Professional Documents

Culture Documents

FIN 3512 Classwork 10.16.2019 To Be Uploaded at End of Class

Uploaded by

gOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 3512 Classwork 10.16.2019 To Be Uploaded at End of Class

Uploaded by

gCopyright:

Available Formats

FIN 3512 CLASSWORK ASSIGNMENT 10.16.

2019 TO BE UPLOADED AT END OF CLASS

Income Statement

($millions) Actual Actual Actual Actual Actual Projected Projected Projected Projected Projected

For the year ended December 31 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Revenue $ 1,230.0 $ 1,295.0 $ 1,379.0 $ 1,464.0 $ 1,544.0 $ 1,667.5 $ 1,784.2 $ 1,891.3 $ 1,985.9 $ 2,065.3

Growth rate n/a 5.3% 6.5% 6.2% 5.5% 8.0% 7.0% 6.0% 5.0% 4.0%

Cost of goods sold 924.0 969.0 1,031.0 1,101.0 1,157.0 1,250.6 1,338.2 1,418.5 1,489.4 1,549.0

Gross profit 306.0 326.0 348.0 363.0 387.0 416.9 446.1 472.8 496.5 516.3

Overhead expense 96.0 103.0 109.0 115.0 121.0 133.4 142.7 151.3 158.9 165.2

SG&A expenses 44.0 48.0 52.0 56.0 59.0 66.7 71.4 75.7 79.4 82.6

EBITDA 166.0 175.0 187.0 192.0 207.0 216.8 232.0 245.9 258.2 268.5

Depreciation 50.0 55.0 65.0 70.0 71.0 75.0 76.7 77.5 77.4 76.4

EBIT 116.0 120.0 122.0 122.0 136.0 141.7 155.2 168.3 180.7 192.1

Interest Expense 35.0 34.0 33.0 32.0 30.0 36.5 40.1 33.9 28.1 25.2

EBT 81.0 86.0 89.0 90.0 106.0 105.3 115.1 134.4 152.6 166.9

Taxes 20.0 22.0 24.0 25.0 27.0 26.3 28.8 33.6 38.1 41.7

Net Income $ 61.0 $ 64.0 $ 65.0 $ 65.0 $ 79.0 $ 78.9 $ 86.3 $ 100.8 $ 114.4 $ 125.2

Common Size Assumptions (in BLUE)/Common Size % (in BLACK)

Revenue 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Revenue Growth Rate n/a 5.3% 6.5% 6.2% 5.5% 8.0% 7.0% 6.0% 5.0% 4.0%

Cost of goods sold % of Revenue 75.1% 74.8% 74.8% 75.2% 74.9% 75.0% 75.0% 75.0% 75.0% 75.0%

Gross profit % of Revenue 24.9% 25.2% 25.2% 24.8% 25.1% 25.0% 25.0% 25.0% 25.0% 25.0%

Overhead expense 7.8% 8.0% 7.9% 7.9% 7.8% 8.0% 8.0% 8.0% 8.0% 8.0%

SG&A expense % of Revenue 3.6% 3.7% 3.8% 3.8% 3.8% 4.0% 4.0% 4.0% 4.0% 4.0%

Depreciation expense % Revenue 4.1% 4.2% 4.7% 4.8% 4.6% 4.5% 4.3% 4.1% 3.9% 3.7%

EBITDA MARGIN 13.5% 13.5% 13.6% 13.1% 13.4% 13.0% 13.0% 13.0% 13.0% 13.0%

EBIT MARGIN 9.4% 9.3% 8.8% 8.3% 8.8% 8.5% 8.7% 8.9% 9.1% 9.3%

Income Tax Rate 24.7% 25.6% 27.0% 27.8% 25.5% 25.0% 25.0% 25.0% 25.0% 25.0%

Net Income Margin 5.0% 4.9% 4.7% 4.4% 5.1% 4.7% 4.8% 5.3% 5.8% 6.1%

Dividend Payout % 24.6% 23.4% 23.1% 23.1% 19.0% 380.0% 20.0% 20.0% 20.0% 20.0%

Dividends $ 15.0 $ 15.0 $ 15.0 $ 15.0 $ 15.0 $ 300.0 $ - $ - $ - $ -

Page 1 Projected Income Statement

FIN 3512 CLASSWORK ASSIGNMENT 10.16.2019 TO BE UPLOADED AT END OF CLASS

Balance Sheet Accounts

($millions) Actual Actual Actual Actual Actual Projected Projected Projected Projected Projected

As of December 31 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Cash $ 25.0 $ 25.0 $ 25.0 $ 24.0 $ 64.0 $ 20.0 $ 20.0 $ 20.0 $ 63.0 $ 169.3

Accounts receivable 113.0 120.0 131.0 133.0 141.0 150.8 161.3 171.0 179.5 186.7

Inventory 210.0 215.0 225.0 242.0 251.0 277.9 297.4 315.2 331.0 344.2

Prepaid expenses 18.0 22.0 24.0 25.0 28.0 30.0 32.1 34.0 35.7 37.2

Total Current Assets 366.0 382.0 405.0 424.0 484.0 478.7 510.8 540.3 609.3 737.4

Fixed Assets - net 325.0 345.0 360.0 375.0 364.0 345.2 326.1 310.6 295.1 283.6

Total Assets 691.0 727.0 765.0 799.0 848.0 823.9 836.9 850.8 904.3 1,021.0

Revolver borrowings - - - - - 202.5 134.4 53.7 0.0 (0.0)

Accounts payable 75.0 78.0 82.0 83.0 86.0 92.5 99.0 104.9 110.2 114.6

Accrued expenses 29.0 33.0 37.0 40.0 42.0 45.0 48.2 51.1 53.6 55.8

Total Current Liabilities 104.0 111.0 119.0 123.0 128.0 340.0 281.6 209.7 163.8 170.3

Debt Outstanding 500.0 480.0 460.0 440.0 420.0 405.0 390.0 375.0 360.0 345.0

Total Liabilities 604.0 591.0 579.0 563.0 548.0 745.0 671.6 584.7 523.8 515.3

Common Stock 40.0 40.0 40.0 40.0 40.0 40.0 40.0 40.0 40.0 40.0

Retained Earnings 47.0 96.0 146.0 196.0 260.0 38.9 125.3 226.1 340.5 465.7

Total Liabilities and Equity $ 691.0 $ 727.0 $ 765.0 $ 799.0 $ 848.0 $ 823.9 $ 836.9 $ 850.8 $ 904.3 $ 1,021.0

In balance - - - - - - (0.00) 0.00 (0.00) 0.00

Assumptions (BLUE)

Revenue $ 1,230.0 $ 1,295.0 $ 1,379.0 $ 1,464.0 $ 1,544.0 $ 1,667.5 $ 1,784.2 $ 1,891.3 $ 1,985.9 $ 2,065.3

Cost of goods sold 924.0 969.0 1,031.0 1,101.0 1,157.0 1,250.6 1,338.2 1,418.5 1,489.4 1,549.0

Minimum required cash level n/a n/a n/a n/a n/a $ 20.0 $ 20.0 $ 20.0 $ 20.0 $ 20.0

Accounts receivable DSO 34 34 35 33 33 33 33 33 33 33

Inventory turnover (Cogs) 4.4 4.5 4.6 4.5 4.6 4.5 4.5 4.5 4.5 4.5

Prepaid Expenses as a % of Revenue 1.5% 1.7% 1.7% 1.7% 1.8% 1.8% 1.8% 1.8% 1.8% 1.8%

Accounts Payable Days of COGS 30 29 29 28 27 27 27 27 27 27

Accrued Expenses % of Revenue 2.4% 2.5% 2.7% 2.7% 2.7% 2.7% 2.7% 2.7% 2.7% 2.7%

CAPX Statistics Assumptions (BLUE)

Capital Expenditures $ 55.0 $ 75.0 $ 80.0 $ 85.0 $ 60.0 $ 56.3 $ 57.5 $ 62.0 $ 62.0 $ 65.0

Depreciation 50.0 55.0 65.0 70.0 71.0 75.0 76.7 77.5 77.4 76.4

Capx / Depreciation & Amortization 110% 136% 123% 121% 85% 75% 75% 80% 80% 85%

Page 2 Projected Balance Sheet

FIN 3512 CLASSWORK ASSIGNMENT 10.16.2019 TO BE UPLOADED AT END OF CLASS

Statement of Cash Flow

($millions) Actual Actual Actual Actual Projected Projected Projected Projected Projected

For the year ended December 31 2015 2016 2017 2018 2019 2020 2021 2022 2023

Operating activity

Net Income $ 64.0 $ 65.0 $ 65.0 $ 79.0 $ 78.9 $ 86.3 $ 100.8 $ 114.4 $ 125.2

Plus/(Less):

