0% found this document useful (0 votes)

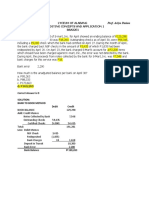

44 views2 pagesBank Reconciliation for Helpless Company

This bank reconciliation document summarizes the balances according to the bank statement and books for Helpless Company. It lists deposits in transit, outstanding checks, bank errors, and adjustments to notes receivable, accounts receivable, and bank service charges to calculate an adjusted balance of ₱570,832.20 that matches between the bank statement and books.

Uploaded by

Enitsuj Eam EugarbalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

44 views2 pagesBank Reconciliation for Helpless Company

This bank reconciliation document summarizes the balances according to the bank statement and books for Helpless Company. It lists deposits in transit, outstanding checks, bank errors, and adjustments to notes receivable, accounts receivable, and bank service charges to calculate an adjusted balance of ₱570,832.20 that matches between the bank statement and books.

Uploaded by

Enitsuj Eam EugarbalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd