Professional Documents

Culture Documents

Dividend Tax Change - Who Gains, Who Loses - The Hindu BusinessLine

Uploaded by

AswinBhimaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend Tax Change - Who Gains, Who Loses - The Hindu BusinessLine

Uploaded by

AswinBhimaCopyright:

Available Formats

Dividend tax change: Who gains,

who loses

PSUs and MNCs, who account for much of the

dividend pool, may pay out more while

promoter-controlled companies may skimp

Aarati Krishnan

The Union Budget for 2020-21 was not too liberal with its

giveaways. But one giveaway that has received mixed reviews from

its recipients is the proposal to abolish the Dividend Distribution Tax

(DDT). While the government claims that this change will result in

tax foregone of ₹25,000 crore, big stock market investors are ruing

the sharp spike in their tax outgo.

The paradox is explained by the fact that, while some categories of

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 1 of 6

equity investors will get to enjoy lower tax incidence on dividend

receipts after the DDT abolition, others will end up paying through

their nose.

Under the current tax regime (until March 31, 2020), companies

distributing dividends are liable to pay tax at an effective rate of

20.56 per cent directly to the government from their surpluses.

Effectively, out of every ₹100 in distributable profits, companies had

to cough up ₹20.56 as tax, with only ₹79.44 left for distribution to

shareholders.

While this makes the government’s job of collecting taxes easy, it

results in all the shareholders of a company suffering a uniform tax

rate on their dividends, irrespective of whether they are humble

salary-earners or the Birlas, Ambanis and Jhunjhunwalas of

investing.

The abolition of the DDT puts an end to this broad-brush treatment,

by requiring all equity investors to treat their dividend receipts as

income and pay taxes on it at their applicable slab rates, as per the

classical system of dividend taxation that is widely prevalent

globally. While this change enables companies to share their entire

distributable profits with shareholders, its impact on dividend

receivers is uneven.

Winners and losers

There seem to be four distinct sets of gainers from the abolition of

the DDT. One, retail investors with a total income of upto ₹10 lakh a

year no longer need to suffer the flat 20.56 per cent imposition on

their dividend receipts when their own slab rates are much lower.

Two, domestic mutual funds/asset managers who enjoy pass-

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 2 of 6

through status and pay no tax can pocket larger dividend incomes

from their portfolios, as they will no longer suffer the indirect

incidence of the DDT.

Three, Foreign Portfolio Investors (FPIs) structured as corporates

can now pay tax on dividends earned in India at either 20 per cent

or lower rates, specified in tax treaties inked by their home

countries. These rates can be as low as 5 per cent in some cases.

Four, multinationals and foreign companies that receive dividends

from their Indian subsidiaries will also enjoy a regime similar to

corporate FPIs. As an added sweetener, many of them can now

claim credit for taxes paid on dividends received in India when

assessed for corporate tax back home. This set-off wasn’t available

with the DDT.

The losers fall into four categories too. One, individual investors in

stocks whose income exceeds ₹10 lakh a year will shell out an

effective tax of 31.2 per cent on their dividends, instead of a flat

20.56 per cent under the DDT. Those whose income tops ₹50 lakh,

₹1 crore and ₹2 crore will now find the hefty super-rich surcharges

taking a big bite out of their dividend income too. For them, this will

mean parting with an effective tax of 34.3 per cent, 35.8 per cent

and 39 per cent, respectively, on dividend income. High net-worth

equity investors with income of over ₹5 crore a year will now pay an

eye-watering 42.74 per cent tax on their dividend receipts.

Which brings us to the second category; most big-name promoters

of India Inc, who are likely to fall in this ₹5 crore category, will have

to pay up the 42.74 per cent effective tax on dividends.

Three, insurance companies and other corporate investors in

shares, who do not enjoy a pass-through status like mutual funds,

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 3 of 6

may see a dent to their incomes from paying tax on dividends at the

corporate tax rate. However, this blow has been somewhat softened

by the Budget restoring Section 80M benefits, which allows

companies to net out the dividends they distribute to their

shareholders from the dividend income they receive, while paying

corporate tax.

Four, NRI investors and FPIs structured as non-corporates will not

reap the benefit of the 20 per cent tax rate on dividends enjoyed by

other foreign investors, and may need to pay taxes at their slab

rates.

Who’ll pay more

The uneven impact of the DDT abolition, as detailed above,

suggests that there’s going to be an active tug-of-war between

different classes of shareholders from the next fiscal, with each

faction trying to alter the dividend policies of India Inc to its benefit.

