Professional Documents

Culture Documents

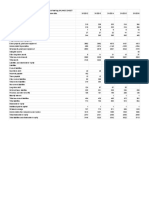

Components of AD and AS

Components of AD and AS

Uploaded by

ZeebaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Components of AD and AS

Components of AD and AS

Uploaded by

ZeebaCopyright:

Available Formats

Components of AD and AS

CONSUMPTION: Consumption expenditure is spending by households and

individuals on durable goods, nondurable goods, and services. Examples

include purchasing food, movie tickets, and vacations.

Some Factors that affect consumption are, disposable income, expected

future income, and wealth or credit.

INVESTMENT: This is spending on capital goods such as plant and

equipment and new buildings to produce more consumer goods in the

future by businesses. Investment includes foreign investment and

domestic investment. Foreign investment by government appears in the

financial and capital accounts of the BOP; such as foreign bonds,

securities, treasury bills. The government has no profit motive in these

investments, it is for the welfare of the general public. Business

investments do carry a profit motive.

Capital investment spending in the UK accounts for between 15-20% of

GDP in any given year.

GOVERNMENT EXPENDITURE: This is spending on state-provided goods

and services including public goods and merit goods by the government.

This spending is categorized into transfer payments and capital spending.

Transfer payments include pensions and unemployment benefits and

capital spending is on things like roads, schools and hospitals.

Governments spend for public welfare, increase AD and to re-distribute

income.

EXPORTS: Exports are the goods and services produced in one country

and purchased by residents of another country. When the country exports

more than it import, it has a trade surplus on BOP. US exported $1.12

trillion in goods between January and August 2018.

SAVINGS: Savings are leakages from circular flow of income occurring

when people decide to postpone their consumption until a future time. It

is household or business income that is not spent. Money can be saved in

banks, pensions, stock markets etc.… The higher the savings ratio in a

country, the lower the consumption and AD in that country would be. For

example; The saving ratio in UK has been falling since 2010 due to strong

customer spending. People might save for various reasons, for short terms

reasons such as holidays or for long tern reasons such as paying kids

college fees.

TAXATION: Taxation is a compulsory payment made by an individual to a

certain body; usually the government. It is charged on workers' income

and business profits, or added to the cost of some goods, services, and

transactions. Governments use taxation to encourage or discourage

certain economic decisions and it is the principal source of revenue for

them. There are two type of taxes; direct taxes and indirect taxes.

A direct tax cannot be transferred to a second or a third party.

Income tax is an example of direct taxes. This is divided further into two

parts; progressive income tax (the higher the income, the more the tax to

pay), and regressive tax (the more you earn, the less you pay). Direct

taxes are usually designed to be progressive, and so can be effective in

redistributing income

Indirect taxes are taxes imposed on goods and services. The burden

of these tax can be passed on to a third party such as the consumers.

Indirect taxes tend to be regressive, such as VAT, so this might result in

increased inequality and create inflation.

IMPORTS

Imports are the value of foreign goods and services bought by a country's

households, firms, government agencies, and other organisations in a

given period of time. Import spending is a leakage (or withdrawal) out of

the circular flow of income. Countries may have to scarcity or lack of

certain natural resources; Philippines having to import oil as they do not

produce imports.

There can be visible imports such as final products, semi- finished goods

or invisible imports such as locals spending abroad as tourists.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- UzAuto Motors IFRS Report FY2022Document41 pagesUzAuto Motors IFRS Report FY2022id00001875No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Payment Medium WorkbenchDocument27 pagesPayment Medium Workbenchanon_78372217250% (2)

- Quiz Fit Git ProblemsDocument2 pagesQuiz Fit Git ProblemsEverlyn YuNo ratings yet

- CorporationDocument6 pagesCorporationJane TuazonNo ratings yet

- Qatar TINDocument6 pagesQatar TINphilip.lambert.za8793No ratings yet

- Forecasting MCQ 1Document13 pagesForecasting MCQ 1Astrid TanNo ratings yet

- Ra 2067Document15 pagesRa 2067Erica DecasaNo ratings yet

- Cir v. PNB (474 Scra 303)Document15 pagesCir v. PNB (474 Scra 303)Karl MinglanaNo ratings yet

- Dividend Policy: Answers To QuestionsDocument10 pagesDividend Policy: Answers To QuestionsLee JNo ratings yet

- MilfordReview A.grahamDocument23 pagesMilfordReview A.grahamCommunities in Schools of DelawareNo ratings yet

- FGS 2018-11-15 Budget2019Consultation Report WebDocument116 pagesFGS 2018-11-15 Budget2019Consultation Report WebAndrew HudsonNo ratings yet

- Cta Eb CV 01844 D 2020feb26 Ref PDFDocument17 pagesCta Eb CV 01844 D 2020feb26 Ref PDFAemie JordanNo ratings yet

- Red Bus Bill 04.03.2024Document1 pageRed Bus Bill 04.03.2024sa jaNo ratings yet

- FINAL EXAM - TAXATION For ExamDocument7 pagesFINAL EXAM - TAXATION For ExamVincent SaavedraNo ratings yet

- Malayan Insurance Company v. St. Francis Square Realty CorporationDocument54 pagesMalayan Insurance Company v. St. Francis Square Realty CorporationBeltran KathNo ratings yet

- Saskatoon Budget at A GlanceDocument3 pagesSaskatoon Budget at A GlanceDavid A. GilesNo ratings yet

- CP575Notice 1640617328139Document2 pagesCP575Notice 1640617328139Dawson BanksNo ratings yet

- Deutsche Bank Vs CirDocument6 pagesDeutsche Bank Vs CirJarvy PinonganNo ratings yet

- CEU Balance SheetDocument1 pageCEU Balance SheetmadhuNo ratings yet

- Taxation ActivityDocument7 pagesTaxation ActivityJohn Cedric Ybañez ParkNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sunady MobilityNo ratings yet

- Chapter 11 HWDocument2 pagesChapter 11 HWVinícius AlvesNo ratings yet

- Sowbaghya - 17bba041 (Suren)Document38 pagesSowbaghya - 17bba041 (Suren)suren moorthy100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DIBYAJYOTI SAMANTANo ratings yet

- Tax Alert: Introduction of Digital Tax Stamps For Excisable GoodsDocument2 pagesTax Alert: Introduction of Digital Tax Stamps For Excisable GoodsEdwin UlikayeNo ratings yet

- Sched 2 & 5Document27 pagesSched 2 & 5Edmar SamortinNo ratings yet

- Relaxo Footwear: Milan 18B117 Harshita 18B113 Nischay 18B118 Raghavendra 18B122Document7 pagesRelaxo Footwear: Milan 18B117 Harshita 18B113 Nischay 18B118 Raghavendra 18B122Harshita GaurNo ratings yet

- PNL YOM727Document8 pagesPNL YOM727Sumit BeniwalNo ratings yet

- 7 - Bcom Benefits of GST To Economy and IndustryDocument13 pages7 - Bcom Benefits of GST To Economy and Industrymnr81No ratings yet

- Rent Vs Buy CalculatorDocument6 pagesRent Vs Buy CalculatorShihab MohammedNo ratings yet