Professional Documents

Culture Documents

Critical Review Sap 7 - Portofolio Selection

Uploaded by

hi nims0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

Critical review sap 7 - portofolio selection.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesCritical Review Sap 7 - Portofolio Selection

Uploaded by

hi nimsCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

TEORI PASAR MODAL DAN INVESTASI

CRITICAL REVIEW JURNAL SAP 7

Selection of Orthogonal Investment Portofolio

using Evolino RNN Trading Model

OLEH. KELOMPOK 4

Magister Maksi Angkatan XXIV Kelas B:

Ida Bagus Nyoman Ramartha Putra (1981611033 / 02)

Ni Wayan Trisna Kusumayanti (1981611039 / 08)

A.A. Rai Niti Darmika Sukawati (1981611041 / 10)

Made Ayu Prilla Winda Puspita (1981611053 / 22)

Ni Made Madani Hapsari (1981611054 / 23)

PROGRAM STUDI MAGISTER AKUNTANSI

FAKULTAS EKONOMI DAN BISNIS UNIVERSITAS UDAYANA

DENPASAR

2020

Kalimat pertama menjorok ke dalam. Spsasi 1.15, times new roman, size

12. Perhatikan terjemahan agar logis dan tata penulisannya dirapikan.

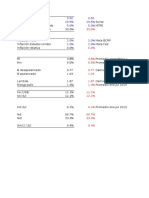

Selection of Orthogonal Investment Portofolio using

1 Judul Evolino RNN Trading Model

Pemilihan Portofolio Investasi Orthogonal menggunakan

Model Perdagangan Evolino RNN

Elsevier: Social and Behavioral Science 110 (2014) 1158-

2 Sumber

1165

3 Penulis Nijole Maknickiene

Investing in financial market require the reliable

predicting of expecting returns, assessment of risk and

reliability. Principle of portfolio orthogonality was using to

reduce the risk of the investment. An artificial intelligence

4 Latar Belakang

system may reveal new opportunities for using this

principle. Prediction of recurrent neural networks ensemble

is stochastically informative distribution, which is helpful

for portfolio selection.

Investment decisions are always made under uncertainty;

it is possible only in a heuristic approach to the maximum

result. Potential distributions best reflect the investment

5 Tujuan Penelitian opportunities. The aim of paper is to select investment

portfolio using parameters of potential distribution obtained

by the model based on ensemble of recurrentneural

networks.

6 Kajian Teoritis

A a

7 Kajian Empiris A a

a a

8 Sampel Penelitian

It is known, that ensembles can predict more accurate,

then single RNN. Authors constructed Evolino RNN based

prediction model, ensemble from 176 RNN. Influence of

9 Metode Penelitian number of RNN in ensemble was investigated by authors in

earlier work (Maknickiene & Maknickas, 2013).

+page 1162, data step, input step dan prediction step –

ringkas.

Page 1162 setelah steps itu sampe sebelum conclusions

itu hasil. Bisa dipilah data nya yang penting masukin kesini.

Temuan dan/atau

10

Hasil Penelitian

Main portfolio selection principals of modern portfolio

theory- maximising expected return and minimising

riskiness – are successfully using together with artificial

intelligence. Potential distributions best reflects the

investment opportunities in conditions of uncertainty.

Model, using ensemble of Evolino RNN, is reliable

forecasting tool useful for investors in currency market. Its

Kesimpulan prediction is stochastically informative potential

11 distribution, which is helpful for portfolio selection. Shape

Penelitian

and parameters of distribution influence decision making in

currency market.

Testing in Forex market in real time confirmed, that

assessment of portfolio riskiness, finding most orthogona

elements of portfolio, influence better results for trading in

real market. Orthogonality and optimization influence the

better selection of investment portfolio.

1.

Keterbatasan

12

Penelitian

You might also like

- Investigation of Financial Market Prediction by Recurrent Neural NetworkDocument6 pagesInvestigation of Financial Market Prediction by Recurrent Neural NetworkalonsoNo ratings yet

- Qiu 2016Document11 pagesQiu 2016Akhi DanuNo ratings yet

- Algorithmic Forex Trading Using Combination of Numeric Time Series and News AnalysisDocument5 pagesAlgorithmic Forex Trading Using Combination of Numeric Time Series and News AnalysismateusfmpetryNo ratings yet

- Pdcat17 Prediction CADocument7 pagesPdcat17 Prediction CAognjanovicNo ratings yet

- Applicability of Portfolio Theory-NRB ReviewDocument30 pagesApplicability of Portfolio Theory-NRB ReviewMega capitalmarketNo ratings yet

