Professional Documents

Culture Documents

Revenue Rulings: Employment Agency Contracts Allowances and Reimbursements Paid To On-Hired Workers

Uploaded by

Wilinton Pisso0 ratings0% found this document useful (0 votes)

13 views1 pageOriginal Title

PT-116

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageRevenue Rulings: Employment Agency Contracts Allowances and Reimbursements Paid To On-Hired Workers

Uploaded by

Wilinton PissoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Revenue Rulings

Employment Agency Contracts

Allowances and reimbursements paid to on-hired workers

Revenue Ruling PT.116

Preamble 2. the expenditure by the employee was incurred in

the course of the employer's business; and

1. The Pay-roll Tax Act 1971 ('the PRT Act') was amended

by the State Taxation Acts (Tax Reform) Act 2004 to 3. the precise amount of the expense is reimbursed.

introduce changes to the employment agency contract 9. However, any reimbursement that is taxable for fringe

provisions from 1 January 2005. benefits tax purposes will be subject to Pay-roll Tax

2. Under the new provisions, the employment agent is regardless of the above criteria. Furthermore, any

liable for pay-roll tax under an employment agency reimbursements that are exempt benefits under the

contract on payments made to, or in relation to, service Fringe Benefits Tax Assessment Act 1986 will be exempt

providers (on-hired workers), as well as on the value of from Pay-roll Tax.

any fringe benefits provided and superannuation 10. For further information on allowances and

contributions made on behalf of these on-hired workers. reimbursements, please refer to Revenue Ruling PT.059

3. The purpose of this ruling is to clarify the correct pay-roll Allowances and Reimbursements.

tax treatment of allowances and reimbursements paid 11. In summary, the treatment for Pay-roll Tax purposes of

(under an employment agency contract) by an allowances and reimbursements paid, under an

employment agent to their on-hired workers. employment agency contract, by an employment agent

to an on-hired worker is as follows:

Allowances

Ruling

Allowances are fully taxable for Pay-roll Tax purposes,

4. Payments of allowances and reimbursements made except for the following allowances:

under an employment agency contract by employment

agents to their on-hired workers, are to be treated in the 1. accommodation,

same manner as allowances and reimbursements paid 2. travelling, and

by employers to their employees.

3. living away from home allowances

5. Allowances have always been included in the definition

Reimbursements

of 'wages' under section 3(1) of the PRT Act. An

allowance is usually paid by an employer to compensate Payments that fall into this category are not taxable

an employee for an expense associated with their unless

employment, as compensation for unusual or they have a taxable value for Fringe Benefits Tax

unfavourable working conditions, or in recognition of purposes.

additional skills. Examples of such allowances include 12. Please note that rulings do not have the force of law.

travelling, accommodation, uniform, tea, meal, dirt and Each decision made by the SRO is made on the merits

first-aid allowances. of each individual case having regard to any relevant

6. As a general rule all allowances are fully taxable for Pay- ruling. All rulings must be read subject to Revenue

roll Tax purposes. The only allowances that are not Ruling GEN.01.

wholly taxable are travelling allowances, accommodation

allowances and living away from home allowances. For

details on the treatment of these allowances see

Revenue Ruling PT.089 Exempt Allowances.

7. Reimbursements differ from allowances and can be

described as business expenses incurred by employees

on behalf of their employer.

8. A reimbursement will not attract Pay-roll Tax provided

the payment has the following characteristics:

1. at the time it is paid, a business related

expense has already been incurred by the

employee (or a payment in advance is made) and

a receipt relating to the expense is provided to the

employer; and

April 2005

Commissioner of State Revenue

Ruling No. PT.116

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- IncomeTax Valuation PerquisitesDocument19 pagesIncomeTax Valuation PerquisitesSanjeevNo ratings yet

- Gross Compensation Income Summary IIDocument7 pagesGross Compensation Income Summary IITriciaNo ratings yet

- Instructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnDocument6 pagesInstructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnIRSNo ratings yet

