Professional Documents

Culture Documents

Chapter-na-Isasalin Sa Accounting

Uploaded by

Jonalyn Ancheta0 ratings0% found this document useful (0 votes)

11 views6 pagesPagsasalin Accounting

Original Title

Chapter-na-Isasalin sa Accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPagsasalin Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesChapter-na-Isasalin Sa Accounting

Uploaded by

Jonalyn AnchetaPagsasalin Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

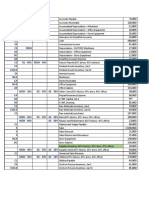

CHAPTER 3

The Accounting Equation

LESSON 3-1: EFFECTS OF OWNER’S INVESTMENT/ WITHDRAWAL AND CASH ACQUISITION OF

ASSETS

Lesson Objective

Identify the effects of transaction on the assets and owner’s equity as a result of

owner’s investment/ withdrawal and cash acquisition of assets

ILLUSTRATION

The effect of the following transactions on the asset and owner’s equity:

Transaction Asset Liabilities Owner’s Equity Analysis

1. Owner invests Assets Capital Cash increases because owner

cash in the Increase Increases invests cash in the business

business which is an asset. Owner’s

interest in the business

increases as represented by an

increase in capital.

2. Owner invests Assets Capital Assets increase because owner

furniture Increase Increases invests furniture in the

business which is an asset.

Owner’s interest in the

business increases because of

the investment as represented

by an increase in capital.

3. Owner withdraws Assets Capital Assets decrease because

cash for personal Decrease Decreases owner withdraws cash which is

use. an asset. Owner’s interest in

the business decrease because

of the withdrawal as

represented by a decrease in

capital.

4. Owner purchases Asset Increase Supplies increase because of

supplies using and Decrease the purchase but cash

cash decrease because of the

payment. Since both are

assets, one asset increases

while another asset

correspondingly decreases.

5. Owner gets Asset Increase Cash increase because of the

refund for and Decrease refund but supplies decrease

returning because of the return. Since

damaged supplies both are assets, one asset

bought on cash. increases while another asset

correspondingly decreases.

6. Owner purchases Asset Increase Furniture increase because of

furniture using and Decrease the purchase but cash

cash decrease because of the

payment. Since both are

assets, one asset increases

while another asset

correspondingly decreases.

7. Owner makes Assets Capital Assets increase because owner

additional cash Increase Increases invests additional cash in the

investment business which is an asset.

Owner’s interest in the

business increases because of

the investment as represented

by an increase in capital.

8. Owner withdraws Asset Decrease Capital Assets decrease because

supplies for Decreases owner withdraws supplies

personal use from the business which is an

asset. Owner’s interest in the

business decrease because of

the withdrawal as represented

by a decrease in capital.

LESSON 3-2: EFFECTS OF INCOME EARNED AND PAYMENT OF EXPENSES

Lesson Objective

Identify the effects of transactions on the assets and owner’s equity as a result of

income earned and payment of expenses

ILLUSTRATION

The effect of the following transactions on the asset and owner’s equity:

Transaction Asset Liabilities Owner’s Equity Analysis

1. Rendered services for Assets Capital Increases Assets increase because

cash. Increase owner collected cash as a

result of services

rendered. Owner’s equity

increases because the

business earned income

for services rendered.

2. Rendered Services on Assets Capital Increases Assets increase because

credit Increase of account collectible

from the customer which

is an asset as a result of

services rendered.

Likewise, owner’s equity

increases because of

income earned from

services rendered.

3. Paid telephone bill Assets Capital Assets decrease because

Decrease Decreases owner pays cash for the

telephone bill. Owner’s

equity decreases because

the telephone bill

represents utilities

expense which decreases

capital.

LESSON 3-2: EFFECTS OF TRANSACTIONS ON THE ACCOUNTING EQUATION

Lesson Objective

Identify the effects of transactions on the assets, liabilities, and owner’s equity as a

result of different transactions affecting the accounting equation

Analyze the different transactions in the service type of business

The following table will illustrate the effect of transactions on the accounting equation. The

abbreviations in the examples shall mean the following:

INC – Increase

DEC – Decrease

NC – No Change

The following details will include the amount and the account affected in illustrating the effects

on the asset equation. Notice that the accounting equation is always balanced in every

transaction such that assets are always equal to liabilities and capital.

Transaction Assets Liabilities Capital Analysis

1. Ms. Go INC NC INC The P800,000 investments

invests cash. of Ms. Go increases the

CASH Ms. Go, Capital

P800,000 cash of the business and

P800,000 P800,000 the capital of the owner.

2. Ms. Go INC NC INC The P50,000 equipment

invests increases the assets of the

Equipment Ms. Go, Capital

equipment. business. Since this is an

P50,000 P50,000 P50,000 investment of Ms. Go, her

capital correspondingly

increases.

3. Renders INC NC INC The business earns

P25,000 P25,000 by rendering

Cash Service Income

services for services and collecting

cash P25,000 P25,000 revenues in cash. The

effect in the accounting

equation is an increase of

P25,000 in cash for the

cash collected and a

P25,000 increase in capital

as revenue increases in

capital.

4. Renders INC NC INC Assets increase by P9,000

P9,000 which is the amount of

Accounts Service Income

services in revenue expected to be

Receivable

credit P9,000 collected from the

P9,000 customer to whom the

services were rendered.

Capital increased by

P9,000 since rendering of

service represents

revenue.

5. Collects INC NC NC Assets increase by P9,000

amount in as there is cash inflow in

Cash

transaction the amount of collection.

#4 P9,000 However, assets

DEC correspondingly decrease

by and equal amount since

Accounts the accounts receivable,

Receivable which is an asset account,

P9,000 decreases. This is because

the amount the customer

owes has already been

collected.

6. Purchases INC INC NC Supplies increase the

P1,000 Supplies Accounts assets of the business by

supplies on Payable P1,000. Liabilities

P1,000

credit correspondingly increase

P1,000

by P1,000 as the supplies

were bought on account or

credit.

7. Returns DEC DEC NC Assets decrease by P120

P120 which is the amount of

Supplies Accounts

defective supplies returned.

Payable

supplies P120 Liabilities correspondingly

P120 decrease by P120 as the

returned supplies decrease

the amount owed.

8. Pays the DEC DEC NC The transaction is a

supplies payment of an account.

Cash Accounts

bought on Supplies purchased in

Payable

account or P880 transaction #6 amount to

credit P880 P1,000. However,

defective supplies in the

amount of P120 was

returned in transaction #7.

Hence, the remaining

liability to be paid is P880.

There is a cash outflow of

P880 upon payment.

Because of this, assets

decrease by P880.

Likewise, liabilities

decrease in the same

amount as the P880

liability on supplies was

paid.

9. Borrows INC INC NC Cash increases the asset of

P90,000 the business because the

Cash Notes Payable

cash issuing business borrowed

a note P90,000 P90,000 P90,000. Notes Payable

increases the liabilities of

the business by P90,000 as

it represents and

obligation on the part of

the business to pay

P90,000 at a future date.

10. Purchases INC NC NC Land increases the asset of

P500,000 the business by P500,000.

Land

land paying Cash correspondingly

cash P500,000 decreases by P500,000

DEC with the cash paid for the

purchase of land.

Cash

P500,000

11. Pays utilities DEC NC DEC Payment represents cash

expense for outflow decreasing the

Cash Utilities Expense

the month, asset of the business by

P800 P800 P800 P800. Likewise, expenses

decrease the capital by

P800 as they have

opposite effect on income.

12. Pays the DEC DEC NC The transaction is a

note in full P90,000 payment of

Cash Accounts

liability. Since there is cash

Payable

P90,000 outflow representing the

P90,000 payment of the note,

assets decrease by

P90,000. Liabilities likewise

decrease by P90,000 which

is the amount of cash

settlement for the notes

payable

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- cOMPUTER sERVICING 123Document1 pagecOMPUTER sERVICING 123Jonalyn AnchetaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Elito Villaflor CircaDocument1 pageElito Villaflor CircaJonalyn AnchetaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Special Qualifying Examination Review 2019: Partnership OperationsDocument4 pagesSpecial Qualifying Examination Review 2019: Partnership OperationsJonalyn AnchetaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Colonial in The PhilippinesDocument18 pagesColonial in The PhilippinesJonalyn AnchetaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 21 Century Literature: Senator Renato "Compañero" Cayetano Memorial Science and Technology High SchoolDocument4 pages21 Century Literature: Senator Renato "Compañero" Cayetano Memorial Science and Technology High SchoolJonalyn AnchetaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 21 Century Literature: Senator Renato "Compañero" Cayetano Memorial Science and Technology High SchoolDocument4 pages21 Century Literature: Senator Renato "Compañero" Cayetano Memorial Science and Technology High SchoolJonalyn AnchetaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- RR HousngDocument24 pagesRR HousngSyed MudhassirNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 1 - Solution 2013Document10 pages1 - Solution 2013Yamer YusufNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 2017 ADB Annual ReportDocument104 pages2017 ADB Annual ReportFuaad DodooNo ratings yet

- Bilant in EngDocument13 pagesBilant in EngDaniela BulardaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Money and Banking: Chapter - 8Document32 pagesMoney and Banking: Chapter - 8Kaushik NarayananNo ratings yet

- Wallstreetjournal 20180531 TheWallStreetJournalDocument34 pagesWallstreetjournal 20180531 TheWallStreetJournalMadhav BhattaraiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DOA With Contract of Sale SampleDocument5 pagesDOA With Contract of Sale SampleJohn Michael VidaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- MAS Financial-RatiosDocument4 pagesMAS Financial-RatiosJulius Lester AbieraNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The History of The Money Changers by Andrew HitchcockDocument10 pagesThe History of The Money Changers by Andrew HitchcockMuhammad AndalusiNo ratings yet

- Investment Analysis ThesisDocument5 pagesInvestment Analysis Thesisallisonschadedesmoines100% (1)

- Probablity QuestionsDocument14 pagesProbablity QuestionsSetu Ahuja100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Pen 2Document6 pagesPen 2Rajan GuptaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 102 - Cost AccountingDocument3 pages102 - Cost Accountingredwan999No ratings yet

- Hype Cycle For Supply Chain Management, 2009Document65 pagesHype Cycle For Supply Chain Management, 2009ramapvkNo ratings yet

- Course Syllabus - The Economics of Cities and Regions 2017-2018Document8 pagesCourse Syllabus - The Economics of Cities and Regions 2017-2018FedeSivakNo ratings yet

- Bir Ruling No. Ot-042-2022Document6 pagesBir Ruling No. Ot-042-2022Ren Mar CruzNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Brooks FM PPT Ch06 BBDocument33 pagesBrooks FM PPT Ch06 BBghj9818No ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet

- The Fundamental Accounting EquationDocument2 pagesThe Fundamental Accounting EquationPreeny Parong ChuaNo ratings yet

- Partnership: Basic Considerations and Formation: Advance AccountingDocument53 pagesPartnership: Basic Considerations and Formation: Advance AccountingZyrah Mae Saez100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- Pinturas Unidas FINALDocument60 pagesPinturas Unidas FINALAlejandro MoyaNo ratings yet

- Order in The Matter of M/s.Peers Allied Corporation LTDDocument28 pagesOrder in The Matter of M/s.Peers Allied Corporation LTDShyam SunderNo ratings yet

- Final ITC Vs HULDocument15 pagesFinal ITC Vs HULpurvish13No ratings yet

- Part 1-FinObj MCQDocument21 pagesPart 1-FinObj MCQdigitalbooksNo ratings yet

- AI-ForEX Robot Installation V1Document15 pagesAI-ForEX Robot Installation V1galoefren2365No ratings yet

- Midterm Exam GovaccDocument3 pagesMidterm Exam GovaccEloisa JulieanneNo ratings yet

- Abebech Tsige Laundry Soap Factory FinalDocument78 pagesAbebech Tsige Laundry Soap Factory Finalberhanu seyoumNo ratings yet

- Case Study 1 Merrill Lynch Investment ClockDocument10 pagesCase Study 1 Merrill Lynch Investment ClockYuanjie ZhuNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)