Professional Documents

Culture Documents

Ey The Chemical Industry Reimagined Vision 2025 PDF

Uploaded by

Gurukrushna PatnaikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ey The Chemical Industry Reimagined Vision 2025 PDF

Uploaded by

Gurukrushna PatnaikCopyright:

Available Formats

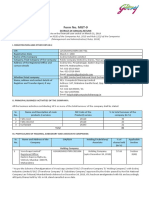

Issue 09 | August 2018

Point of view

Life Sciences, Health

and Chemicals

The chemical

industry

reimagined —

vision 2025

Foundation businesses | Platform businesses | Ecosystem businesses

1. Foreword

Before we disappoint you with our conclusions at the

end, let us warn you now: our vision will not be

numbers-focused — EY’s crystal ball for 2025 was

temporarily out of order.¹ Nevertheless, we see the

chemicals industry at the tipping point between a new

future and a downgrading to a general purpose utility

function for others. Classical thinking about the

industry is maxed-out, and by now most of the players

are trapped in a prisoner’s dilemma, preventing them

from embracing new ways. It’s time leaders in

chemicals take their heads out of the sand, open their

minds and reimagine their industry by first giving up

their industry thinking. In this paper, we will explain the

trends we are currently observing, their consequences

and how these could impact chemical companies.

2. How our world is changing

Recent publications have tried to forecast numbers

for 2025. However, we believe we’d all be better off

acknowledging we would be wrong anyway in trying to complicated problem-solving methods obsolete and,

predict the same. So, we’ve decided not to follow that as a result, all projections become meaningless.4 In a

route. As Roy Amara famously said:² complex system (world), we are no longer able to

know all the influencing factors; the relationship

“We always overestimate the change that will

between these factors is also not transparent. This

occur in the next two years and underestimate

means we are not able to define an equation for any

the change that will occur in the next 10.”

prediction that realistically mirrors reality. Abstraction

This has been proven over and over again; even the becomes too high-level to produce meaningful output.

brightest minds and companies have fallen victim to

this fallacy (see the following table for examples). Humans are just not good enough in estimating the

Even experienced and famous experts aren’t able to impact caused by exponential and strongly networked

accurately forecast. As Philip Tetlock found in his developments combined with too many unknowns,

research, in making a forecast “the average expert such as we are experiencing in our current age of the

was roughly as accurate as a dart-throwing fourth industrial revolution. Putting numbers on the

chimpanzee.“3 future in the hope of ensuring and fulfilling business

success is not possible. It’s better to stick with

The reason for this failure is that, as a business Alan Kay, who said:5

executive, you have to understand the difference

between complicated and complex. Rick Nason nicely

“The best way to predict the future is to

elaborates that most business problems are getting

invent it.”

more and more complex, making our tried and tested

1

In the course of our argumentation, we explain why we skipped the number-crunching and forecasting the industry until 2025.

2

Later repeated by Bill Gates.

3

Philip Tetlock and Dan Gardner, Superforecasting: The Art and Science of Prediction (Signal, 2015).

4

Rick Nason, It’s not complicated: The Art and Science of Complexity in Business (Rotman-UTP Publishing, 2017).

5

Alan Kay, at a meeting of PARC, 1971

2 | The chemical industry reimagined — vision 2025

Or, consider these words from Michael Anissimov6:

Example: computers

“One of the biggest flaws in the common conception

of the future is that the future is something that • Past:

happens to us, not something

• “I think there is a world market for maybe five

we create.”

computers.” — Thomas Watson, President of

We know that for engineering-minded people this IBM, 1943

mindset is new, and the past decades of scientific • “There is no reason anyone would want a computer in

their home.” — Ken Olsen, founder of Digital

management and strategic planning driven by MBA

Equipment Corporation, 1977

educations were different.7 These worked well for

complicated problems but no longer apply when the

• Reality:

system becomes predominantly complex. It’s now

about “doing the right thing” and no longer about • 308 million sold in 2014 alone (IDC: worldwide PC

“doing things right” with number-crunching market: 1Q15 Update)

optimization. The past is no longer a predictor

of the future, and this is a challenge for all of us Example: mobile phones

schooled in traditional strategy tools and traditional

professional services.

• Past:

Safety was and remains important in chemicals: getting • “Forecast cell phone penetration in the US by 2000.

important things wrong can cause dramatic The consultant’s prediction, 900,000 subscribers,

consequences for humans and nature. But here we are was less than 1% of the actual figure, 109 million.”

— McKinsey, 1980

talking about a business sector that is always

uncertain, therefore we shouldn’t expect overly precise

predictions. Often in today’s business world, these • Reality:

kinds of reports are a form of management insurance, • 5 billion mobile users worldwide, with 400 million in

as in: “ABC said …“ Such an approach no longer works; the US in 2014

in a dynamic world, you have to take back the driver’s

seat with all its consequences otherwise the “train will

leave the station before you realize that you should be Example: internet

on it.“

• Past:

The chemical industry is a heavy asset world, and too

• “Almost all of the many predictions now being made

many people today confuse digital disruption in

about 1996 hinge on the Internet‘s continuing

technology, media and similar industries with exponential growth. But I predict the Internet will soon

disruptions in asset industries. Industry 4.0 had great go spectacularly supernova and in 1996

ambitions for the manufacturing industry, but catastrophically collapse.” — Robert Metcalfe, founder

degenerated toward a pure efficiency play, neglecting of 3Com, 1995

the significantly bigger impact of new possibilities.

Just because you can’t calculate the possibilities in • Reality:

Excel doesn’t mean they will not appear. Or as Dilbert • 3 billion internet users worldwide; 42% penetration

nicely phrased it:8 rate worldwide

6

Michael Anissimov, Chapter six of The Singularity Is Near : When Humans Transcend Biology by Ray Kurzweil, The Viking Press, 1st edition ©2005.

7

Henry Mintzberg highlighted in “The Fall and Rise of Strategic Planning,“ in the January-February 1994 issue of the Harvard Business Review, that strategic planning is doomed to fail.

8

Scott Adams, “Dilbert,“ http://dilbert.com/buy?date=2010-12-23, 23 December 2010, Andrews McMeel Syndication

The chemical industry reimagined — vision 2025 | 3

3. What it means for chemicals that sheer size and scale is the ultimate success factor,

we believe that in an ecosystem future, size will most

likely not be key to success as in today’s world of

We are certain that the chemicals industry will not

economies of scale and synergies. Telecom providers

disappear because of the fundamental role it plays in

were big in the past, they even held monopoly positions

more or less every other industry, and the fact that it is

in their markets, but that didn’t protect them from

strongly asset-based (or have you ever tried to build

being degraded to general purpose infrastructure

your personal steam-cracker in your own backyard?).

providers. Big web and technology companies are

Nevertheless, the chemical industry will be impacted

eating into the margins on which their infrastructure is

not only from within its own industry but also greatly

based. Essential in the new ecosystem world will be

by its customer industries. Currently, we don’t see any

how you integrate, which role you play in which

game-changing technological innovation on the radar

ecosystem, rather than the size of your assets.

that could change the overall production process, as

Furthermore, how dynamically you will be able to

3D printing has done in manufacturing. Some areas,

change, react and adapt to new market thinking and

such as performance materials, batch-to-conti reactors9

how easy or difficult it will be for your organization to

or biosynthesis, could change the dynamics, but this

follow, or even lead, will also play an essential role.

has to be proven on large scale. The outcomes of

Recent chemical industry trends, such as digital supply

Figure 1: Transformation to ecosystems in three stages

chain, vertical and horizontal integration with

everybody and everything (Internet of Things is

calling), big-scale M&As, and the move downstream

Business toward special chemicals, are, in our opinion, short-

impact

term scale-ups and optimizations for the current mode

of operation, which is “doing things right.“ They will not

Disruption

ensure the long-term success of a chemical company

because they stay within their current scope of

Revolution

industry thinking: seeking new competitive advantages

by establishing newer, stronger market-entry barriers,

Evolution

Time

molecular patents of the last 30 years are manageable,

and we don’t see any threat of dematerialization in

chemicals, therefore supporting physical chemical

products for the next decades. This limits the impact of

disruption, the feared and massive disruption that

happens when products get dematerialized, such as

happened in the music, media and banking industries,

when the full exponential powers of digital disruption

converged.

However, due to the digital revolution, chemicals will

inherently move toward new business and operating

models. This will mainly be driven by the disintegration

of our classical industries and the formation of

ecosystems (see Figure 2: Convergences toward

ecosystems). Despite the current mainstream belief

9

For example, Ehrfeld Mikrotechnik Miprowa Reactor

4 | The chemical industry reimagined — vision 2025

be it low costs or unique values or services. As Rita or collaboration and co-innovation. You will act more

McGrath elaborates very clearly, this strategic direction like a network of players than a value chain of

has its limits — the end of competitive advantage in the competitors.11 This makes it mandatory to apply new

classical sense has come.10 For “chemical tankers,” this management approaches that are derived more

means they are heading toward a storm, because their from the complex system theory and copy the

competitive advantages today are: behavior of biological systems, like our nerve cells.

a. Economies of scale and synergies (big, heavy assets c. Today’s product portfolio of the chemical industry

and strongly interconnected production sites) will commoditize at an accelerating pace (see

Figure 3: Commoditization), driven also by the fact

b. IP protection

that the classical oil and gas industry is moving

c. Unique access to feedstock, especially oil and gas downstream beyond petrochemicals for harvesting

new grounds.

The well-known mega trends, such as urbanization,

climate change and sustainability, are very applicable d. Digitalization will re-shift today’s operations and

and important; nevertheless, they are only a first step enable a reconfiguration of the industry, jointly with

toward a future world for chemicals. Our way of the first factor. Many activities that previously

thinking doesn’t omit them, but our approach goes fostered the creation of big chemical conglomerates

beyond thinking in the same box (taking the definition due to better economies of scale or/and transaction

of chemical industry for granted). At a macro- costs are now fundamentally changing, resulting in

socioeconomic level, we see seven factors: lower transaction costs (e.g., availability of know-

how, complexity of plant operations), which

a. Foremost, the classical client industries of chemical questions today’s operating models.

companies are converging toward ecosystems (see

Figure 2: Convergences toward ecosystems). e. M&A and the drive toward special chemicals and

solutions will not generate the anticipated

b. In an ecosystem environment, it is less about your competitive advantages. As the term special

own particular service, solution or product. It’s chemicals says, it was about being special, resulting

about the overall solution combined from multiple in serving a niche market. Now, having everybody

building blocks and generated by joint cooperation heading downstream makes markets too small to

Figure 2: Convergences toward ecosystems

10 2

Automotive and transportation Smart humans

Ecosystem will combine products and services from today’s diverse

Smart worksites Smart homes

industries.

Consumer products The customer will be in the focus and served with a holistic offering

based on their changing demands.

9 3

Despite the well-discussed “smart vehicles” ecosystem with the Smart Smart offices

Electric and electronics mobility as a service world another illustrative examples smart production and and education

health care: warehouses Digital

Clinics and medical professionals identify the problem.

Agriculture

ecosystems Smart

Chemicals could provide customized nutrition supply

Smart vehicles retail,

based on the clinical results.

wholesale,

Energy and resources Combined with real-time wearable technology tracking the 8 distribution 4

nutrition supply can be adopted.

It’s not a standalone offering: strong physical and information Smart Smart

Health and nutrition supply chain integration is needed between. transportation health care

Smart urban

environments

Construction and housing 7 5

10

Rita McGrath, The End of Competitive Advantage (Harvard Business Review Press, 2013).

11

Frank Jenner, “Die Komplexität wächst — IT-Visionen in der Prozessindustrie,“ CHEManager 22/2002.

The chemical industry reimagined — vision 2025 | 5

operate economically and erodes the glorified since chemical production facilities have risen in the

higher margin that initially attracted everybody. last 20 years in the emerging markets, will result in

Classical basic economical reactions of demand and less ecological impact due to shorter transportation

supply with an equilibrium price result in more distances.

supply because more players go into the same niche

g. Innovation, especially in the downstream areas,

but cause falling prices when demand is stable.

becomes more and more expensive due to

f. Global trade flows for ecosystem businesses will regulations and the maturity of the field. For

diminish, reshaping the supply chains of today. For example, in AgriChemicals, the lead time and the

foundational businesses where asset scale stays key, costs are already approaching those levels,

we foresee regional clusters, e.g., in Europe, Asia triggering an industry consolidation as in the

and the Americas. Today’s products will be pharma sector during the '80s and '90s.

produced and used within these clusters. Eliminating

transcontinental transportation of these chemicals,

Figure 3: Commoditization12

Exhibit 3 — The commodity frontier continues to move the right

Commodity Few remaining riches Rapid commoditization Onset commoditization Specialty

Intermediates Specialty Premium

Feedstock Petrochemicals chemicals

Plastics materials

Technical

Natural gas Methanol EO,5 PO6 Monomers ETP¹³

polymers

Functional Thermoset

LPG¹ Ethylene Solvents Seeds

chemicals resins

Crop

Naphtha Propylene Additives

protection

Gas oil C4+³ Polyolefins PET,9 PMMA10 Coatings Catalyst

NGL² BTX4 PVC,7 PS8 ABC,11 PC12 Pigments Battery materials

Commodity Increasing

markets complexity

Fragmented More

markets concentrated

Significant Commodity frontier moving to the right markets

volatility (price Low volatility

and demand) Value-based

Cost-curve- pricing

based pricing

1 Liquefied petroleum gas 8 Polystyrene

2 Natural gas liquids 9 Polyethylene terephthalate

3 Butadiene, butylenes 10 Polymethyl methacrylate

4 Benzene, toluene, xylene 11 Acrylonitrile butadiene styrene

5 Ethylene oxide 12 Polycarbonate

6 Propylene oxide 13 Engineering thermoplastics

7 Polyvinyl oxide

12

McKinsey: commoditization of chemicals, 2016.

6 | The chemical industry reimagined — vision 2025

4. Reimagine chemicals: the 4.1 Foundation businesses

chemical world in 2025 Foundation businesses, which definitely include

today’s chemical value chain up to the intermediates,

In the future, most of today’s chemical industry players will be managed based on traditional efficiency thinking

will be general purpose production industrial methods using the well-established complicated

foundation businesses, serving slavish multiple thinking management methods.

ecosystems. They will be trapped, just like the telco

infrastructure providers that provide the basic Why does this happen? Like the banking industry in the

infrastructure for today’s hyper-connected world, while 1990s, chemical companies are often still integrated

other tech giants reap the biggest profits. Based on the along the process chain (vertical integration), but the

general purpose production foundation, a plenitude of reasons for this are now changing. To some extent,

ecosystem businesses operate within dedicated vertical integration is given by the physical production

ecosystems (see Figure 1: Convergences toward process. Production flow forces integration up to the

ecosystems). Both are intertwined by a third business end of the intermediary process step at least (see

category of platform businesses, which are potentially Figure 4: Industry structure (UBS) red marked area).

decentralized, automating most of the work. As soon the process is started, it will flow, and stopping

it or other interactions is hardly possible.13

Figure 4: Industry structure (UBS)

Chemicals market overview — creating products across the industrial and consumer world — Home Page — Industry Overview — Business divisions

of European stocks — Chemical products as percenatge of sales in Europe

Industrial gases

Upstream

Inorganics Oil and Gas

Industrial Gases

Salt, carbonates, ores (phosphorous,

silicon, metal, potash), etc. Natural gas Naphtha Heavy oils

Air gases

N2, 02, etc.

Commodity chemicals

Ethane

Wax

Propane

Lubricants

Chlorine, (Causticsoda) Ethylene

Fuel

Soda Ash Propylene

TiO2. Silicon Butadiene

Benzene

Toluene

Xylene

Specialty chemicals

Construction chemicals Water treatment

Glass manufacturing Pharmaceutical ingredients

Engineering plastics Adhesives

Crop Amino acids, food and personal care Catalysts

Agricultural chemicals

protection Pigments and industrial coatings Detergents

Downstream

Industrial manufacturing

Fertilizers Steel production

(Potash, Nitrate, Chemical manufacturing

etc.) Consumer care Paints and coatings

Food additives Surfactants

Flavor and fragrances Vitamins

Seeds

Consumer chemicals

13

At least as long as current production technology is used. Here, a new way of doing things would also put the downstream part of the chemical industry on a new growth trajectory.

The chemical industry reimagined — vision 2025 | 7

about a new business model here we are not

Example: referring to the on-trend discussions about solutions

instead of products, or providing services in

In near term, the foundation business will already realize a addition to chemical products. To be able to

fundamental and radical shift of employees out of traditional integrate into an ecosystem, it is necessary to

back-office functions that is literally driven by further process

leverage the full potential of diverse players by

automations, such as robotic process automation (RPA), followed by

machine learning (ML) and, finally, artificial intelligence (AI). This in cooperation and joint engineering of a multisided

itself will shake up the chemical industry and many companies will platform business. In these setups, different

not adapt fast or quickly enough and, therefore, will vanish from the industries join together. By so doing, they will

market when others have already established a more than 20% cost harvest the value add and be the tech giants

advantage. themselves. Just take nutrition chemicals and

However, this will not be the end of the game but just the starting imagine a smart health ecosystem:

point for ecosystem and platform businesses.

Example:

This is also the space where most of the heavy assets

are used in production, making it a perfect field of play Smart health: In such an ecosystem, hospitals, doctors, health

for economies of scale. However, it is also the area with insurance, pharma, fitness, food, and nutrition chemicals could be

the least know-how needed for production and where players who jointly provide the value proposition: healthy life. This

no product or service differentiation is possible ecosystem would be based on this purpose to provide healthy life to

(propane is propane — full stop), which is why it is the consumers, and the different players would each add their part.

Nutrition chemicals could provide supplements tailored to the

currently a commodity business driven by price.

individual based on the latest medical test results and the known

Integration beyond this point is generally reasoned with records of personal activity and stress (which might be provided by

economies of synergies, higher specialization and lower the fitness player operating a wearable device) to optimally support

transactions costs. the body. Looping in the health insurance provider, this could even

stimulate the insurance costs the consumer has to handle. Already

With today’s technology, these transaction costs, today we see examples of this: the Italian health insurance company

especially between the foundation and the ecosystem Generali offers policies that are connected to wearables, and

businesses, can be lowered by using a market consumers can benefit from having an active life. Fitness wearables

transaction compared with an intra-firm transaction. (e.g., FitBit) that are already connected to the food world to better

balance calorie intake and consumption (e.g., MyFitnessPal) provide

We are now able to efficiently communicate and settle

the consumer with active control of their metabolic life.

transactions for commodity goods.

You might ask, why now? As so often seen in other

industries, today’s technologies enable new modes of Ecosystem businesses are potentially very specific to

operation and interaction that which weren’t technically their ecosystem and, due to the fluid platform type of

and/or economically possible in the past. Without, for setup in an ecosystem, it will be a chance also for

example, the computing power at scale and in the cloud smaller firms to participate.

operating a platform business, a general purpose

Just as the internet provided access to many via a

production would not be economically feasible.

standardized process, the ecosystem will ultimately

4.2 Ecosystem businesses find a standard that is open to ensure that critical mass

is reached (see next chapter). In the abovementioned

Ecosystem businesses will be the integrators into the example, the scenario could go so far that supplements

ecosystems, containing the downstream parts of are personalized at home, with a printer-like device that

today’s value chain to the value-adding ecosystem is operated by the nutrition chemical company.

players from vast industries. They will follow the rules Operated means fed with the right instructions

of complexity and require not only a new business concerning dosing, automated resupplies as soon as

model but also new ways of management that are more the cartridges empty, or providing cartridges with

based on complex system management.14 When talking other ingredient depending on data analytics from the

14

For more on management approach, refer to Donald Sull‘s and Kathleen M. Eisenhardt‘s Simple Rules: How to Thrive in a Complex World (Mariner Books, 2015).

8 | The chemical industry reimagined — vision 2025

ecosystem. This would ultimately transform the However, marketplaces and platform businesses are

nutrition chemical company to an operator of millions similar in that they strive for growth based on network

of small devices instead of running a few factories only. effects (direct and indirect), which kick off as soon as

Here, proximity and agility are more important the number of consumers and providers on the

than scale. platform passes the critical frontier (see Figure 5:

Critical mass and frontier (based on Evans,

Today, it is unclear which players will initiate an “Matchmakers”)).

ecosystem and how these ecosystems will be balanced

in terms of power. What can be learned from the past is Figure 5: Critical mass and frontier (based on Evans,

that the monolithic positions of internet and tech giants “Matchmakers”)

will be unlikely. Today’s customers (B2B) and

consumers (B2C) are well aware of lock-ins and are Ignition

Side A

becoming more critical when it concerns the D* - Long run aquarium

monetization of their information. Ecosystem business C` Points of critical mass

builders would therefore benefit from taking a more

neutral approach and finding setups where the Movements at starting to achieve

critical mass

C*

consumer or customer stays in control of their C``

information. Emerging data market places where

consumer or customers monetize their data themselves

could be one way of achieving such a setup.

O

4.3 Platform businesses

Side B

The key role of a platform business will be to ensure a

Bringing both foundation businesses and ecosystem healthy ratio of players on both sides as otherwise the

businesses together results in the establishment of a ecosystem will not prove attractive for the consumer.

third category: platform businesses. These platform Players can provide a multitude of services (just refer

businesses are the glue holding all parts together. Their back to the “smart health” example). These can also be

reason for being is that the glue requires a certain complementary services, such as transportation or the

independence from the foundation and the ecosystem previously mentioned insurance. This need for multiple

businesses to become a trusted partner for business. different players with different industry backgrounds

The fear of lock-in will be significant, especially as the also explains why a vertical integration approach only

platform will hold most of the transactional data, giving for one company is just not feasible. Such a

it a very strong position. conglomerate would be gigantic and incur sky-

rocketing transaction or management costs internally,

Most readers now think of businesses like marketplaces

thereby resulting in suboptimal operations in all areas.

or transactional platforms. This is not wrong, but falls

short of the real picture. Marketplaces are very Foundation players will offer their commodities to the

rudimentary platform businesses; in a digital world, a ecosystem business, which then combines and

platform business will be more advanced. Marketplaces intertwines them into the ecosystem offering. The

in chemicals don’t have a great past: some started with interaction between the foundation and ecosystem

high ambitions, but have since disappeared. The key businesses will also be handled via a platform. We see

reason is that marketplaces foster competition by primarily basic end-to-end supply chain services, such

focusing purely on price, driving everybody out of the as integrated planning, supply and demand

market, either by becoming bankrupt or by finding synchronization, and optimization of production

other channels in which to sell. Even so, some platform utilization on this level. The latter is potentially the

providers survived while they are mainly based on its biggest lever as we are currently already experiencing

founding partners and serves a clear purpose of overcapacity in the basic and intermediate chemical

providing cheap transactional cost between chemical segments (see Figure 6: Capacity utilization in the EU

business partners. chemical industry). Applying a sharing-economy-style

yield optimization service here will ensure that the

whole industry operates more efficiently by

establishing a merit order curve for production

The chemical industry reimagined — vision 2025 | 9

capacity. Brutally said, the platform will define who will differentiation is not meaningful (foundation) and

make revenue based on the cost profile. Players with specialization by ecosystem integration will be possible.

too-high costs will lose market access or will just

service demand peaks — which can be a business model For today’s players in the chemical industry, the key

in itself, as you can see in the utility market, where question will be: who takes the position of the platform

peak demand capacity is paid very well. owner, and how will I react to this? We currently see

that in established industries multiple players are trying

Figure 6: Capacity utilization in the EU chemical to establish themselves as the platform

industry15 owner — in addition to their product and service

business — in the hope of harmonizing everyone on

120 85 their platform. This normally is very challenging as

everybody else fears getting locked-in and

Production index (2010 = 100)

115

Capacity utilization in %

110

80

105

100

disintermediated from their customer base. Some

95 75 industries try to solve this challenge by establishing

90

85

70

JVs for operating the platform, which brings a lot of

80

75

governance issues. With the emerging distributed

70 65

ledger technologies, the opportunity exists to establish

Q2/00

Q3/01

Q1/02

Q3/02

Q1/03

Q3/03

Q1/04

Q3/04

Q1/05

Q3/05

Q1/06

Q3/06

Q1/07

Q3/07

Q1/08

Q3/08

Q1/09

Q3/09

Q1/10

Q3/10

Q1/11

Q3/11

Q1/12

Q3/12

Q1/13

Q3/13

Q1/14

Q3/14

Q1/15

Q3/15

Q1/16

Q3/16

Q1/17

a decentralized platform stack that operates

EU chemicals capacity utilisation in %

EU chemicals production index (2010=100)

autonomously based on defined rules (e.g., smart

Long-term average level (1995-2016) contracts). This is owned by nobody, thereby taking the

fear out of the game. This will be a highly possible

option for the platform between the general purpose

Think of this emerging industry environment as foundation and the ecosystem business as the business

industry stacks (see Figure 7: Industry stack). At the contracts for these commodity goods are very well

lowest level, you find the infrastructure providers (the defined, which is prerequisite to establishing successful

general purpose foundation), which can be compared smart-contract-based platforms. As soon as the

with cloud service providers. On the next level, there contracts are incomplete, meaning not all conditions

will be a technical platform business that serves as a can be specified in advance, a fully automated platform

connection between the foundation business and the will not work. Such incompleteness is very likely the

ecosystem businesses, which themselves will be players case in the ecosystem platforms where the pieces need

in more specialized platforms within each ecosystem. to evolve and reach a commodity-like character before

By this, economies of scale will be leveraged where they can be automated.

Figure 7: Industry stack

Media/

Docs Consumers

Insurance Value service

ecosystem platform

Nutrition

chemicals D

Ecosystem businesses

Market place

Production model

Platform “ technical” 3PL

Demand/supply

Industry general

A B C purpose foundation

Chemicals Feed stock Complements, e.g..,

company transportation

service

15

European Commission Business and Consumer Survey

10 | The chemical industry reimagined — vision 2025

5. Road map

Fix the basics and get Revolutionize phase

digital (yesterday) (before 2020)

Digitize operations 1 a. Identify what is foundation

and what has ecosystem

2 potential

b. Identify the ecosystem to

Revolutionize phase II play in

(go live around c. Identify partners for a

2022—25) 3 platform (breaking the

prisoner’s dilemma)

Decentralize your

platforms

Fully disrupt

4 (beyond 2030)

6. Conclusions

The consequence for today’s chemical companies will Our vision lives from “standing on the shoulders of

be that their heavy assets and their diverse giants“15 and we are not hesitant to mention all the

conglomerates focused on economies of scale and other great thinkers. It is no value add for the world if

synergies will not provide them with competitive we just reinvent the wheel or crunch numbers again

advantages, and if they would, these will not be just to arrive at a proprietary or copyrighted truth that

strategically important as the rules of the game have is slightly different, but still wrong in the long run.

changed. Therefore, instead of investing in more heavy

What we aimed for in this document is to name key

assets or buying more companies, reimagine slicing

triggers that will reshape the chemical industry going

your conglomerate into effective operating pieces

forward and to derive potential scenarios or visions and

(connected both vertically and horizontally) and which

describe how the chemical industry might then look as

roles will apply to which pieces in the future. Be open

a result.

and start cooperating rather than forcing competition.

The future will be information- or knowledge-driven; in We encourage you to draw your own conclusions. We

this world, sharing will be key. would enjoy discussing your opinions with you.

Whether we agree or disagree, sharing will advance the

Our vision brings light and darkness for the chemical

thinking and knowledge of us all. Our attitude toward

industry. It might mean head-shaking for some of you,

chemicals has become very risk averse — leading to

well … we accept that. Nevertheless, we think we have

more management than leadership in the industry

added value to the discussion through our

(remember Dilbert), and this has to end. The future will

interpretation and reintegration of previous, current

come to pass no matter what, and we should look

and potential future work.

forward to enjoying it together instead of focusing

purely on the risks.

Sincerely,

Frank Jenner

Christian Neumann

15

Bernard of Chartres

The chemical industry reimagined — vision 2025 | 11

EY | Assurance | Tax | Transactions | Advisory

Contacts About EY

EY is a global leader in assurance, tax,

transaction and advisory services. The insights

and quality services we deliver help build

trust and confidence in the capital markets

Gerd W. Stürz and in economies the world over. We develop

EY GSA Market Segment Leader outstanding leaders who team to deliver on

Life Sciences Health and Chemicals our promises to all of our stakeholders. In so

Phone +49 221 2779 25622 doing, we play a critical role in building a better

working world for our people, for our clients

Mobile +49 160 939 18622

and for our communities.

gerd.w.stuerz@de.ey.com

EY refers to the global organization, and may

refer to one or more, of the member firms of

Ernst & Young Global Limited, each of which is

a separate legal entity. Ernst & Young Global

Limited, a UK company limited by guarantee,

Dr.-Ing. Frank Jenner does not provide services to clients. For more

Chemical Industry Leader information about our organization, please visit

Germany, Switzerland and Austria ey.com.

Phone +49 621 4208 18000

© 2018 EYGM Limited.

Mobile +49 172 9450920 All Rights Reserved.

frank.jenner@de.ey.com

EYG no: 03799-184GBL

ED None

This material has been prepared for general

Christian Neumann informational purposes only and is not intended

Co-author and EY Alumnus to be relied upon as accounting, tax or other

professional advice. Please refer to your

advisors for specific advice.

The views of third parties set out in this publication are not

necessarily the views of the global EY organization or its

member firms. Moreover, they should be seen in the context

of the time they were made.

ey.com

You might also like

- Decision Intelligence: Transform Your Team and Organization with AI-Driven Decision-MakingFrom EverandDecision Intelligence: Transform Your Team and Organization with AI-Driven Decision-MakingNo ratings yet

- Ey The Chemical Industry Reimagined Vision 2025Document12 pagesEy The Chemical Industry Reimagined Vision 2025Luca EgidiNo ratings yet

- 2023 Supply Chain Outlook: Expert Advice On Thriving in Times of ChangeDocument18 pages2023 Supply Chain Outlook: Expert Advice On Thriving in Times of ChangeYan JinNo ratings yet

- 19 Traits of Top Cios: Qualities, Values, and HabitsDocument12 pages19 Traits of Top Cios: Qualities, Values, and Habitsjcfchee2804No ratings yet

- Innovating From Necessity The Business Building Imperative in The Current CrisisDocument7 pagesInnovating From Necessity The Business Building Imperative in The Current CrisisAditya Singh RajputNo ratings yet

- new-fundamentals-report-eng_faDocument11 pagesnew-fundamentals-report-eng_fafnnc6jmgwhNo ratings yet

- Session 3 Rey Lugtu Strategic Thinking Ready For The Alternate FuturesDocument96 pagesSession 3 Rey Lugtu Strategic Thinking Ready For The Alternate FuturesRay Joseph LealNo ratings yet

- How To Become A Data Scientist in Six MonthsDocument15 pagesHow To Become A Data Scientist in Six MonthsSree ReethikaNo ratings yet

- Deloitte Au Consulting Digital Disruption Whitepaper 230217Document52 pagesDeloitte Au Consulting Digital Disruption Whitepaper 230217AlanNo ratings yet

- 083 Strategy+business Magazine Summer 2016Document116 pages083 Strategy+business Magazine Summer 2016Yevhen KurilovNo ratings yet

- Blockchain Startups: Watch Out ForDocument44 pagesBlockchain Startups: Watch Out ForPriya AnandNo ratings yet

- How To Turn Ambiguity Into Opportunity A New Approach To Strategy Under UncertaintyDocument11 pagesHow To Turn Ambiguity Into Opportunity A New Approach To Strategy Under UncertaintyjdomlNo ratings yet

- Venkat Digital Matrix BookletDocument7 pagesVenkat Digital Matrix BookletJayz JoeNo ratings yet

- Why Good Project Managers Make Bad Choices: The Power of IllusionsDocument10 pagesWhy Good Project Managers Make Bad Choices: The Power of IllusionsMohammad DoomsNo ratings yet

- KKR White - Paper Global Macro TrendsDocument20 pagesKKR White - Paper Global Macro TrendsAlaric Chua Sheng HaoNo ratings yet

- The Real Reason Manufacturing Digitalization FailsDocument6 pagesThe Real Reason Manufacturing Digitalization FailsajayvgNo ratings yet

- How To Build Scenarios - GBNDocument11 pagesHow To Build Scenarios - GBNVince TobiasNo ratings yet

- Connecting The DotsDocument111 pagesConnecting The Dotsrohit goswamiNo ratings yet

- CISO Strategies & Tactics For Incident Response: August, 2020Document12 pagesCISO Strategies & Tactics For Incident Response: August, 2020KrishnaNo ratings yet

- Kitsing IBPP Slides Scenario Planning Workshop 18211123Document48 pagesKitsing IBPP Slides Scenario Planning Workshop 18211123mayank AgrawalNo ratings yet

- Demo Lecture 2Document89 pagesDemo Lecture 2Umair CheemaNo ratings yet

- From To Everything You Wanted To Know About The Future of Your Work But Were Afraid To Ask Codex4799 PDFDocument55 pagesFrom To Everything You Wanted To Know About The Future of Your Work But Were Afraid To Ask Codex4799 PDFVedant MundadaNo ratings yet

- What Is Most Likely To Matter Tomorrow?: Books Worth Your TimeDocument2 pagesWhat Is Most Likely To Matter Tomorrow?: Books Worth Your TimeEric GarlandNo ratings yet

- Accelerated Digital Transformation Datascientists 112560Document17 pagesAccelerated Digital Transformation Datascientists 112560bujjbabuNo ratings yet

- NRF 2024 - MJV Technology & InnovationDocument46 pagesNRF 2024 - MJV Technology & Innovationjefferson CamposNo ratings yet

- FT - Coronavirus Has Transformed WorkDocument4 pagesFT - Coronavirus Has Transformed WorkStella PutriNo ratings yet

- 100 Ways to Boost Construction ProductivityDocument35 pages100 Ways to Boost Construction Productivityukasz-sznajder-1624No ratings yet

- 1 - BBDS - Why Learning Data Science Is An Absolute MustDocument59 pages1 - BBDS - Why Learning Data Science Is An Absolute MustbaikariNo ratings yet

- Fourth Industrial RevolutionDocument26 pagesFourth Industrial RevolutionMark Francis del CastilloNo ratings yet

