Professional Documents

Culture Documents

Estate Tax Payable Problem

Uploaded by

Marie Tes Locsin0 ratings0% found this document useful (0 votes)

25 views1 pageTaxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageEstate Tax Payable Problem

Uploaded by

Marie Tes LocsinTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

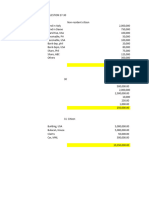

Estate Tax Payable

Illustration: Mr. Ice, a resident citizen, died living the following properties and estate deductions as

follows:

Properties Mr. Ice Mrs. Ice Conjugal Properties

Located in the Philippines

Personal Properties 1,400,000.00 1,100,000.00 2,500,000.00

Family Home 5,000,000.00

Other Real Properties 1,300,000.00 1,800,000.00 4,000,000.00

Total Philippine Properties 2,700,000.00 2,900,000.00 11,500,000.00

Located Abroad

Personal Properties 2,000,000.00 1,000,000.00 4,000,000.00

Real Properties 1,000,000.00 2,500,000.00 3,500,000.00

Total Foreign Properties 3,000,000.00 3,500,000.00 8,200,000.00

World Properties 5,700,000.00 6,400,000.00 19,700,000.00

The executor of Mr. Ice compiled the following expenses and deductions which are matched to their

respective sources:

Philippines and Abroad Mr. Ice Mrs. Ice Conjugal Properties

Funeral Expenses 250,000.00 0.00 350,000.00

Judicial Expenses 600,000.00

Obligations 1,000,000.00 1,800,000.00 2,000,000.00

Losses 200,000.00 400,000.00 300,000.00

Medical Expenses 400,000.00 200,000.00

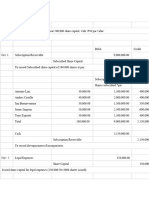

Estate Tax Payable

Illustration: An unmarried Filipino, Mr. Ice, a resident citizen, died living the following properties and

estate deductions as follows:

Properties Philippines Abroad Total

Motorcycle 120,000.00 - 120,000.00

Business Interests 1,500,000.00 800,000.00 2,300,000.00

Family Home 4,000,000.00 4,000,000.00

Other Personal Properties 200,000.00 100,000.00 300,000.00

Gross Estate 5,820,000.00 900,000.00 6,720,000.0.0

The following expenses and deductions which are matched to their respective sources:

Funeral Expenses 180,000.00 40,000.00 220,000.00

Judicial Expenses 40,000.00 30,000.00 70,000.00

Obligations 300,000.00 200,000.00 500,000.00

Losses 50,000.00 50,000.00 100,000.00

Medical Expenses 150,000.00 400,000.00 550,000.00

You might also like

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Estate Tax PayableDocument8 pagesEstate Tax PayableHazel Jane Esclamada100% (2)

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Problem 1: Net Taxable Estate 530,000 75,000 605,000Document3 pagesProblem 1: Net Taxable Estate 530,000 75,000 605,000camscamsNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Calculate Estate Tax for Married Filipino DecedentDocument14 pagesCalculate Estate Tax for Married Filipino DecedentLea ChermarnNo ratings yet

- Solutions For Module 3 IllustrationDocument22 pagesSolutions For Module 3 IllustrationColeen GaliciaNo ratings yet

- CTT Answer Season 1Document4 pagesCTT Answer Season 1ucc second yearNo ratings yet

- CTT Answer Season 1Document4 pagesCTT Answer Season 1ucc second yearNo ratings yet

- De Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSADocument9 pagesDe Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAJohn Francis RosasNo ratings yet

- Princess Elaine Esperat - Tax 2 - Activity 2 FinalDocument3 pagesPrincess Elaine Esperat - Tax 2 - Activity 2 FinalPrincess Elaine EsperatNo ratings yet

- Estate Tax and Donor's Tax ComputationDocument8 pagesEstate Tax and Donor's Tax ComputationHeidi KaterineNo ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- Estate TaxDocument9 pagesEstate TaxHafi DisoNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- De Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSADocument11 pagesDe Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAJohn Francis RosasNo ratings yet

- 123Document12 pages123GIANN RHEY HILANo ratings yet

- Chapter 7&8 ProblemsDocument5 pagesChapter 7&8 ProblemsAngeline Aquino LaroaNo ratings yet

- Answers To ActivityDocument19 pagesAnswers To ActivityjayNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- TaxfinDocument3 pagesTaxfinShr BnNo ratings yet

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- Estate WorkbookDocument10 pagesEstate WorkbookXin ZhaoNo ratings yet

- Estate Taxation - Discussions...............Document5 pagesEstate Taxation - Discussions...............jangjangNo ratings yet

- ANSWER KEY (Mid-Term Quiz 1)Document1 pageANSWER KEY (Mid-Term Quiz 1)JoyluxxiNo ratings yet

- Hardware Partnership FormationDocument13 pagesHardware Partnership FormationAllen GonzagaNo ratings yet

- The Accounting Process 7th EditionDocument9 pagesThe Accounting Process 7th EditionPaula Anyssa Tobias BerbaNo ratings yet

- Multiple Choice Problems on Estate TaxationDocument9 pagesMultiple Choice Problems on Estate TaxationKatKat Olarte67% (3)

- Prv-Tax 1Document4 pagesPrv-Tax 1Kathylene GomezNo ratings yet

- Chapter 3Document12 pagesChapter 3Briggs Navarro BaguioNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Gross Estate Activity PDFDocument5 pagesGross Estate Activity PDFJaypee Verzo SaltaNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Taxn03b DrillDocument1 pageTaxn03b Drillsmosaldana.cvtNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- A. Statement of Affairs B. State of Realization and LiquidationDocument9 pagesA. Statement of Affairs B. State of Realization and Liquidationloyd smithNo ratings yet

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- GROSS ESTATE OF MARRIED DECENDENTSDocument35 pagesGROSS ESTATE OF MARRIED DECENDENTSbetariceNo ratings yet

- Final Exam - Tax BDocument2 pagesFinal Exam - Tax BBea Clarence IgnacioNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Semi Quiz 1Document2 pagesSemi Quiz 1jp careNo ratings yet

- Illustration On Situs and Gross EstateDocument2 pagesIllustration On Situs and Gross EstateClaire BarbaNo ratings yet

- Donors Tax For DiscussionDocument5 pagesDonors Tax For DiscussionCyril John ReyesNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Estate Tax Sample ComputationDocument3 pagesEstate Tax Sample ComputationEmir Mendoza100% (1)

- INCOME TAX ON INDIVIDUALSDocument32 pagesINCOME TAX ON INDIVIDUALSAngela CanayaNo ratings yet

- Exclusions and DeductionsDocument4 pagesExclusions and DeductionsOG FAM0% (1)

- Estate Tax CalculationDocument4 pagesEstate Tax CalculationJohn Francis RosasNo ratings yet

- Part and Corporation Formation 1Document17 pagesPart and Corporation Formation 1Maila LoquincioNo ratings yet

- Solutions To Problems: Pe On Estate TaxDocument11 pagesSolutions To Problems: Pe On Estate TaxErica NicolasuraNo ratings yet

- Test Bank 1 UpdatedDocument5 pagesTest Bank 1 UpdatedSumanting GarnethNo ratings yet

- Applicable Property Regime in Default of An AgreementDocument3 pagesApplicable Property Regime in Default of An AgreementMarie Tes LocsinNo ratings yet

- Prob 2 - Corporation ActDocument6 pagesProb 2 - Corporation ActDenise Jane DesoyNo ratings yet

- Calculate Estate and Donor's Tax for Philippine EstateDocument8 pagesCalculate Estate and Donor's Tax for Philippine EstateMary Benedict AbraganNo ratings yet

- Estate Tax Computation Guide for Juan Dela CruzDocument2 pagesEstate Tax Computation Guide for Juan Dela Cruzjarlen cosasNo ratings yet

- Chapter FIVEDocument14 pagesChapter FIVEannisaNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Chapter 2 Far 2Document7 pagesChapter 2 Far 2Crestina100% (1)

- Vat Comprehensive ExerciseDocument1 pageVat Comprehensive ExerciseMarie Tes LocsinNo ratings yet

- Adamson University College of Business Administration Financial Accounting III Midterm Examination OriginalDocument5 pagesAdamson University College of Business Administration Financial Accounting III Midterm Examination OriginalMarie Tes LocsinNo ratings yet

- VAT ExercisesDocument3 pagesVAT ExercisesMarie Tes LocsinNo ratings yet

- Source of Regular Input VATDocument1 pageSource of Regular Input VATMarie Tes LocsinNo ratings yet

- Adamson University Business Tax Final Exam ReviewDocument7 pagesAdamson University Business Tax Final Exam ReviewMarie Tes LocsinNo ratings yet

- Rules Gross Estate Taxation PhilippinesDocument4 pagesRules Gross Estate Taxation PhilippinesMarie Tes LocsinNo ratings yet

