Professional Documents

Culture Documents

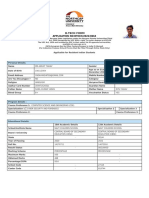

Uganda Christian University Faculty of Law Administrative Authorities

Uganda Christian University Faculty of Law Administrative Authorities

Uploaded by

katushabe brenda0 ratings0% found this document useful (0 votes)

10 views3 pagesThe document discusses Uganda's legal and institutional framework for ensuring control of public finances. Several key laws have been enacted to regulate public funds, including the Constitution of Uganda, the Public Finance and Accountability Act, Treasury Instructions and Regulations, and the Local Government Financial and Accounting Regulation. These laws establish a consolidated fund under the Constitution into which all government revenues are paid and from which expenditures must be appropriated. They also define the country's financial year and provide oversight of public finances to promote accountability and effective use of funds.

Original Description:

Original Title

admin law

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses Uganda's legal and institutional framework for ensuring control of public finances. Several key laws have been enacted to regulate public funds, including the Constitution of Uganda, the Public Finance and Accountability Act, Treasury Instructions and Regulations, and the Local Government Financial and Accounting Regulation. These laws establish a consolidated fund under the Constitution into which all government revenues are paid and from which expenditures must be appropriated. They also define the country's financial year and provide oversight of public finances to promote accountability and effective use of funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesUganda Christian University Faculty of Law Administrative Authorities

Uganda Christian University Faculty of Law Administrative Authorities

Uploaded by

katushabe brendaThe document discusses Uganda's legal and institutional framework for ensuring control of public finances. Several key laws have been enacted to regulate public funds, including the Constitution of Uganda, the Public Finance and Accountability Act, Treasury Instructions and Regulations, and the Local Government Financial and Accounting Regulation. These laws establish a consolidated fund under the Constitution into which all government revenues are paid and from which expenditures must be appropriated. They also define the country's financial year and provide oversight of public finances to promote accountability and effective use of funds.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

UGANDA CHRISTIAN UNIVERSITY

FACULTY OF LAW

ADMINISTRATIVE AUTHORITIES

LECTURER: BAGUMA EDGAR

TUTOR: BWAMBALE WILBERFOCE

NAME: KATUSHABE BRENDA

REG. No: KS19B11/068

QUESTION;

I will not tolerate any mismanagement of public resources and ghost

workers in all government sectors must be wiped out with immediate

effect per H.E.Y.K MUSEVENI. The parliament of Uganda has enacted

several legislations in relation to the control of public finance. With

the aid of relevant authorities, examine the existing legal and

institutional framework on ensuring control of public finance and the

extent to which they have been effective

Public finance is the study of the role of the government in the economy. It is the

branch of economics that assesses the government revenue and government

expenditure of the public authorities and the adjustment of one or the other to achieve

desirable effects and avoid undesirable. In managing public funds, different laws have been

enacted to make sure that there is effective use of the fund and that they are distributed accordingly.

Some of these laws are; The constitution of the republic of Uganda 1995, The public finance and

Accountability Act, The treasury instructions and regulations, The local government financial and

accounting regulation, 1998.The local government Act 2007, The National audit Act 2008. The

Budget Act 2001 and the Appropriation Act. These laws are supplemented by occasional directives

from the ministry of finance, planning and development. A country’s finance can be received through

different ways the main one being taxation and, In this case, a “tax” is a compulsory financial charge

or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund

various public expenditures. And a failure to pay, along with evasion of or resistance to taxation, is

punishable by law. Borrowing both internal and external through the IMF is also another mean, rates

fees, among others are some of the sources of government revenue. In this case therefore the

constitution establishes a consolidated fund, under Article 153 of the constitution and also states

exactly how money can be withdrawn from the consolidated fund. It also defines the financial year

(July – June).

The consolidated fund is created by Article 153 of the constitution of the republic of Uganda which

stipulates in (1) that there shall be a consolidated fund into which shall be paid all revenues or other

monies raised or received for the purpose of, or on behalf of, or in trust for the Government. On the

other hand, a consolidated fund is a fund which consists of taxes and any other revenue payable to

the state

You might also like

- Cases in Legal EthicsDocument138 pagesCases in Legal Ethicsfuckvinaahhh50% (2)

- Insurance and BondsDocument15 pagesInsurance and BondsJackson TanNo ratings yet

- Constitutional Analysis Memo Re Vaccines and QuarantineDocument30 pagesConstitutional Analysis Memo Re Vaccines and QuarantineGreg GlaserNo ratings yet

- Appen - CrowdsourcingDocument14 pagesAppen - CrowdsourcingkalaisenthilNo ratings yet

- Economics Project WorkDocument27 pagesEconomics Project WorkBashar Ahmed100% (4)

- Economics Project On Government Budget - Class 12 CBSE PDFDocument14 pagesEconomics Project On Government Budget - Class 12 CBSE PDFVAISHVIK SALASIYA89% (38)

- Calculate Tax Fees and Charge PDFDocument30 pagesCalculate Tax Fees and Charge PDFJamal80% (5)

- INFOLINK COLLEGE (Public Finance)Document138 pagesINFOLINK COLLEGE (Public Finance)arsen lupin100% (1)

- Fiscal Policy Impact On Developing CountriesDocument35 pagesFiscal Policy Impact On Developing CountriesBharati Shet100% (1)

- Public FinanceDocument48 pagesPublic FinanceJorge Labante100% (1)

- People vs. JamilosaDocument2 pagesPeople vs. JamilosaKling KingNo ratings yet

- Constitutional History Notes (Onoria)Document90 pagesConstitutional History Notes (Onoria)katushabe brenda100% (2)

- IPLDocument9 pagesIPLDon TiansayNo ratings yet

- Chapter One Basics of Public FinanceDocument30 pagesChapter One Basics of Public FinanceAhmedNo ratings yet

- Elpa - 306 - Office Legal MemorandumDocument2 pagesElpa - 306 - Office Legal MemorandumAngela Nicole Salve ElpaNo ratings yet

- Instructional Manual-Discernment ToolsDocument49 pagesInstructional Manual-Discernment ToolsRuth Abigail R. Acero-Flores100% (3)

- Heads of IncomeDocument26 pagesHeads of IncomeShardulWaikar100% (2)

- People vs. Figueroa DigestDocument3 pagesPeople vs. Figueroa DigestMyra Myra100% (1)

- Constitutional Bases of Public Finance in The Philippines (Taxation)Document23 pagesConstitutional Bases of Public Finance in The Philippines (Taxation)DARLENE100% (1)

- Accessories Specialists vs. AlabanzaDocument2 pagesAccessories Specialists vs. AlabanzaRuss TuazonNo ratings yet

- The Effectiveness of The Legal Framework Governing Control of Public Finance in UgandaDocument10 pagesThe Effectiveness of The Legal Framework Governing Control of Public Finance in UgandaVictor K. AshNo ratings yet

- Basic Concepts in Budgeting: 1. What Is A Fund?Document5 pagesBasic Concepts in Budgeting: 1. What Is A Fund?riaroblesNo ratings yet

- TaxationDocument5 pagesTaxationK8Y KattNo ratings yet

- Government BudgetDocument25 pagesGovernment BudgetChristanique McIntosh100% (1)

- Tutorial 1 AnswerDocument8 pagesTutorial 1 AnswerFatin NajihahNo ratings yet

- Republic Act 10633 General Appropriation Act of 2014Document3 pagesRepublic Act 10633 General Appropriation Act of 2014Marc Eric Redondo0% (1)

- Fiscal Administration Masteral ClassDocument90 pagesFiscal Administration Masteral ClassAnna Lou KeshiaNo ratings yet

- Public Finance: MeaningDocument69 pagesPublic Finance: MeaningMaitreyee jambekarNo ratings yet

- Chapter 1 Individuals and GovernmentDocument16 pagesChapter 1 Individuals and GovernmentSherlyn PecsonNo ratings yet

- Federalism ProjectDocument19 pagesFederalism Project210531050098No ratings yet

- Basic Concepts in BudgetingDocument4 pagesBasic Concepts in BudgetingniqdelrosarioNo ratings yet

- Acc 214 Taxation 1Document59 pagesAcc 214 Taxation 1folarintaiwosegunNo ratings yet

- The Role of GovernmentDocument15 pagesThe Role of GovernmentBatang MalolosNo ratings yet

- GROUP8A Written Report LegalDocument9 pagesGROUP8A Written Report LegalMa'am Hannah AnicetoNo ratings yet

- Tax Law Project 2020Document15 pagesTax Law Project 2020Kamlesh raiNo ratings yet

- Chapter-One Overview of Public Finance & TaxationDocument211 pagesChapter-One Overview of Public Finance & Taxationarsen lupinNo ratings yet

- Taxation FinalDocument10 pagesTaxation FinalMaelyn GelilangNo ratings yet

- Government Budgeting Experience in The PhilDocument9 pagesGovernment Budgeting Experience in The PhilPOC MMPA17No ratings yet

- Petitioner: PM Cares Cannot Deny RtiDocument5 pagesPetitioner: PM Cares Cannot Deny RtiSwastik GroverNo ratings yet

- What Is Currency Swap?: Principal Interest Loan Net Present ValueDocument6 pagesWhat Is Currency Swap?: Principal Interest Loan Net Present ValueRyan GregoryNo ratings yet

- Compilation of QuestionDocument11 pagesCompilation of QuestionShihab HasanNo ratings yet

- Accounty IngDocument2 pagesAccounty IngIbrahim AbdullahiNo ratings yet

- Fiscal FederalismDocument25 pagesFiscal FederalismAastha AgnihotriNo ratings yet

- Legal Framework of TaxationDocument34 pagesLegal Framework of TaxationCamille HofilenaNo ratings yet

- The Importance of Public Sector Accounting Information To UsersDocument2 pagesThe Importance of Public Sector Accounting Information To UsersKomba KangbaiNo ratings yet

- I. 7. CSC Vs DBMDocument8 pagesI. 7. CSC Vs DBMJean Francois OcasoNo ratings yet

- Torion - ASSIGNMENT 2 - in A NutshellDocument2 pagesTorion - ASSIGNMENT 2 - in A NutshellJeric TorionNo ratings yet

- What Is BudgetDocument4 pagesWhat Is BudgetDhanvanthNo ratings yet

- Caltex v. Commissioner, 208 SCRA 755: Received Principle."Document3 pagesCaltex v. Commissioner, 208 SCRA 755: Received Principle."joyNo ratings yet

- Araullo Vs AquinoDocument6 pagesAraullo Vs AquinoJunivenReyUmadhayNo ratings yet

- DocumentDocument3 pagesDocumentCreate EdNo ratings yet

- Group 7 - Income Tax AssignmentDocument7 pagesGroup 7 - Income Tax AssignmentkaranNo ratings yet

- CH 3 Public Finace and TaxationDocument20 pagesCH 3 Public Finace and TaxationEbsa AbdiNo ratings yet

- Unit 1 Taxation NotesDocument74 pagesUnit 1 Taxation Notesstevin.john538No ratings yet

- Of Public Finance) - Whereas IN PUBLIC FISCAL ADMINISTRATION Shall Govern The Conduct andDocument2 pagesOf Public Finance) - Whereas IN PUBLIC FISCAL ADMINISTRATION Shall Govern The Conduct andDina C. NecesitoNo ratings yet

- Taxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaDocument16 pagesTaxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaBhanu Pratap SinghNo ratings yet

- Group 3 - Budget ProcessDocument16 pagesGroup 3 - Budget ProcessAnne MalongoNo ratings yet

- Basic Taxation and Commercial LawDocument2 pagesBasic Taxation and Commercial LawSheila Marie RangcapanNo ratings yet

- Barrowing Power of The UnionDocument15 pagesBarrowing Power of The UnionRohit KumarNo ratings yet

- Article 265 of Constitution of IndiaDocument10 pagesArticle 265 of Constitution of IndiaAshutosh Singh ParmarNo ratings yet

- Chapter One TaxationDocument10 pagesChapter One TaxationEmebet TesemaNo ratings yet

- Public Finance NoteDocument6 pagesPublic Finance NotenarrNo ratings yet

- PFM Hand BookDocument53 pagesPFM Hand BookWaqar AhmadNo ratings yet

- Budget 2021-22Document57 pagesBudget 2021-22sathsihNo ratings yet

- 14 - Chapter 6 PDFDocument49 pages14 - Chapter 6 PDFJay PatelNo ratings yet

- GST and Fiscal FederalismDocument16 pagesGST and Fiscal FederalismnehaNo ratings yet

- Types of Budget: What Is The Union Budget?Document5 pagesTypes of Budget: What Is The Union Budget?AMIT_7011No ratings yet

- Administrative and Financial Structure of The Colombian StateDocument9 pagesAdministrative and Financial Structure of The Colombian StateIpuc La PazNo ratings yet

- Lecture - Budget ProcessDocument9 pagesLecture - Budget ProcessEfren ChanNo ratings yet

- Part 1 Chapter 2 GOVERNMENT IN PRACTICEDocument34 pagesPart 1 Chapter 2 GOVERNMENT IN PRACTICEJoyleen Unay BuacNo ratings yet

- The United States Government Shutdowns and Emergency Declarations: Facts to RememberFrom EverandThe United States Government Shutdowns and Emergency Declarations: Facts to RememberNo ratings yet

- BRENDA2Document11 pagesBRENDA2katushabe brendaNo ratings yet

- Uganda Christian University Faculty of Law Contracts Law: LecturerDocument8 pagesUganda Christian University Faculty of Law Contracts Law: Lecturerkatushabe brendaNo ratings yet

- Advise The Parties in The Following Situations:: Question 2 (Group 2)Document1 pageAdvise The Parties in The Following Situations:: Question 2 (Group 2)katushabe brendaNo ratings yet

- Cases On Exemption ClausesDocument5 pagesCases On Exemption Clauseskatushabe brendaNo ratings yet

- Burden of Proof in Criminal CasesDocument20 pagesBurden of Proof in Criminal Caseskatushabe brendaNo ratings yet

- Compliance With Anti-Corruption Laws Sample ClausesDocument4 pagesCompliance With Anti-Corruption Laws Sample ClausesRAJARAJESHWARI M GNo ratings yet

- TAN vs. DAGPINDocument7 pagesTAN vs. DAGPINGirlai BibancoNo ratings yet

- 12 Case Digest ProjectDocument41 pages12 Case Digest ProjectKathleen GarciaNo ratings yet

- COURSE OUTLINE Property FALL2022 PavlichDocument8 pagesCOURSE OUTLINE Property FALL2022 PavlichRichard JiangNo ratings yet

- Noble and Murat - The London Gazette, September 17, 1897Document1 pageNoble and Murat - The London Gazette, September 17, 1897macedo.sampaio4274No ratings yet

- Fundamental Rights in IndiaDocument7 pagesFundamental Rights in IndiaAzimul Aktar BarbhuiyaNo ratings yet

- Complaint - Sous Chef LLC v. Providence, Xavier MitchellDocument14 pagesComplaint - Sous Chef LLC v. Providence, Xavier MitchellKeith PearsonNo ratings yet

- 2-Moot Proposition 5th Surana & Surana 2022Document6 pages2-Moot Proposition 5th Surana & Surana 2022ardeebss.officialNo ratings yet

- Application Form BTech 2022 0663Document4 pagesApplication Form BTech 2022 0663Akshit YadavNo ratings yet

- Rule 140 of The Rules of CourtDocument3 pagesRule 140 of The Rules of CourtChristina AureNo ratings yet

- Omar Narvaez At-Large: Candidate Name: DCS DistrictDocument3 pagesOmar Narvaez At-Large: Candidate Name: DCS DistrictStonewall Democrats of DallasNo ratings yet

- What Is MediationDocument2 pagesWhat Is MediationNgan Tuy100% (1)

- Page 14Document1 pagePage 14suvasish pantNo ratings yet

- Prevention Ofmoney Laundering Act-2002 (PMLA)Document25 pagesPrevention Ofmoney Laundering Act-2002 (PMLA)vikramNo ratings yet

- Gurbaksh Singh Sibbia vs. State of PunjabDocument3 pagesGurbaksh Singh Sibbia vs. State of PunjabMAMATHA NaiduNo ratings yet

- Republic Vs ZurbaranDocument8 pagesRepublic Vs ZurbaranMarizPatanaoNo ratings yet

- Task 27Document4 pagesTask 27ANUBHNo ratings yet

- In Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No. 10-13800)Document3 pagesIn Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No. 10-13800)Chapter 11 DocketsNo ratings yet

- 10th Circuit Ruling On UEP TrustDocument16 pages10th Circuit Ruling On UEP TrustLindsay WhitehurstNo ratings yet