- Itp M: I F, C M, B P: Mis Uarterly XecutiveDocument12 pagesItp M: I F, C M, B P: Mis Uarterly XecutiveGrand OverallNo ratings yet

- The New Now: Preparing for the 10 Trends that will Dominate a Post-COVID WorldFrom EverandThe New Now: Preparing for the 10 Trends that will Dominate a Post-COVID WorldNo ratings yet

- Emerging-Trends-In-Infrastructure-2022 KPMGDocument20 pagesEmerging-Trends-In-Infrastructure-2022 KPMGKa Yu YeungNo ratings yet

- CH 01 PDFDocument28 pagesCH 01 PDFAndemariamNo ratings yet

- CH 01 PDFDocument28 pagesCH 01 PDFAndemariamNo ratings yet

- Workforce of The Future: The Competing Forces Shaping 2030Document42 pagesWorkforce of The Future: The Competing Forces Shaping 2030Bảo ChâuuNo ratings yet

- Anatomy of A (Nearly Perfect) Press ReleaseDocument1 pageAnatomy of A (Nearly Perfect) Press ReleaseSko SkoNo ratings yet

- Contagious Radar 2024Document37 pagesContagious Radar 2024lanakharebovaaNo ratings yet

- Chief Data OfficerDocument17 pagesChief Data OfficerPankaj MadaanNo ratings yet

- 15th AnniversaryDocument1 page15th AnniversaryKrutarth PatelNo ratings yet

- Win With Decency: How to Use Your Better Angels for Better BusinessFrom EverandWin With Decency: How to Use Your Better Angels for Better BusinessNo ratings yet

- Desktop Engineering - 2014-09Document73 pagesDesktop Engineering - 2014-09Бушинкин ВладиславNo ratings yet

- Aula 11 - 2010 - Chris Adams Andy Neely - The Performance Prism 2000Document5 pagesAula 11 - 2010 - Chris Adams Andy Neely - The Performance Prism 2000TabitaNo ratings yet

- FTI 2021 Tech Trends Volume 7 Policy GovernmentDocument52 pagesFTI 2021 Tech Trends Volume 7 Policy GovernmentDani IrawanNo ratings yet

- Blix Digitalization Report 20160206Document203 pagesBlix Digitalization Report 20160206Jatinder KaurNo ratings yet

- Internet Futures Scenarios Explore Open vs Controlled ModelsDocument12 pagesInternet Futures Scenarios Explore Open vs Controlled ModelsMawuli AttahNo ratings yet

- Workforce of The Future The Competing Forces Shaping 2030 PWCDocument42 pagesWorkforce of The Future The Competing Forces Shaping 2030 PWCNatukula SrinivasuluNo ratings yet

- Perspectives from Global Leaders on the New Energy WorldDocument28 pagesPerspectives from Global Leaders on the New Energy WorldkriteriaNo ratings yet

- Productivity A Better Way From Stratex HubDocument17 pagesProductivity A Better Way From Stratex HubSelvaraj BalasundramNo ratings yet

- 41 Big Ideas That Will Change Our World in 2023Document40 pages41 Big Ideas That Will Change Our World in 2023Lamine KeitaNo ratings yet

- Your Definitive Guide To Ai in Corporate LearningDocument26 pagesYour Definitive Guide To Ai in Corporate LearningsajNo ratings yet

- Your Definitive Guide To Ai in Corporate LearningDocument26 pagesYour Definitive Guide To Ai in Corporate LearningsajNo ratings yet

- Communications201106 DLDocument132 pagesCommunications201106 DLhhhzineNo ratings yet

- Win With Decency: How to Use Your Better Angels for Better BusinessFrom EverandWin With Decency: How to Use Your Better Angels for Better BusinessNo ratings yet

- Project Management:: MS Samreen Malik: Duaa Nadeem 024 Hooriya Naseem 028 Miraj Sikander 047Document10 pagesProject Management:: MS Samreen Malik: Duaa Nadeem 024 Hooriya Naseem 028 Miraj Sikander 047hooriya naseemNo ratings yet

- The 'Security' ParadoxDocument15 pagesThe 'Security' Paradoxanna9412No ratings yet

- 10 Challenges Facing ITDocument4 pages10 Challenges Facing ITvincent otieno awandoNo ratings yet

- Template - BCP GeneralDocument20 pagesTemplate - BCP GeneralGurukrushna PatnaikNo ratings yet

- Company Contact Details SheetDocument98 pagesCompany Contact Details SheetGurukrushna PatnaikNo ratings yet

- Form MGT 9 FY 201819Document22 pagesForm MGT 9 FY 201819Gurukrushna PatnaikNo ratings yet

- Apteka - Participants - Profile1Document26 pagesApteka - Participants - Profile1Gurukrushna PatnaikNo ratings yet

- EvaluatePharma World Preview 2019 PDFDocument26 pagesEvaluatePharma World Preview 2019 PDFGurukrushna PatnaikNo ratings yet

- LIST OF ICC MEMBER-COMPANIES PERMITTED TO USE RESPONSIBLE CARE LOGODocument9 pagesLIST OF ICC MEMBER-COMPANIES PERMITTED TO USE RESPONSIBLE CARE LOGOYogesh Chhaproo100% (1)

- Ey The Chemical Industry Reimagined Vision 2025 PDFDocument12 pagesEy The Chemical Industry Reimagined Vision 2025 PDFGurukrushna PatnaikNo ratings yet

- Organizational Structure Changes Needed for Pharma Companies to Address High Employee TurnoverDocument4 pagesOrganizational Structure Changes Needed for Pharma Companies to Address High Employee TurnoverGurukrushna PatnaikNo ratings yet

- In Fs Deloitte Banking Colloquium Thoughtpaper CiiDocument23 pagesIn Fs Deloitte Banking Colloquium Thoughtpaper CiiAbhijeet AnandNo ratings yet

- 2019 Q3 - EN - LXS - Web PDFDocument17 pages2019 Q3 - EN - LXS - Web PDFGurukrushna PatnaikNo ratings yet