- Applicable Property Regime in Default of An AgreementDocument3 pagesApplicable Property Regime in Default of An AgreementMarie Tes LocsinNo ratings yet

- Source of Regular Input VATDocument1 pageSource of Regular Input VATMarie Tes LocsinNo ratings yet

- Cash AccountsDocument1 pageCash AccountsMarie Tes LocsinNo ratings yet

- Deemed SaleDocument1 pageDeemed SaleMarie Tes LocsinNo ratings yet

- Implementing a Managed Debt Management ProjectDocument8 pagesImplementing a Managed Debt Management ProjectMarie Tes LocsinNo ratings yet

- Let Export Copy: Indian Customs Edi SystemDocument10 pagesLet Export Copy: Indian Customs Edi SystemMona ManochaNo ratings yet

- COUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band EDocument2 pagesCOUNCIL TAX BILL 2023/2024: The Valuation Office Agency Valued This Property As Band Erboadu71No ratings yet

- Solution CA Inter TaxationDocument17 pagesSolution CA Inter TaxationBhola Shankar PrasadNo ratings yet

- Determinants of Ethiopian Tax RevenueDocument102 pagesDeterminants of Ethiopian Tax RevenueamanualNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Notes Class XDocument2 pagesNotes Class XmailinspectoryadavNo ratings yet

- The Problem With Our Tax System and How It Affects UsDocument65 pagesThe Problem With Our Tax System and How It Affects Ussan pedro jailNo ratings yet

- Tax Treaties: Minimum StandardDocument2 pagesTax Treaties: Minimum StandardANDREANo ratings yet

- Ebook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFDocument68 pagesEbook Byrd and Chens Canadian Tax Principles 2018 2019 1St Edition Byrd Test Bank Full Chapter PDFShannonRussellapcx100% (12)

- Paseo Realty & Development Corporation vs. Court of AppealsDocument12 pagesPaseo Realty & Development Corporation vs. Court of AppealsMp CasNo ratings yet

- (G.R. No. 202105. April 28, 2021) La Flor Del Isabela Vs CIR HernandoDocument17 pages(G.R. No. 202105. April 28, 2021) La Flor Del Isabela Vs CIR HernandoChatNo ratings yet

- Invoice: Advanced Taxation PracticeDocument1 pageInvoice: Advanced Taxation PracticeAftab JamilNo ratings yet

- Types of TaxesDocument6 pagesTypes of TaxesRohan DangeNo ratings yet

- Tax Slides 2016Document56 pagesTax Slides 2016velasquez0731No ratings yet

- Abakada Guru PartyDocument42 pagesAbakada Guru PartyRhuejane Gay MaquilingNo ratings yet

- Business and Transfer Taxation - Multiple ChoiceDocument7 pagesBusiness and Transfer Taxation - Multiple ChoiceEuli Mae SomeraNo ratings yet

- Treaty-Based Return Position Disclosure Under Section 6114 or 7701 (B)Document5 pagesTreaty-Based Return Position Disclosure Under Section 6114 or 7701 (B)Mohammed Ziaur RahamanNo ratings yet

- Tax Invoice: Zoho Technologies Pvt. LTDDocument3 pagesTax Invoice: Zoho Technologies Pvt. LTDSales Sodhani BiotechNo ratings yet

- 4.8 S. International Trade - MCQsDocument1 page4.8 S. International Trade - MCQsbakerallb1No ratings yet

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanNo ratings yet

- Taxpayer Standing to Question Legality of Tax ExemptionsDocument3 pagesTaxpayer Standing to Question Legality of Tax ExemptionsEllen Glae Daquipil100% (2)

- 2006 BIR-RMC ContentsDocument22 pages2006 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- GST Supply Chain Management PDFDocument31 pagesGST Supply Chain Management PDFKrishna Sashank JujaruNo ratings yet

- D-8 - Property Tax-Payment Receipt - 2021-22Document1 pageD-8 - Property Tax-Payment Receipt - 2021-22Raviraj BankarNo ratings yet

- Joint Ventures ChecklistDocument2 pagesJoint Ventures ChecklistBlack BudNo ratings yet

- Payroll in ExcelDocument9 pagesPayroll in Excelsindhu100% (1)

- Brokerage Structure - ABSL Multi Asset Allocation Fund NFODocument1 pageBrokerage Structure - ABSL Multi Asset Allocation Fund NFOSanjay GuptaNo ratings yet

- Sample Sanction OrderDocument2 pagesSample Sanction OrderNayan Vankar100% (1)

- Hotel BillDocument3 pagesHotel BillAbbas FakhruddinNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)