- Pengembangan Model Prediksi Harga Saham Berbasis Neural NetworkDocument10 pagesPengembangan Model Prediksi Harga Saham Berbasis Neural Networknurdi afriantoNo ratings yet

- Improving Stock Trading Decisions Based On Pattern Recognition Using Machine Learning TechnologyDocument25 pagesImproving Stock Trading Decisions Based On Pattern Recognition Using Machine Learning TechnologyCasper CaluwéNo ratings yet

- Stock Price Forecast of Macro-Economic Factor Using Recurrent Neural NetworkDocument10 pagesStock Price Forecast of Macro-Economic Factor Using Recurrent Neural NetworkIAES IJAINo ratings yet

- Application of Neural Network For Forecasting of Exchange Rates and Forex Trading Nijolė Maknickienė, Algirdas MaknickasDocument6 pagesApplication of Neural Network For Forecasting of Exchange Rates and Forex Trading Nijolė Maknickienė, Algirdas MaknickasManuelPlaNo ratings yet

- Forecasting of Stock Prices Using Multi Layer PerceptronDocument6 pagesForecasting of Stock Prices Using Multi Layer Perceptronijbui iir100% (1)

- Impact of Technical Parameters For Short - and Long-Term Analysis ofDocument6 pagesImpact of Technical Parameters For Short - and Long-Term Analysis ofPutu Tirta AdityaNo ratings yet

- A Neural-Network-Based Nonlinear Metamodeling Approach To Financial Time Series ForecastingDocument12 pagesA Neural-Network-Based Nonlinear Metamodeling Approach To Financial Time Series ForecastingFrancisco MirandaNo ratings yet

- Agnostic Risk Parity: Taming Known and Unknown-UnknownsDocument12 pagesAgnostic Risk Parity: Taming Known and Unknown-Unknownsaymane.oubellaNo ratings yet

- Portfolio SelectionDocument12 pagesPortfolio SelectionChantal DeLarentaNo ratings yet

- Integrating Metaheuristics and Artificial Neural Networks For Improved Stock Price PredictionDocument12 pagesIntegrating Metaheuristics and Artificial Neural Networks For Improved Stock Price PredictionMarcus ViniciusNo ratings yet

- Portfolio Optimization Using Neuro Fuzzy SystemDocument6 pagesPortfolio Optimization Using Neuro Fuzzy SystemPraneeth KNo ratings yet

- Integration of Non Linear Independent Component Analysis and Support Vector Regression For Stock Price ForecastingDocument9 pagesIntegration of Non Linear Independent Component Analysis and Support Vector Regression For Stock Price Forecastingsarte00No ratings yet

- Applying Portfolio Selection: A Case of Indonesia Stock ExchangeDocument10 pagesApplying Portfolio Selection: A Case of Indonesia Stock ExchangeShahnaz AflahaNo ratings yet

- Improving Returns On Stock Investment Through Neural Network SelectionDocument7 pagesImproving Returns On Stock Investment Through Neural Network SelectionAakash DebnathNo ratings yet

- Prediction Based For Stock With DNNDocument13 pagesPrediction Based For Stock With DNNnandaNo ratings yet

- Comparison of Algorithms in Foreign Exchange Rate PredictionDocument5 pagesComparison of Algorithms in Foreign Exchange Rate PredictionshrutiNo ratings yet

- Construction of Optimal Portfolio Using Sharpe's Single Index Model: An Empirical Study On Nifty 50 StocksDocument10 pagesConstruction of Optimal Portfolio Using Sharpe's Single Index Model: An Empirical Study On Nifty 50 StocksNishtha AgarwalNo ratings yet

- 13.prediction of Stock Market Performance by Using Machine Learning TechniquesDocument1 page13.prediction of Stock Market Performance by Using Machine Learning Techniqueskamran raiysatNo ratings yet

- Cao 2019Document13 pagesCao 2019Matheus LaranjaNo ratings yet

- Forecasting Stock Prices With Long-Short Term MemoDocument15 pagesForecasting Stock Prices With Long-Short Term MemoSalah SamNo ratings yet

- The Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexDocument9 pagesThe Construction of Optimal Portfolio Using Sharpe's Single Index Model - An Empirical Study On Nifty Metal IndexRevanKumarBattuNo ratings yet

- A Low Risk Stock Trading Decision Support System: W. Wen, R.T. QinDocument5 pagesA Low Risk Stock Trading Decision Support System: W. Wen, R.T. Qinmazin903No ratings yet

- Comparison of Returns and Risk Using-4958Document8 pagesComparison of Returns and Risk Using-4958rochdi.keffalaNo ratings yet

