Professional Documents

Culture Documents

Product Snapshot: DSP Bond Fund

Uploaded by

Manoj SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Product Snapshot: DSP Bond Fund

Uploaded by

Manoj SharmaCopyright:

Available Formats

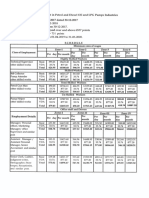

DSP BOND FUND

An open ended medium term debt scheme investing in debt and money market securities such that

the Macaulay duration of the portfolio is between 3 years and 4 years (please refer page no. 32

under the section “Where will the Scheme invest” in the SID for details on Macaulay’s Duration)

PRODUCT SNAPSHOT

INFORMATION AS ON DECEMBER 31, 2019

AUM of Scheme Scheme Objective

` 242 Cr. An Open Ended income Scheme, seeking to generate an attractive return, consistent with prudent

risk, from a portfolio which is substantially constituted of high quality debt securities, predominantly

of issuers domiciled in India. As a secondary objective, the Scheme will seek capital appreciation. The

Portfolio - YTM Scheme will also invest a certain portion of its corpus in money market securities, in order to meet

7.3 % liquidity requirements from time to time.

Weighted Average

Scheme Positioning

Suitable for investor seeking medium duration (~3 yrs), high credit quality (100% in AA or better)

Maturity

portfolio

4.21 yrs

Alternative to traditional >=3 yr term deposits

Modified Duration Asset Allocation Pattern

3.15 yrs Indicative Allocation

Instruments (% of total assets)

Benchmark: *Debt and Money market securities 0 - 100%

CRISIL Medium Term

Debt Index Units issued by REITs/InviTS 0 - 10%

*Debt securities may include securitised debts up to 50% of the net assets.

Total Expense Ratio Top Exposures

Regular Plan: 0.79%

Direct Plan: 0.33% Top Exposure Rating % to Net Assets

7.35% GOI 22062024 SOV 10.68%

Entry load:

Not Applicable NATIONAL HIGHWAYS AUTHORITY OF INDIA CRISIL AAA 9.18%

NTPC LIMITED CRISIL AAA 8.48%

Exit load: HOUSING DEVELOPMENT FINANCE

For Holding period: CORPORATION LIMITED CRISIL AAA 8.44%

<=6 months: 0.25%

>6 months: Nil ICICI BANK LIMITED CRISIL A1+ 8.18%

HDFC BANK LIMITED IND AA+ 7.53%

STATE BANK OF INDIA CRISIL AA+ 7.23%

INDIAN RAILWAY FINANCE CORPORATION LIMITED CARE AAA 6.67%

Fund Manager

7.32% GOI 28012024 SOV 6.58%

REC LIMITED CRISIL AAA 6.55%

Rating Profile Sector Allocation

Saurabh Bhatia A1+

Sector % of Portfolio

Total work experience of 16 years. 12% SOV 17.27%

Managing this Scheme since AA

February 2018.

5% BANKS - PRIVATE 15.71%

Cash &

Equivalent

ENERGY - POWER 14.77%

AAA

4%

47% PFI 13.22%

PUBLIC SECTOR BANKS 11.33%

SOV

17% HOUSING FINANCE 9.50%

AA+

SERVICES 9.18%

15%

NBFC 5.22%

REPO/TREPS 0.80%

Page 1 of 2

For disclaimer & product labelling please refer page no 2

Maturity Profile (December 2019)^ Portfolio Average Maturity (Years)^

80% 72.16% 6

70%

60% 5

50%

4

40%

27.84%

30%

3

20%

10% 0.00% 0.00% 0.00% 2

Jul-19

Feb-19

Sep-19

Dec-19

Jun-19

May-19

Aug-19

Oct-19

Jan-19

Mar-19

Apr-19

Nov-19

0%

0-5Y 5-10Y 10-15Y 15-20Y 25Y+

AUM (in INR Crore)^ Portfolio YTM (%)^

600 10.0

9.0

400

8.0

200

7.0

0 6.0

Dec-19

Feb-19

Jul-19

Sep-19

Feb-19

Jul-19

Sep-19

Dec-19

Jun-19

Jun-19

Aug-19

Oct-19

May-19

Aug-19

Oct-19

Mar-19

Apr-19

May-19

Mar-19

Apr-19

Nov-19

Nov-19

Jan-19

Jan-19

^Source: Internal

Key Scheme Information

Minimum investment and minimum additional purchase Options available: (Regular Plan and Direct Plan)

