Professional Documents

Culture Documents

Acc 496 Chapter 3

Uploaded by

Abdul HassonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 496 Chapter 3

Uploaded by

Abdul HassonCopyright:

Available Formats

9.

A. Ted is attempting to meet the control requirement of the section 351. In order to qualify as non-taxable

exchange under section 351, Peggy must join Ted in the transaction. If the requirements are not met

$80000 on the transfer will be recognized as gain to Ted

B. The regulation provides that stock issued for property whose value is relatively small compared to the

value of stock already owned will not be treated as issued in return for property

11.

a) Liabilities not effects of liabilities on recognized gain and on basis. that's way it will not considered boot for

determining gain. Also note that liabilities have no effect on the determination of adjusted basis of the property to

the corporation.

b) If the transferee’s aggregate the adjusted basis property which is transferred in such transaction will exceed fair

market value of such property immediately after such transaction.

c) Here you get only stock in exchange of property, not stock along with property. The Corporation basis in the

property it receives in exchange against stock is the same basis you had in the property when transferred.

d) stock you receive is the same as the adjusted basis in the property you transfer

20

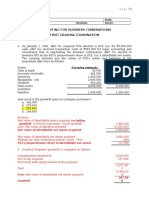

Statement Showing amount of gain recognized by G

Particular amount

Amount realized 18000

Less: property transferred 12000

Gain realized 6000

Gain recognized 6000

Therefore, G’s recognized and realized gain is $6,000 and stock basis is $18,000

22.

Particulars Amount

Liability on the transferred real estate 300,000

Less: adjusted real basis value 260,000

Gain recognized 40,000

Therefore, the gain on transfer is $40,000

28.

a. No gain on exchanges would be recognized by any party if the three exchanges are part of a pre-arranged plan

b. The gain that C will recognize on exchange is calculated below:

Recognized gain = Value of property – Basis of property

= $350,000 - $90,000

= $260,000

c. The parties could structure the transaction by using 351 if the property that Clyde contributes has a basis of

$490,000 (instead of $90,000). The realized gains would not be recognized under this section. It would be a benefit

for all parties. Also, the loss of $140,000 ($490,000 (FMV) - $350,000 basis on C’s exchange could be realized

You might also like

- ACC 430 Chapter 9Document13 pagesACC 430 Chapter 9vikkiNo ratings yet

- Corporate Tax HW SolutionsDocument12 pagesCorporate Tax HW SolutionsbiziakmNo ratings yet

- Nontaxable Exchanges Like-Kind Exchanges - 1031Document6 pagesNontaxable Exchanges Like-Kind Exchanges - 1031张心怡No ratings yet

- Chapter 9 PDFDocument17 pagesChapter 9 PDFJay BrockNo ratings yet

- South Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFDocument45 pagesSouth Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20Th Edition Raabe Solutions Manual Full Chapter PDFSarahSweeneyjpox100% (8)

- I. Structure 1. Gross Income A. Determine GROSS INCOME: - Above The Line: Taken After Calculating Gross Income andDocument4 pagesI. Structure 1. Gross Income A. Determine GROSS INCOME: - Above The Line: Taken After Calculating Gross Income andIva K. TodorovaNo ratings yet

- Wassim Zhani Income Taxation of Corporations (Chapter 2)Document46 pagesWassim Zhani Income Taxation of Corporations (Chapter 2)wassim zhaniNo ratings yet

- Prelim ExamDocument12 pagesPrelim ExamCyd Chary Limbaga BiadnesNo ratings yet

- ACC 430 Chapter 8Document19 pagesACC 430 Chapter 8vikkiNo ratings yet

- Property Transactions OutlineDocument63 pagesProperty Transactions OutlineslcsandraNo ratings yet

- Principles of Taxation For Business and Investment Planning 16Th Edition Jones Test Bank Full Chapter PDFDocument48 pagesPrinciples of Taxation For Business and Investment Planning 16Th Edition Jones Test Bank Full Chapter PDFrosyseedorff100% (7)

- Chapter 19 Homework SolutionDocument3 pagesChapter 19 Homework SolutionJack100% (1)

- Chapter 2Document6 pagesChapter 2Tyler WoodyardNo ratings yet

- BUSINESS COMBINATION - PTDocument13 pagesBUSINESS COMBINATION - PTSchool FilesNo ratings yet

- Definitions - No Definition in The Code For: G. Capital Gains & LossesDocument5 pagesDefinitions - No Definition in The Code For: G. Capital Gains & LossesJen MoloNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Taxes: Transactions in Property: B.1 Capital AssetsDocument2 pagesTaxes: Transactions in Property: B.1 Capital AssetsZeyad El-sayedNo ratings yet

- Federal Income Tax Outline 2021 AH FINALDocument71 pagesFederal Income Tax Outline 2021 AH FINALAndrea Healy100% (1)

- Chapter 2 AssignmentDocument3 pagesChapter 2 AssignmentJasmin MarreroNo ratings yet

