Professional Documents

Culture Documents

B

Uploaded by

euricoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B

Uploaded by

euricoCopyright:

Available Formats

BAbstract

The present work aims to analyze the efficiency in financial markets, by analyzing the positions

of the 2013 Nobel Economy prize winners, who obtained this recognition because of their

empirical contributions concerning the prediction of the behavior of financial asset prices,

based

on different theoretical foundations.

The Efficient Markets Theory of Eugene Fama is analyzed, as well as, irrational behaviors of

investors and the generation of speculative bubbles from the perspective of Robert Shiller, and

finally Lars Peter´s contributions with the Generalized Model of Moments.

It concludes that markets become more efficient, when analysts believes that there are more

inefficient and competes in the search of information in order to take advantage of that

inefficiency.

Normally analysts act on the basis of imperfect markets, using technical analysis, carrying out

fundamental reviews and accepting that privilege information exists; this reality make markets

more efficient.

Market efficiency is half-truth; financial asset prices seem to frequently reflect its intrinsic

value

to a certain extent and in specific situations, widespread irrational behaviors generates

bubbles.

Key words: Financial Markets, Market efficiency, Behavioral finances, Speculative Bubbles.

You might also like

- Senate Bill 669: Pregnant Person's Freedom Act of 2022Document4 pagesSenate Bill 669: Pregnant Person's Freedom Act of 2022euricoNo ratings yet

- B450M Mortar MaxDocument1 pageB450M Mortar MaxeuricoNo ratings yet

- Champion Gear Guide Jun 20Document12 pagesChampion Gear Guide Jun 20euricoNo ratings yet

- Outlook 2016 GuideDocument89 pagesOutlook 2016 GuideeuricoNo ratings yet

- Core T2000Document2 pagesCore T2000euricoNo ratings yet

- Dispositivos AndroidDocument4 pagesDispositivos AndroideuricoNo ratings yet

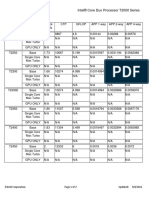

- Intel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedDocument2 pagesIntel® Core Duo Processor T2000 Series: ©intel Corporation Page 1 of 2 9/8/2011 UpdatedeuricoNo ratings yet

- Dispositivos AndroidDocument4 pagesDispositivos AndroideuricoNo ratings yet

- Core T2000Document2 pagesCore T2000euricoNo ratings yet

- Core T2000Document2 pagesCore T2000euricoNo ratings yet

- Barcelona MedicineDocument3 pagesBarcelona MedicineeuricoNo ratings yet

- Ajo Versus Cancer5862Document2 pagesAjo Versus Cancer5862euricoNo ratings yet

- Tiny House Plans Quartz Model by Ana White 6.8.16Document20 pagesTiny House Plans Quartz Model by Ana White 6.8.16kathy_burg100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)