher than one of the years we used to compute your benefit,

your benefit amount may increase. Tell us right away if you expect to earn more than

the limit, so we can pay you correctly.

• The 2020 earnings limit for people under full retirement age all year is $18,240.

We deduct $1 from your benefits in 2020 for each $2 you earn over $18,240.

• The 2020 earnings limit for people turning full retirement age is $48,600. We

deduct $1 from your benefits in 2020 for each $3 you earn over $48,600 until

the month you reach full retirement age.

What If I Worked In 2019?

If you were under full retirement age in 2019 and worked, we paid your benefits based

on your estimate of how much you would make. We will adjust your benefits as

necessary when your employer reports your earnings on your W-2 form. If the earnings

on your 2019 W-2 form(s) include money you earned in another year, please contact us

before April 15, 2020, to let us know.

• The 2019 earnings limit for people under full retirement age all year was

$17,640.

• The 2019 earnings limit for people who turned full retirement age in 2019 was

$46,920.

To Access my Social Security Online Services

Use your my Social Security online account to check your benefits and make sure

your contact information is up to date. If you have Medicare, it is important that you

keep your address up to date with Social Security. You can change your address or

telephone number, start or change direct deposit of your benefits, get a replacement

Medicare card, and get a benefit verification letter online.

Rules For Certain Family Members

• Tell us if you marry or remarry if you get benefits as a widow, widower, parent,

or child.

• Tell us if a child who gets benefits no longer lives with you.

• Tell us if a stepchild gets benefits from your work, and you and the stepchild’s

parent divorce.

• Tell us if you divorce or your spouse dies if you get benefits as a spouse.

Life Changes May Affect Eligibility For Federal Benefits

It's not unusual for people’s circumstances to change after they apply for or start

receiving benefits. These changes may increase your Federal benefits. For example,

if your spouse or ex-spouse dies, you may qualify for a higher Social Security benefit.

Visit www.ssa.gov/potentialentitlement to find out more. You also can use the Benefit

Form SSA-4926-SM (1-2020)

19B1555C60072 Page 3 of 3

Eligibility Screening Tool at www.ssabest.benefits.gov/ to find out about benefits from

Social Security.

Suspect Social Security Fraud?

If you suspect Social Security fraud, please visit https://oig.ssa.gov/report or call the

Inspector General’s Fraud Hotline at 1-800-269-0271 (TTY 1-866-501-2101).

Help Prevent Identity Theft

Be aware of scams through the mail, Internet, telephone, or in person. You should be

careful when someone asks for personal information, especially your Social Security

number. Please visit www.usa.gov/identity-theft to find out more.

Medicare Information

• Starting January 1, 2020, you should use your new Medicare card to get care.

Old cards with Social Security numbers will no longer be accepted. If you do

not have a new Medicare card, call 1-800-MEDICARE (1-800-633-4227) (TTY

1-877-486-2048).

• To learn about Medicare eligibility or to apply, visit

www.ssa.gov/medicare/mediinfo.html or call Social Security at 1-800-772-1213

(TTY 1-800-325-0778).

• If you do not sign up for Medicare Part B (medical insurance) when you are first

eligible, or if you cancel Part B and then get it later, you may have to pay a late

enrollment penalty for as long as you have Part B.

• For questions about Medicare coverage and billing, visit www.Medicare.gov or

call 1-800-MEDICARE (1-800-633-4227) (TTY 1-877-486-2048).

• The Extra Help program may help pay the costs of a Medicare Prescription

Drug Plan for people with limited income and resources. Costs include

premiums, deductibles, and co-payments. You can apply online at

www.ssa.gov/medicare/prescriptionhelp or call Social Security at

1-800-772-1213 (TTY 1-800-325-0778).

• The Medicare Savings Programs may help pay for Medicare premiums and

other out-of-pocket costs for people with limited income and resources. You

can start the application process when you apply for Extra Help or you can

contact your State or local medical assistance (Medicaid) office.

Need Health Insurance Or Know Someone Who Does?

Visit www.HealthCare.gov or call 1-800-318-2596 (TTY 1-855-889-4325) to learn more.

Social Security Administration

Form SSA-4926-SM (1-2020)

You might also like

- Your 2024 Social Security Cost of Living IncreaseDocument4 pagesYour 2024 Social Security Cost of Living IncreasenazoyaqNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification LetterLawrence GouldNo ratings yet

- Benefit Verification LetterDocument4 pagesBenefit Verification LetterDonna BridgesNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letteroh lampNo ratings yet

- Document2 PDFDocument1 pageDocument2 PDFErma MonieNo ratings yet

- Overview My Home My Social SecurityDocument2 pagesOverview My Home My Social Securitybucks tomNo ratings yet

- Martita Togba - Social - Security - StatementDocument4 pagesMartita Togba - Social - Security - StatementRichlue GeegbaeNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letterwilliams sundayNo ratings yet

- BenefitVerificationLetter PDFDocument2 pagesBenefitVerificationLetter PDFMelissa FisherNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification LetterNinaPintaSantaMaria100% (1)

- BenefitVerificationLetter (1) .ActionDocument4 pagesBenefitVerificationLetter (1) .ActionJoshua CoverstoneNo ratings yet

- CCR 14-15 q4 Paystub ExampleDocument1 pageCCR 14-15 q4 Paystub Exampleapi-232724808No ratings yet

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDocument6 pagesYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNo ratings yet

- Certain Government Payments: 4. Federal Income Tax WithheldDocument2 pagesCertain Government Payments: 4. Federal Income Tax WithheldWhisnu Wardhana0% (1)

- BenefitVerificationLetter July August 2015Document1 pageBenefitVerificationLetter July August 2015Steven SchoferNo ratings yet

- MONETARYDETERMINATIONPANDEMICUNEMPLOYMENTASSISTANCE jASONKROLL-3824202010074018 PDFDocument3 pagesMONETARYDETERMINATIONPANDEMICUNEMPLOYMENTASSISTANCE jASONKROLL-3824202010074018 PDFjuanchy12No ratings yet

- Main Sample Social Security Verification LetterDocument1 pageMain Sample Social Security Verification LetterSucre100% (1)

- Real ID Reminder From The Massachusetts Registry of Motor VehiclesDocument2 pagesReal ID Reminder From The Massachusetts Registry of Motor VehiclesJim KinneyNo ratings yet

- SSA AcronymsDocument14 pagesSSA AcronymsAtul SharmaNo ratings yet

- Lab Req 11Document2 pagesLab Req 11karthick TNo ratings yet

- Main - Sample Ssi Award Letter PDFDocument2 pagesMain - Sample Ssi Award Letter PDFLenora GibsonNo ratings yet

- SS$0benefit Verification LetterDocument2 pagesSS$0benefit Verification LetterTerre ChilicasNo ratings yet

- Membership ApplicationDocument5 pagesMembership ApplicationAbhishek VijayNo ratings yet

- Foodstamp LetterDocument6 pagesFoodstamp LetterTemisha BrownNo ratings yet

- 853 Title Smart Document 02-04-19Document5 pages853 Title Smart Document 02-04-19Kirsten Johnston EllesNo ratings yet

- James Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Document6 pagesJames Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Dani HoneymanNo ratings yet

- Payment Information Summary of Account ActivityDocument3 pagesPayment Information Summary of Account ActivityTyrone J PalmerNo ratings yet

- January 2022 Debit Account Statement for Douglas Jon HarveyDocument1 pageJanuary 2022 Debit Account Statement for Douglas Jon HarveyMark Dewey0% (1)

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Notice of Case Action: Medicaid For Unborn BabiesDocument6 pagesNotice of Case Action: Medicaid For Unborn Babiestb99bwk5cqNo ratings yet

- Benefit-Verification-letter (2) Date September 20 2022Document2 pagesBenefit-Verification-letter (2) Date September 20 2022CYNTHIA CORNATTNo ratings yet