- Genetic Algorithm - Investment Decision MakingDocument6 pagesGenetic Algorithm - Investment Decision MakingKarel SarapNo ratings yet

- Chapter 1 - Introduction To Statistics - Part 1Document20 pagesChapter 1 - Introduction To Statistics - Part 1Faten ZaraNo ratings yet

- Comparative Study of Neural Networks and Decision Trees For Application in Trading Financial FuturesDocument6 pagesComparative Study of Neural Networks and Decision Trees For Application in Trading Financial Futures2o de medicinaNo ratings yet

- Stock Price Prediction Using Artificial Neural Networks: Padmaja Dhenuvakonda, R. Anandan, N. KumarDocument5 pagesStock Price Prediction Using Artificial Neural Networks: Padmaja Dhenuvakonda, R. Anandan, N. KumarVignesh Jaya100% (1)

- An ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeDocument7 pagesAn ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeAnita AndrianiNo ratings yet

- A Study On Relationship Between Risk and Return Analysis of Selected Stocks On NSE Using Capital Asset Pricing ModelDocument4 pagesA Study On Relationship Between Risk and Return Analysis of Selected Stocks On NSE Using Capital Asset Pricing Modelfaheem munimNo ratings yet

- ARIMA Model Has A Strong Potential For Short-Term Prediction of Stock Market TrendsDocument4 pagesARIMA Model Has A Strong Potential For Short-Term Prediction of Stock Market TrendsMahendra VarmanNo ratings yet

- JAACMV7A2 Sharkawy PDFDocument13 pagesJAACMV7A2 Sharkawy PDFgibog52499No ratings yet

- Stock Market Forecasting Techniques: A Survey: G. Preethi, B. SanthiDocument7 pagesStock Market Forecasting Techniques: A Survey: G. Preethi, B. SanthiJames CharoensukNo ratings yet

- Derivatives OptionDocument21 pagesDerivatives OptionSuresh Kumar NayakNo ratings yet

- Sharpe Mutual Fund PerformanceDocument21 pagesSharpe Mutual Fund PerformanceMark FrellipsNo ratings yet

- 05.stock Market Prediction UsingDocument4 pages05.stock Market Prediction Usingkamran raiysatNo ratings yet

- Portfolio Management Strategy Based On LSTMDocument9 pagesPortfolio Management Strategy Based On LSTMGiàu Lê ThanhNo ratings yet

- Austin Journal of Business Administration and ManagementDocument4 pagesAustin Journal of Business Administration and ManagementAustin Publishing GroupNo ratings yet

- NELION Non-Linear Stock Prediction and Portfolio Management SystemDocument185 pagesNELION Non-Linear Stock Prediction and Portfolio Management SystemleekiangyenNo ratings yet

- Irjet V5i3634Document4 pagesIrjet V5i3634zoravarNo ratings yet

- Factor Investing in Fixed-Income - Cross-Sectional and Time-Series Momentum in Sovereign Bond MarketsDocument48 pagesFactor Investing in Fixed-Income - Cross-Sectional and Time-Series Momentum in Sovereign Bond Marketspietro silvestriNo ratings yet

- Portfolio Optimization With Return Prediction Using Deep Learning and Machine LearningDocument15 pagesPortfolio Optimization With Return Prediction Using Deep Learning and Machine LearningnandaNo ratings yet

- Expert Systems With Applications: Bruce Vanstone, Gavin FinnieDocument13 pagesExpert Systems With Applications: Bruce Vanstone, Gavin FinnieCarlosNo ratings yet

- DEBASMITA Report 2Document16 pagesDEBASMITA Report 2SHIR DATTANo ratings yet

- Portfolio Optimisation For Two InvestorsDocument9 pagesPortfolio Optimisation For Two InvestorsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis On Stock Market Prediction Using Machine Learning TechniquesDocument5 pagesAnalysis On Stock Market Prediction Using Machine Learning TechniquesIJCIRAS Research PublicationNo ratings yet

- Taiwan Stock Investment With Gene Expression Programming: SciencedirectDocument10 pagesTaiwan Stock Investment With Gene Expression Programming: Sciencedirectsuciati_liaNo ratings yet

- Batch-17 SYNOPSIS PDFDocument17 pagesBatch-17 SYNOPSIS PDFSiva Poojitha VeluriNo ratings yet

- Bts Kat ArmyDocument3 pagesBts Kat ArmyBeakatrine CabreraNo ratings yet

- 6053 LecturesDocument17 pages6053 Lecturesapi-3699305No ratings yet

- Kwan 2006Document21 pagesKwan 2006rochdi.keffalaNo ratings yet

- Intelligent Automation & Soft ComputingDocument14 pagesIntelligent Automation & Soft Computingabhishek choudharyNo ratings yet