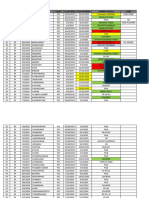

Some quick number-crunching on 1,752 NSE-listed companies last

fiscal (FY19), based on the Capitaline database, showed that only

938 of them paid out a dividend last year, with the payout

aggregating to about ₹2 lakh crore. Of this, promoters (Indian and

foreign) took home the lion’s share of about ₹1 lakh crore in

dividends, FPIs pocketed about ₹37,000 crore, domestic mutual

funds earned ₹16,000 crore, insurers ₹11,500 crore. Larger retail

investors (holding over ₹1 lakh nominal value of shares) earned

about ₹3,300 crore, while smaller retail investors pocketed ₹12,200

crore (the rest went to NRIs, corporate bodies, etc).

But big picture apart, whether individual companies will distribute

more of their DDT savings, or simply sit on them, will depend on

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 4 of 6

their ownership pattern and the clout that different categories of

shareholders exercise on their dividend polices.

Based on where their promoters stand, two large classes of

companies are quite likely to see their dividend payouts go up

sharply — public sector undertakings (PSUs) and MNCs (including

companies with foreign promoters). In the case of PSUs, given that

their largest shareholder (the government) isn’t liable to income tax,

it is very likely that it will insist on all the savings from the DDT

abolition being paid out as dividends. PSU stocks, some of which

are already high-dividend yield, may have reason to up their payouts

further in future. Given that dividends are the key route through

which local arms of MNCs/foreign companies share their profits with

their parents, they are also likely to raise their payouts in the future.

Of the 938 dividend payers last year, there were 58 PSUs and 108

companies were with MNCs or foreign parents. Despite their small

numbers, these two sets of firms made up nearly 49 per cent of the

dividend pool, with PSUs distributing about ₹64,500 crore and

foreign-owned companies paying ₹34,000 crore.

Of the companies with Indian promoters, 288 are widely held with

promoter holdings of less than 50 per cent. These paid out ₹56,638

crore as dividends last year. In these companies, institutional

investors may have sufficient clout to keep up the current dividend

rates.

However, the promoter-dominated faction of India Inc, which

accounts for 484 companies of the 938 and paid ₹54,500 crore in

dividends last fiscal, may very well skimp on dividends and explore

buybacks from next fiscal. This faction, though, makes up just 28

per cent of the dividend pool. Therefore, overall, the abolition of the

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 5 of 6

DDT is likely to improve the attractiveness of Indian markets to

foreign investors and domestic retail investors, from a dividend yield

perspective. But the super-rich taxation on dividends flowing back

to India Inc’s promoters, who are the primary risk-takers in the

economy, may also mean less cash flows and appetite for investing

in new ventures/projects from domestic entrepreneurs.

https://www.thehindubusinessline.com/opinion/columns/aara…dend-tax-change-who-gains-who-loses/article30764201.ece 29/03/20, 12:41 AM

Page 6 of 6

You might also like

- (Semester) Examinations, January 2021.: HVI/HA2B/ Cha2B/HbaiDocument2 pages(Semester) Examinations, January 2021.: HVI/HA2B/ Cha2B/HbaiAswinBhimaNo ratings yet

- B.L. (Hons.) /LL.B. (Hons.) DEGREE (SEMESTER) EXAMINATIONS, JANUARY 2021Document2 pagesB.L. (Hons.) /LL.B. (Hons.) DEGREE (SEMESTER) EXAMINATIONS, JANUARY 2021AswinBhimaNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Register No.: Hc2B/Chc2BDocument2 pagesRegister No.: Hc2B/Chc2BAswinBhimaNo ratings yet

- Coronavirus Impact - How Indian Bureaucracy Is Moving Urgent Files With Ingenuity During The Lockdown - The Economic TimesDocument6 pagesCoronavirus Impact - How Indian Bureaucracy Is Moving Urgent Files With Ingenuity During The Lockdown - The Economic TimesAswinBhimaNo ratings yet

- How India Is Fighting Coronavirus With A Colonial-Era Law On Epidemics - The Economic TimesDocument7 pagesHow India Is Fighting Coronavirus With A Colonial-Era Law On Epidemics - The Economic TimesAswinBhimaNo ratings yet

- Coronavirus Impact - Coronavirus - Faced With An Unprecedented Challenge, How Is India Faring? - The Economic TimesDocument11 pagesCoronavirus Impact - Coronavirus - Faced With An Unprecedented Challenge, How Is India Faring? - The Economic TimesAswinBhimaNo ratings yet

- 'Force Majeure', 'Act of God' & 'Doctrine of Frustration' Under Indian Contract Act (Explainer)Document12 pages'Force Majeure', 'Act of God' & 'Doctrine of Frustration' Under Indian Contract Act (Explainer)AswinBhimaNo ratings yet