Depreciation 55.0 65.0 70.0 71.0 75.0 76.7 77.5 77.4 76.4

Change in accounts receivable (7.0) (11.0) (2.0) (8.0) (9.8) (10.6) (9.7) (8.5) (7.2)

Change in inventory (5.0) (10.0) (17.0) (9.0) (26.9) (19.5) (17.8) (15.8) (13.2)

Change in prepaids (4.0) (2.0) (1.0) (3.0) (2.0) (2.1) (1.9) (1.7) (1.4)

Change in accounts payable 3.0 4.0 1.0 3.0 6.5 6.5 5.9 5.2 4.4

Change in accrued expenses 4.0 4.0 3.0 2.0 3.0 3.2 2.9 2.6 2.1

Cash from operating activity 110.0 115.0 119.0 135.0 124.8 140.6 157.8 173.7 186.3

Investment activity

Capital expenditures (75.0) (80.0) (85.0) (60.0) (56.3) (57.5) (62.0) (62.0) (65.0)

Net cash from investment activity (75.0) (80.0) (85.0) (60.0) (56.3) (57.5) (62.0) (62.0) (65.0)

Financing activity

Repayment of debt (20.0) (20.0) (20.0) (20.0) (15.0) (15.0) (15.0) (15.0) (15.0)

New borrowings - - - - - - - - -

Dividends (15.0) (15.0) (15.0) (15.0) (300.0) - - - -

Net cash from financing activity (35.0) (35.0) (35.0) (35.0) (315.0) (15.0) (15.0) (15.0) (15.0)

Net increase/(decrease) in cash - - (1.0) 40.0### (246.5) 68.0 80.7 96.7 106.3

Cash beginning of year 25.0 25.0 25.0 24.0 64.0 20.0 20.0 20.0 63.0

Total 25.0 25.0 24.0 64.0 (182.5) 88.0 100.7 116.7 169.3

Minimum required operating cash n/a n/a n/a n/a 20.0 20.0 20.0 20.0 20.0

Cash Surplus/(Deficit) n/a n/a n/a n/a (202.5) 68.0 80.7 96.7 149.3

Revolver borrowings n/a n/a n/a n/a 202.5 - - - -

Revolver repayment n/a n/a n/a n/a - (68.0) (80.7) (53.7) 0.0

Cash end of year $ 25.0 $ 25.0 $ 24.0 $ 64.0 20.0 20.0 20.0 63.0 169.3

Projected Cash Flow Statement

Page 3

FIN 3512 CLASSWORK ASSIGNMENT 10.16.2019 TO BE UPLOADED AT END OF CLASS

Debt Schedule

($millions) Actual Projected Projected Projected Projected Projected

For the year ended December 31 2018 2019 2020 2021 2022 2023

Debt outstanding

Beginning $ 420.0 $ 405.0 $ 390.0 $ 375.0 $ 360.0

Less: Repayments 15.0 15.0 15.0 15.0 15.0

Add: New borrowings - - - - -

Ending 420.0 405.0 390.0 375.0 360.0 345.0

Interest Rate 7.0% 7.0% 7.0% 7.0% 7.0% 7.0%

Interest Expense n/a $ 29.4 $ 28.4 $ 27.3 $ 26.3 $ 25.2

Revolver debt outstanding

Beginning $ - $ 202.5 $ 134.4 $ 53.7 $ (0.0)

Add: new borrowings 202.5 - - - -

Less: repayments - 68.0 80.7 53.7 0.0

Ending - 202.5 134.4 53.7 0.0 (0.0)

Average outstanding balance $ 101.2 $ 168.5 $ 94.1 $ 26.9 $ (0.0)

Interest Rate 7.0% 7.0% 7.0% 7.0% 7.0% 7.0%

Interest Expense n/a $ 7.1 $ 11.8 $ 6.6 $ 1.9 $ (0.0)