- Regular Plan & Direct Plan: • Growth

` 500/- & any amount thereafter. • Monthly Dividend (Payout Dividend/Reinvest Dividend)

• Dividend (Payout Dividend/Reinvest Dividend)

Investors are requested to visit the website of DSP Mutual Fund (‘the Fund’) at Inception Date: NAV as on December 31, 2019

www.dspim.com or AMFI’s website at www.amfiindia.com for NAV at each plan and 29 April 1997 (Regular Plan) Regular Plan

option level for the Schemes of the Fund, which is updated on each business day. 01 Jan 2013 (Direct Plan) Growth Option: ` 57.7688

PRODUCT LABELLING & SUITABILITY RISKOMETER

This Scheme is suitable for investor who are seeking*

• Income over a medium-term investment horizon

• Investment in money market and debt securities

*Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for them.

In the preparation of the material contained in this document, DSP Investment Managers Private Limited (“AMC”) has used information that is publicly available, including information developed in-house. The AMC however does not

warrant the accuracy, reasonableness and / or completeness of any information. The data/statistics are given to explain general market trends in the securities market, it should not be construed as any research report/research

recommendation. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are

“forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market

risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in

interest rates, foreign exchange rates, equity prices or other rates or prices etc. All figures and other data given in this document are dated as on December 31, 2019 and the same may or may not be relevant in future. Investors are advised

to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the DSP Mutual Fund (“Fund”). The sector(s)/stock(s)/issuer(s) mentioned

in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). Past performance may or may not be sustained in the future and should not

be used as a basis for comparison with other investments. Figures and statistics mentioned in this presentation should not be construed as any indicative returns/performance of the Scheme. The portfolio of the scheme is subject to

changes within the provisions of the Scheme Information Document (SID) of the scheme. Please refer to the SID for investment pattern, strategy and risk factors. Exposure to securities and sectors is calculated on Dirty Price basis (i.e.

market value of asset with accrued interest as on December 31, 2019).

The above mentioned strategy is currently followed by the Scheme and there is no assurance that the investment objective of the Scheme will be realized. The same may change in future depending on market conditions and other factors.

Disclaimer for CRISIL:

“© CRISIL Limited 2016. All Rights Reserved

Each CRISIL Index (including, for the avoidance of doubt, its values and constituents) is the sole property of CRISIL Limited (CRISIL). No CRISIL Index may be copied, retransmitted or redistributed in any manner. While CRISIL uses

reasonable care in computing the CRISIL Indices and bases its calculation on data that it considers reliable, CRISIL does not warrant that any CRISIL Index is error-free, complete, adequate or without faults. Anyone accessing and/or

using any part of the CRISIL Indices does so subject to the condition that: (a) CRISIL is not responsible for any errors, omissions or faults with respect to any CRISIL Index or for the results obtained from the use of any CRISIL Index; (b)

CRISIL does not accept any liability (and expressly excludes all liability) arising from or relating to their use of any part of CRISIL Indices.”

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You might also like

- Oisd STD-118Document27 pagesOisd STD-118veerkumarp100% (5)

- IIM Lucknow Casebook v15Document344 pagesIIM Lucknow Casebook v15Subhendu Pradhan100% (2)

- Petroleum Rules 2002Document237 pagesPetroleum Rules 2002deeparora188% (8)

- Petroleum Rules 2002Document237 pagesPetroleum Rules 2002deeparora188% (8)

- Merger and Consolidation of Icici Ltd. and Icici BankDocument65 pagesMerger and Consolidation of Icici Ltd. and Icici BankArpit GuptaNo ratings yet

- 20MW SPV Project Report NagalandDocument2 pages20MW SPV Project Report NagalandHimanshu Bhatia100% (1)

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- BlueChip Fund aims to provide medium to long term capital appreciationDocument1 pageBlueChip Fund aims to provide medium to long term capital appreciationPiyushNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Debt FundDocument8 pagesDebt Fundapi-3705377No ratings yet

- DebtDocument9 pagesDebtapi-3705377No ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)Sohail AhmedNo ratings yet

- SBI LTD Initiating Coverage 19062020Document8 pagesSBI LTD Initiating Coverage 19062020Devendra rautNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- Aptus Housing Finance IPO NoteDocument5 pagesAptus Housing Finance IPO NoteupsahuNo ratings yet

- NBP Government Securities Liquid Fund (NGSLF)Document1 pageNBP Government Securities Liquid Fund (NGSLF)HIRA -No ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- Fund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISDocument8 pagesFund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISmuhammad taufikNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- NWPCap PrivateDebt Q1-2023Document2 pagesNWPCap PrivateDebt Q1-2023zackzyp98No ratings yet

- NBP Government Securities Savings Fund (NGSSF)Document1 pageNBP Government Securities Savings Fund (NGSSF)Ali RazaNo ratings yet

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJeuz Llorenz Colendra-ApitaNo ratings yet

- Hybrid Fund Completes 5 Years NoteDocument3 pagesHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Fund Features Portfolio: An Open Ended Income Fund 31st March 2018Document4 pagesFund Features Portfolio: An Open Ended Income Fund 31st March 2018Mayank SainiNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- PMSGDSEP2022Document292 pagesPMSGDSEP2022Rohan ShahNo ratings yet

- IDFC Floating Rate Fund Satellite Bucket TitleDocument1 pageIDFC Floating Rate Fund Satellite Bucket TitledaveNo ratings yet

- Invest in quality bond fund with average maturity of 6.88 yearsDocument14 pagesInvest in quality bond fund with average maturity of 6.88 yearsDeepak Singh PundirNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Floating Rate Fund Invests in Debt with Low to Medium RiskDocument1 pageFloating Rate Fund Invests in Debt with Low to Medium RiskdaveNo ratings yet

- NBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2020 Unit Price (29/02/2020) : Rs.10.6043Document1 pageNBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) February 2020 Unit Price (29/02/2020) : Rs.10.6043HaseebPirachaNo ratings yet

- Icici Prudential Mutual Fund - 100655Document27 pagesIcici Prudential Mutual Fund - 100655Gauresh BandhalNo ratings yet

- Top Pages of ReportDocument24 pagesTop Pages of ReportRakieb HusseinNo ratings yet

- Press Release: YFC Projects Private LimitedDocument5 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- 258 - HCEP Factsheet Oct 2022Document2 pages258 - HCEP Factsheet Oct 2022Sundaresan MunuswamyNo ratings yet

- LiquiLoans - LiteratureDocument28 pagesLiquiLoans - LiteratureNeetika SahNo ratings yet

- About Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentDocument10 pagesAbout Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentTunirNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Canara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsDocument25 pagesCanara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsmayankNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- 1.session - Christopher Hamilton - InvescoDocument33 pages1.session - Christopher Hamilton - InvescoBG CHOINo ratings yet

- UTI Treasury Advantage Fund - UTI Mutual FundDocument15 pagesUTI Treasury Advantage Fund - UTI Mutual FundRinku MishraNo ratings yet

- LIC MF Factsheet Jan 2022Document3 pagesLIC MF Factsheet Jan 2022Ruchi LicnmfNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- DSP Dec 2021Document97 pagesDSP Dec 2021RUDRAKSH KARNIKNo ratings yet

