Professional Documents

Culture Documents

Slides-2.3.2 PDF

Uploaded by

dbh j0 ratings0% found this document useful (0 votes)

13 views7 pagesOriginal Title

_44e89e7851df5b0a483f7bffe17c8d84_Slides-2.3.2.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views7 pagesSlides-2.3.2 PDF

Uploaded by

dbh jCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

What are the Journal Entries?

• September 30: BOC loans $100,000 to an employee at a 12% interest

rate

Dr. Notes Receivable (+A) 100,000

Cr. Cash (-A) 100,000

• December 31: End of the fiscal year, and no principal or interest

payments have been made yet

Dr. Interest Receivable (+A) 3,000

Cr. Interest Revenue (+R, +SE) 3,000

• January 6: The employee sends a check for three months of interest

on the loan

Dr. Cash (+A) 3,000

Cr. Interest Receivable (-A) 3,000

KNOWLEDGE FOR ACTION

What are the Journal Entries?

• December 31: End of the fiscal year. During December, employees

earned $400,000 in salaries, but paychecks do not get issued until

January 2

Dr. Salary Expense (+E, -SE) 400,000

Cr. Salaries Payable (+L) 400,000

• January 2: The paychecks are sent

Dr. Salaries Payable (-L) 400,000

Cr. Cash (-A) 400,000

KNOWLEDGE FOR ACTION

What are the Journal Entries?

• November 20: BOC pays $10,000 for December’s rent

Dr. Prepaid Rent (+A) 10,000

Cr. Cash (-A) 10,000

• December 31: End of the fiscal year. Is an adjusting entry needed? If

so, what is it?

Dr. Rent Expense (+E, -SE) 10,000

Cr. Prepaid Rent (-A) 10,000

KNOWLEDGE FOR ACTION

What are the Journal Entries?

• June 30: A customer pays BOC $60,000 for a three-year software

license

Dr. Cash (+A) 60,000

Cr. Unearned Software Revenue (+L) 60,000

• December 31: End of the fiscal year. Is an adjusting entry needed? If

so, what is it?

Dr. Unearned Software Revenue (-L) 10,000

Cr. Software revenue (+R, +SE) 10,000

KNOWLEDGE FOR ACTION

What are the Journal Entries?

• June 30: BOC purchases a building for $500,000. The expected life of

the building is 20 years and its expected salvage value is $100,000

Dr. Building (+A) 500,000

Cr. Cash (-A) 500,000

• December 31: End of the fiscal year: Is an adjusting entry needed? If

so, what is it?

Dr. Depreciation Expense (+E, -SE) 10,000

Cr. Accumulated Depreciation (+XA, -A) 10,000

(500,000 – 100,000) / 20 = 20,000 annual expense

20,000 / 2 = 10,000 six-month expense

KNOWLEDGE FOR ACTION

What are the Journal Entries?

• December 31: BOC still has an outstanding order for $300,000 of

products that will be delivered and billed in January

No entry

KNOWLEDGE FOR ACTION

Overview of Adjusting Entries

Dr. Cash Dr. Liability Deferred Revenue

Cr. Liability Cr. Revenue

Dr. Asset Dr. Expense Deferred Expense

Cr. Cash Cr. Asset

Cash Accounting Cash

Transaction Recognition Transaction

Accrued Expense Dr. Expense Dr. Liability

Cr. Liability Cr. Cash

Accrued Revenue Dr. Asset Dr. Cash

Cr. Revenue Cr. Asset

KNOWLEDGE FOR ACTION

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Income Tax MaterialDocument86 pagesIncome Tax MaterialRohith krishnan kt100% (1)

- Midterm Exam BTT 2ndSemAY2017-2018 SendDocument6 pagesMidterm Exam BTT 2ndSemAY2017-2018 SendelmerNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Manual TAX 1. 2019 20 PDFDocument35 pagesManual TAX 1. 2019 20 PDFkNo ratings yet

- 1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 ForDocument1 page1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 Forhassan taimourNo ratings yet

- Inter II GENAP - Session 11 - Income TaxesDocument6 pagesInter II GENAP - Session 11 - Income Taxesnathania kNo ratings yet

- Kapil Raj Mandavi 23-24Document1 pageKapil Raj Mandavi 23-24khan khanNo ratings yet

- 5.1-Module 5Document3 pages5.1-Module 5Arpita ArtaniNo ratings yet

- Illustration: Income Before Bonus and Before Tax (Y)Document2 pagesIllustration: Income Before Bonus and Before Tax (Y)Monette DellosaNo ratings yet

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingNo ratings yet

- What Train LawDocument1 pageWhat Train LawJanlie GautaneNo ratings yet

- Financials ResultsDocument1 pageFinancials ResultsAmis2018 Amis2018No ratings yet

- Itr - TCSDocument3 pagesItr - TCSsivaNo ratings yet

- Appeals and Procedure For Filing Appeals 2018Document69 pagesAppeals and Procedure For Filing Appeals 2018Chaithanya RajuNo ratings yet

- Philippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Document2 pagesPhilippine Carabao Center USM Kabacan, North Cotabato Agency Action Plan and Status of Implementation Audit Observations and Recommendations For The Calendar Year 2018 As of March 2019Mea Cocal JTNo ratings yet

- General Comments On The SocietyDocument5 pagesGeneral Comments On The Societyraja_tanukuNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Assessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationDocument6 pagesAssessment Details and Submission Guidelines: Holmes Institute Faculty of Higher EducationMuhammad Sheharyar MohsinNo ratings yet

- Accounting A Level NSC Grade 12 Past Exam Papers 2013 p1 Question PaperDocument12 pagesAccounting A Level NSC Grade 12 Past Exam Papers 2013 p1 Question PaperWonder Bee NzamaNo ratings yet

- 15th Business Presentation For NACSTACCSDocument14 pages15th Business Presentation For NACSTACCSDavid MythNo ratings yet

- Unit 4 Profits and Gainsfrom Bus or ProfessionDocument11 pagesUnit 4 Profits and Gainsfrom Bus or ProfessionSahana SadanandNo ratings yet

- CIR Vs Lancaster CIRDocument18 pagesCIR Vs Lancaster CIRAerith AlejandreNo ratings yet

- Financial Maths - Study Notes 2021Document4 pagesFinancial Maths - Study Notes 2021Samara DiasNo ratings yet

- CWT RulesDocument2 pagesCWT RulesCherry Amor Venzon OngsonNo ratings yet

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountBalajiNo ratings yet

- Trial Balance UD BUANADocument1 pageTrial Balance UD BUANAAdindaFitriani HariantoNo ratings yet

- Income From OtherDocument7 pagesIncome From OtherAyush AwasthiNo ratings yet

- Income Tax: Introduction and Important DefinitionsDocument25 pagesIncome Tax: Introduction and Important DefinitionsVicky DNo ratings yet

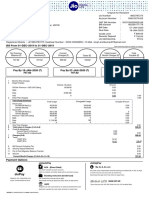

- Jio Dec 2019Document1 pageJio Dec 2019Amitkumar SinghNo ratings yet