Professional Documents

Culture Documents

Yau Chu V CA

Uploaded by

Jaz SumalinogOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yau Chu V CA

Uploaded by

Jaz SumalinogCopyright:

Available Formats

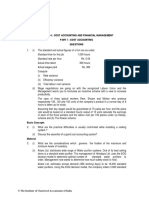

Yau Chu v CA

GR No. 78519, 26 Sept 1989

FACTS:

1. Petitioner Victoria Yau Chu had been purchasing cement on credit from CAMS Trading

Enterprises. To guaranty payment, she executed deeds of assignment of her time

deposits (P320,000) in the Family Savings Bank in favor of CAMS Trading. The deeds of

assignment were prepared by petitioner’s lawyer stating that:

“x x x. That this assignment serves as a collateral or guarantee for the payment of my obligation with the

said CAMS TRADING ENTERPRISES, INC. on account of my cement withdrawal from said company, per

separate contract executed between us.”

2. On the other hand, CAMS Trading notified the Bank that Mrs Chu had an unpaid account

(P314,639.75) and asked it to be allowed to encash the time deposit certificates

assigned to it. In doing so, it submitted a letter of Mrs.Chu admitting her outstanding

account.

3. The Bank agreed to encash the certificates after verablly advising Mrs.Chu of CAMS

Trading’s request and deliviered P283,737.75 only (since one of the time deposit

certificates lacked proper signatures).

4. Upon knowing of the encashment, Mrs. Chu demanded the Bank and CAMS Trading to

restore her time deposit but no one complied. Thus, she filed a complaint to recover teh

encashed amount.

5. RTC dismissed the complaint for lack of merit and CA affirmed it.

ISSUE: WON the encashment of the subject time deposit certificates should be annulled for

being pactum commisorium. NO.

RULING:

The encashment of the deposit certificates was not a pacto commissorio which is prohibited

under Art. 2088 of the Civil Code. A pacto commissorio is a provision for the automatic

appropriation of the pledged or mortgaged property by the creditor in payment of the loan

upon its maturity. The prohibition against a pacto commissorio is intended to protect the

obligor, pledgor, or mortgagor against being overreached by his creditor who holds a pledge

or mortgage over property whose value is much more than the debt. Where, as in this case,

the security for the debt is also money deposited in a bank, the amount of which is even less

than the debt, it was not illegal for the creditor to encash the time deposit certificates to pay

the debtors’ overdue obligation, with the latter’s consent.

NOTES:

CA found that the deeds of assignment were contracts of pledge, but, as the collateral was

also money or an exchange of “peso for peso,” the provision in Article 2112 of the CC for the

sale of the thing pledged at public auction to convert it into money to satisfy the pledgor’s

obligation, did not have to be followed. All that had to be done to convert the pledgor’s time

deposit certificates into cash was to present them to the bank for encashment after due notice

to the debtor.

On Mrs. Chu’s contention that she already paid her obligations:

CA found that such was not proven since the receipts for payments submitted by Mrs Chu to

the court was made prior to Jul 18, 1980. The letter she signed admitting her indebtedness

was signed by her on Jul 18, 1980. There is no proof of payment made by her after to reduce

or extinguish her debt.

You might also like

- Estmt - 2016 07 08Document10 pagesEstmt - 2016 07 08Dennis Chen100% (1)

- Bayot V CA GR No. 155635, 7 Nov 2008 Topic: Citizenship Via Recognition FactsDocument2 pagesBayot V CA GR No. 155635, 7 Nov 2008 Topic: Citizenship Via Recognition FactsJaz SumalinogNo ratings yet

- Francisco V PeopleDocument2 pagesFrancisco V PeopleJaz SumalinogNo ratings yet

- Go v. Bureau of ImmigrationDocument4 pagesGo v. Bureau of ImmigrationJaz SumalinogNo ratings yet

- Gen - Math 11Document15 pagesGen - Math 11Chrry MrcdNo ratings yet

- Felix Plazo Urban Poor Settlers Comm. Assn. Inc. v. Lipat SR., G.R. No. 182409, March 20, 2017 PDFDocument2 pagesFelix Plazo Urban Poor Settlers Comm. Assn. Inc. v. Lipat SR., G.R. No. 182409, March 20, 2017 PDFMilca, Mike Zaccahry MNo ratings yet

- Panaguiton V DOJ Facts:: SandiganbayanDocument2 pagesPanaguiton V DOJ Facts:: SandiganbayanJaz SumalinogNo ratings yet

- Steel Corporation of The Philippines V BOCDocument2 pagesSteel Corporation of The Philippines V BOCJaz SumalinogNo ratings yet

- Lopez V ComelecDocument2 pagesLopez V ComelecJaz Sumalinog100% (1)

- Etoro Forex Trading Course - First LessonDocument19 pagesEtoro Forex Trading Course - First LessonTrading Guru100% (4)

- 53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Document1 page53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Zyrene CabaldoNo ratings yet

- Responsibilityaccounting 160428005250Document16 pagesResponsibilityaccounting 160428005250RajanSharmaNo ratings yet

- Belgian Overseas Chartering and Shipping NDocument2 pagesBelgian Overseas Chartering and Shipping NMXKatNo ratings yet

- Guaranty and Suretyship (Dela Cruz)Document6 pagesGuaranty and Suretyship (Dela Cruz)Geriel Dela CruzNo ratings yet

- 001 LBP Vs Banal 434 Scra 543Document13 pages001 LBP Vs Banal 434 Scra 543Maria Jeminah Turaray0% (1)

- Evidence Midterm ReviewerDocument24 pagesEvidence Midterm Reviewercmv mendozaNo ratings yet

- San Carlos Milling v. BPIDocument1 pageSan Carlos Milling v. BPISerena RogerNo ratings yet

- Gempesaw Vs CADocument1 pageGempesaw Vs CARoche DaleNo ratings yet

- People V Whisenhunt GR No. 123819, 14 Nov 2001 FactsDocument3 pagesPeople V Whisenhunt GR No. 123819, 14 Nov 2001 FactsJaz SumalinogNo ratings yet

- Robinson & Co. v. Belt, 187 U.S. 41 (1902)Document8 pagesRobinson & Co. v. Belt, 187 U.S. 41 (1902)Scribd Government DocsNo ratings yet

- Insurance Services and Commercial Traders, Inc. v. Court of Appeals, G.R. No. 109305, October 2, 2000, 341 SCRA 572, 580.Document7 pagesInsurance Services and Commercial Traders, Inc. v. Court of Appeals, G.R. No. 109305, October 2, 2000, 341 SCRA 572, 580.TENsai1986No ratings yet

- 2 Matute v. Court of AppealsDocument31 pages2 Matute v. Court of AppealsMary Licel RegalaNo ratings yet

- People Vs DomasianDocument2 pagesPeople Vs DomasianJaz SumalinogNo ratings yet

- PNB Vs BanataoDocument1 pagePNB Vs BanataoBenedicto Eulogio C. ManzonNo ratings yet

- Philippine National Bank v. AmoresDocument6 pagesPhilippine National Bank v. AmoresRoemma Kara Galang PaloNo ratings yet

- Case FriaDocument7 pagesCase FriaMichelle Marie TablizoNo ratings yet

- Credit CasesDocument49 pagesCredit CasesBechay PallasigueNo ratings yet

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- People V PO1 TrestizaDocument2 pagesPeople V PO1 TrestizaJaz SumalinogNo ratings yet

- Nego Case Patrimonio Vs GutierrezDocument2 pagesNego Case Patrimonio Vs GutierrezIsay JimenezNo ratings yet

- TRANSPORTATION LAW Vigilance Over Goods Duration of Liability Temporary Unloading or Storage Oriental Assurance Corp. v. Ong - MagbojosDocument1 pageTRANSPORTATION LAW Vigilance Over Goods Duration of Liability Temporary Unloading or Storage Oriental Assurance Corp. v. Ong - MagbojosKristine MagbojosNo ratings yet

