Professional Documents

Culture Documents

Jawaban Soal Stock Valuation

Jawaban Soal Stock Valuation

Uploaded by

refita0 ratings0% found this document useful (0 votes)

101 views3 pagesThe document contains financial information about three securities: an obligasi bond issued by PT Sihartani, preferred shares of PT Gabriella, and common shares of PT Eka Maria. It provides details like coupon rates, prices, required rates of return, and calculates the theoretical value of each security by discounting future cash flows. It finds that the prices of the preferred shares and common shares are higher than their theoretical values, while the bond price is lower than its theoretical value. Growth rates are also calculated to check if they match the securities' expected returns.

Original Description:

Jawaban Soal Stock Valuation

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains financial information about three securities: an obligasi bond issued by PT Sihartani, preferred shares of PT Gabriella, and common shares of PT Eka Maria. It provides details like coupon rates, prices, required rates of return, and calculates the theoretical value of each security by discounting future cash flows. It finds that the prices of the preferred shares and common shares are higher than their theoretical values, while the bond price is lower than its theoretical value. Growth rates are also calculated to check if they match the securities' expected returns.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

101 views3 pagesJawaban Soal Stock Valuation

Jawaban Soal Stock Valuation

Uploaded by

refitaThe document contains financial information about three securities: an obligasi bond issued by PT Sihartani, preferred shares of PT Gabriella, and common shares of PT Eka Maria. It provides details like coupon rates, prices, required rates of return, and calculates the theoretical value of each security by discounting future cash flows. It finds that the prices of the preferred shares and common shares are higher than their theoretical values, while the bond price is lower than its theoretical value. Growth rates are also calculated to check if they match the securities' expected returns.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

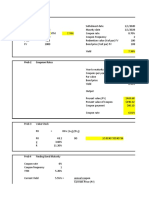

Obligasi PT Sihartani

n = 12

Par Value = 1,000,000.00

coupon rate = 8.75%

Bond Price = 1,314,000.00

required rate of return = 6%

Saham Preferen PT Gabriella

D = 25.00

Price = 255.00

required rate of return = 7%

Saham Biasa PT Eka Maria

Price = 367.50

D0 = 13.2

EPS -5 tahun = 14.90

EPS now = 30.60

required rate of return = 18%

Selisih antara Harga

Sekuritas dan Nilai

Sekuritas

PV dari Pembayaran Bunga = $733,586.34

PV dari Pokok Obligasi = $496,969.36

Nilai Obligasi = $1,230,555.71 ($83,444.29)

Nilai Saham Preferen = 357.14 102.14

g = 15.48%

Nilai Saham Biasa = 604.91 237.41

g2 = 12.48%

Nilai Saham Biasa = 268.98 (98.52)

Check g nya benar atau tidak

-5 -4 -3 -2 -1 0

14.9 17.2 19.9 22.9 26.5 30.6

You might also like

- MINI CASE CREDIT POLICY at BRAAM INDUSTRIESDocument3 pagesMINI CASE CREDIT POLICY at BRAAM INDUSTRIESraudhah100% (1)

- Chapter 3 Review Quiz SolutionsDocument4 pagesChapter 3 Review Quiz SolutionsA. ZNo ratings yet

- Franchise OrganizationsDocument475 pagesFranchise OrganizationsrefitaNo ratings yet

- Chapter 10 FIXED INCOME SECURITIES PDFDocument21 pagesChapter 10 FIXED INCOME SECURITIES PDFJinal SanghviNo ratings yet

- Take Home Exam Fin 4910 6440 Spring 2008Document4 pagesTake Home Exam Fin 4910 6440 Spring 2008nathaniel.chrNo ratings yet

- KellerFI504ProjectSolutionDocument5 pagesKellerFI504ProjectSolutionkfree76No ratings yet

