Professional Documents

Culture Documents

Case 13-50 - ShikharMohan - PGFS

Uploaded by

SHIKHAR MOHANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 13-50 - ShikharMohan - PGFS

Uploaded by

SHIKHAR MOHANCopyright:

Available Formats

Shikhar Mohan (PGDM-FS)

Roll no: 037

Case 13-50

Q.1 If New Age Industries continues to use ROI as the sole measure of divisional

performance, explain why FTEC would be reluctant to acquire Recreational Leasing,

Inc.

1. If New Age Industries continued to use return on investment (ROI) as the sole

measure of “division performance”, Fun Times Entertainment Corporation (FTEC)

would be reluctant to acquire Recreational Leasing Incorporation (RLI) because the

post-acquisition combined ROI would decrease.

Particulars Return on Investment

FTEC RLI Combined

Operating Income $10,00,000 $3,00,000 $13,00,000

Total Assets $40,00,000 %15,00,000 $55,00,000

ROI(Income/Assets) 25% 20% 23.6%

The result would be that FTEC’s management would either lose their bonuses or have their

bonuses limited to 50% of the eligible amounts. The assumption is that management could

provide convincing explanations for the decline in ROI.

Q.2 If New Age Industries could be persuaded to use residual income to measure the

performance of FTEC, explain why FTEC would be more willing to acquire RLI.

2. Residual income is the profit earned that exceeds an amount charged for funds

committed to a business unit. The amount charged for funds committed is equal to

an imputed interest rate multiplied by invested capital. If new age industries could

be persuaded to use residual income to measure performance, FTEC would be more

interested to acquire RLI, because residual income of the combined operations

would increase.

3. Discuss how the behavior of division managers is likely to be affected by the use of

the following performance measures: (a) return on investment and (b) residual

income.

A) The likely effect on the behavior of division managers whose performance is

measured by return on investment includes incentives to do the following:

Put off capital improvements or modernization to avoid capital expenditures.

Shy away from profitable opportunities or investments that would yield more than

the company's cost of capital but that could lower ROI.

B) The likely effect on the behavior of division managers whose performance is

measured by residual income includes incentives to do the following:

Seek any opportunity or investment that will increase overall residual income.

Seek to reduce the level of assets employed in the business.

You might also like

- Chapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingDocument70 pagesChapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingEninta SebayangNo ratings yet

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- DCF Model TemplateDocument6 pagesDCF Model TemplateHamda AkbarNo ratings yet

- Corporate Strategy and Governance - 2Document13 pagesCorporate Strategy and Governance - 2GodsonNo ratings yet

- Divisional Performance Measures and Transfer Pricing NotesDocument83 pagesDivisional Performance Measures and Transfer Pricing NotesShreya PatelNo ratings yet

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxDocument27 pagesChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaNo ratings yet

- Interpreting Apple's Statement of Stockholders' EquityDocument5 pagesInterpreting Apple's Statement of Stockholders' EquityRafael Ernesto Ponce PérezNo ratings yet

- Ebit Eps AnalysisDocument22 pagesEbit Eps AnalysisPiyuksha PargalNo ratings yet

- Business Finance ReviewerDocument5 pagesBusiness Finance ReviewerGela May SadianNo ratings yet

- Blain Kitchenware Inc.: Capital StructureDocument7 pagesBlain Kitchenware Inc.: Capital StructureRoy Lambert100% (4)

- Pembahasan Soal Bab 10 DesentralisasiDocument5 pagesPembahasan Soal Bab 10 DesentralisasimentoelNo ratings yet

- Holiday Entertainment Co. - Group 5 ReportDocument12 pagesHoliday Entertainment Co. - Group 5 Reportbamd888100% (1)

- Ch 13 Investment Centers Transfer PricingDocument2 pagesCh 13 Investment Centers Transfer PricingKhaidir Firmansyah100% (2)

