Professional Documents

Culture Documents

What Is Cost-Plus Pricing Strategy

What Is Cost-Plus Pricing Strategy

Uploaded by

Agung HartantoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Cost-Plus Pricing Strategy

What Is Cost-Plus Pricing Strategy

Uploaded by

Agung HartantoCopyright:

Available Formats

What Is Cost-Plus Pricing Strategy?

by Scott Shpak; Updated November 06, 2018

Cost-plus is a marketing strategy used for pricing goods and services.

Cost-plus pricing is, perhaps, the most common way of establishing a profitable selling price for

a product or service, since it ensures that a company sells a product for more than it had cost

the company to make the product, provided that the cost calculations are accurate. Usually,

pricing on the cost-plus model adds a fixed percentage on top of unit cost. This may be

established by the company, and sometimes, it's a negotiating point with re-sellers who want to

gain a competitive edge.

Establishing Unit Cost

Central to the cost-plus strategy is the accurate definition of unit cost, since undervaluing the

true cost of providing a product or service means that the cost-plus price doesn't produce the

intended profit. For a company following generally accepted accounting principles, calculating

unit cost is generally straight forward.

Unit cost is calculated by adding direct material costs, direct labor costs and an allocation of the

company's overhead expenses. For example, if a company makes only one product, 100

percent of overhead expenses, or fixed costs, would be added to the unit cost price. If the

company adds a second product, perhaps 50 percent of fixed costs would be attributed to each

product, unless the new product represented a different proportion of the company's sales. The

point is to account for all of the company's fixed costs through unit cost allocation, so that unit

cost calculations present accurate break-even pricing, as the basis for its cost-plus strategy.

Creating a Cost-Plus Model

The cost-plus calculation itself is simple. Once the accurate unit costs are calculated, the

cost-plus value is simply added to unit cost. This doesn't include all market factors or influences,

however. There are costs such as return of unsold goods, for example, that may not be

accountable at the time of cost-plus pricing, except on a past-performance or projection basis.

Client contracts may also influence cost-plus pricing. For instance, a client who negotiates a

guaranteed maximum price contract could limit the cost-plus value, tying the producing

company to terms of the contract, even if production costs increase after the contract goes into

effect.

The Pros and Cons of Cost-Plus Pricing

The simplicity of the cost-plus strategy is perhaps its most attractive advantage. Establishing a

profitable sales price is easy, if you know the unit cost and the cost-plus amount. For example,

in a sales negotiation, a company representative can quickly calculate new pricing, if a potential

buyer increases an offer to purchase. If the representative knows that the cost-plus amount is

30 percent over unit cost, the representative could offer percentage incentives of, say, 10 to 15

percent for certain volume purchases, without accidentally pricing a product at a loss. Cost-plus

pricing ensures profitability and also provides a way of ensuring profit margins even as

production costs increase.

The primary drawback of cost-plus pricing is the assumption that unit cost is competitive.

Consider a company that manufactures a toaster for a $20.00 unit cost, to which it adds a 30

percent cost-plus amount for a retail price of $26.00. A competing company that makes a similar

toaster for $10.00 unit cost has a remarkable advantage. Pricing competitively, the other

company makes $16.00 of profit per sale, and they could even impact the more expensive

company by selling their toaster at half-price while maintaining 30 percent profitability.

Cost-plus strategy also removes some incentive for streamlining production efficiencies. Since

the cost-plus margin is assured regardless of production costs, a company may not seek to

lower its costs to either gain market advantage or increase profit margins. In fact, as sometimes

happens with government procurement contracts issued on a cost-plus basis, a disreputable

business may pad its costs or alter overhead allocations to create artificially inflated selling

prices.