- DDM ReturnsDocument12 pagesDDM ReturnsVishnu GaurNo ratings yet

- Profit & Loss - SOLS - Concept 31 To 40Document11 pagesProfit & Loss - SOLS - Concept 31 To 40xyzNo ratings yet

- Reviewing Number and Financial Mathematics: Review of Numbers Operations With Fractions RoundingDocument2 pagesReviewing Number and Financial Mathematics: Review of Numbers Operations With Fractions Roundingkartik.goel3010No ratings yet

- G Mi T MergedDocument5 pagesG Mi T Mergedkartik.goel3010No ratings yet

- BHP Buyback ValuationDocument2 pagesBHP Buyback ValuationCharles WuNo ratings yet

- 48-Hour Take-Home Exercises Session 2 - CFM - Nguyen Truong Bao NgocDocument13 pages48-Hour Take-Home Exercises Session 2 - CFM - Nguyen Truong Bao NgocXiao FengNo ratings yet

- Ratio Keuangan 2017Document5 pagesRatio Keuangan 2017Mutia FlorenzaNo ratings yet

- 5 Most Important Question VOS-BONDDocument7 pages5 Most Important Question VOS-BONDram reddyNo ratings yet

- SALARYDocument1 pageSALARYPocket OptionNo ratings yet

- MCB Common Size AnalysisDocument23 pagesMCB Common Size AnalysisBabar AdeebNo ratings yet

- Chapter 7Document1 pageChapter 7Thảo NguyễnNo ratings yet

- Jawaban Forum P10Document2 pagesJawaban Forum P10Sindi PertiwiNo ratings yet

- 4 61 60603 MQGM Prel SM 3E 08Document11 pages4 61 60603 MQGM Prel SM 3E 08Zacariah SaadiehNo ratings yet

- Pembahasan Mentoring UAs Ganjil Manajemen KeuanganDocument13 pagesPembahasan Mentoring UAs Ganjil Manajemen KeuanganaliciakarleyinNo ratings yet

- BAF 173005 Quiz 2Document4 pagesBAF 173005 Quiz 2Hamza KhaliqNo ratings yet

- Answers To Problem Sets: Valuing OptionsDocument26 pagesAnswers To Problem Sets: Valuing Optionsmandy YiuNo ratings yet

- Mmo Most Important Question SolutionDocument4 pagesMmo Most Important Question SolutionAshish GoelNo ratings yet

- Financial Ratio CalculationDocument2 pagesFinancial Ratio CalculationAbank FahriNo ratings yet

- ACST202/ACST851: Mathematics of Finance Tutorial Solutions 10: BondsDocument7 pagesACST202/ACST851: Mathematics of Finance Tutorial Solutions 10: BondsAbhishekMaranNo ratings yet

- 03 Debt Markets SOLUTIONSDocument22 pages03 Debt Markets SOLUTIONSSusanNo ratings yet

- BarrtDocument2 pagesBarrtcczzNo ratings yet

- CarrssrDocument1 pageCarrssrcczzNo ratings yet

- Question No 1 Answer: Madiha Baqai (12258) BbahDocument8 pagesQuestion No 1 Answer: Madiha Baqai (12258) BbahMadiha Baqai EntertainmentNo ratings yet

- HW3 - Chapter 7 - 8Document10 pagesHW3 - Chapter 7 - 8RuturajPatilNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisKana jillaNo ratings yet

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- Assignment 4 TVMDocument5 pagesAssignment 4 TVMKHANSA DIVA NUR APRILIANo ratings yet

- 5 Accounting PrinciplesDocument3 pages5 Accounting Principleswhiteorchid11100% (1)

- Debt Management: Lecture No.10 Endrianur Rahman Zain, STP - MM Fundamentals of Engineering EconomicsDocument14 pagesDebt Management: Lecture No.10 Endrianur Rahman Zain, STP - MM Fundamentals of Engineering EconomicsFeni Ayu LestariNo ratings yet