Total Interest Expense n/a $ 36.5 $ 40.1 $ 33.9 $ 28.1 $ 25.2

DEBT COVENANTS

EBITDA - Capx $ 160.5 $ 174.4 $ 183.8 $ 196.2 $ 203.5

EBITDA 216.8 232.0 245.9 258.2 268.5

EBITDA-Capx/Interest 4.4 4.3 5.4 7.0 8.1

Minimum Covenant 4.0 4.0 5.0 6.0 7.0

Pass = P and Fail = F P P P P P

Total Debt/EBITDA 2.80 2.26 1.74 1.39 1.28

Maximum Covenant 3.25 2.75 2.25 1.75 1.50

Page 4 Projected Debt Schedule

Pass = P and Fail = F P P P P P

Page 5 Projected Debt Schedule

FIN 3512 CLASSWORK ASSIGNMENT 10.16.2019 TO BE UPLOADED AT END OF CLASS

RE and Fixed Assets Schedule

($millions) Actual Projected Projected Projected Projected Projected

For the year ended December 31 2018 2019 2020 2021 2022 2023

Retained Earnings

Beginning $ 260.0 $ 38.9 $ 125.3 $ 226.1 $ 340.5

Add/(less): Net income/loss 78.9 86.3 100.8 114.4 125.2

Less: dividends 300.0 - - - -

Ending $ 260.0 $ 38.9 $ 125.3 $ 226.1 $ 340.5 $ 465.7

Fixed Assets

Beginning $ 364.0 $ 345.2 $ 326.1 $ 310.6 $ 295.1

Add: Capx 56.3 57.5 62.0 62.0 65.0

Less: Depreciation 75.0 76.7 77.5 77.4 76.4

Ending $ 364.0 $ 345.2 $ 326.1 $ 310.6 $ 295.1 $ 283.6

Page 6 Projected RE and Fixed Assets Schedule

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Passing Package AccDocument93 pagesPassing Package AccOM VNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3Sharmaine Rivera MiguelNo ratings yet

- Chapter 4Document27 pagesChapter 4Annalyn MolinaNo ratings yet

- Cashflow Analsis: Tony Deepa PankajDocument20 pagesCashflow Analsis: Tony Deepa PankajDeepaNo ratings yet

- 6th Practice Qs 99.2Document3 pages6th Practice Qs 99.2BromanineNo ratings yet

- PACRADocument516 pagesPACRABenjamin Banda100% (1)

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- MCQ Fa (Unit 3)Document10 pagesMCQ Fa (Unit 3)Udit SinghalNo ratings yet

- PeriodicDocument1 pagePeriodicMaria Raven Joy ValmadridNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- Interglobe AviatDocument18 pagesInterglobe AviatVishalPandeyNo ratings yet

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- MGAC CH 14 For Yahoo Group (Slide 1-12)Document12 pagesMGAC CH 14 For Yahoo Group (Slide 1-12)schatzchenNo ratings yet

- Financial StatementDocument21 pagesFinancial Statement777priyankaNo ratings yet

- FinRep SummaryDocument36 pagesFinRep SummaryNikolaNo ratings yet

- P1 ACC 113 Assignment 1Document4 pagesP1 ACC 113 Assignment 1Danica Mae UbeniaNo ratings yet

- Chapter 6 - Solution ManualDocument91 pagesChapter 6 - Solution Manualgilli1tr58% (12)

- 26 - LCCI L3 AC - Sep 2019 - ASE 20104 - MSDocument15 pages26 - LCCI L3 AC - Sep 2019 - ASE 20104 - MSKhin Zaw Htwe100% (6)

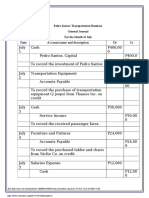

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლNo ratings yet

- CHAPTER - 3 - Problems - AnswersDocument6 pagesCHAPTER - 3 - Problems - AnswersFahad Mushtaq71% (7)

- 03 - PPT - Chapter 28Document28 pages03 - PPT - Chapter 28RicardoNo ratings yet

- Lanz Co.Document590 pagesLanz Co.Eve Rose Tacadao IINo ratings yet

- P2 ACCA - Step Acq.Document6 pagesP2 ACCA - Step Acq.IFTEKHAR IFTENo ratings yet

- AccountingDocument9 pagesAccountingTakuriNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument6 pagesFramework For The Preparation and Presentation of Financial Statementsg0025No ratings yet

- Full Set of FSDocument68 pagesFull Set of FSMary Joy VallarNo ratings yet

- OCIDocument74 pagesOCIValerie CapinpinNo ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- 2020-21 - HYE - QP - Accountancy - SET A - XII - PDFDocument3 pages2020-21 - HYE - QP - Accountancy - SET A - XII - PDFLakshay SethNo ratings yet

- FBLA Accounting Test PrepDocument10 pagesFBLA Accounting Test PrepjhouvanNo ratings yet