In practice, cost-plus pricing may be part of a more flexible pricing strategy, one that factors in

categories such as market competition and pricing, rather than concerning itself with generating

fixed percentages of profit that are vulnerable to market conditions.

https://smallbusiness.chron.com/cost-plus-pricing-strategy-1110.html

You might also like

- "Ikigai - The Japanese Secret To A Long and Happy Life" (Book Summary)Document12 pages"Ikigai - The Japanese Secret To A Long and Happy Life" (Book Summary)Agung Hartanto100% (3)

- MANAGERIAL ECONOMICS Assignment 1Document23 pagesMANAGERIAL ECONOMICS Assignment 1BRAMANTYO CIPTA ADI100% (1)

- The India Soap Marker Consists of More Than 100 BrandsDocument2 pagesThe India Soap Marker Consists of More Than 100 BrandsArun MishraNo ratings yet

- Pricing ObjectivesDocument10 pagesPricing Objectivessundaravalli50% (2)

- A Level Economics Assignment - Profits and Profit MaximisationDocument3 pagesA Level Economics Assignment - Profits and Profit MaximisationHong Ken TeohNo ratings yet

- Merchandising CostingDocument11 pagesMerchandising CostingVishwajeet BhartiNo ratings yet

- Pricing StratagyDocument47 pagesPricing StratagyKranthiNalla100% (1)

- Pricing StrategyDocument9 pagesPricing StrategyVindhya ShankerNo ratings yet

- Sec - C Cma Part 2Document6 pagesSec - C Cma Part 2shreemant muniNo ratings yet

- Economics NotesDocument11 pagesEconomics NotesRuthveek FadteNo ratings yet

- Advantages and Disadvantages: Direct Materials Cost Variable AllocatedDocument1 pageAdvantages and Disadvantages: Direct Materials Cost Variable Allocateddinesh JainNo ratings yet

- Pricing: Introduction, Factors Affecting Pricing Decisions: Unit 3Document35 pagesPricing: Introduction, Factors Affecting Pricing Decisions: Unit 3siddharth nathNo ratings yet

- Pricing Strategies: Navigation Search Product ServiceDocument6 pagesPricing Strategies: Navigation Search Product ServiceSandhiya KalyanNo ratings yet

- Pricing MethodsDocument7 pagesPricing MethodsakmohideenNo ratings yet

- Pricing: Legal and Regulatory GuidelinesDocument6 pagesPricing: Legal and Regulatory GuidelinesVaibhav AroraNo ratings yet

- UNIT 5 StategiesDocument6 pagesUNIT 5 StategiesNari RaoNo ratings yet

- PricingDocument12 pagesPricingSupreet Singh BediNo ratings yet

- Definition of Pricing StrategyDocument7 pagesDefinition of Pricing StrategyYvonne WongNo ratings yet

- Cost Plus PriceDocument3 pagesCost Plus PricenituljyotidasNo ratings yet

- Pricing of Services: Cost-Based Pricing (Cost-Plus Pricing)Document1 pagePricing of Services: Cost-Based Pricing (Cost-Plus Pricing)JithinNo ratings yet

- International MarketDocument21 pagesInternational MarketNathish RajendranNo ratings yet

- Termeni Engleza 2Document18 pagesTermeni Engleza 2andrey7coNo ratings yet

- Managerial Economics Pricing StrategiesDocument5 pagesManagerial Economics Pricing StrategiespoojaNo ratings yet

- PricingDocument4 pagesPricingSrikanth ReddyNo ratings yet

- Pricing StrategiesDocument18 pagesPricing Strategiesduanedejager01No ratings yet

- Marketing MangementDocument26 pagesMarketing MangementPopuri Nagasai KrishnaNo ratings yet

- Pricing Strategy TermsDocument3 pagesPricing Strategy TermsVernie N. PiamonteNo ratings yet

- Unit 3 Marketing ManagementDocument18 pagesUnit 3 Marketing ManagementvasantharaoNo ratings yet

- Cost PlusDocument5 pagesCost PlusArare AbdisaNo ratings yet

- Pricing - Understanding Customer ValueDocument31 pagesPricing - Understanding Customer ValueKelvin Namaona NgondoNo ratings yet

- Activity 6: Module 6: InflationDocument4 pagesActivity 6: Module 6: InflationJoyce CastroNo ratings yet

- Pricing Strategy of StarbucksDocument28 pagesPricing Strategy of Starbucksvishrutak1760% (5)

- Pricing Strategy: Models of Pricing Absorption PricingDocument28 pagesPricing Strategy: Models of Pricing Absorption PricingNarsingh Das AgarwalNo ratings yet

- Pricing StrategiesDocument7 pagesPricing StrategiesPrakhyathThejveerNo ratings yet

- U5 Pricing EconomicsDocument17 pagesU5 Pricing EconomicsHepsi KonathamNo ratings yet

- Chapter 4Document20 pagesChapter 4Aydin NajafovNo ratings yet

- UNEC - International School of Economics: Pricing On The World MarketDocument50 pagesUNEC - International School of Economics: Pricing On The World MarketNihad PashazadeNo ratings yet

- Pricing StrategiesDocument13 pagesPricing Strategiesbitawfiq100No ratings yet

- PR Chapter Six-Principles of MarketingDocument13 pagesPR Chapter Six-Principles of MarketingyeshiwasdagnewNo ratings yet

- Week 7 8Document10 pagesWeek 7 8rosieselew091No ratings yet

- Assignment 1Document11 pagesAssignment 1Hai NinhNo ratings yet

- Cost & Management AccountingDocument9 pagesCost & Management AccountingUdbhav ShuklaNo ratings yet

- A3 - ECON 119-1 - Osunero, LeanzyDocument6 pagesA3 - ECON 119-1 - Osunero, Leanzyleanzyjenel domiginaNo ratings yet

- Chapter 3 - Pricing Objectives and Price DeterminationDocument7 pagesChapter 3 - Pricing Objectives and Price DeterminationChierhy Jane BayudanNo ratings yet

- Assignment On Marketing Management: Mr. Maninderpal Kaur (120425718) Hardeep Sharma (120425717)Document11 pagesAssignment On Marketing Management: Mr. Maninderpal Kaur (120425718) Hardeep Sharma (120425717)Preet RandhawaNo ratings yet

- Price Structure PriceDocument4 pagesPrice Structure PriceJOLLYBEL ROBLESNo ratings yet

- Management Accountring Unit 3Document38 pagesManagement Accountring Unit 3Vishwas AgarwalNo ratings yet

- Unit - 4 Definition of PricingDocument15 pagesUnit - 4 Definition of PricingmussaiyibNo ratings yet

- Pricing Strategy Chapter 2Document29 pagesPricing Strategy Chapter 2Kimshen TaboadaNo ratings yet

- Advantages of Cost Plus PricingDocument1 pageAdvantages of Cost Plus PricingLJBernardoNo ratings yet

- .What Is A Fixed Cost and Variable CostDocument4 pages.What Is A Fixed Cost and Variable CostJennelNo ratings yet

- Cost Plus Transfer Pricing ExamplesDocument2 pagesCost Plus Transfer Pricing ExamplesLJBernardoNo ratings yet

- ECONOMICDocument2 pagesECONOMICKimberly HipolitoNo ratings yet

- CPRG-Volume-1 Análise de PreçosDocument140 pagesCPRG-Volume-1 Análise de Preçosvsbotino84No ratings yet

- Price Unit 2Document11 pagesPrice Unit 2MathiosNo ratings yet

- Pricing Meaning DefinitionDocument22 pagesPricing Meaning Definitionchinmaykhara27No ratings yet

- Pricing Staregies and TacticsDocument40 pagesPricing Staregies and TacticsrithikkumuthaNo ratings yet

- Group 6Document41 pagesGroup 6Ej RubioNo ratings yet

- Markting 6Document12 pagesMarkting 6History and EventNo ratings yet

- Unit IiiDocument21 pagesUnit IiiAnuradha MauryaNo ratings yet

- Pricing: Chapter - 7Document19 pagesPricing: Chapter - 7GUDINA MENGESHA MEGNAKANo ratings yet

- 9 Recommended Books That Bill Gates, Jeff Bezos, and Warren Buffett Think You Should ReadDocument3 pages9 Recommended Books That Bill Gates, Jeff Bezos, and Warren Buffett Think You Should ReadAgung HartantoNo ratings yet

- The Top Five Principles of Successful RetailDocument3 pagesThe Top Five Principles of Successful RetailAgung HartantoNo ratings yet

- How Coconut Farmers Can Become RichDocument7 pagesHow Coconut Farmers Can Become RichAgung HartantoNo ratings yet

- David TIF Ch05Document23 pagesDavid TIF Ch05Jue Yasin64% (11)

- IJSER15814Document4 pagesIJSER15814Aravinda ShettyNo ratings yet

- Introduction To RetailingDocument4 pagesIntroduction To Retailingankiee syNo ratings yet

- PPC Tutorial PDFDocument68 pagesPPC Tutorial PDFSoumik NagNo ratings yet

- Ice Cream Monthly Performance - Feb'2020Document43 pagesIce Cream Monthly Performance - Feb'2020Gulfam AnsariNo ratings yet

- Professional Salesmanship Week 1Document6 pagesProfessional Salesmanship Week 1Ronnie Jay100% (2)

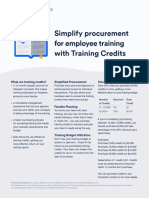

- Atlassian Training CreditsDocument1 pageAtlassian Training Creditsdaniela villalobosNo ratings yet

- Starting A Caf or Coffee Shop BusinessDocument11 pagesStarting A Caf or Coffee Shop Businessastral05No ratings yet

- MBS 1st and 2nd Sem Syllabus 2018 PDFDocument22 pagesMBS 1st and 2nd Sem Syllabus 2018 PDFSantosh Kumar GuptNo ratings yet

- CV Fashion DesignerDocument3 pagesCV Fashion DesignerSushNo ratings yet

- Presentation Airbnb ProfileDocument14 pagesPresentation Airbnb ProfileGuillermo VillacrésNo ratings yet

- 7004mfh CW ExemplarDocument23 pages7004mfh CW ExemplarNasiya JahanNo ratings yet

- Internship ReporDocument55 pagesInternship ReporRaj GaneshNo ratings yet

- Week 9-1698913045694Document21 pagesWeek 9-1698913045694Rizky MaulanaNo ratings yet

- Market Mapping and SegmentationDocument14 pagesMarket Mapping and SegmentationRam Ramji0% (1)

- Marketing Management CGDocument20 pagesMarketing Management CGAmie Jane MirandaNo ratings yet

- Managing Research As An Investment Portfolio 02172011Document5 pagesManaging Research As An Investment Portfolio 02172011google_overture8441No ratings yet

- A Study On The Effectiveness of Advertisement in KTDC Hotels and Resorts Limitted TVMDocument13 pagesA Study On The Effectiveness of Advertisement in KTDC Hotels and Resorts Limitted TVMSooryakanth PvNo ratings yet

- c01 PDFDocument32 pagesc01 PDFmiraaloabi100% (1)

- Marketing Research and Market IntelligenceDocument10 pagesMarketing Research and Market IntelligenceSatyender Kumar JainNo ratings yet

- ERPA Leadership Meeting Consolidated SummaryDocument34 pagesERPA Leadership Meeting Consolidated SummaryReverend ChicagodomNo ratings yet

- 5 Consumer BehaviourDocument27 pages5 Consumer BehaviourHarshit SharmaNo ratings yet

- IMT 30 Sales and Distribution Management M1Document3 pagesIMT 30 Sales and Distribution Management M1solvedcareNo ratings yet

- Distribution ManagementDocument17 pagesDistribution Managementleni thNo ratings yet

- Management Hierarchy: Askari Bank LimitedDocument14 pagesManagement Hierarchy: Askari Bank LimitedEeshaa Malik50% (2)

- Volvo Trucks: Penetrating The U.S. Market: Strategy ManagementDocument4 pagesVolvo Trucks: Penetrating The U.S. Market: Strategy ManagementManish SinghNo ratings yet

- A Study On Customer Preference For Honda H'nessDocument9 pagesA Study On Customer Preference For Honda H'nessAshokNo ratings yet

- Analysis For A New Beauty SalonDocument2 pagesAnalysis For A New Beauty SalonJulio Cesar H.G.No ratings yet