- Fact Sheet - ICON Flexible Bond Fund (IOBZX)Document2 pagesFact Sheet - ICON Flexible Bond Fund (IOBZX)acie600No ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Ppfas MF Factsheet October 2019Document8 pagesPpfas MF Factsheet October 2019Shyam GuptaNo ratings yet

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJohh-RevNo ratings yet

- NBP Income Opportunity Fund (Niof)Document1 pageNBP Income Opportunity Fund (Niof)HIRA -No ratings yet

- Portfolio Holding Vs Performance (Since Inception) Sector - HoldingsDocument3 pagesPortfolio Holding Vs Performance (Since Inception) Sector - HoldingsAshok MishraNo ratings yet

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurNo ratings yet

- Max Diversified Equity FundDocument1 pageMax Diversified Equity FundNimish PavanNo ratings yet

- NBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Document1 pageNBP Mahana Amdani Fund (Nmaf) : MONTHLY REPORT (MUFAP's Recommended Format) July 2020 Unit Price (31/07/2020) : Rs.10.2426Kiran SheikhNo ratings yet

- Edelweiss Government Securities Fund August 2021 16092021 030955 PMDocument1 pageEdelweiss Government Securities Fund August 2021 16092021 030955 PMHarsimran SNo ratings yet

- 06 - Aditi Jhanwar IAPM Presentation PDFDocument37 pages06 - Aditi Jhanwar IAPM Presentation PDFAditi JhanwarNo ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- GRAP Order Dated 14112022Document9 pagesGRAP Order Dated 14112022Manoj SharmaNo ratings yet

- DSP Global Allocation Fund: Product StructureDocument2 pagesDSP Global Allocation Fund: Product StructureManoj SharmaNo ratings yet

- Elss Is A Wise Choice!: So, Spare A Thought and Weigh The Pros and Cons!Document2 pagesElss Is A Wise Choice!: So, Spare A Thought and Weigh The Pros and Cons!Manoj SharmaNo ratings yet

- DSP Bond Fund 30 PDFDocument2 pagesDSP Bond Fund 30 PDFManoj SharmaNo ratings yet

- Mirae Asset Factsheet - March 2020 PDFDocument26 pagesMirae Asset Factsheet - March 2020 PDFManoj SharmaNo ratings yet

- 55 Employment in Petrol and Diesel Oil and LPG Pumps IndDocument2 pages55 Employment in Petrol and Diesel Oil and LPG Pumps IndManoj SharmaNo ratings yet

- Oisd STD 235Document110 pagesOisd STD 235naved ahmed100% (5)

- NSDL E-Governance Infrastructure LTD Central Recordkeeping AgencyDocument10 pagesNSDL E-Governance Infrastructure LTD Central Recordkeeping AgencyManoj SharmaNo ratings yet

- Key Fund Facts from March 2020 Fund SpeakDocument26 pagesKey Fund Facts from March 2020 Fund SpeakManoj SharmaNo ratings yet

- Oisd STD-225Document43 pagesOisd STD-225Manoj SharmaNo ratings yet

- Oisd STD-225Document43 pagesOisd STD-225Manoj SharmaNo ratings yet

- XyzDocument8 pagesXyzManoj SharmaNo ratings yet

- Revised Helicopter Fare in The Kochi/Calicut - Island and Inter Island Sector With Effect From 1 OCTOBER 2006Document4 pagesRevised Helicopter Fare in The Kochi/Calicut - Island and Inter Island Sector With Effect From 1 OCTOBER 2006Manoj SharmaNo ratings yet

- Hindi Rajput Hindu 26 Years Bride:Girl Bangalore - Matrimonial Profile SMF1478672 Avika Singh - SimplyMarry Matrimony 2Document2 pagesHindi Rajput Hindu 26 Years Bride:Girl Bangalore - Matrimonial Profile SMF1478672 Avika Singh - SimplyMarry Matrimony 2Manoj SharmaNo ratings yet

- Corporate Solutions at Jones Lang LaSalle 2001Document15 pagesCorporate Solutions at Jones Lang LaSalle 2001Dipak Thakur50% (2)

- HW 11 SolutionDocument5 pagesHW 11 SolutionPepe BufordNo ratings yet

- PE Quiz 1Document94 pagesPE Quiz 1Abhi JainNo ratings yet

- Final Exams1 AnswersDocument5 pagesFinal Exams1 AnswersThea BaltazarNo ratings yet

- 2017 State of The City SpeechDocument13 pages2017 State of The City SpeechReno Gazette JournalNo ratings yet

- Shiori Bano - Assignment in AccstraDocument8 pagesShiori Bano - Assignment in AccstraShr BnNo ratings yet

- Exercises IAS 32 and IAS 39Document3 pagesExercises IAS 32 and IAS 39Gustavo Almeida100% (1)

- Strategic Assets and Organizational RentDocument14 pagesStrategic Assets and Organizational RentEduardo SantocchiNo ratings yet

- Financial Management Core Concepts 2nd Edition Brooks Solutions Manual 1Document35 pagesFinancial Management Core Concepts 2nd Edition Brooks Solutions Manual 1tom100% (37)

- Chapter 2: Traditional and Behavioral FinanceDocument22 pagesChapter 2: Traditional and Behavioral FinanceGeeta RanjanNo ratings yet

- Cherry Hill 0828Document20 pagesCherry Hill 0828elauwitNo ratings yet

- Auranga TeamDocument2 pagesAuranga TeamBen RossNo ratings yet

- Article1380550430 - Büyüksalvarci and AbdiogluDocument11 pagesArticle1380550430 - Büyüksalvarci and AbdiogluAlma ZildžićNo ratings yet

- Ch007 5170 HW Students Sol-1Document9 pagesCh007 5170 HW Students Sol-1evelynemoussallemNo ratings yet

- Kepler Nova RETDocument2 pagesKepler Nova RETKepler NovaNo ratings yet

- HDFC Bank Balance Sheet, HDFC Bank Financial Statement & Accounts PDFDocument4 pagesHDFC Bank Balance Sheet, HDFC Bank Financial Statement & Accounts PDFAashish GamdyanNo ratings yet

- PArtDocument6 pagesPArtMay DabuNo ratings yet

- ÁIFM Terms and ConditionsDocument3 pagesÁIFM Terms and Conditionspizza nmorevikNo ratings yet

- Citigroup Study On Global ProtestsDocument48 pagesCitigroup Study On Global ProtestsJustin WedesNo ratings yet

- RSK 4801 ASSIGNMENT 01 TOPICS 1-3Document13 pagesRSK 4801 ASSIGNMENT 01 TOPICS 1-3Byron Jason50% (2)

- Booker JonesDocument3 pagesBooker JonesCrystal Laksono PranotoNo ratings yet

- Finance Module 01 - Week 1Document14 pagesFinance Module 01 - Week 1Christian ZebuaNo ratings yet

- Definition of Financial ManagementDocument5 pagesDefinition of Financial Managementzainabqaisar07No ratings yet

- Memorandum of AssociationDocument13 pagesMemorandum of Associationsagarika915512No ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document9 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Vic BarrientosNo ratings yet

- NRO Vs NREDocument3 pagesNRO Vs NREsushantNo ratings yet

- FM BOOSTER MAY 24 NOTESDocument129 pagesFM BOOSTER MAY 24 NOTES311812922nishanthininkNo ratings yet

- Chemical Engineering Plant Economics MCQ Questions & Answers - Chemical EngineeringDocument5 pagesChemical Engineering Plant Economics MCQ Questions & Answers - Chemical Engineeringsrinu02062100% (1)

- 08 Handout 1 PDFDocument3 pages08 Handout 1 PDFJeffer Jay GubalaneNo ratings yet