- Fuzzy Portfolio Allocation Models Through A New Risk Measure and Fuzzy Sharpe RatioDocument18 pagesFuzzy Portfolio Allocation Models Through A New Risk Measure and Fuzzy Sharpe RatioRizki AminNo ratings yet

- Statistical and Neural Classifiers: An Integrated Approach to DesignFrom EverandStatistical and Neural Classifiers: An Integrated Approach to DesignNo ratings yet

- Evolutionary Algorithms and Neural Networks: Theory and ApplicationsFrom EverandEvolutionary Algorithms and Neural Networks: Theory and ApplicationsNo ratings yet

- Introduction of SoftbankDocument11 pagesIntroduction of SoftbankThai CelineNo ratings yet

- Foreign Direct Investment by Dr. JunaidDocument33 pagesForeign Direct Investment by Dr. JunaidPrachi KaushikNo ratings yet

- Partnership-Dissolution ExercisesDocument2 pagesPartnership-Dissolution ExercisesLeenNo ratings yet

- Chapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFDocument40 pagesChapter 5 Zvi Bodie - Alex Kane - Alan J.Marcus - Investments-McGraw-Hill Education (2018) PDFEllin Damayanti100% (1)

- Module 4Document29 pagesModule 4Anjali Ajz77No ratings yet

- New Issue MarketDocument15 pagesNew Issue MarketRavi Kumar100% (1)

- RV Capital Letter 2018-12Document6 pagesRV Capital Letter 2018-12Rocco HuangNo ratings yet

- International Certificate in Corporate Finance Columbia Business SchooDocument19 pagesInternational Certificate in Corporate Finance Columbia Business SchooMoises GutiérrezNo ratings yet

- LCCI L3 Advanced Business Calculations Nov 2016 - MSDocument12 pagesLCCI L3 Advanced Business Calculations Nov 2016 - MSchee pin wongNo ratings yet

- Damodaran - Value CreationDocument27 pagesDamodaran - Value Creationishuch24No ratings yet

- Notes From A Seth Klarman MBA LectureDocument5 pagesNotes From A Seth Klarman MBA LecturePIYUSH GOPALNo ratings yet

- Account Case StudyDocument9 pagesAccount Case Studyamado_florezNo ratings yet

- FX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargDocument9 pagesFX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargSarvagya JhaNo ratings yet

- Capital Expenditures (CapEx)Document9 pagesCapital Expenditures (CapEx)JonalleeNo ratings yet

- Essays in Insider Trading Informational Efficiency and Asset PR PDFDocument144 pagesEssays in Insider Trading Informational Efficiency and Asset PR PDFANIKET SHARMANo ratings yet

- Group Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtDocument31 pagesGroup Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtPhạm Ngọc ÁnhNo ratings yet

- Assignment 3Document2 pagesAssignment 3Dani WedajeNo ratings yet

- CEMEXDocument20 pagesCEMEXNandish GuptaNo ratings yet

- FN3092 SG PDF PDFDocument156 pagesFN3092 SG PDF PDFКарен ХачатрянNo ratings yet

- BSBFIA402 Report On Financial ActivityDocument64 pagesBSBFIA402 Report On Financial ActivityAlexDrive100% (1)

- Solucionario - PC1 2019-02 EF71Document37 pagesSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeNo ratings yet

- FIN254 Project Final AbcDocument37 pagesFIN254 Project Final AbcSazzad66No ratings yet

- Yes Bank CrisisDocument16 pagesYes Bank CrisisGaurav Tandel0% (1)

- P11Document7 pagesP11Arif RahmanNo ratings yet

- Edited For Final SubmissionDocument47 pagesEdited For Final SubmissionMedina Pangilinan0% (1)

- Financial Lemonade: Refresh Your Wellbeing Thru Managing Personal FinanceDocument40 pagesFinancial Lemonade: Refresh Your Wellbeing Thru Managing Personal FinanceConrado Delos Reyes Jr.No ratings yet

- Private Equity Portfolio Company FeesDocument78 pagesPrivate Equity Portfolio Company Feesed_nycNo ratings yet

- UaeDocument201 pagesUaenspectah1No ratings yet

- Factors Determining Capital StructureDocument3 pagesFactors Determining Capital StructuretushNo ratings yet

- Session 9 Case Discussion Immulogic Pharmaceutical CorporationDocument32 pagesSession 9 Case Discussion Immulogic Pharmaceutical CorporationK RameshNo ratings yet