- U P & E S C L: Niversity of Etroleum Nergy Tudies Ollege of Egal StudiesDocument16 pagesU P & E S C L: Niversity of Etroleum Nergy Tudies Ollege of Egal StudiesRakshit JoshiNo ratings yet

- Tax Treatments of Fringe BenefitsDocument63 pagesTax Treatments of Fringe BenefitsAdmNo ratings yet

- Tax Treatments of Fringe BenefitsDocument14 pagesTax Treatments of Fringe BenefitsAdmNo ratings yet

- Chapter 3Document88 pagesChapter 3giezele ballatanNo ratings yet

- Employer'S Guide To Pay As You Earn (PAYE)Document20 pagesEmployer'S Guide To Pay As You Earn (PAYE)Curter Lance LusansoNo ratings yet

- LabourLaw NeelamLalwani DivC-155Document5 pagesLabourLaw NeelamLalwani DivC-155KB Financial and Tax ServicesNo ratings yet

- Tax ConsiderationsDocument30 pagesTax ConsiderationsLubertuz WahyuNo ratings yet

- Instructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnDocument4 pagesInstructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnIRSNo ratings yet

- Songco Vs NLRCDocument3 pagesSongco Vs NLRCDi Koy50% (2)

- Module 4 - Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 4 - Fringe Benefits Tax and de Minimis Benefitsjustine panaliganNo ratings yet

- Case SummaryDocument5 pagesCase SummaryMae Joan AbanNo ratings yet

- Module 3 Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 3 Fringe Benefits Tax and de Minimis BenefitsJericho PapioNo ratings yet

- Instructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnDocument6 pagesInstructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnIRSNo ratings yet

- Additional Notes Fringe Benefit TaxDocument10 pagesAdditional Notes Fringe Benefit TaxAngela Nicole NobletaNo ratings yet

- HONG KONG Expat Tax Guide - Mar10Document4 pagesHONG KONG Expat Tax Guide - Mar10etechodNo ratings yet

- Chapter 03 Fringe Benefit TaxDocument42 pagesChapter 03 Fringe Benefit TaxVisperas, Jana Mae U.No ratings yet

- WAGES With RulingDocument7 pagesWAGES With RulingReen DosNo ratings yet

- FBT Perks Vs FBTDocument5 pagesFBT Perks Vs FBTnirav_poptaniNo ratings yet

- Chapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitDocument8 pagesChapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitMARIA BELEN GUTIERREZNo ratings yet

- Salary Income LawDocument25 pagesSalary Income Lawvishal singhNo ratings yet

- RR 3-98Document7 pagesRR 3-98evelyn b t.No ratings yet

- RMC 39-2012Document2 pagesRMC 39-2012Kris GrubaNo ratings yet

- SU Ch-04 FA II AcFn4012Document12 pagesSU Ch-04 FA II AcFn4012Prof. Dr. Anbalagan ChinniahNo ratings yet

- The Secretary of Labor, of Board, Lodging, or Other Facilities Customarily Furnished by The Employer To The EmployeeDocument4 pagesThe Secretary of Labor, of Board, Lodging, or Other Facilities Customarily Furnished by The Employer To The EmployeeutaknghenyoNo ratings yet

- Article 9 Paragraph 1 of The Income Tax Law - POSITIVE FISCAL ADJUSTMENTDocument2 pagesArticle 9 Paragraph 1 of The Income Tax Law - POSITIVE FISCAL ADJUSTMENTanggraeni_ayuNo ratings yet

- Instructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnDocument4 pagesInstructions For Form CT-1: Employer's Annual Railroad Retirement Tax ReturnIRSNo ratings yet

- Remuneration For Services Performed by An Employee For His EmployerDocument3 pagesRemuneration For Services Performed by An Employee For His Employerzeref dragneelNo ratings yet

- Unit 4 PayrollDocument11 pagesUnit 4 PayrollHussen AbdulkadirNo ratings yet

- Fringe Benefits Tax and de MinimisDocument6 pagesFringe Benefits Tax and de MinimisL.ShinNo ratings yet