- Principles of Taxation For Business and Investment Planning 16Th Edition Jones Solutions Manual Full Chapter PDFDocument39 pagesPrinciples of Taxation For Business and Investment Planning 16Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (9)

- Principles of Taxation For Business and Investment Planning 14Th Edition Jones Solutions Manual Full Chapter PDFDocument38 pagesPrinciples of Taxation For Business and Investment Planning 14Th Edition Jones Solutions Manual Full Chapter PDFlaeliavanfyyqz100% (9)

- Canadian Income Taxation 2016 2017 19th Edition Buckwold Test Bank DownloadDocument15 pagesCanadian Income Taxation 2016 2017 19th Edition Buckwold Test Bank Downloadsaturnagamivphdh100% (28)

- Chapter 03..Document36 pagesChapter 03..nadeemNo ratings yet

- Mixed Accounting QuestionsDocument10 pagesMixed Accounting QuestionsSVTKhsiaNo ratings yet

- CH 05Document23 pagesCH 05Damy RoseNo ratings yet

- Principles of Taxation For Business and Investment Planning 21st Edition Jones Solutions ManualDocument19 pagesPrinciples of Taxation For Business and Investment Planning 21st Edition Jones Solutions Manualgentlecaniculej444gu100% (17)

- Principles of Taxation For Business and Investment Planning 17Th Edition Jones Solutions Manual Full Chapter PDFDocument44 pagesPrinciples of Taxation For Business and Investment Planning 17Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (9)

- Partnership-FormationDocument47 pagesPartnership-FormationStudent 101No ratings yet

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- DocxDocument12 pagesDocxAimee DyingNo ratings yet

- Prelim Exam - Doc2Document16 pagesPrelim Exam - Doc2alellie100% (1)

- Taxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, ADocument3 pagesTaxes: Transactions in Property:) S - C S - S S o y S y S - S" e S A A A S G S. X S, AZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Business Combination ActivityDocument5 pagesBusiness Combination ActivityAndy LaluNo ratings yet

- Taxes: Corporate: But D N LDocument2 pagesTaxes: Corporate: But D N LZeyad El-sayedNo ratings yet

- ACC 311 Ass#2Document7 pagesACC 311 Ass#2Justine Reine CornicoNo ratings yet

- Advanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5Document14 pagesAdvanced Tax (Acct 407) Chapter 17, 2, 3, 4, and 5barlie3824No ratings yet

- Intermediate Accounting II - Chapter 10 Study GuideDocument13 pagesIntermediate Accounting II - Chapter 10 Study GuideCoco Tucker100% (4)

- IAS 3 - GoodwillDocument23 pagesIAS 3 - GoodwillReyad Al-WeshahNo ratings yet

- Taxes: Transactions in PropertyDocument2 pagesTaxes: Transactions in PropertyEl Sayed AbdelgawwadNo ratings yet

- PDF 325316809 Chapter 1 Partnership Formation Test Banks Docxdocx DLDocument46 pagesPDF 325316809 Chapter 1 Partnership Formation Test Banks Docxdocx DLSofia SerranoNo ratings yet

- Learning ResourceDocument5 pagesLearning ResourceRemedios Capistrano CatacutanNo ratings yet

- VideosDocument79 pagesVideosSarah GhielenNo ratings yet

- Intercompany Transfers of Services and Noncurrent Assets: AnswerDocument34 pagesIntercompany Transfers of Services and Noncurrent Assets: AnswerIzzy B100% (1)

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Chapters 10 and 11 OutlineDocument11 pagesChapters 10 and 11 OutlineHamzah B ShakeelNo ratings yet

- Partnership ExercisesDocument37 pagesPartnership ExercisesAuroraNo ratings yet

- Lesson 2. Partnership FormationDocument6 pagesLesson 2. Partnership Formationangelinelucastoquero548No ratings yet

- ACC 547 Week 5 ProblemDocument3 pagesACC 547 Week 5 ProblemHector Valentin0% (1)

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading ExaminationNhel AlvaroNo ratings yet

- TA Xes: Transactions in Property: (5) The Basis of Like-Kind Property Received Is The Basis of Like-Kind Property GivenDocument2 pagesTA Xes: Transactions in Property: (5) The Basis of Like-Kind Property Received Is The Basis of Like-Kind Property GivenEl Sayed AbdelgawwadNo ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- Partnership ExercisesDocument35 pagesPartnership ExercisesshiieeNo ratings yet

- Applied Group Fin Reporting-Changes in Group Structure PDFDocument25 pagesApplied Group Fin Reporting-Changes in Group Structure PDFObey SitholeNo ratings yet

- Lec 2Document5 pagesLec 2ahmedgalalabdalbaath2003No ratings yet

- Chapter 1 - Test Bank Advanced Accounting BakerDocument12 pagesChapter 1 - Test Bank Advanced Accounting Bakergilli1tr100% (4)

- Corporate Tax ChecklistsDocument15 pagesCorporate Tax ChecklistsJakeJohnson100% (2)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Acc 496 Chapter 10Document1 pageAcc 496 Chapter 10Abdul HassonNo ratings yet

- Acc 496 Chapter 9Document2 pagesAcc 496 Chapter 9Abdul HassonNo ratings yet

- Example Fund: Homework Chapter 2Document2 pagesExample Fund: Homework Chapter 2Abdul HassonNo ratings yet

- Acc 496 Chapter 6Document2 pagesAcc 496 Chapter 6Abdul HassonNo ratings yet

- Acc 496 Chapter 5Document2 pagesAcc 496 Chapter 5Abdul HassonNo ratings yet

- Acc 496 Chapter 4Document2 pagesAcc 496 Chapter 4Abdul HassonNo ratings yet

- Acc 496 Chapter 2Document2 pagesAcc 496 Chapter 2Abdul HassonNo ratings yet

- Acc 496 Chapter 2Document2 pagesAcc 496 Chapter 2Abdul HassonNo ratings yet

- Brockhaus-Long ApproximationDocument8 pagesBrockhaus-Long Approximationmainak.chatterjee03No ratings yet

- TITLE X (Appraisal Right)Document2 pagesTITLE X (Appraisal Right)Princess Ann Mendegorin100% (1)

- Lesson Four-E-CommerceDocument40 pagesLesson Four-E-CommerceWambui KaragoNo ratings yet

- Position Size and Leverage - by CryptoCred - MediumDocument1 pagePosition Size and Leverage - by CryptoCred - MediumSlavko Gligorijević100% (1)

- Stock Screener - MarketBeatDocument5 pagesStock Screener - MarketBeatSeudonim SatoshiNo ratings yet

- Risk ManagementDocument16 pagesRisk ManagementMarieNo ratings yet

- Ag Bio Tech Abt Was Organized On January 1 by PDFDocument1 pageAg Bio Tech Abt Was Organized On January 1 by PDFHassan JanNo ratings yet

- 2022 ICT Mentorship Episode 6Document46 pages2022 ICT Mentorship Episode 6Jérôme Schaad100% (4)

- Solution Homework 9Document4 pagesSolution Homework 9calun12100% (1)

- CF Chap 4 MultipleDocument22 pagesCF Chap 4 MultipleĐào Thị Thùy TrangNo ratings yet

- 1 Liquidity RiskDocument8 pages1 Liquidity RiskShreyanko GhosalNo ratings yet

- NISM Series VII SORM Workbook - August 2022Document200 pagesNISM Series VII SORM Workbook - August 2022atul0576No ratings yet

- 20190204018-MULTICAP FUND (Sep 2020) DP-LeafletDocument3 pages20190204018-MULTICAP FUND (Sep 2020) DP-Leafletkovi mNo ratings yet

- Securities-Law 015155Document14 pagesSecurities-Law 015155nashNo ratings yet

- Comparative Analysis of HDFCDocument18 pagesComparative Analysis of HDFCgagandeepsingh86No ratings yet

- Microstructure Invariance in U.S. Stock Market TradesDocument36 pagesMicrostructure Invariance in U.S. Stock Market TradesRolf ScheiderNo ratings yet

- Options Futures and Other Derivatives 9Th Edition Hull Solutions Manual PDFDocument25 pagesOptions Futures and Other Derivatives 9Th Edition Hull Solutions Manual PDFhenry.gaver123100% (13)

- Principles of Economics 8Th Edition Melvin Test Bank Full Chapter PDFDocument37 pagesPrinciples of Economics 8Th Edition Melvin Test Bank Full Chapter PDFamandabinh1j6100% (9)

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- Entrep Week 3 Q3 Recognize A Potential MarketDocument32 pagesEntrep Week 3 Q3 Recognize A Potential MarketEsperanza DisepedaNo ratings yet

- Volatility As An Asset Class PDFDocument44 pagesVolatility As An Asset Class PDFSanket PatelNo ratings yet

- Security Analysis - Investment ManagementDocument0 pagesSecurity Analysis - Investment ManagementAru BhartiNo ratings yet

- Maitra Commodities Pvt. LTD: Introduction To Investing in StocksDocument26 pagesMaitra Commodities Pvt. LTD: Introduction To Investing in StocksAkash JadhavNo ratings yet

- Database of Stock BrokersDocument11 pagesDatabase of Stock BrokersDoctor planet global instituteNo ratings yet

- Bullish Hammer: Reversal Candlestick Pattern: HammerDocument23 pagesBullish Hammer: Reversal Candlestick Pattern: HammerCinaru CosminNo ratings yet

- Ultimate Options Strategies WorkbookDocument20 pagesUltimate Options Strategies WorkbookjitendrasutarNo ratings yet

- Ckyc & Kra Kyc FormDocument27 pagesCkyc & Kra Kyc Formvbpathi87No ratings yet

- ML4T 2017fall Exam1 Version BDocument8 pagesML4T 2017fall Exam1 Version BDavid LiNo ratings yet

- Liquidity Grab Strategy - The Prop TraderDocument8 pagesLiquidity Grab Strategy - The Prop TraderVishal Nikam100% (1)

- Destruction of CertsDocument4 pagesDestruction of CertsYTOLeaderNo ratings yet