- Book 1Document5 pagesBook 1Thanh Tâm Lê ThịNo ratings yet

- Debt Management: Lecture No.10 Professor C. S. Park Fundamentals of Engineering EconomicsDocument14 pagesDebt Management: Lecture No.10 Professor C. S. Park Fundamentals of Engineering EconomicsAbdulaziz AlzahraniNo ratings yet

- Taha Taha Taha!Document14 pagesTaha Taha Taha!Shaham FarrukhNo ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Scenario Summary: Changing CellsDocument9 pagesScenario Summary: Changing Cellsy shNo ratings yet

- Pay Slip Components: Australian Concert and Entertainment Security Pty LTDDocument1 pagePay Slip Components: Australian Concert and Entertainment Security Pty LTDGaro KhatcherianNo ratings yet

- CH 18 Solutions To Selected End of Chapter ProblemsDocument3 pagesCH 18 Solutions To Selected End of Chapter Problemsbobhamilton3489No ratings yet

- Tutorial 1 AnswersDocument7 pagesTutorial 1 AnswersFreya LiNo ratings yet

- CaressrDocument1 pageCaressrcczzNo ratings yet

- AlfredDocument14 pagesAlfredQuequ AppiahNo ratings yet

- Evaluasi Dan Analisis PT UltramilkDocument14 pagesEvaluasi Dan Analisis PT UltramilkVolitania AugustaNo ratings yet

- Appendix BDocument5 pagesAppendix Bowenish9903No ratings yet

- BM-PT CagapeDocument5 pagesBM-PT CagapePrincess Sophia CagapeNo ratings yet

- Chapter 7Document11 pagesChapter 7Niaz MorshedNo ratings yet

- Chapter-11 Stock Return and ValuationDocument7 pagesChapter-11 Stock Return and ValuationAnushrut MNo ratings yet

- FIN 350 - Business Finance Homework 3 Fall 2014 SolutionsDocument6 pagesFIN 350 - Business Finance Homework 3 Fall 2014 SolutionsGomishChawlaNo ratings yet

- AFIN858 201 7 Week 4 Q &p's - Suggested Answers and SolutionsDocument4 pagesAFIN858 201 7 Week 4 Q &p's - Suggested Answers and SolutionsBasit SattarNo ratings yet

- Cfa Level 1 Mock Solutions - 24.09.2018Document18 pagesCfa Level 1 Mock Solutions - 24.09.2018guayrestudioNo ratings yet

- Chapter 10: Bond Return and Valuation Q. 6. Find Out The Yield To Maturity On A 8 Per Cent 5 Year Bond Selling at Rs 105?Document6 pagesChapter 10: Bond Return and Valuation Q. 6. Find Out The Yield To Maturity On A 8 Per Cent 5 Year Bond Selling at Rs 105?amarprabhu567No ratings yet

- Assessment 2Document2 pagesAssessment 2Trisha DiegoNo ratings yet

- Security Analysis & Portfolio Management: Name Muqaddas ZubairDocument7 pagesSecurity Analysis & Portfolio Management: Name Muqaddas ZubairMahlab RajpootNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 4 - SolutionsDocument3 pagesACF 103 - Fundamentals of Finance Tutorial 4 - SolutionsRiri FahraniNo ratings yet

- Contemporary Business Mathematics Canadian 10th Edition Hummelbrunner Solutions ManualDocument40 pagesContemporary Business Mathematics Canadian 10th Edition Hummelbrunner Solutions Manualgarconshudder.4m4fs100% (20)

- financial đề mẫuDocument6 pagesfinancial đề mẫuNgọc Minhh NgọcNo ratings yet

- Jawaban Latihan at Dan Reval atDocument13 pagesJawaban Latihan at Dan Reval atrefitaNo ratings yet

- Bentoel Group 2016 Annual Report Eng PDFDocument172 pagesBentoel Group 2016 Annual Report Eng PDFrefitaNo ratings yet

- Kuis AkperDocument4 pagesKuis AkperrefitaNo ratings yet