Professional Documents

Culture Documents

Ratio Analysis Best Practice 3 PDF

Ratio Analysis Best Practice 3 PDF

Uploaded by

Ege GoksuzogluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis Best Practice 3 PDF

Ratio Analysis Best Practice 3 PDF

Uploaded by

Ege GoksuzogluCopyright:

Available Formats

Turkish

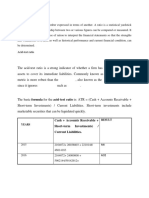

Airlines 2015 2016 GRAPH RATE

Liquidity Ratios

Current Ratio 0,81 0,80 -0,01

Quick Ratio 0,757 0,753 -0,004

Cash Ratio 0,25 0,40 0,16

Profitability Ratios

Gross Profit Margin 0,20 0,12 -0,08

Operating Profit Margin 0,09 0,03 -0,06

Net Income Margin 0,08 0,03 -0,06

Return on Equity 0,18 0,05 -0,14

Return on Assets 0,05 0,01 -0,04

Efficiency Ratio

Total Asset Turnover 0,64 0,53 -0,11

Fixed Asset Turnover 0,79 0,66 -0,14

Inventory Turnover 38,98 39,89 0,91

Days in Inventory 9,36 9,15 -0,21

Some

Account Recv turnover 29,15 25,84 -3,31

Average Collection Period 12,52 14,13 1,60

Accounts Payable Turnover 11,15 12,21 1,06

Informations

Average Payment Period 32,73 29,90 -2,83

Operating Cycle 21,89 23,28 1,39

Cash Conversion Cycle 42,09 39,05 -3,05

Dept Ratio

Total Debt Ratio 0,70 0,72 0,02

Long Term Dept 0,47 0,48 0,01

Times Interst Earned 4,45 -0,57 -5,02

Liquidity Ratios

Liquidity ratios measure a company's ability to pay debt obligations and its margin of safety as we can see from the ratio analysis test company's power to pay back its liability with its assets is decreased which also the company has lessiquid position which inventory is skipped. But

looking from the positive side the company can repay its short-term debts.So it is a good impression for creditors.

Profitability Ratios

Profitability ratios are a class of financial metrics that are used to assess a business's ability to generate earnings compared to its expenses and other relevant costs incurred during a specific period of time. For most of these ratios, having a higher value relative to the same ratio

from a previous period indicates that the company is doing well. But looking for that comany we can see the reverse situation.Situation for profitability has become worse,company can be unable to pay for its operating expenses.It could be happen because of a business model

change. Looking on the return of assets gives investors an idea of how effectively the company is converting the money it has to invest into net income.

Efficiency Ratio

An efficiency ratio can calculate the turnover of receivables, the repayment of liabilities, the quantity and usage of equity, and the general use of inventory and machinery. This ratio can also be used to track and analyze the performance of commercial and investment banks.

Looking for this company The firm's sales each dolar earned from assets are not working enough.The firm is using its fixed asset uneffectively and generating its sales worse than previous year.The company's efficiency of managing its inventories increased which is a postitive effect

as companies want to have small levels of inventory level.Company is converting its inventory to sales less quickly comparing to 2015. Also there is a decrease in turnover which causes to the organization is collecting it's payments slower.As the average payment period increased

which has a meaning that the company has spend more time to pay their payments.Even company's liquidity performance is low and its liabilities are increase,company can pay its debts more efficiently.

Dept Ratio

A financial ratio that measures the extent of a company’s or consumer’s leverage which shows us the possibility to borrow cash from organizations. As we can see there is a increase in the total dept ratio which means the higher the degree of leverage and more financial risk.

Company is funding most of its ventures with debt.Company can be at risk of bankruptcy if it becomes unable to finance its debt due to decreased income or cash flow problems.Negative ratio indicates that a business may not be in a position to pay its interest obligations. In 2016,

the ability to service debt is a problem for a borrower.

SUMMARY

The firm’s liquidity has decreased significantly, as indicated by current and quick ratio. Decreasing quick ratios suggest that a company is over-leveraged, struggling to maintain or grow sales, paying bills too quickly or collecting receivables too slowly. However, the cash ratio is a

bit increasing since it relies on inventory in part for liquidity. The current ratio is called “current” because, unlike some other liquidity ratios, it incorporates all current assets and liabilities. Management has done a less-than-average job of generating operating profits on its assets.

Gross Profit margin clearly decreased. For THY this might happen most probably because of decrease in the selling price of goods, without any decrease in the cost of goods sold or increase in the cost of goods sold without any increase in selling price due to high competition.

Strong, growing operating profit is a positive indicator of financial health. Therefore, decreasing operating profit means trouble for a business.

However, this ineffectiveness is countered by efficiencies in keeping operating expenses high. Lower fixed-asset turnover ratio in 2016 indicates that a company has less effectively utilized investment in fixed assets to generate revenue. A lower turnover of THY implies weak sales

and, therefore, excess inventory for the company. It might mean that if in last two years they had the same amount of flights, on 2016 they had more empty seats. A higher average collection period is an indicator of a few possible problems for THY. From a logistic standpoint, it

may mean that their business needs better communication with customers regarding their debts and your expectations of payment. More strict bill collection steps may need to be taken. It takes longer for THY to repay to creditors and suppliers will include the risk to the price of

their goods. Company collecting its cash slower than last year. Which is not good for company and it has to improve immediately.

Ece İrem Namazcı-1501160

Mert Cicigün-1506245

Selin Umay-1508069

Mert Can-1500710

You might also like

- Month To Go Moving ChecklistDocument9 pagesMonth To Go Moving ChecklistTJ MehanNo ratings yet

- Negotiable Instruments ActDocument49 pagesNegotiable Instruments ActJasMeetEdenNo ratings yet

- Equity Seminar 1 Equity Seminar 1: Q3: Doctrine of NoticeDocument7 pagesEquity Seminar 1 Equity Seminar 1: Q3: Doctrine of NoticeTeeruVarasuNo ratings yet

- Nhóm 4 - In-Class Exercise BOP - 2020Document36 pagesNhóm 4 - In-Class Exercise BOP - 2020Thảo Hoàng PhươngNo ratings yet

- How To Load Amore Prepaid Card - Google SearchDocument1 pageHow To Load Amore Prepaid Card - Google SearchDanny MontanaNo ratings yet

- Strategic Analysis of Starbucks CorporationDocument18 pagesStrategic Analysis of Starbucks CorporationCarla Grace Tobias-Samoy Roc50% (2)

- Swing Trade Pro 2.0: The 5-Step Swing Trading BlueprintDocument36 pagesSwing Trade Pro 2.0: The 5-Step Swing Trading BlueprintIsIs DroneNo ratings yet

- Anandam CompanyDocument8 pagesAnandam CompanyNarinderNo ratings yet

- Optimal Delta HedgingDocument16 pagesOptimal Delta HedgingHenry ChowNo ratings yet

- Case 1.4Document4 pagesCase 1.4Nam Hong Joo88% (8)

- Ratio Analysis For Nestle and F&NDocument37 pagesRatio Analysis For Nestle and F&NVinod Venkatesan33% (6)

- Quezon Project Case MemoDocument4 pagesQuezon Project Case MemogregsteinbrennerNo ratings yet

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- Max's Ratio AnalysisDocument16 pagesMax's Ratio AnalysisMykaNo ratings yet

- Airway BillDocument3 pagesAirway Billoender070% (1)

- 2Q16 Financial StatementsDocument82 pages2Q16 Financial StatementsJBS RINo ratings yet

- Gilbert Lumber Case A11Document7 pagesGilbert Lumber Case A11karthik sNo ratings yet

- 123 PatternDocument7 pages123 PatternbirengNo ratings yet

- A Study On Financial Performance of AmulDocument18 pagesA Study On Financial Performance of AmulBarun100% (1)

- Analysis: (Document Subtitle)Document20 pagesAnalysis: (Document Subtitle)Mohemin MehmoodNo ratings yet

- Project Report: A Study On Financial Planning and Forecasting in Honda Motorcompany LimitedDocument11 pagesProject Report: A Study On Financial Planning and Forecasting in Honda Motorcompany LimitedArpita GuptaNo ratings yet

- BF 12 Worksheet 2 2023Document2 pagesBF 12 Worksheet 2 2023John Dreed PorrasNo ratings yet

- A Study On Financial Performance of Amul (Project)Document18 pagesA Study On Financial Performance of Amul (Project)BarunNo ratings yet

- Tata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & InterpretationDocument31 pagesTata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & Interpretationaditya_sanghviNo ratings yet

- Attock Cements Financial Forecasting: Assigment 1Document10 pagesAttock Cements Financial Forecasting: Assigment 1attiqueNo ratings yet

- Dion Global Solutions Limited: Previous YearsDocument1 pageDion Global Solutions Limited: Previous Yearsanupoju nagasaikrishnaNo ratings yet

- Omkar WCDocument14 pagesOmkar WComNo ratings yet

- FM Ratio PresentationDocument9 pagesFM Ratio Presentationansary75No ratings yet

- Financial Ratio Analysis of Star Cement PVT LTD: Presentation By: Aditi ChaudharyDocument16 pagesFinancial Ratio Analysis of Star Cement PVT LTD: Presentation By: Aditi ChaudharyGunjan ChaudharyNo ratings yet

- Liquidity Ratios AssignmentDocument6 pagesLiquidity Ratios AssignmentNoor Hidayah Binti Taslim0% (1)

- Liquidity RatiosDocument5 pagesLiquidity Ratioskashish AgarwalNo ratings yet

- Section B - Group No. 1 - FM-II A2 - Rashmi Singh - Godrej ConsumerProductLtdDocument9 pagesSection B - Group No. 1 - FM-II A2 - Rashmi Singh - Godrej ConsumerProductLtdSubhendu MishraNo ratings yet

- Corporate Finance Mini CaseDocument6 pagesCorporate Finance Mini CaseMashaal FNo ratings yet

- Calculation of Financial Ratios and Its Analysis: Advance Performance ManagemntDocument8 pagesCalculation of Financial Ratios and Its Analysis: Advance Performance ManagemntZeeshan AbdullahNo ratings yet

- Internal Forces G, HDocument6 pagesInternal Forces G, HRui JiaNo ratings yet

- A Report On Alibaba Group's Financial Health AnalysisDocument8 pagesA Report On Alibaba Group's Financial Health AnalysisNayeem Ahamed AdorNo ratings yet

- Financial Analysis of Olympic Industries LimitedDocument5 pagesFinancial Analysis of Olympic Industries LimitedরাসেলআহমেদNo ratings yet

- Report On Financial Ratio Analysis Of: Section: 01Document25 pagesReport On Financial Ratio Analysis Of: Section: 01Meher AfrozNo ratings yet

- Working Capital Analysis Dish TV India LTD.: Course: Financial Management - II Assignment No: 2Document10 pagesWorking Capital Analysis Dish TV India LTD.: Course: Financial Management - II Assignment No: 2Pratibha PrasadNo ratings yet

- Leather Industry of Bangladesh: Performance Analysis Based On Financial RatioDocument15 pagesLeather Industry of Bangladesh: Performance Analysis Based On Financial RatioKazi SiamNo ratings yet

- Discussion C2Document7 pagesDiscussion C2Tô Lâm Thiên TrangNo ratings yet

- Hochschild 2015 Annual ReportDocument128 pagesHochschild 2015 Annual ReportVictor ValdiviaNo ratings yet

- Project: Flying Cement CompanyDocument21 pagesProject: Flying Cement CompanyAleena IdreesNo ratings yet

- Fin 410: Financial Statement Analysis: Submitted ToDocument26 pagesFin 410: Financial Statement Analysis: Submitted ToMd Borhan Uddin 2035097660No ratings yet

- Ratio Analysis of Sainsbury PLCDocument4 pagesRatio Analysis of Sainsbury PLCshuvossNo ratings yet

- BF Group Assignment Group 3 (Hero MotoCorp)Document21 pagesBF Group Assignment Group 3 (Hero MotoCorp)Shiva KrishnanNo ratings yet

- Project Report On Gokul Refoils and Solvent LTDDocument23 pagesProject Report On Gokul Refoils and Solvent LTDvishal jhaNo ratings yet

- Berger Paints: Types of Ratios 2012-2013 2011-2012Document7 pagesBerger Paints: Types of Ratios 2012-2013 2011-2012NehaAsifNo ratings yet

- Corporate Finance and WACC AnalysisDocument4 pagesCorporate Finance and WACC AnalysisOmar ChaudhryNo ratings yet

- Ratio Analysis of VoltasDocument11 pagesRatio Analysis of Voltasriya guptaNo ratings yet

- Cash Management IN Unimech Seals India PVT LTD: Second ReviewDocument24 pagesCash Management IN Unimech Seals India PVT LTD: Second Reviewwasim musthaqNo ratings yet

- Report On: Ratio Analysis of GSX Techedu Inc, Inc. & Helen of Troy LimitedDocument11 pagesReport On: Ratio Analysis of GSX Techedu Inc, Inc. & Helen of Troy LimitedAiman KhanNo ratings yet

- RATIO AnalysisDocument27 pagesRATIO AnalysisTracy Ann AcedilloNo ratings yet

- Introduction To Financial Management: GROUP PROJECT: Ratio Analysis ofDocument34 pagesIntroduction To Financial Management: GROUP PROJECT: Ratio Analysis ofJahida Akter LovnaNo ratings yet

- Alkyl Amines Chemicals LTD (Ratio)Document7 pagesAlkyl Amines Chemicals LTD (Ratio)Hardik BhanushaliNo ratings yet

- Report On Liquidity Ratio Analysis and InferencesDocument3 pagesReport On Liquidity Ratio Analysis and InferencesPravallikaNo ratings yet

- Operating Cycle: To CashDocument8 pagesOperating Cycle: To CashNoor Islam FahadNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceAmel NAJMNo ratings yet

- AStudy On Financial Performance Using Ratio Analysisof Visa Steel LimitedfinalDocument10 pagesAStudy On Financial Performance Using Ratio Analysisof Visa Steel LimitedfinalSANJAY M 112106025No ratings yet

- Ratio Analysis of RILDocument10 pagesRatio Analysis of RILadityabaid4No ratings yet

- Ratio Analysis: Liquidity RatiosDocument5 pagesRatio Analysis: Liquidity RatiosVanshGuptaNo ratings yet

- Report On Profitability Ratios: Gross Profit MarginDocument8 pagesReport On Profitability Ratios: Gross Profit MarginakhilNo ratings yet

- Cash Flow Statement AnalysisDocument36 pagesCash Flow Statement Analysisthilaganadar100% (5)

- Financial System Analysis OF Godrej Hershey LTDDocument54 pagesFinancial System Analysis OF Godrej Hershey LTDrakeshkumar978010856No ratings yet

- WCM IndividualDocument9 pagesWCM IndividualSiddharth PoddarNo ratings yet

- Running Header: Case Study Report-Woolworths Group LTDDocument22 pagesRunning Header: Case Study Report-Woolworths Group LTDCalcutta PeppersNo ratings yet

- Financial Performance of Ram Haldi Pvt. LTD.: Table 1: Chart of Accounts Name of The Account Code Assets Current AssetsDocument6 pagesFinancial Performance of Ram Haldi Pvt. LTD.: Table 1: Chart of Accounts Name of The Account Code Assets Current AssetsWinston DsouzaNo ratings yet

- Financial Analysis: RevenueDocument9 pagesFinancial Analysis: RevenueMaithri Vidana KariyakaranageNo ratings yet

- Employee Payroll NewDocument669 pagesEmployee Payroll NewWossen DemissNo ratings yet

- Ratio AnalysisDocument8 pagesRatio AnalysisikramNo ratings yet

- Eicher Motors CFProject Group11Document10 pagesEicher Motors CFProject Group11Greeshma SharathNo ratings yet

- Contemporary Logistics: Organizational and Managerial Issues in LogisticsDocument44 pagesContemporary Logistics: Organizational and Managerial Issues in LogisticsEge GoksuzogluNo ratings yet

- Contemporary Logistics: Twelfth Edition, Global EditionDocument47 pagesContemporary Logistics: Twelfth Edition, Global EditionEge GoksuzogluNo ratings yet

- Contemporary Logistics: ProcurementDocument34 pagesContemporary Logistics: ProcurementEge GoksuzogluNo ratings yet

- Statistical Analysis - Spring 2020 Beykoz University Name-Surname: Student ID: Quiz 2Document1 pageStatistical Analysis - Spring 2020 Beykoz University Name-Surname: Student ID: Quiz 2Ege GoksuzogluNo ratings yet

- Turkish LogisticsDocument23 pagesTurkish LogisticsEge GoksuzogluNo ratings yet

- CH 11 - Measuring Cost of LivingDocument33 pagesCH 11 - Measuring Cost of LivingEge GoksuzogluNo ratings yet

- Statistical Analysis - Spring 2020 Beykoz University Name-Surname: Student ID: Quiz 2Document1 pageStatistical Analysis - Spring 2020 Beykoz University Name-Surname: Student ID: Quiz 2Ege GoksuzogluNo ratings yet

- Murphy ContemporaryLogistics 12e PPT Ch03Document33 pagesMurphy ContemporaryLogistics 12e PPT Ch03Ege GoksuzogluNo ratings yet

- Q2 PDFDocument4 pagesQ2 PDFDyenNo ratings yet

- Measurement of Risk and Calculation of Portfolio RiskDocument16 pagesMeasurement of Risk and Calculation of Portfolio RiskSankalp ZalaNo ratings yet

- GR 159048 Go Vs BacaronDocument7 pagesGR 159048 Go Vs Bacaronlucci_1182100% (1)

- Submitted By: Vivek SharmaDocument18 pagesSubmitted By: Vivek SharmaVe1kNo ratings yet

- The Electrical Worker January 2009Document16 pagesThe Electrical Worker January 2009Kathryn R. ThompsonNo ratings yet

- Stéphane Giraud EGIS France PPPDocument31 pagesStéphane Giraud EGIS France PPPvikasNo ratings yet

- Corporate Restructuring Companies Amendment Act 2021Document9 pagesCorporate Restructuring Companies Amendment Act 2021Najeebullah KardaarNo ratings yet

- Uses of The Cash Flow StatementDocument2 pagesUses of The Cash Flow StatementNIS TTNo ratings yet

- Credit and Collection: Chapter 6 - Credit Decision MakingDocument51 pagesCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataNo ratings yet

- Pelaporan Korporat - Pertemuan 1 - SAK Dan Conceptual FrameworkDocument82 pagesPelaporan Korporat - Pertemuan 1 - SAK Dan Conceptual FrameworkAlam HarahapNo ratings yet

- NYSCRF Actuary ReportDocument15 pagesNYSCRF Actuary ReportJimmyVielkindNo ratings yet

- Webinar Manajemen Keuangan PerusahaanDocument69 pagesWebinar Manajemen Keuangan PerusahaanDias CandrikaNo ratings yet

- CF Unit 3Document21 pagesCF Unit 3Saravanan ShanmugamNo ratings yet

- Types of Companies - : On The Basis of IncorporationDocument6 pagesTypes of Companies - : On The Basis of IncorporationKunal SanchetiNo ratings yet

- MATH4512 - Topic - 1 Duration Bond MatchingDocument110 pagesMATH4512 - Topic - 1 Duration Bond MatchingKennyNo ratings yet

- Spare-Parts Zone Pte LTD: (Tax Invoice) ReprintDocument2 pagesSpare-Parts Zone Pte LTD: (Tax Invoice) ReprintCP KrunalNo ratings yet

- Taxation Pilot QuestionsxDocument14 pagesTaxation Pilot QuestionsxEmmanuel ObafemmyNo ratings yet

- Exam 2 Section 1Document26 pagesExam 2 Section 1Chuchai JittavirojNo ratings yet