- 2010 08 15 - BillDocument2 pages2010 08 15 - Billteporocho9No ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- BenefitVerificationLetter PDFDocument1 pageBenefitVerificationLetter PDFWilliam WilliamsonNo ratings yet

- Lili Monthly Statement 2022-08 2Document2 pagesLili Monthly Statement 2022-08 2Robert Wilson100% (1)

- Benefit Verification LetterMichaelPunter 1Document4 pagesBenefit Verification LetterMichaelPunter 1DianaCarolinaCastaneda100% (1)

- 0149 Atap SK Brgy. Kaulanguhan, CaibiranDocument4 pages0149 Atap SK Brgy. Kaulanguhan, CaibiranOrne PaulNo ratings yet

- 1 Articles R A Cert of Formation File Stamped 01169448xBF97D PDFDocument6 pages1 Articles R A Cert of Formation File Stamped 01169448xBF97D PDFBeing ArethaNo ratings yet

- Report of Medical History: PhoneDocument3 pagesReport of Medical History: PhoneLeroy Jethro Gibbs NicosiaNo ratings yet

- Seguro SocialDocument2 pagesSeguro SocialTaina ColonNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptAmber CarterNo ratings yet

- 美国metabank账单Document2 pages美国metabank账单juliaechardhqa85No ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letterqjyb546c9p100% (1)

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- OT AC HE CK: Earnings StatementDocument1 pageOT AC HE CK: Earnings StatementAlyson CampbellNo ratings yet

- Frequently Asked Questions On Electronic Clearing ServiceDocument7 pagesFrequently Asked Questions On Electronic Clearing Serviceravi150888No ratings yet

- Briñez VillalobosDocument2 pagesBriñez VillalobosMundo RealNo ratings yet

- Money transfer receipt from US to PhilippinesDocument1 pageMoney transfer receipt from US to PhilippinesAgatha Dominique BacaniNo ratings yet

- Internet Att BillDocument4 pagesInternet Att Billben tenNo ratings yet

- Social Security Benefits LetterDocument2 pagesSocial Security Benefits LetterRocketLawyerNo ratings yet

- Earn StatementDocument1 pageEarn StatementKhu RehNo ratings yet

- ReceiptDocument4 pagesReceipttop gNo ratings yet

- Signed PackageDocument35 pagesSigned PackageRocio OchoaNo ratings yet

- Hotel Voucher: Booking InformationDocument2 pagesHotel Voucher: Booking Informationsenthil dharunNo ratings yet

- Social Security Administration Office LetterDocument1 pageSocial Security Administration Office LetterTom KnobNo ratings yet

- Pine Ridge Apartment Welcome LetterDocument2 pagesPine Ridge Apartment Welcome LetterKamil KowalskiNo ratings yet

- Verizon bill detailsDocument8 pagesVerizon bill detailsnitinNo ratings yet

- On-Site Guide (BS 7671 - 2018) (Electrical Regulations)Document4 pagesOn-Site Guide (BS 7671 - 2018) (Electrical Regulations)Farshid AhmadiNo ratings yet

- Format of Undertaking by A Foreign Nation in Case of Absence of PANDocument1 pageFormat of Undertaking by A Foreign Nation in Case of Absence of PANGaurav Kumar SharmaNo ratings yet

- Erudite Mortgage Banking SpecialistDocument3 pagesErudite Mortgage Banking SpecialistJaniceNo ratings yet

- HITESHDocument5 pagesHITESHhiteshNo ratings yet

- Presentation On "A Comparative Study Between Private Sector Banks and Public Sector Banks With Respect To Cachar District"Document40 pagesPresentation On "A Comparative Study Between Private Sector Banks and Public Sector Banks With Respect To Cachar District"deepanjan1180% (5)

- Legal and Regulatory Aspects of BankingDocument216 pagesLegal and Regulatory Aspects of Bankingeknath2000No ratings yet

- Grade 7 Ems: Financial LiteracyDocument9 pagesGrade 7 Ems: Financial LiteracyStacey Nefdt0% (1)