- 2019 Q3 - EN - LXS - Web PDFDocument17 pages2019 Q3 - EN - LXS - Web PDFGurukrushna PatnaikNo ratings yet

- Annual Report 2018-19 NewDocument224 pagesAnnual Report 2018-19 NewGurukrushna PatnaikNo ratings yet

- PWC - NBFC-the-changing-landscape PDFDocument28 pagesPWC - NBFC-the-changing-landscape PDFrahulp9999No ratings yet

- GAVL PERFORMANCE UPDATEDocument16 pagesGAVL PERFORMANCE UPDATEGurukrushna PatnaikNo ratings yet

- Mylan A4Factsheet ININNONP2099 EN V15.0Document4 pagesMylan A4Factsheet ININNONP2099 EN V15.0Gurukrushna PatnaikNo ratings yet

- The Importance of An SLA in RPODocument7 pagesThe Importance of An SLA in RPOGurukrushna PatnaikNo ratings yet

- Alkanes From Crude OilDocument28 pagesAlkanes From Crude OilAkram AishatNo ratings yet

- Nano-Scale ZSM-5 Zeolite Effectively Cracks HydrocarbonsDocument9 pagesNano-Scale ZSM-5 Zeolite Effectively Cracks HydrocarbonsIka SulistyaningtiyasNo ratings yet

- L8-9 Material BalancesDocument30 pagesL8-9 Material Balancesjivie30099867% (3)

- Neurotoxicologists urged consider effects safety healthDocument2 pagesNeurotoxicologists urged consider effects safety healthpmp aspirantNo ratings yet

- EGC Gas Compressor Guide 8182014Document16 pagesEGC Gas Compressor Guide 8182014zhangjie100% (1)

- Welder Qualification Test: Field Inspection & Certification DossierDocument7 pagesWelder Qualification Test: Field Inspection & Certification Dossieradnanbutt1984No ratings yet

- Feasibility Study of Dicyclopentadiene ProductionDocument3 pagesFeasibility Study of Dicyclopentadiene ProductionIntratec SolutionsNo ratings yet

- Short Notes On PolymerizationDocument6 pagesShort Notes On PolymerizationMohammed AshroffNo ratings yet

- The Star Process by Uhde: Industrial SolutionsDocument24 pagesThe Star Process by Uhde: Industrial SolutionsAjaykumarNo ratings yet

- Lecture2 (Petrochemical)Document12 pagesLecture2 (Petrochemical)ToniAndiwijaya100% (1)

- (Doi 10.1002 - 0471238961.0308121518090308.a01) Richey, W. Frank - Kirk-Othmer Encyclopedia of Chemical Technology - Chlorohydrins PDFDocument14 pages(Doi 10.1002 - 0471238961.0308121518090308.a01) Richey, W. Frank - Kirk-Othmer Encyclopedia of Chemical Technology - Chlorohydrins PDFWidya Isti AriantiNo ratings yet

- PEP Report 267A: Ihs ChemicalDocument8 pagesPEP Report 267A: Ihs ChemicalVinh Do ThanhNo ratings yet

- HP Top Project AwardsDocument9 pagesHP Top Project AwardsSterlingNo ratings yet

- Kitagawa Tube ListDocument16 pagesKitagawa Tube ListMehmet Ali TağNo ratings yet

- Reactions of Alkenes and AlcoholsDocument4 pagesReactions of Alkenes and AlcoholsRaquel da Silva JustinoNo ratings yet

- FChE SKKK 4153 PLANT DESIGN 2014/2015-SEM 1 FINAL REPORTDocument114 pagesFChE SKKK 4153 PLANT DESIGN 2014/2015-SEM 1 FINAL REPORTDivyansh Singh ChauhanNo ratings yet

- 4 Dissolved Gas AnalysisDocument55 pages4 Dissolved Gas AnalysisHoang Thanh VanNo ratings yet

- Valve Summary AS2473.3Document4 pagesValve Summary AS2473.3Time To Use BrainNo ratings yet

- Industrial OrganicDocument159 pagesIndustrial OrganicAfzaalUmair100% (1)

- Future Refinery FCCs Role in Refinery Petrochemical IntegrationDocument12 pagesFuture Refinery FCCs Role in Refinery Petrochemical IntegrationAzif RahmanNo ratings yet

- Petrochemical Plants in Malaysia PDFDocument12 pagesPetrochemical Plants in Malaysia PDFWan Faiz0% (1)

- Propylene Oxide - New MethodDocument8 pagesPropylene Oxide - New Methodvinicius_amaral_5No ratings yet

- PROPYLENE Mini Design Project UiTMDocument69 pagesPROPYLENE Mini Design Project UiTMSyazwina Azizi100% (2)

- Ácido Acrilico A Partir Da Glicerina IhsDocument18 pagesÁcido Acrilico A Partir Da Glicerina IhsLiège Costa0% (1)

- Naphtha Catalytic Cracking For Propylene ProudctionDocument5 pagesNaphtha Catalytic Cracking For Propylene ProudctionWong Yee SunNo ratings yet

- Feasibility Study of Isononanol ProductionDocument3 pagesFeasibility Study of Isononanol ProductionIntratec SolutionsNo ratings yet

- KBR Catalytic Olefins TechnologyDocument2 pagesKBR Catalytic Olefins TechnologyTomasz OleckiNo ratings yet

- Optimize Thermal Cracker via Linear ProgrammingDocument5 pagesOptimize Thermal Cracker via Linear ProgrammingDami TaiwoNo ratings yet

- Catalagram: A Catalysts Technologies PublicationDocument22 pagesCatalagram: A Catalysts Technologies PublicationMón Quà Vô GiáNo ratings yet

- CA2004312C - Production of Allyl Chloride - Google PatentsDocument5 pagesCA2004312C - Production of Allyl Chloride - Google PatentsTeeTeeXdNo ratings yet