Professional Documents

Culture Documents

Hybrid Financing

Uploaded by

hitekshaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hybrid Financing

Uploaded by

hitekshaCopyright:

Available Formats

Hybrid Financing

Hybrid Financing can be defined as a combined face of equity and debt. This means that the

characteristics of both equity and bond can be found in Hybrid Financing. There are several forms

of Hybrid Financing like preference capital, convertible debentures, warrants, innovative hybrids

and so on.

Purpose of Hybrid Financing:

The concept of Hybrid Financing has been developed to enjoy the positive factors of both the

equities and debt instruments. The residual claim is related to the equities. If someone is holding

shares of a particular company then it is obvious that the person would enjoy some special rights

regarding the cash flow and the assets. At the same time, the shareholder of the company is also

entitled to play an important role while making business decisions.

Debt instruments are totally different from equities. These instruments are used by the major

companies to arrange a kind of loan for the development of the company. The debt instruments do

not provide the right to take part in the management of the particular company. But at the same

time, the debt instruments confirm a permanent claim on the assets of the company.

Now these two are totally different and the purpose of Hybrid Financing is to combine the qualities

of both these investment instruments and to develop something better for the investors.

Types of Hybrid Financing

1. Preference Capital

This capital is always preferred at the time of distribution of the dividends. Again, preference

capital is paid first when the company is winding up its activities. The equity capital always comes

next.

2. Warrant

Warrant is a kind of hybrid financing and it is very close to security options. Any person who is

holding a warrant is guaranteed to be provided with specific number underlying instruments and

the prices for that instruments are fixed previously. This means that if the value of the particular

instrument is going up the investor can make good amount of profit and if the market is not

favorable, the warrant-holder is not bound to use the warrant. Like securities market, here also

both the call and put warrants are available.

3. Convertible Debenture

Convertible debentures are those that can be transformed into the shares of the same company.

These debentures are also known as convertible bonds. The ratio of conversion from bond to share

is fixed by the company and the bonds are usually converted to common stocks.

You might also like

- PROFIT MAXIMIZATION Vs WEALTH MAXIMIZATIONDocument5 pagesPROFIT MAXIMIZATION Vs WEALTH MAXIMIZATIONAman poddar100% (1)

- LeveragesDocument51 pagesLeveragesmaitrisharma131295100% (1)

- Lecture Notes On Receivable ManagementDocument9 pagesLecture Notes On Receivable Managementritika rustagiNo ratings yet

- Investment AvenuesDocument35 pagesInvestment AvenuesJoshua Stalin SelvarajNo ratings yet

- CASE StudyDocument26 pagesCASE Studyjerah may100% (1)

- Objectives of A FirmDocument3 pagesObjectives of A Firmyasheshgaglani100% (1)

- CHAPTER 3 - Marketing PPT MGMTDocument41 pagesCHAPTER 3 - Marketing PPT MGMTrtNo ratings yet

- Ebit Eps AnalysisDocument25 pagesEbit Eps AnalysisSitaKumari33% (3)

- Synopsis Ratio AnalysisDocument2 pagesSynopsis Ratio Analysismoshiurrah0% (2)

- Merchant BankingDocument6 pagesMerchant BankingVivek TathodNo ratings yet

- Meaning and Nature of UnderwritingDocument3 pagesMeaning and Nature of UnderwritingDr. MURALI KRISHNA VELAVETINo ratings yet

- Baumol Model of Cash ManagementDocument1 pageBaumol Model of Cash ManagementMichelle Go100% (2)

- Topic 7 - Financial Leverage - Part 1Document82 pagesTopic 7 - Financial Leverage - Part 1Baby KhorNo ratings yet

- Financial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Document2 pagesFinancial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Sabhaya Chirag100% (2)

- Consumer FinanceDocument17 pagesConsumer FinanceVaishali Trivedi OjhaNo ratings yet

- Need & Importance of Capital BudgetingDocument4 pagesNeed & Importance of Capital BudgetingSrinidhi PnaNo ratings yet

- Goal Congruence MCS Form ProcessDocument9 pagesGoal Congruence MCS Form Processmukeshkumar91No ratings yet