- Middleeast Chamber SummonsDocument2 pagesMiddleeast Chamber SummonsfedwredNo ratings yet

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- Solutions Manual Managerial Economics 3rd Edition Froeb Mccann Ward Shor PDFDocument6 pagesSolutions Manual Managerial Economics 3rd Edition Froeb Mccann Ward Shor PDFDivine Grace GapasangraNo ratings yet

- Ford's VEP Returns $10B to ShareholdersDocument8 pagesFord's VEP Returns $10B to ShareholdersRatish Mayank100% (3)

- BMA 12e SM CH 29 Final PDFDocument17 pagesBMA 12e SM CH 29 Final PDFNikhil ChadhaNo ratings yet

- Audit Mcqs PDFDocument10 pagesAudit Mcqs PDFMian AttaNo ratings yet

- 1.1 Introduction To The Stock MarketDocument4 pages1.1 Introduction To The Stock MarketYesaswiniNo ratings yet

- LP 8 TaxationDocument2 pagesLP 8 TaxationJames CorpuzNo ratings yet

- Chapter 9 SolutionsDocument80 pagesChapter 9 SolutionsHarsh KhandelwalNo ratings yet

- Life Partner Plus Pay Endowment To Age 75 NewDocument6 pagesLife Partner Plus Pay Endowment To Age 75 NewshamaritesNo ratings yet

- Q4 2019 Alta Fox Capital Quarterly Letter-1 PDFDocument6 pagesQ4 2019 Alta Fox Capital Quarterly Letter-1 PDFGanesh GuhadosNo ratings yet

- BCG Matrix of HDFC BANKDocument2 pagesBCG Matrix of HDFC BANKRamneet Parmar67% (12)

- Topic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsDocument3 pagesTopic 7: Cash Management and Control, Preparation Bank Reconciliations and Maintaining A Petty Cash System Solutions To Tutorial QuestionsMitchell BylartNo ratings yet

- Neosym Industry Limited: Update Summary of Rating ActionDocument8 pagesNeosym Industry Limited: Update Summary of Rating ActionPuneet367No ratings yet

- Saving Associations and Credit Unions: All Rights ReservedDocument46 pagesSaving Associations and Credit Unions: All Rights ReservedIrakli SaliaNo ratings yet

- Integ02 ADocument2 pagesInteg02 ARonald CorunoNo ratings yet

- Group 13 Harsh Electricals COGS Exercise and BEPDocument12 pagesGroup 13 Harsh Electricals COGS Exercise and BEPShoaib100% (3)

- Rangers Creditors Report 5th April 2012Document65 pagesRangers Creditors Report 5th April 2012HirsutePursuitNo ratings yet

- Discover Unreported Income for Cash BusinessesDocument15 pagesDiscover Unreported Income for Cash BusinesseskiracimaoNo ratings yet

- Ratio Analysis ExplainedDocument8 pagesRatio Analysis ExplainedTawanda Tatenda HerbertNo ratings yet

- SHORT-TERM FUNDS SOURCESDocument9 pagesSHORT-TERM FUNDS SOURCESJack Herer100% (1)

- Guide To Consolidation Journal EntriesDocument9 pagesGuide To Consolidation Journal EntriesClarize R. MabiogNo ratings yet

- Lahore Business School Accounting 2 Assignment 3 on Statement of Cash FlowsDocument3 pagesLahore Business School Accounting 2 Assignment 3 on Statement of Cash Flowsmrs adilNo ratings yet

- Chapter 28 Financial AnalysisDocument4 pagesChapter 28 Financial AnalysisSaranyieh RamasamyNo ratings yet

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNo ratings yet

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- Blood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansFrom EverandBlood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansRating: 4.5 out of 5 stars4.5/5 (10)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Hatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaFrom EverandHatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaRating: 4 out of 5 stars4/5 (5)

- A Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyFrom EverandA Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyRating: 3.5 out of 5 stars3.5/5 (19)