- Instructions For Form CT-1: Internal Revenue ServiceDocument4 pagesInstructions For Form CT-1: Internal Revenue ServiceIRSNo ratings yet

- CHAPTER 3 PayrollDocument14 pagesCHAPTER 3 PayrollMahlet AemiroNo ratings yet

- Adobe Scan Dec 09, 2023Document7 pagesAdobe Scan Dec 09, 2023Renalyn Ps MewagNo ratings yet

- Payroll Hand OutDocument8 pagesPayroll Hand OutmikialeNo ratings yet

- Practice Note No 11 Income From EmploymentDocument13 pagesPractice Note No 11 Income From EmploymentLeyla SaidNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- FS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoDocument11 pagesFS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- 06 Gross IncomeDocument103 pages06 Gross IncomeJSNo ratings yet

- Gross Income ReportDocument12 pagesGross Income ReportXyvie Dianne D. DaradarNo ratings yet

- Public Ruling 1384 6 Salary Wages PDFDocument11 pagesPublic Ruling 1384 6 Salary Wages PDFAbedNo ratings yet

- Instructions For Form CT-1: Internal Revenue ServiceDocument4 pagesInstructions For Form CT-1: Internal Revenue ServiceIRSNo ratings yet

- Chapter 6Document38 pagesChapter 6assadrafaqNo ratings yet

- Departmental Interpretation and Practice Notes No. 33 (Revised)Document21 pagesDepartmental Interpretation and Practice Notes No. 33 (Revised)Difanny KooNo ratings yet

- Employment Income TaxDocument10 pagesEmployment Income TaxHarsh Nahar100% (1)

- TA U4 Salaries 23 PDFDocument5 pagesTA U4 Salaries 23 PDFRafaelKwongNo ratings yet

- The Allowances' in Question, With Its ConditionsDocument2 pagesThe Allowances' in Question, With Its ConditionsJoesil DianneNo ratings yet

- INCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeDocument4 pagesINCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeJoAiza DiazNo ratings yet

- Income From SalaryDocument28 pagesIncome From SalaryMuhammad JunaidNo ratings yet

- Unit 2 Notes, Part 1Document19 pagesUnit 2 Notes, Part 1Sandip Kumar BhartiNo ratings yet

- RR Income Tax For Public Consultation Under TrainDocument25 pagesRR Income Tax For Public Consultation Under TrainGenesis ManaliliNo ratings yet

- Salaries: After Studying This Chapter, You Would Be Able ToDocument80 pagesSalaries: After Studying This Chapter, You Would Be Able ToSatyam Kumar AryaNo ratings yet

- 13th Month PayDocument3 pages13th Month PayChristine GalsimNo ratings yet

- Taxation I - Part Ii Compilation of Cited Bir Issuances, EtcDocument186 pagesTaxation I - Part Ii Compilation of Cited Bir Issuances, Etccmv mendozaNo ratings yet

- Labor Laws Assignment No. 3Document11 pagesLabor Laws Assignment No. 3Jane Therese BanaagNo ratings yet

- TAX Digests Cases BenefitsDocument7 pagesTAX Digests Cases BenefitsRomhead SJNo ratings yet

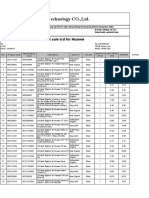

- Hot Sale LCD For Huawei in AgustDocument2 pagesHot Sale LCD For Huawei in AgustWilinton PissoNo ratings yet

- Kicad C++ Source Code Style Guide: Latest Publishing: February 2013 First Published: September 2010Document15 pagesKicad C++ Source Code Style Guide: Latest Publishing: February 2013 First Published: September 2010Wilinton PissoNo ratings yet

- Table of Content: GUI Translation HOWTODocument11 pagesTable of Content: GUI Translation HOWTOWilinton PissoNo ratings yet

- SQ Technology CO.,Ltd.: Top Selling 100Document10 pagesSQ Technology CO.,Ltd.: Top Selling 100Wilinton PissoNo ratings yet

- Notes About Pcbnew New File Format: and Its Internal DataDocument4 pagesNotes About Pcbnew New File Format: and Its Internal DataWilinton PissoNo ratings yet

- GUI Translation HOWTODocument11 pagesGUI Translation HOWTOWilinton PissoNo ratings yet

- Color Monitor: Service ManualDocument37 pagesColor Monitor: Service ManualWilinton PissoNo ratings yet

- Samsung Ua32eh50x0r 40eh50x0r Ua42eh5000r Ua46eh50x0r-50eh50x0r Ua22es500xr Chassis U73a 74pagesDocument74 pagesSamsung Ua32eh50x0r 40eh50x0r Ua42eh5000r Ua46eh50x0r-50eh50x0r Ua22es500xr Chassis U73a 74pagesWilinton PissoNo ratings yet

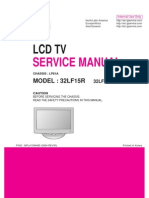

- Maual de Servicio TV LG 32lf15r-MaDocument31 pagesMaual de Servicio TV LG 32lf15r-MaJaime E FernandezNo ratings yet

- BN44-00497A PSLF121A03C Samsung PsuDocument3 pagesBN44-00497A PSLF121A03C Samsung PsuSameer Mansuri100% (2)

- Haier: Color Television & DVDDocument29 pagesHaier: Color Television & DVDWilinton PissoNo ratings yet

- SGH-P900 Schematics PDFDocument8 pagesSGH-P900 Schematics PDFWilinton PissoNo ratings yet

- Hisense Lhd24k26amn Lhd24k300amn Lhd24n10amn Chassis msd1309bt Rsag7.820.5268 Sanyo Lce32xh11 Noblex 32ld858ht Ver.1.0 PDFDocument46 pagesHisense Lhd24k26amn Lhd24k300amn Lhd24n10amn Chassis msd1309bt Rsag7.820.5268 Sanyo Lce32xh11 Noblex 32ld858ht Ver.1.0 PDFGerardo Aguirre MNo ratings yet

- SGH-P900 Schematics PDFDocument8 pagesSGH-P900 Schematics PDFWilinton PissoNo ratings yet

- Esquema Eletrico XT1626 SchematicsDocument52 pagesEsquema Eletrico XT1626 SchematicsFranz HernandezNo ratings yet

- LCD TV: Service ManualDocument31 pagesLCD TV: Service Manualبوند بوندNo ratings yet

- SM J500M Evapl 3 PDFDocument1 pageSM J500M Evapl 3 PDFWilinton PissoNo ratings yet

- Apple Ipod Case Design GuidelinesDocument65 pagesApple Ipod Case Design Guidelinesanthony81212No ratings yet

- Diagrama Celular ChinoDocument19 pagesDiagrama Celular ChinoWilinton Pisso33% (3)

- Iphone 5 SchematicDocument53 pagesIphone 5 Schematicchufta100% (4)

- Installed FilesDocument37 pagesInstalled FilesWilinton PissoNo ratings yet

- MT6328 MediatekDocument12 pagesMT6328 MediatekAlexander MolinaNo ratings yet

- Sabt100p PDFDocument174 pagesSabt100p PDFWilinton PissoNo ratings yet

- Lg+cm8340-Ab - DCHLLLK Afn76592102 EvDocument79 pagesLg+cm8340-Ab - DCHLLLK Afn76592102 Evlibre2009No ratings yet

- HCD Ex99Document74 pagesHCD Ex99Leonel MartinezNo ratings yet

- Color Monitor: Service ManualDocument55 pagesColor Monitor: Service ManualWilinton PissoNo ratings yet

- Ipa90r500c3 - 1.0 Mosfet TransistorDocument10 pagesIpa90r500c3 - 1.0 Mosfet TransistorWilinton PissoNo ratings yet

- Datasheet Tda 9351psDocument118 pagesDatasheet Tda 9351psTrevor PatonNo ratings yet