- ITC Company Profile and Financial AnalysisDocument13 pagesITC Company Profile and Financial AnalysisDIVYANG AGARWAL 2023291No ratings yet

- Cuacm413 Presentation Group 9..Qns 21Document13 pagesCuacm413 Presentation Group 9..Qns 21Jeremiah NcubeNo ratings yet

- Chapter 24 - AnswerDocument12 pagesChapter 24 - AnswerAgentSkySkyNo ratings yet

- Financial Anlysis of FFC For InvestorsDocument7 pagesFinancial Anlysis of FFC For InvestorsAli KhanNo ratings yet

- 29 Purity Steel Compensation Plan AnalysisDocument7 pages29 Purity Steel Compensation Plan Analysisfajarina ambarasariNo ratings yet

- Performance 6.10Document3 pagesPerformance 6.10George BulikiNo ratings yet

- Answer No. 1: Allama Iqbal Open University Name:Faiqa Mughal Roll No - AD514873Document9 pagesAnswer No. 1: Allama Iqbal Open University Name:Faiqa Mughal Roll No - AD514873Amber ShahNo ratings yet

- Performance Evaluation in The Decentralized FirmDocument38 pagesPerformance Evaluation in The Decentralized FirmMuhammad Rusydi AzizNo ratings yet

- Chapter 15 Financial and Nonfinancial PMDocument22 pagesChapter 15 Financial and Nonfinancial PMSophia Zavynne Ancheta BuenoNo ratings yet

- Accounting-Financial Statements of Companies-1653399167327513Document37 pagesAccounting-Financial Statements of Companies-1653399167327513Badhrinath ShanmugamNo ratings yet

- Capital StructureDocument8 pagesCapital StructureVarun MudaliarNo ratings yet

- Responsibility Accounting SystemDocument13 pagesResponsibility Accounting SystemTsundere DoradoNo ratings yet

- ACCO 400 Weeks 5 and 6 Discussion Questions and AnswersDocument4 pagesACCO 400 Weeks 5 and 6 Discussion Questions and AnswersWasif SethNo ratings yet

- Responsibility Accounting, Segment Evaluation, and Transfer PricingDocument4 pagesResponsibility Accounting, Segment Evaluation, and Transfer PricingAlliahData100% (1)

- Accy 2 Extra CreditDocument6 pagesAccy 2 Extra CreditCường Trần MinhNo ratings yet

- Division PerformanceDocument8 pagesDivision PerformanceTimilehin GbengaNo ratings yet

- Current Ratio (Amount in RS.)Document10 pagesCurrent Ratio (Amount in RS.)Balakrishna ChakaliNo ratings yet

- MBG-206 2019-20 09-12-2021Document4 pagesMBG-206 2019-20 09-12-2021senthil.jpin8830No ratings yet

- Unit 2Document23 pagesUnit 2nandan velankarNo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- CREDITFAQ30 Pitfalls of EBITDA 092016Document3 pagesCREDITFAQ30 Pitfalls of EBITDA 092016handsomepeeyushNo ratings yet

- MB0045 Set 2Document5 pagesMB0045 Set 2Ahmed BarkaatiNo ratings yet

- AutoZone Stock Performance and Share Repurchase AnalysisDocument3 pagesAutoZone Stock Performance and Share Repurchase AnalysisGeorgina AlpertNo ratings yet

- FM AssignmentDocument3 pagesFM Assignmentdua tanveerNo ratings yet

- IFC-analysis-ratiosDocument6 pagesIFC-analysis-ratiosKumar RajeshNo ratings yet

- Chapter - 4: Analysis and Interpretation OF DataDocument62 pagesChapter - 4: Analysis and Interpretation OF Dataprashanraj123No ratings yet

- 1.4 Introduction To The Global Investment Performance Standards (Gips)Document3 pages1.4 Introduction To The Global Investment Performance Standards (Gips)Alvin PhuongNo ratings yet

- Solutions To CasesDocument3 pagesSolutions To CasesHETTYNo ratings yet

- Transfer PricingDocument15 pagesTransfer PricingEjaz Khan100% (1)

- Investment Centers ROI Residual IncomeDocument43 pagesInvestment Centers ROI Residual IncomeYong RenNo ratings yet

- Investment Centers and Transfer Pricing: Answers To Review QuestionsDocument45 pagesInvestment Centers and Transfer Pricing: Answers To Review QuestionsShey INFTNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document16 pagesIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikNo ratings yet

- MAS Responsibility Acctg.Document6 pagesMAS Responsibility Acctg.Rosalie Solomon BocalaNo ratings yet

- Managing Capital and Financial AssetsDocument13 pagesManaging Capital and Financial AssetsLeonard Muchiri NyagaNo ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- Wa0005.Document4 pagesWa0005.ParveshNo ratings yet

- Valuation Seminar ExerciseDocument4 pagesValuation Seminar ExerciseMihai MirceaNo ratings yet

- Write Up m201802 SinghalDocument14 pagesWrite Up m201802 Singhalshalini singhalNo ratings yet

- Finance Chapter 20Document21 pagesFinance Chapter 20courtdubs100% (3)

- EBIT-EPS Analysis Maximizes Shareholder ValueDocument27 pagesEBIT-EPS Analysis Maximizes Shareholder ValueKaran MorbiaNo ratings yet

- Unit Iv: Leverage & Capital BudgetingDocument63 pagesUnit Iv: Leverage & Capital BudgetingMehak SinghNo ratings yet

- Financial Management 2iu3hudihDocument10 pagesFinancial Management 2iu3hudihNageshwar singhNo ratings yet

- COMMERCE 100 HOMEWORK TUTORIALDocument5 pagesCOMMERCE 100 HOMEWORK TUTORIALTinotendaBarweNo ratings yet

- Performance Evaluation in The Decentralized FirmDocument38 pagesPerformance Evaluation in The Decentralized FirmNana LeeNo ratings yet

- Group 6 - Management Control System of Measurement and Control of Managed AssetsDocument25 pagesGroup 6 - Management Control System of Measurement and Control of Managed AssetsHernawatiNo ratings yet

- Solutions - Chapter 5Document21 pagesSolutions - Chapter 5Dre ThathipNo ratings yet

- Hilton7e SM CH13Document50 pagesHilton7e SM CH13VivekRaptorNo ratings yet

- Report on PMC Bank Scam and Ethical ChallengesDocument8 pagesReport on PMC Bank Scam and Ethical ChallengesSHIKHAR MOHANNo ratings yet

- Tech Start-Ups in India Across Various Sectors: 1. Practo (Healthcare)Document11 pagesTech Start-Ups in India Across Various Sectors: 1. Practo (Healthcare)SHIKHAR MOHANNo ratings yet

- Stolyarov MFE Study Guide PDFDocument279 pagesStolyarov MFE Study Guide PDFSachin SomaniNo ratings yet

- An Empirical Study On The DynaDocument17 pagesAn Empirical Study On The Dynaswapnil tyagiNo ratings yet

- HBSEntrepreneurship 125studio Trailer Rc1-EnDocument1 pageHBSEntrepreneurship 125studio Trailer Rc1-EnSHIKHAR MOHANNo ratings yet

- Slidex - Tips - Yamunotri Ropeway Project PDFDocument39 pagesSlidex - Tips - Yamunotri Ropeway Project PDFSHIKHAR MOHANNo ratings yet

- HBSEntrepreneurship 125studio Trailer Rc1-EnDocument1 pageHBSEntrepreneurship 125studio Trailer Rc1-EnSHIKHAR MOHANNo ratings yet

- Bookkeeping Basics: Name - Block - DateDocument12 pagesBookkeeping Basics: Name - Block - DateMaria AparicioNo ratings yet

- Sales Seasonality and Product ProfitabilityDocument45 pagesSales Seasonality and Product ProfitabilityKrestyl Ann GabaldaNo ratings yet

- CW 3 SolutionDocument2 pagesCW 3 SolutionMtl AndyNo ratings yet

- 2022 Edition of The Guide To Doing Business in OmanDocument25 pages2022 Edition of The Guide To Doing Business in OmanafrahNo ratings yet

- K to 12 Basic Education Curriculum TLE Agriculture Crop ProductionDocument9 pagesK to 12 Basic Education Curriculum TLE Agriculture Crop ProductionShien Zan SouNo ratings yet

- Module 3 - Income Tax ConceptsDocument18 pagesModule 3 - Income Tax ConceptsShayneNo ratings yet

- Progressive Development Corporation vs. Quezon City, GR No. L-36081 Dated April 24, 1989Document5 pagesProgressive Development Corporation vs. Quezon City, GR No. L-36081 Dated April 24, 1989EdvangelineManaloRodriguezNo ratings yet

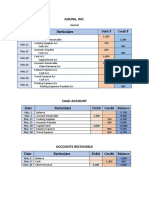

- Date Particulars: Ahuna, IncDocument5 pagesDate Particulars: Ahuna, IncUsama RamzanNo ratings yet

- Fme Financial Ratio Formulas Checklist PDFDocument2 pagesFme Financial Ratio Formulas Checklist PDFWahyu WidayatNo ratings yet

- A. Balance Sheet: Hytek Income Statement Year 2012Document3 pagesA. Balance Sheet: Hytek Income Statement Year 2012marc chucuenNo ratings yet

- Class 2 ECO 214Document3 pagesClass 2 ECO 214Peter DundeeNo ratings yet

- Afework Business PalnDocument31 pagesAfework Business PalnAbel GetachewNo ratings yet

- Income From House PropertyDocument27 pagesIncome From House PropertyJames Anderson0% (1)

- Net Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreDocument3 pagesNet Income (Loss) Reconciliation For Corporations With Total Assets of $10 Million or MoreHazem El SayedNo ratings yet

- Wealth ManagementDocument10 pagesWealth ManagementAditi pandeyNo ratings yet

- Rameez Practice ExcelDocument14 pagesRameez Practice ExcelSaswat PanigrahiNo ratings yet

- Part A: Unit I - Statistics For Economics: SyllabusDocument7 pagesPart A: Unit I - Statistics For Economics: SyllabusRadhika JaiswalNo ratings yet

- Lecture Notes1, Factors For Eco Dev. (Dr. Atiq)Document10 pagesLecture Notes1, Factors For Eco Dev. (Dr. Atiq)Eamon awanNo ratings yet

- IAS - 12 (DEFERRED TAX) (Exercise)Document8 pagesIAS - 12 (DEFERRED TAX) (Exercise)Saad AtharNo ratings yet

- Ifra Book Sept 23Document254 pagesIfra Book Sept 23Hasnain AzizNo ratings yet

- Hundaol ProposalDocument22 pagesHundaol ProposalletahundaolkasaNo ratings yet

- Contempo LayoutDocument14 pagesContempo LayoutBainaot Abdul SumaelNo ratings yet

- TOPIC 5-Budgetary PlanningDocument73 pagesTOPIC 5-Budgetary PlanningDashania GregoryNo ratings yet

- Caa MicroproectDocument19 pagesCaa MicroproectTanmay WartheNo ratings yet

- Cash Balances Quantity Theory of MoneyDocument8 pagesCash Balances Quantity Theory of MoneyAppan Kandala VasudevacharyNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- OMZIL MID YEAR 2021 FINANCIAL RESULTS FINAL From Lawrence 31AUG21Document10 pagesOMZIL MID YEAR 2021 FINANCIAL RESULTS FINAL From Lawrence 31AUG21Mandisi MoyoNo ratings yet