- S.No Case Type Case No Parties Name Court 1St Hearing Next Hearing Current Status StepsDocument14 pagesS.No Case Type Case No Parties Name Court 1St Hearing Next Hearing Current Status StepsAswinBhimaNo ratings yet

- MCA Allows Companies To Hold EGMs Through Video Conferencing or Other Audio Visual Means - The Economic TimesDocument6 pagesMCA Allows Companies To Hold EGMs Through Video Conferencing or Other Audio Visual Means - The Economic TimesAswinBhimaNo ratings yet

- Christian Marriage NotesDocument37 pagesChristian Marriage NotesAswinBhimaNo ratings yet

- Women Empowerment in India Is Not Just A Status But With Human DignityDocument10 pagesWomen Empowerment in India Is Not Just A Status But With Human DignityAswinBhimaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Marketing Strategy of Berjaya Corporation BerhadDocument4 pagesMarketing Strategy of Berjaya Corporation BerhadJaJa ZaRinie0% (1)

- New ContactsDocument6 pagesNew Contactsashish srivastavaNo ratings yet

- Picking Stocks The Warren Buffett Way Understanding ROEDocument4 pagesPicking Stocks The Warren Buffett Way Understanding ROEprintulNo ratings yet

- SIP Report FormatDocument18 pagesSIP Report FormatSahilNo ratings yet

- Fundata Screener DataDocument8 pagesFundata Screener DataKrishna MoorthyNo ratings yet

- Assignment Print View13.3Document5 pagesAssignment Print View13.3alexie aurelioNo ratings yet

- EY Member Firms and AffiliatesDocument9 pagesEY Member Firms and AffiliatesNguyen Huong TranNo ratings yet

- Indicatorul Valoarea AdaugataDocument12 pagesIndicatorul Valoarea Adaugatababy_bluero5575No ratings yet

- Contact Us: PH: Fax: EmailDocument21 pagesContact Us: PH: Fax: EmailCorrosion FactoryNo ratings yet

- LLP Conversion ProcedureDocument3 pagesLLP Conversion ProcedureCorproNo ratings yet

- Marion Company Is An 80 Owned Subsidiary of Lange CompanyDocument1 pageMarion Company Is An 80 Owned Subsidiary of Lange CompanyMuhammad ShahidNo ratings yet

- Unit 14Document17 pagesUnit 14Jim SalajohnnyNo ratings yet

- Admas University: Course OutlineDocument5 pagesAdmas University: Course Outlinerediet solomonNo ratings yet

- B.N.M Institute of Technology: Department: Master of Business Administration LESSON PLAN Year: 2010-2011Document3 pagesB.N.M Institute of Technology: Department: Master of Business Administration LESSON PLAN Year: 2010-2011Vaishnavi NvNo ratings yet

- Debacle of Satyam Computers Limited: A Case Study of India's EnronDocument40 pagesDebacle of Satyam Computers Limited: A Case Study of India's EnronSultana ChowdhuryNo ratings yet

- The Big 6 Media CompaniesDocument3 pagesThe Big 6 Media Companiesima nerd907No ratings yet

- Ch4 Test BankDocument70 pagesCh4 Test Bank斌王No ratings yet

- CharDocument5 pagesCharMark Joseph OlinoNo ratings yet

- All Brands Data GmailDocument40 pagesAll Brands Data GmailLukas PanjageNo ratings yet

- Mark Andrew Vully de CandoleDocument10 pagesMark Andrew Vully de CandoleJohn Adam St Gang: Crown ControlNo ratings yet

- Soal Akl1Document7 pagesSoal Akl1Khazanah UmiNo ratings yet

- Banking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Document7 pagesBanking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Ashraf AliNo ratings yet

- Kansai Nerolac AnalysisDocument228 pagesKansai Nerolac AnalysisRohit KrishnaNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- Big Data Analytics - Tracxn Feed Report - 07 Feb 2024 FreeDocument65 pagesBig Data Analytics - Tracxn Feed Report - 07 Feb 2024 FreeAnkitNo ratings yet

- Óleo C180 w203Document15 pagesÓleo C180 w203FernNo ratings yet

- Assembly-Row WEB Directory 7.8.21Document2 pagesAssembly-Row WEB Directory 7.8.21SimonettaNo ratings yet

- How To Read A Value Line ReportDocument15 pagesHow To Read A Value Line ReportJamie GiannaNo ratings yet

- Study Id56476 Online-MarketplacesDocument41 pagesStudy Id56476 Online-MarketplacesLincolnNo ratings yet

- Chapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)Document2 pagesChapter - 2 BBA Sem 3 Buy-Back of Equity Shares (Que. 3)shubham ThakerNo ratings yet