Professional Documents

Culture Documents

Inv 1

Uploaded by

Aik Luen LimOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inv 1

Uploaded by

Aik Luen LimCopyright:

Available Formats

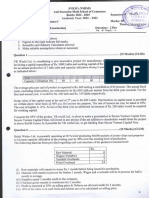

QUESTION 4

A company is considering two altemative investment projects both Of which require the purchase of new

equipmeni with a lifespan of four years. The following information relates to the two projects:

M

Proiect Prolect N

€000 €000

Purchase cost ofequipment - Year 0 350 600

Es\\rna\b$assD\rN\T\gPrs\r\s.

Year 1 (20) 50

Year 2 (5) 125

Year 3 210 90

Year 4 60 30

Estimated disposal value of equipment 70 80

The company's depreciation policy is to write off the cost of equipment using the straight-line method.

Cost of capital is 15olo Per annum.

Discount factors: Year 10% 15% '20% 25%

1 0.909 0.870 0.833 0.800

.2 0.826 0.756 0.694 0.640

3 0.751 0.658 0.579 0.512

4 0.683 0.572 0.482 0.410

REQUIRED

(a) Calculate for each of Project M and Project N, the:

(i) payback period

(7 marks)

(ii) net present value

(5 marks)

(iii) intemalrate of retum.

(6 marks)

(b) Recommend which project should be undertaken giving reasons for your decision.

(2 marks)

(Total20 marks)

3024l2l11lMA Page'10 of 15

You might also like

- Inv 2Document1 pageInv 2Aik Luen LimNo ratings yet

- Answer All Questions: (8 Marks)Document9 pagesAnswer All Questions: (8 Marks)manojNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- Cost ManagemnetDocument45 pagesCost ManagemnetGowri Shaji0% (1)

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- Dba 302 Financial Management Test 4TH March 2020 Part TimeDocument6 pagesDba 302 Financial Management Test 4TH March 2020 Part Timemulenga lubembaNo ratings yet

- Capital Budgeting Final - 1286455 - 2023 - 07 - 20 - 22 - 59Document14 pagesCapital Budgeting Final - 1286455 - 2023 - 07 - 20 - 22 - 59Nirav TibraNo ratings yet

- Management Accounting Level 3/series 2 2008 (Code 3024)Document14 pagesManagement Accounting Level 3/series 2 2008 (Code 3024)Hein Linn Kyaw67% (3)

- Project Appraisal FinanceDocument20 pagesProject Appraisal Financecpsandeepgowda6828No ratings yet

- Dba 302 Financial Management Supplementary TestDocument3 pagesDba 302 Financial Management Supplementary Testmulenga lubembaNo ratings yet

- Capital BudgetingDocument75 pagesCapital Budgetingsubroshakar gamerNo ratings yet

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- CA33 Advanced Financial Management-1Document4 pagesCA33 Advanced Financial Management-1Bob MarshellNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- Investment Appraisal TAE TESTDocument2 pagesInvestment Appraisal TAE TESTJames MartinNo ratings yet

- Oct 2018Document487 pagesOct 2018udayNo ratings yet

- Img 20200626 0001Document7 pagesImg 20200626 0001seyon sithamparanathanNo ratings yet

- A-3 Capital BudgetingDocument4 pagesA-3 Capital BudgetingUTkarsh DOgraNo ratings yet

- ADVANCED CORPORATE FINANCE 3rd TermDocument11 pagesADVANCED CORPORATE FINANCE 3rd TermdixitBhavak DixitNo ratings yet

- Mock - Main and Supplementary Examination and SolutionsDocument16 pagesMock - Main and Supplementary Examination and SolutionsGurveer SNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- ENT2Document3 pagesENT2danielzashleybobNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Tutorial 4 - Capital Investment DecisionsDocument4 pagesTutorial 4 - Capital Investment DecisionsIbrahim HussainNo ratings yet

- Tutorial 4 Capital Investment Decisions 1Document4 pagesTutorial 4 Capital Investment Decisions 1phillip HaulNo ratings yet

- GE 03.BMB - .L December 2017Document3 pagesGE 03.BMB - .L December 2017Md. Zakir HossainNo ratings yet

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocument2 pagesLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNo ratings yet

- BFC 3226 Introduction To Financial Management - 5Document3 pagesBFC 3226 Introduction To Financial Management - 5karashinokov siwoNo ratings yet

- Assessment 2 - Exam Paper - April 2022 CohortDocument8 pagesAssessment 2 - Exam Paper - April 2022 CohortRamona GabrielaNo ratings yet

- L-4/T-2/MME Date: 02/08/2015: Section-ADocument9 pagesL-4/T-2/MME Date: 02/08/2015: Section-AArif AmancioNo ratings yet

- PST Fundamentals of Finance 2015 2022Document58 pagesPST Fundamentals of Finance 2015 2022benard owinoNo ratings yet

- CE31206 Construction Planning and Management EA 2012Document2 pagesCE31206 Construction Planning and Management EA 2012Suman SahaNo ratings yet

- Question June - 2010Document8 pagesQuestion June - 2010pawan kumar MaheshwariNo ratings yet

- Paper 2 Quantitative Techniques PDFDocument12 pagesPaper 2 Quantitative Techniques PDFTuryamureeba JuliusNo ratings yet

- Strategic Financial ManagementDocument5 pagesStrategic Financial ManagementdechickeraNo ratings yet

- University of Mauritius: Faculty of Information, Communication and Digital TechnologiesDocument5 pagesUniversity of Mauritius: Faculty of Information, Communication and Digital Technologiesmy pcNo ratings yet

- Corporate Finance I763 UmyMzqnN1hDocument2 pagesCorporate Finance I763 UmyMzqnN1hABHINAV AGRAWALNo ratings yet

- Corporate Finance-AssignmentDocument4 pagesCorporate Finance-AssignmentAssignment HelperNo ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- M.E (2017 Pattern) 288 PDFDocument386 pagesM.E (2017 Pattern) 288 PDFkanchan khadeNo ratings yet

- Ce 8 Sem Construction Economics and Finance Jun 2017Document4 pagesCe 8 Sem Construction Economics and Finance Jun 2017Panna KurmiNo ratings yet

- Answer All Questions (100 Marks) Question One (20 Marks) : Bwfm5013 Corporate Finance MATRIC NODocument14 pagesAnswer All Questions (100 Marks) Question One (20 Marks) : Bwfm5013 Corporate Finance MATRIC NONur LiyanaNo ratings yet

- Project Planning and Capital BudgetingDocument16 pagesProject Planning and Capital BudgetingtoabhishekpalNo ratings yet

- FM ZadaciDocument48 pagesFM ZadaciPolovnaRobaNo ratings yet

- Stata w19Document3 pagesStata w19shreyashbworkNo ratings yet

- Practice 6 - QuestionsDocument4 pagesPractice 6 - QuestionsantialonsoNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- University of Zimbabwe: Professional and Industrial StudiesDocument7 pagesUniversity of Zimbabwe: Professional and Industrial StudiesBrightwell InvestmentsNo ratings yet

- Cost Grand Test 1Document5 pagesCost Grand Test 1moniNo ratings yet

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet