Professional Documents

Culture Documents

Implications of External Debt

Uploaded by

shivam kumar0 ratings0% found this document useful (0 votes)

10 views1 pageImplication of external debt

Original Title

Implications of external debt

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentImplication of external debt

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageImplications of External Debt

Uploaded by

shivam kumarImplication of external debt

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

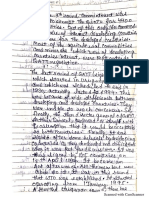

Implications of external debt

Excessive confidence in borrowing to promote economic growth and development.

Equally, there could be over-confidence in lenders to lend money in short-term

without evaluation of possible problems.

Investment that is misplaced and fails to achieve a decent rate of return to help pay the

debt interest payments. For example, developing countries may struggle to make use

of funds for industrialisation if they lack the necessary skills and infrastructure.

Unexpected devaluation in the exchange rate, which increases the real value of debt

interest payments denominated in dollars.

A decline in commodity prices which leads to a decline in the terms of trade for

developing economies and relative fall in export earnings.

Demand-side shock which reduces GDP. For example, conflict or global recession

which hits demand and GDP.

Servicing external debt (paying debt interest payments) ceteris paribus, reduces GDP

because the monetary payments flow out of the country. These debt payments reduce

the amount available to invest in improving public services, which can help economic

development.

Growing levels of debt can discourage foreign and private investment because of

concerns that the debt is becoming unsustainable.

If a country is struggling to meet interest payments, they may be tempted to borrow to

meet debt interest payments, but then the problem can spiral and magnify.

Countries in regional areas may suffer from a regional downgrade in credit

assessment. For example, many Sub-Saharan African countries experienced rising

external debt ratios, and this made investors reluctant to lend at cheap rates.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Scanned With CamscannerDocument8 pagesScanned With Camscannershivam kumarNo ratings yet

- Custom Search: Law Articles - India's Most Authentice Free Legal Source OnlineDocument4 pagesCustom Search: Law Articles - India's Most Authentice Free Legal Source Onlineshivam kumarNo ratings yet

- Indian Democracy - Role of Election CommDocument84 pagesIndian Democracy - Role of Election Commshivam kumarNo ratings yet

- Trips and TrimsDocument2 pagesTrips and Trimsshivam kumarNo ratings yet

- History ProjectDocument9 pagesHistory Projectshivam kumarNo ratings yet