- Melva Theresa Alviar Gonzales Vs RCBCDocument1 pageMelva Theresa Alviar Gonzales Vs RCBCAlexir MendozaNo ratings yet

- Tan JR V HosanaDocument2 pagesTan JR V HosanaJaz SumalinogNo ratings yet

- 37-Santos v. NLRC G.R. No. 101699 March 13, 1996 PDFDocument4 pages37-Santos v. NLRC G.R. No. 101699 March 13, 1996 PDFJopan SJNo ratings yet

- Facts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsDocument7 pagesFacts:: Allied Banking Corporation, Petitioner Versus Lim Sio Wan, Metropolitan Bank and Trust Co., RespondentsNadzlah BandilaNo ratings yet

- Frivaldo Vs COMELECDocument2 pagesFrivaldo Vs COMELECJaz Sumalinog100% (1)

- Chu v. Court of Appeals DigestDocument2 pagesChu v. Court of Appeals DigestChrissyNo ratings yet

- Perla V RamoleteDocument2 pagesPerla V RamoleteiptrinidadNo ratings yet

- DENR V United Planners ConsultantsDocument3 pagesDENR V United Planners ConsultantsJaz SumalinogNo ratings yet

- People Vs EganDocument2 pagesPeople Vs EganJaz SumalinogNo ratings yet

- People V PugayDocument1 pagePeople V PugayJaz SumalinogNo ratings yet

- People V YauDocument1 pagePeople V YauJaz SumalinogNo ratings yet

- Aguirre V SOJDocument2 pagesAguirre V SOJJaz Sumalinog0% (1)

- Timoner V PeopleDocument1 pageTimoner V PeopleJaz Sumalinog100% (1)

- Digests Sec 1-13Document7 pagesDigests Sec 1-13Chic PabalanNo ratings yet

- Feria vs. CADocument16 pagesFeria vs. CAMaria LopezNo ratings yet

- Melva Theresa Alviar Gonzales, Petitioner, vs. Rizal Commercial Banking Corporation, RespondentDocument2 pagesMelva Theresa Alviar Gonzales, Petitioner, vs. Rizal Commercial Banking Corporation, RespondentCharlotteNo ratings yet

- Heirs of Belinda Dahlia CastilloDocument2 pagesHeirs of Belinda Dahlia CastilloLilibeth Dee GabuteroNo ratings yet

- Amex v. SantiagoDocument3 pagesAmex v. SantiagoElla ThoNo ratings yet

- Bpi V CA 232 Scra302Document11 pagesBpi V CA 232 Scra302frank japosNo ratings yet

- BPI Vs HerridgeDocument8 pagesBPI Vs HerridgePau JoyosaNo ratings yet

- PEOPLE Vs YATARDocument1 pagePEOPLE Vs YATARbenjaminteeNo ratings yet

- American Insurance V Macondray GR No. L-23222 June 10, 1971Document2 pagesAmerican Insurance V Macondray GR No. L-23222 June 10, 1971Cristina OlaritaNo ratings yet

- Cases - Negotiable Instruments (Week 4)Document163 pagesCases - Negotiable Instruments (Week 4)Gelyssa Endozo Dela CruzNo ratings yet

- Aznar Brother Realty Co. vs. CADocument1 pageAznar Brother Realty Co. vs. CARomarie AbrazaldoNo ratings yet

- Special Commercial Law Digested CasesDocument5 pagesSpecial Commercial Law Digested CasesVedarWolfNo ratings yet

- JAI-ALAI V BPIDocument6 pagesJAI-ALAI V BPIKeej DalonosNo ratings yet

- OCA v. LiangcoDocument1 pageOCA v. LiangcoVincent Quiña PigaNo ratings yet

- Joven de Cortes Vs Venturanza 79SCRA709Document14 pagesJoven de Cortes Vs Venturanza 79SCRA709Era Lim- Delos ReyesNo ratings yet

- 01 Belman Inc. v. Central Bank (104 Phil. 877)Document4 pages01 Belman Inc. v. Central Bank (104 Phil. 877)Mary LeandaNo ratings yet

- G.R. No. 84281Document1 pageG.R. No. 84281Rocky LadignonNo ratings yet

- Calimlim-Canullas vs. FortunDocument2 pagesCalimlim-Canullas vs. Fortungen1No ratings yet

- Gavieres VS TaveraDocument1 pageGavieres VS TaveraShane Nuss Red100% (1)

- GSIS Vs CorderoDocument2 pagesGSIS Vs CorderoMei SuyatNo ratings yet

- Tec Bi & Co V Chartered Bank of India, Australia and ChinaDocument1 pageTec Bi & Co V Chartered Bank of India, Australia and ChinaJillian AsdalaNo ratings yet

- La Sociedad Dalisay vs. Delos Reyes DIGESTDocument3 pagesLa Sociedad Dalisay vs. Delos Reyes DIGESTChin RojasNo ratings yet

- AFISCO Insurance Corporation v. CADocument2 pagesAFISCO Insurance Corporation v. CAlealdeosa100% (2)

- 29 Pan American Airlines vs. Rapadas 209 SCRA 67 PDFDocument14 pages29 Pan American Airlines vs. Rapadas 209 SCRA 67 PDFpa0l0sNo ratings yet

- LIM FILCRO Illegal RecruitmentDocument2 pagesLIM FILCRO Illegal RecruitmentVivienne Nicole LimNo ratings yet

- Miles City Bank v. Askin - RodriguezDocument2 pagesMiles City Bank v. Askin - RodriguezJOYCE CAMILLE RODRIGUEZNo ratings yet

- Far East Marble, Inc., and Tabuenas v. CA, BPI: Case Summary: Doctrine: FactsDocument3 pagesFar East Marble, Inc., and Tabuenas v. CA, BPI: Case Summary: Doctrine: FactsMarc VirtucioNo ratings yet

- Baritua Vs MercaderDocument2 pagesBaritua Vs MercadermasterlegitNo ratings yet

- Adolph Ramish IncDocument3 pagesAdolph Ramish IncClarisseOsteriaNo ratings yet

- Sadaya vs. SevillaDocument8 pagesSadaya vs. SevillaMaria Nicole VaneeteeNo ratings yet

- New Sampaguita VS Phils., 435 SCRA 565Document57 pagesNew Sampaguita VS Phils., 435 SCRA 565June DoriftoNo ratings yet

- Legaspi vs. CelestialDocument2 pagesLegaspi vs. Celestialbb yattyNo ratings yet

- 191274Document14 pages191274Zy AquilizanNo ratings yet

- Villar: Guerrero, J.Document2 pagesVillar: Guerrero, J.One TwoNo ratings yet

- Digest Credit Trans CasesDocument7 pagesDigest Credit Trans CasesGracelyn Enriquez Bellingan100% (1)

- Agrarian Reform Constitutional BasisDocument5 pagesAgrarian Reform Constitutional BasisSohayle Boriongan MacaunaNo ratings yet

- 35 Victoria Yau Chu v. CA (Pua)Document1 page35 Victoria Yau Chu v. CA (Pua)Kevin HernandezNo ratings yet

- Yau Chu vs. CA and Family Savings BankDocument2 pagesYau Chu vs. CA and Family Savings BankBryan Jay NuiqueNo ratings yet

- People V Campuhan GR No. 129433, 30 Mar 2000 FactsDocument2 pagesPeople V Campuhan GR No. 129433, 30 Mar 2000 FactsJaz SumalinogNo ratings yet

- Tan V CADocument2 pagesTan V CAJaz SumalinogNo ratings yet

- Quinto V Andres GR No. 155791, 16 Mar 2005 FactsDocument2 pagesQuinto V Andres GR No. 155791, 16 Mar 2005 FactsJaz SumalinogNo ratings yet

- Pangan Vs GarbaliteDocument2 pagesPangan Vs GarbaliteJaz SumalinogNo ratings yet

- G.R. No. 120988, Aug. 11, 1997: People v. Dela CruzDocument1 pageG.R. No. 120988, Aug. 11, 1997: People v. Dela CruzJaz SumalinogNo ratings yet