- 5-Gec ModelDocument10 pages5-Gec Modelsirisha INo ratings yet

- Concept of Strategy, Concept of Strategic Management and TypeDocument18 pagesConcept of Strategy, Concept of Strategic Management and Typepopat vishalNo ratings yet

- Franchise Management Subject NotesDocument19 pagesFranchise Management Subject NotesAmyra JohnsonNo ratings yet

- PCA & RD Bank PDFDocument86 pagesPCA & RD Bank PDFmohan ks100% (2)

- Similarities and Differences Between Entrepreneurial VenturesDocument3 pagesSimilarities and Differences Between Entrepreneurial Venturesareel bhatti100% (1)

- Unit 1. Nature and Scope of Investment and Portfolio ManagementDocument7 pagesUnit 1. Nature and Scope of Investment and Portfolio ManagementCLIVE100% (1)

- Dividend TheoriesDocument22 pagesDividend TheoriesRadhakrishna Mishra100% (1)

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- Role of The State and Its Impact On Business OrganizationsDocument20 pagesRole of The State and Its Impact On Business OrganizationsBaby Joy Bautista100% (3)

- Ratio AnalysisDocument11 pagesRatio Analysiskarthik.s88% (24)

- Key Elements of Effective Portfolio ManagementDocument1 pageKey Elements of Effective Portfolio ManagementRameezNo ratings yet

- DebenturesDocument12 pagesDebenturesNamrata DasNo ratings yet

- An Overview of Financial ManagementDocument8 pagesAn Overview of Financial ManagementCHARRYSAH TABAOSARESNo ratings yet

- Properties and Pricing of Financial Assets ExplainedDocument23 pagesProperties and Pricing of Financial Assets ExplainedSharif Ullah100% (1)

- Virtual Stock Trading Journal GuideDocument16 pagesVirtual Stock Trading Journal GuideMaria100% (1)

- 7 Emerging Trends in Brand ManagementDocument2 pages7 Emerging Trends in Brand Managementgajendhar mbaNo ratings yet

- Role of Board of DirectorsDocument3 pagesRole of Board of DirectorsMee Fritzie ClarkNo ratings yet

- Alexandria Uni EMBA quiz on investmentsDocument1 pageAlexandria Uni EMBA quiz on investmentsWael_Barakat_3179100% (1)

- Tps Case StudyDocument16 pagesTps Case StudyHomework Ping100% (1)

- Japanese ModelDocument16 pagesJapanese ModelakhilNo ratings yet

- Chapter 4 - Sources and Uses of FundsDocument17 pagesChapter 4 - Sources and Uses of Fundsmarissa casareno almueteNo ratings yet

- 6 Working Capital ManagementDocument28 pages6 Working Capital Managementrommel legaspi0% (1)

- Four financial statements in annual reportsDocument2 pagesFour financial statements in annual reportsbrnycNo ratings yet

- Managerial Theories of Firms - PPTX MeDocument26 pagesManagerial Theories of Firms - PPTX MeNachiket Hanmantgad100% (3)

- Objectives of Investment GoalsDocument7 pagesObjectives of Investment GoalsVinoth CscNo ratings yet

- Internal AssessmentDocument48 pagesInternal AssessmentMicah Shaine ValdezNo ratings yet

- HR's Evolving Strategic RoleDocument8 pagesHR's Evolving Strategic Rolearmughan050% (1)

- Financial Statements Analysis - ComprehensiveDocument60 pagesFinancial Statements Analysis - ComprehensiveGonzalo Jr. RualesNo ratings yet

- TRUE-FALSE STATEMENTS Black - True And: Chapter 1 Introduction To Financial Management Answer KeyDocument4 pagesTRUE-FALSE STATEMENTS Black - True And: Chapter 1 Introduction To Financial Management Answer KeyMary Angeline LopezNo ratings yet

- Fin544-Stock and Debt ApproachDocument21 pagesFin544-Stock and Debt ApproachRakesh MoparthiNo ratings yet

- The Investment SettingDocument23 pagesThe Investment Settingnavin_singhNo ratings yet

- Dividend DecisionDocument5 pagesDividend DecisionRishika SinghNo ratings yet

- Asset-Management Chapter 5Document5 pagesAsset-Management Chapter 5kaylee dela cruzNo ratings yet

- Theories of MergersDocument10 pagesTheories of Mergerssam4sumeet100% (1)

- Capital StructureDocument41 pagesCapital StructuremobinsaiNo ratings yet

- Ratio Analysis - Tata and M Amp MDocument38 pagesRatio Analysis - Tata and M Amp MNani BhupalamNo ratings yet

- International vs Domestic Financial ManagementDocument14 pagesInternational vs Domestic Financial ManagementgowthamNo ratings yet

- What Are The SecuritiesDocument6 pagesWhat Are The SecuritiesSeigfreud LlanesNo ratings yet

- Investment LawDocument90 pagesInvestment LawROHIT SINGH RajputNo ratings yet

- Credit Card FraudsDocument63 pagesCredit Card FraudsAnaghaPuranikNo ratings yet

- Debentures ProjectDocument28 pagesDebentures ProjectMT RA100% (1)

- Unit 2Document11 pagesUnit 2POORNA GOYANKA 2123268No ratings yet

- Sources of Finance and Capitalization TheoriesDocument11 pagesSources of Finance and Capitalization Theoriespurvang selaniNo ratings yet

- Parikalpana Journal Cover (December-2017)Document2 pagesParikalpana Journal Cover (December-2017)hitekshaNo ratings yet

- Basic of DerivatiovesDocument12 pagesBasic of DerivatioveshitekshaNo ratings yet

- Financial ServicesDocument22 pagesFinancial ServiceshitekshaNo ratings yet

- BXPHARMADocument4 pagesBXPHARMASayeedNo ratings yet

- Investing Lessons in Time of CovidDocument1 pageInvesting Lessons in Time of CovidhitekshaNo ratings yet

- SubjectsDocument1 pageSubjectshitekshaNo ratings yet

- FAQ Corporate BondDocument11 pagesFAQ Corporate Bondashwini.krs80No ratings yet

- Research Paper On IPODocument5 pagesResearch Paper On IPOhitekshaNo ratings yet

- Case StudyDocument11 pagesCase StudyhitekshaNo ratings yet

- ArticlesDocument7 pagesArticlesrenga317914No ratings yet

- Unit 4Document14 pagesUnit 4hitekshaNo ratings yet

- Unit 1Document9 pagesUnit 1hitekshaNo ratings yet

- Chapter 3Document30 pagesChapter 3hitekshaNo ratings yet

- Account CommonsizeDocument4 pagesAccount CommonsizehitekshaNo ratings yet

- Valuation ReportDocument42 pagesValuation Reporthiteksha100% (2)

- Case study assignment quiz reading researchDocument8 pagesCase study assignment quiz reading researchhitekshaNo ratings yet

- CBMDocument4 pagesCBMhitekshaNo ratings yet

- NRPGDM Quiz 1 - Banking & Insurance TermsDocument1 pageNRPGDM Quiz 1 - Banking & Insurance TermshitekshaNo ratings yet

- ImjDocument17 pagesImjhitekshaNo ratings yet

- Stock LevelsDocument2 pagesStock Levelshiteksha100% (1)

- Model GST Act 2016 DraftDocument126 pagesModel GST Act 2016 DrafthitekshaNo ratings yet

- ArticlesDocument7 pagesArticlesrenga317914No ratings yet

- Banking & Insurance Quiz 2 - Principles, Policies, Marine Insurance, IRDA RolesDocument1 pageBanking & Insurance Quiz 2 - Principles, Policies, Marine Insurance, IRDA RoleshitekshaNo ratings yet

- SFMDocument2 pagesSFMhitekshaNo ratings yet

- TP FormulaeDocument1 pageTP FormulaehitekshaNo ratings yet

- Banking & Insurance Quiz 2 - Principles, Policies, Marine Insurance, IRDA RolesDocument1 pageBanking & Insurance Quiz 2 - Principles, Policies, Marine Insurance, IRDA RoleshitekshaNo ratings yet

- Unit 1Document9 pagesUnit 1hitekshaNo ratings yet

- Books Available at Taxmann PublicationsDocument6 pagesBooks Available at Taxmann PublicationshitekshaNo ratings yet

- PracticalsDocument1 pagePracticalshitekshaNo ratings yet

- IFRS Metodo Del Derivado HipoteticoDocument12 pagesIFRS Metodo Del Derivado HipoteticoEdgar Ramon Guillen VallejoNo ratings yet

- Broadcom Financial Analysis - Written ReportDocument28 pagesBroadcom Financial Analysis - Written ReportKipley_Pereles_5949No ratings yet

- NISM Series III A Securities Intermediaries Compliance NF Certication ExamDocument222 pagesNISM Series III A Securities Intermediaries Compliance NF Certication ExamNIFM PGDMFNo ratings yet

- Introduction To Bank AccountingDocument22 pagesIntroduction To Bank AccountingHenry So E DiarkoNo ratings yet

- Asset Allocation & Global InvestingDocument64 pagesAsset Allocation & Global InvestingZeeshan SiddiqueNo ratings yet

- Company Appeal (AT) (Ins.) No. 542 of 2023Document18 pagesCompany Appeal (AT) (Ins.) No. 542 of 2023Surya Veer SinghNo ratings yet

- InternshipsDocument24 pagesInternshipsMohammed Zakir HussainNo ratings yet

- CFA Level 1 - V2 Exam 1 PMDocument30 pagesCFA Level 1 - V2 Exam 1 PMHongMinhNguyenNo ratings yet

- BSTD Grade 10 Notes 2023Document101 pagesBSTD Grade 10 Notes 2023Lesego MoikabiNo ratings yet

- Investment Accounts PDFDocument35 pagesInvestment Accounts PDFRam Iyer80% (10)

- S SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexDocument64 pagesS SA Saif SAR Saturns SB SBD SC Scap SCR SD SDD SDR SE Seaq SEC SED Sehk SEK SHP Siac SIC SimexleenajaiswalNo ratings yet

- Pyq Merge f9Document90 pagesPyq Merge f9Anonymous gdA3wqWcPNo ratings yet

- SHV Ishares Short Treasury Bond Etf Fund Fact Sheet en Us PDFDocument3 pagesSHV Ishares Short Treasury Bond Etf Fund Fact Sheet en Us PDFMariano Javier DenegriNo ratings yet

- Homr Loan HDFC BankDocument73 pagesHomr Loan HDFC BankPRAKASHNo ratings yet

- Capital Market OverviewDocument74 pagesCapital Market OverviewSatish PenumarthiNo ratings yet

- Share Market Guide: Basics, Types, Trading & MoreDocument45 pagesShare Market Guide: Basics, Types, Trading & Moretn63 villanNo ratings yet

- B6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFDocument5 pagesB6301 Foundations of Valuation Syllabus Spring 2023 Supera PDFTrialNo ratings yet

- Financial reporting objectives and current liabilitiesDocument3 pagesFinancial reporting objectives and current liabilitiesJessel Ann MontecilloNo ratings yet

- Nism Securities Operations and Risk ManagementDocument117 pagesNism Securities Operations and Risk ManagementKailashnath GantiNo ratings yet

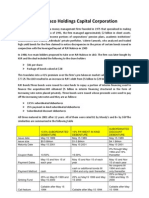

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaNo ratings yet

- FINC3015 Final Exam Sample QuestionsDocument5 pagesFINC3015 Final Exam Sample QuestionsTecwyn LimNo ratings yet

- Investor Doc 1716814Document295 pagesInvestor Doc 1716814Prakash RNo ratings yet

- Chapter 9 Financial Instruments: Learning ObjectivesDocument41 pagesChapter 9 Financial Instruments: Learning Objectivessamuel_dwumfourNo ratings yet

- BIBM Math WrittenDocument158 pagesBIBM Math WrittenIqBal HossaiNNo ratings yet

- Capital MarketsDocument10 pagesCapital MarketsAadityaMahanteNo ratings yet

- 2 Financial Markets and Interest RatesDocument21 pages2 Financial Markets and Interest Ratesadib nassarNo ratings yet

- Moody's Weekly OutlookDocument23 pagesMoody's Weekly OutlookAceNo ratings yet

- Financial Literacy and Stock Market ParticipationDocument3 pagesFinancial Literacy and Stock Market ParticipationNeemaNo ratings yet

- Ubs Global Family Office Report 2020Document21 pagesUbs Global Family Office Report 2020Peter ErnstNo ratings yet

- Cost of CapitalDocument8 pagesCost of CapitalSiva KotiNo ratings yet