- Off-Line Quasi-Resonant Switching Regulators: STR-X6729Document11 pagesOff-Line Quasi-Resonant Switching Regulators: STR-X6729Ossian Valera PinedaNo ratings yet

- Auditing and Assurance Services A Systematic Approach 9th Edition Messier Test Bank 1Document42 pagesAuditing and Assurance Services A Systematic Approach 9th Edition Messier Test Bank 1willie100% (31)

- Labor Case DigestsDocument73 pagesLabor Case DigestsKim Estal75% (4)

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Chapter 13 Employee Benefits Noe 13th EdDocument66 pagesChapter 13 Employee Benefits Noe 13th EdbryanbernabeNo ratings yet

- Accounting For Labor CostDocument28 pagesAccounting For Labor CostStp100% (1)

- 1 - Session 3 - CL and Provision - Kieso - CH 13Document50 pages1 - Session 3 - CL and Provision - Kieso - CH 13melva vionaNo ratings yet

- Work From Anywhere (WFA) : Avast GroupDocument14 pagesWork From Anywhere (WFA) : Avast GroupClay LeeNo ratings yet

- GMAT - 2018.PDF Version 1Document21 pagesGMAT - 2018.PDF Version 1Alex MoonNo ratings yet

- Thomas Co LTD Payroll 2019Document2 pagesThomas Co LTD Payroll 2019MaxineNo ratings yet

- Aeb SM CH20 1Document22 pagesAeb SM CH20 1Vironica ValentineNo ratings yet

- Employee Handbook: Legendary Tales of Adventure Begin InsideDocument31 pagesEmployee Handbook: Legendary Tales of Adventure Begin InsideMD IMRAN RAJMOHMADNo ratings yet

- TIES EgyptDocument31 pagesTIES EgyptdarkclawsNo ratings yet

- All Job OrderDocument11 pagesAll Job OrderBPH MaramagNo ratings yet

- K04106 Key Payroll Benchmarks at A Glance - Consumer Products, Packaged GoodsDocument3 pagesK04106 Key Payroll Benchmarks at A Glance - Consumer Products, Packaged GoodsProcusto LNo ratings yet

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (8)

- Oracle HCM PayrollDocument7 pagesOracle HCM PayrollVi ViNo ratings yet

- Anil Kumar - ETL Testing - 3.2 Yrs - ResumeDocument4 pagesAnil Kumar - ETL Testing - 3.2 Yrs - Resumeabreddy2003No ratings yet

- Questions For Payroll ComputationDocument5 pagesQuestions For Payroll ComputationvikramNo ratings yet

- LaborDocument20 pagesLaborHNo ratings yet

- HR Practical Training - Without RecruitmentDocument8 pagesHR Practical Training - Without RecruitmentgracyNo ratings yet

- Pendance - A Web - Based Payroll Management System For Pnoc at Mabini BatangasDocument15 pagesPendance - A Web - Based Payroll Management System For Pnoc at Mabini BatangasSAIRON LECS ALBANIANo ratings yet

- Job Order Costing 1Document46 pagesJob Order Costing 1Rajib Ali bhuttoNo ratings yet

- Weygandt Accounting Principles 10e PowerPoint Ch11Document60 pagesWeygandt Accounting Principles 10e PowerPoint Ch11billy93No ratings yet

- A5997127965bcea94666f1 PayslipDocument2 pagesA5997127965bcea94666f1 PayslipAshutosh GuptaNo ratings yet

- Direct Tax Interview Questions For ArticleshipDocument15 pagesDirect Tax Interview Questions For ArticleshipAayush GamingNo ratings yet

- Accrued Liabilities and Deferred RevenuesDocument22 pagesAccrued Liabilities and Deferred Revenueschesca marie penarandaNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- 2022.12.20 Final Report House Ways and MeansDocument29 pages2022.12.20 Final Report House Ways and MeansBrandon Conradis25% (4)

- Journal Posting TempletDocument7 pagesJournal Posting TempletbiniyamNo ratings yet

- Exit FormalityDocument7 pagesExit Formalityhr.singlaNo ratings yet