- People V RocheDocument1 pagePeople V RocheJaz SumalinogNo ratings yet

- People V AlapanDocument1 pagePeople V AlapanJaz SumalinogNo ratings yet

- Miranda V Deportation BoardDocument1 pageMiranda V Deportation BoardJaz SumalinogNo ratings yet

- Recebido Vs PeopleDocument2 pagesRecebido Vs PeopleJaz SumalinogNo ratings yet

- People V SanidadDocument2 pagesPeople V SanidadJaz Sumalinog0% (1)

- Guevarra V Atty Eala (Fulltext)Document22 pagesGuevarra V Atty Eala (Fulltext)Jaz SumalinogNo ratings yet

- Risos-Vidal V COMELECDocument3 pagesRisos-Vidal V COMELECJaz SumalinogNo ratings yet

- Ma V Fernandez, JR GR No. 183133, 26 Jul 2010 FactsDocument2 pagesMa V Fernandez, JR GR No. 183133, 26 Jul 2010 FactsJaz SumalinogNo ratings yet

- A Study On Fundamental Analysis of Top IT Companies in IndiaDocument14 pagesA Study On Fundamental Analysis of Top IT Companies in IndiaMuttavva mudenagudiNo ratings yet

- BIAYA MODAL CompressedDocument89 pagesBIAYA MODAL CompressedMuh IdhamsyahNo ratings yet

- Franchise AccountingDocument17 pagesFranchise AccountingCha EsguerraNo ratings yet

- Chapter 2Document22 pagesChapter 2Tiến ĐứcNo ratings yet

- 2 Discount Rate BSLDocument44 pages2 Discount Rate BSLfarNo ratings yet

- Charterhouse 1Document57 pagesCharterhouse 1arbet100% (1)

- Assignment: Individual InsolvencyDocument5 pagesAssignment: Individual InsolvencyKunal ChaudhryNo ratings yet

- Fin Midterm 1 PDFDocument6 pagesFin Midterm 1 PDFIshan DebnathNo ratings yet

- BA 211 Midterm 2Document6 pagesBA 211 Midterm 2Gene'sNo ratings yet

- Solution Manual For Foundations of Financial Management Block Hirt Danielsen 15th EditionDocument37 pagesSolution Manual For Foundations of Financial Management Block Hirt Danielsen 15th Editionabatisretroactl5z6100% (26)

- Adtp Fee 2022 IntiDocument1 pageAdtp Fee 2022 IntiAsma AkterNo ratings yet

- Chapter 7 9eDocument37 pagesChapter 7 9eRahil VermaNo ratings yet

- Beams11 - PPT 16Document49 pagesBeams11 - PPT 16naufal bimoNo ratings yet

- Bihar Land Acquisition ActDocument12 pagesBihar Land Acquisition Actsamy naikNo ratings yet

- RA 7721 As Amended by RA 10641Document3 pagesRA 7721 As Amended by RA 10641Anonymous 4IOzjRIB1No ratings yet

- BookDocument98 pagesBookmuthulakshmiNo ratings yet

- Assignemnt 1 Muhammad Awais (NUML-S20-11149)Document40 pagesAssignemnt 1 Muhammad Awais (NUML-S20-11149)Muhammad AwaisNo ratings yet

- Wacc - Capital LeaseDocument2 pagesWacc - Capital LeaseMuzzamil UsmanNo ratings yet

- Cityam 2010-11-09Document36 pagesCityam 2010-11-09City A.M.No ratings yet

- All I KnowDocument305 pagesAll I Knowhitesh_21No ratings yet

- BEPS AnalyzeDocument2 pagesBEPS AnalyzeMurilo Domene de SiqueiraNo ratings yet

- Chapter 21 (Saunders)Document21 pagesChapter 21 (Saunders)sdgdfs sdfsf100% (1)

- CMADDocument4 pagesCMADSridhanyas kitchenNo ratings yet

- Quiz 2 Audtheo PDFDocument4 pagesQuiz 2 Audtheo PDFCharlen Relos GermanNo ratings yet

- Paper 4Document44 pagesPaper 4Mayuri KolheNo ratings yet