Professional Documents

Culture Documents

PROBLEMS

PROBLEMS

Uploaded by

Renz Guiao0 ratings0% found this document useful (0 votes)

12 views2 pagesOriginal Title

PROBLEMS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesPROBLEMS

PROBLEMS

Uploaded by

Renz GuiaoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

PROBLEMS

ASA Company bought merchandise on January 12, 2020 from ABC

Company costing P15,000; terms, less 20%, 20% down payment. Two

days after, P212,000 worth of merchandise was returned due to wrong

specification. Moneba Company paid the account within the discount

period. How much the Company paid to ABC Company?

Merchandise shipped fob destination to customer was made on

January 15, 2020 for P25,000. The customer issued P100,000 12%

30-day note and the balance 2/10, n/30 on January 10, 2020, the

date the goods were received. The customer made a partial payment

on January 15, 2020 for P5,000. Payment was made within the

discount period. How much discount was granted?

On January 10, 2020, ALA Company sold merchandise on account fob

destination to ELA Co. for P20,000. ALA. paid the freight cost of

P1,500 to be deducted from its account. How much ELA Company

paid to Lao Company?

Goods worth P512,000 was shipped on account (2/10, n/30) to UBE

Company on January 15, 2020 from UBAS Company The term of the

shipment was fob shipping point. UBE Company paid freight of

P1,950. On January 12, 2020, P102,500 worth of merchandise was

received by UBE Co. from UBAS Co. due to wrong specification.

Ibuyan Company made a partial payment of P15,000. How much is

the subsequent collection of UBE Company from UBAS Company

assuming UBAS Company paid within the discount period?

ABC Company purchased merchandise on account for P100,000 from

BCD Company with term shipping point. The freight cost was P11,500

and was paid by ABC Company Upon the arrival of the carrier, it found

out that the merchandise got lost while in transit. The carrier

company accepted the loss as their fault. How much is the subsequent

collection of BCD Company from ABC Company?

UY Company bought from CY Company a second-hand machinery for

the use of its plant for P500,000 A 50% down payment was made and

balance 2/10, n/30. Freight cost was paid by Chan Company for

P12,000. CY Company acquired the machinery three years ago at

P60,000 with 12 year life. (Straight-line method is use in computing

Depreciation). Two days after purchase, Casas Company granted the

request of UY Company for a P15,000 price adjustments because of

some defects of the machinery. Cash paid by UY Company to CY

Company assuming the account was paid within the discount period.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Wells Fargo Everyday CheckingDocument3 pagesWells Fargo Everyday CheckingKarapet MerganyanNo ratings yet

- CFPB Sample Revocation Letter To Your Bank or Credit UnionDocument2 pagesCFPB Sample Revocation Letter To Your Bank or Credit UnionkongbengNo ratings yet

- Union Bank of India (1) Account Statement PDFDocument2 pagesUnion Bank of India (1) Account Statement PDFJoshua Hannity50% (4)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Maharashtra State Electricity Distribution Co. LTDDocument2 pagesMaharashtra State Electricity Distribution Co. LTDsunnyramidi100% (1)

- 2014 Vol 1 CH 4 AnswersDocument11 pages2014 Vol 1 CH 4 AnswersSimoun Torres100% (2)

- Oracle AP Training DocumentDocument29 pagesOracle AP Training DocumentMadhu Sudan ReddyNo ratings yet

- MR Kamal Sondhi 24 Elizabeth ST Bentleigh East Vic 3165Document5 pagesMR Kamal Sondhi 24 Elizabeth ST Bentleigh East Vic 3165KamalNo ratings yet

- Credit Card ProcessingDocument28 pagesCredit Card ProcessingvluhadNo ratings yet

- Investor RelationsDocument43 pagesInvestor RelationsSalman Alfarisyi Lesmana, S.I.Kom., M.MNo ratings yet

- Deferred TaxesDocument5 pagesDeferred TaxesCris Joy BiabasNo ratings yet

- Airbnb's Rising Valuation: Will The Bubble Burst?Document16 pagesAirbnb's Rising Valuation: Will The Bubble Burst?Jennilyn HenaresNo ratings yet

- BalanceDocument1 pageBalanceRenz GuiaoNo ratings yet

- The Commission On Audit, in Compliance With The Philippine Government's State Audit Approach (IRRBA), and The Enactment of RA No. 9710 or The Magna Carta On Women (MCW)Document1 pageThe Commission On Audit, in Compliance With The Philippine Government's State Audit Approach (IRRBA), and The Enactment of RA No. 9710 or The Magna Carta On Women (MCW)Renz GuiaoNo ratings yet

- Letter 1.Document1 pageLetter 1.Renz GuiaoNo ratings yet

- Signed in The Presence ofDocument1 pageSigned in The Presence ofRenz GuiaoNo ratings yet

- Professional Standards: Chapter Welcome To Econ 132-AuditDocument18 pagesProfessional Standards: Chapter Welcome To Econ 132-AuditRam kumarNo ratings yet

- Pengesahan Nasihat Yang Diberikan Kepada: Confirmation of Advice Given ToDocument1 pagePengesahan Nasihat Yang Diberikan Kepada: Confirmation of Advice Given TonadiaNo ratings yet

- Inoperative Account DefinitionDocument1 pageInoperative Account Definitionmkumar.itNo ratings yet

- Credit Transaction Midterm ReviewerDocument7 pagesCredit Transaction Midterm ReviewerCarl MontemayorNo ratings yet

- LPMI April 2020 Desk PDFDocument67 pagesLPMI April 2020 Desk PDFShaji VkNo ratings yet

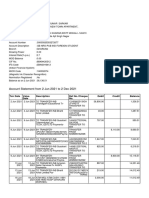

- Account Statement From 2 Jun 2021 To 2 Dec 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument9 pagesAccount Statement From 2 Jun 2021 To 2 Dec 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSumon SarkarNo ratings yet

- Sarlaft Persona Natural PDFDocument3 pagesSarlaft Persona Natural PDFPauline GamaNo ratings yet

- Venezuela Electric DefaultDocument2 pagesVenezuela Electric DefaultZerohedgeNo ratings yet

- 10 10 Ftse Kick Out PlanDocument37 pages10 10 Ftse Kick Out PlanLiving GrangerNo ratings yet

- 37th SLBC AGENDA Mar-2023Document52 pages37th SLBC AGENDA Mar-2023D MNo ratings yet

- Focus Notes - Philippine Standard On Auditing 120Document1 pageFocus Notes - Philippine Standard On Auditing 120Kristine Apale100% (1)

- Explain The Rationale For The Nationalization of BanksDocument13 pagesExplain The Rationale For The Nationalization of Bankssanjay parmarNo ratings yet

- Credit Card Industry in IndiaDocument124 pagesCredit Card Industry in IndiaMandar KadamNo ratings yet

- Ghana Financial InstitutionsDocument2 pagesGhana Financial InstitutionsKristineCostanzaNo ratings yet

- APF2Document1 pageAPF2chuckepsteinNo ratings yet

- The Voucher System of ControlDocument32 pagesThe Voucher System of ControlNicole LaiNo ratings yet

- Starting Catering BusinessDocument21 pagesStarting Catering BusinessGloria Le Thi EsquivelNo ratings yet

- 033129Document1 page033129vinsensius rasaNo ratings yet

- 13Brg356 / SLK Bima Brokers Private Limited: Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument2 pages13Brg356 / SLK Bima Brokers Private Limited: Reliance Private Car Vehicle Certificate Cum Policy Schedulemaakabhawan26No ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet