Professional Documents

Culture Documents

Table 1: Bank Group-Wise Weighted Average Lending Rates (WALR) (On Outstanding Rupee Loans) Scheduled Commercial Banks

Uploaded by

Shiva Mehta0 ratings0% found this document useful (0 votes)

10 views5 pagesOriginal Title

PR1653LR09012020.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views5 pagesTable 1: Bank Group-Wise Weighted Average Lending Rates (WALR) (On Outstanding Rupee Loans) Scheduled Commercial Banks

Uploaded by

Shiva MehtaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

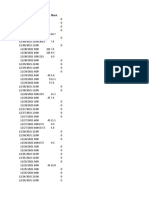

Table 1: Bank Group-wise Weighted Average Lending Rates (WALR)

(On Outstanding Rupee Loans)

(Per cent)

Scheduled

Month-end Public Sector Banks Private Sector Banks Foreign Banks

Commercial Banks

Feb-2012 12.51 12.74 12.06 12.53

Mar-2012 12.63 12.41 12.08 12.56

Apr-2012 12.69 12.63 12.04 12.65

May-2012 12.50 12.46 12.01 12.47

Jun-2012 12.39 12.47 12.23 12.40

Jul-2012 12.39 12.47 12.25 12.40

Aug-2012 12.38 12.50 11.28 12.35

Sep-2012 12.29 12.59 11.87 12.33

Oct-2012 12.22 12.32 11.92 12.23

Nov-2012 12.27 12.45 11.90 12.29

Dec-2012 12.21 12.43 11.73 12.23

Jan-2013 12.27 12.41 11.56 12.25

Feb-2013 12.13 12.49 11.96 12.19

Mar-2013 12.11 12.39 12.58 12.19

Apr-2013 12.04 12.39 12.58 12.14

May-2013 12.05 12.17 12.56 12.11

Jun-2013 12.03 12.33 12.47 12.12

Jul-2013 12.00 12.48 12.63 12.13

Aug-2013 12.02 12.52 12.88 12.17

Sep-2013 12.05 12.80 13.10 12.25

Oct-2013 12.02 12.53 13.04 12.17

Nov-2013 12.05 12.56 12.87 12.19

Dec-2013 12.02 12.58 12.70 12.18

Jan-2014 12.03 12.59 12.64 12.17

Feb-2014 12.01 12.64 12.46 12.16

Mar-2014 11.99 12.43 12.32 12.11

Apr-2014 11.99 12.54 12.32 12.11

May-2014 11.98 12.54 12.38 12.11

Jun-2014 11.95 12.55 12.32 12.10

Jul-2014 11.80 12.53 12.31 11.98

Aug-2014 11.78 12.43 12.16 11.94

Sep-2014 11.74 12.54 11.68 11.90

Oct-2014 11.73 12.46 12.20 11.91

Nov-2014 11.74 12.42 12.12 11.90

Dec-2014 11.68 12.34 12.01 11.84

Jan-2015 11.69 12.39 11.86 11.85

Feb-2015 11.67 12.48 11.93 11.86

Mar-2015 11.61 12.24 11.84 11.76

Apr-2015 11.59 12.24 11.80 11.73

May-2015 11.53 12.19 11.64 11.68

Jun-2015 11.46 12.07 11.69 11.61

July-2015 11.44 12.10 11.67 11.60

Aug-2015 11.43 12.09 11.80 11.60

Sep-2015 11.39 11.97 11.56 11.53

Oct-2015 11.20 11.85 11.39 11.35

Nov-2015 11.19 11.83 11.35 11.36

Dec-2015 11.14 11.85 11.33 11.31

Jan-2016 11.18 11.65 11.33 11.30

Feb-2016 11.15 11.75 11.21 11.31

Mar-2016 11.10 11.46 11.29 11.20

Apr-2016 11.15 11.61 11.18 11.26

May-2016 11.14 11.53 11.15 11.25

June-2016 11.13 11.47 11.11 11.23

July-2016 11.12 11.48 11.03 11.22

Aug-2016 11.11 11.48 11.07 11.20

Sept-2016 11.07 11.44 11.02 11.17

Oct-2016 11.08 11.34 11.03 11.15

Nov-2016 11.06 11.34 10.90 11.13

Dec-2016 11.04 11.23 11.01 11.09

Jan-2017 10.98 11.18 10.97 11.03

Feb-2017 10.93 11.18 10.78 10.99

Mar-2017 10.74 10.92 10.93 10.80

Apr-2017 10.63 10.75 10.73 10.66

May-2017 10.63 10.71 10.84 10.66

June-2017 10.59 10.82 10.87 10.67

July-2017 10.57 10.73 10.55 10.62

Aug-2017 10.54 10.80 10.49 10.62

Sep-2017 10.43 10.56 10.65 10.48

Oct-2017 10.38 10.58 10.62 10.45

Nov-2017 10.33 10.52 10.70 10.41

Dec-2017 10.29 10.47 10.62 10.36

Jan-2018 10.22 10.41 10.43 10.28

Feb-2018 10.24 10.53 10.33 10.33

Mar-2018 10.12 10.48 10.48 10.25

Apr-2018 10.14 10.50 10.34 10.26

May-2018 10.12 10.53 10.28 10.25

June-2018 10.13 10.53 10.36 10.26

July-2018 10.12 10.53 10.36 10.26

Aug-2018 10.06 10.93 10.41 10.35

Sep-2018 9.99 10.94 10.44 10.32

Oct-2018 10.00 10.99 10.56 10.34

Nov-2018 10.00 11.04 10.59 10.36

Dec-2018 9.94 11.11 10.66 10.35

Jan-2019 9.96 11.06 10.63 10.37

Feb-2019 9.95 11.02 10.58 10.35

Mar-2019 9.95 11.00 10.64 10.33

Apr-2019 9.98 11.11 10.61 10.40

May-2019 9.97 11.12 10.59 10.40

Jun-2019 9.97 11.11 10.59 10.40

July-2019 9.97 11.11 10.44 10.39

Aug-2019 9.97 11.12 10.40 10.40

Sep-2019 9.95 11.12 10.32 10.39

Oct-2019 9.93 11.14 10.30 10.38

Nov-2019 9.90 11.12 10.18 10.36

Note: WALRs have been computed based on data submitted by banks.

As banks often revise their past data, these data are provisional.

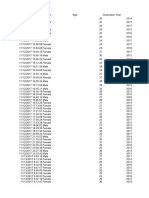

Table 2 : Bank Group wise Weighted Average Lending Rates (WALR)

(On Fresh Rupee Loans Sanctioned)

(Per cent)

Public Sector Private Sector Scheduled

Month Foreign Banks

Banks Banks Commercial Banks

Sep-2014 11.32 12.17 10.94 11.52

Oct-2014 11.32 11.93 11.11 11.49

Nov-2014 11.24 12.09 10.87 11.51

Dec-2014 11.27 12.09 10.69 11.45

Jan-2015 11.04 11.81 10.63 11.22

Feb-2015 11.16 11.79 10.63 11.28

Mar-2015 10.86 11.93 10.50 11.07

Apr-2015 11.09 11.89 10.52 11.23

May-2015 10.89 11.84 10.22 11.06

Jun-2015 10.90 11.68 10.33 11.03

July-2015 10.87 11.69 10.14 10.98

Aug-2015 10.77 11.60 10.39 10.97

Sep-2015 10.63 11.30 10.18 10.77

Oct-2015 10.72 11.47 9.76 10.78

Nov-2015 10.55 11.30 9.78 10.69

Dec-2015 10.44 11.19 9.61 10.59

Jan-2016 10.49 11.43 9.72 10.67

Feb-2016 10.48 11.06 9.65 10.54

Mar-2016 10.29 10.97 10.01 10.47

Apr-2016 10.54 11.02 9.71 10.59

May-2016 10.51 11.09 9.51 10.61

June-2016 10.38 10.84 9.47 10.43

July-2016 10.30 10.94 9.58 10.39

Aug-2016 10.13 11.07 9.53 10.40

Sept-2016 10.17 10.99 9.47 10.35

Oct-2016 10.34 10.99 9.54 10.48

Nov-2016 10.03 10.76 9.51 10.22

Dec-2016 10.03 10.51 9.24 10.12

Jan-2017 9.80 10.39 8.90 9.93

Feb-2017 9.54 10.36 9.19 9.80

Mar-2017 9.56 10.12 9.42 9.74

Apr-2017 9.76 10.04 9.09 9.81

May-2017 9.61 10.26 9.25 9.84

Jun-2017 9.37 9.75 8.97 9.50

Jul-2017 9.64 10.05 9.50 9.80

Aug-2017 9.39 9.74 9.33 9.53

Sep-2017 9.31 9.59 9.38 9.42

Oct-2017 9.39 9.62 9.43 9.48

Nov-2017 9.46 9.75 9.35 9.56

Dec-2017 9.36 9.52 9.10 9.41

Jan-2018 9.36 9.62 9.13 9.43

Feb-2018 9.33 9.94 9.28 9.55

Mar-2018 9.04 9.87 9.16 9.34

Apr-2018 9.04 9.99 9.33 9.41

May-2018 9.10 9.91 8.88 9.40

June-2018 9.11 9.92 9.15 9.45

July-2018 9.27 10.10 9.32 9.65

Aug-2018 9.28 10.09 9.39 9.63

Sep-2018 9.45 10.06 9.32 9.67

Oct-2018 9.44 10.37 9.23 9.79

Nov-2018 9.47 10.42 9.46 9.89

Dec-2018 9.38 10.44 9.54 9.79

Jan-2019 9.47 10.69 9.63 9.97

Feb-2019 9.31 10.65 9.30 9.81

Mar-2019 9.15 10.59 9.63 9.73

Apr-2019 9.36 10.37 9.30 9.76

May-2019 9.31 10.59 9.32 9.86

Jun-2019 9.25 10.32 9.10 9.68

July-2019 9.32 10.35 9.20 9.77

Aug-2019 9.21 10.20 8.94 9.67

Sep-2019 9.15 10.18 8.92 9.57

Oct-2019 9.00 10.29 8.81 9.53

Nov-2019 8.91 10.21 8.77 9.48

Note: WALRs have been computed based on data submitted by banks.

As banks often revise their past data, these data are provisional.

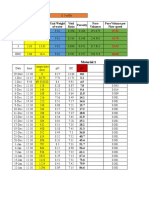

Table 3: Bank Group wise Weighted Average Domestic Term Deposit Rates (WADTDR)

(Outstanding Rupee Term Deposits)

(Per cent)

Public Sector Private Sector Scheduled

Month-end Foreign Banks

Banks Banks Commercial Banks

Mar-2013 8.84 8.92 7.63 8.81

Apr-2013 8.81 8.79 7.30 8.76

May-2013 8.70 8.84 7.16 8.68

Jun-2013 8.77 8.83 7.14 8.73

Jul-2013 8.71 8.86 7.68 8.70

Aug-2013 8.80 8.99 8.20 8.81

Sep-2013 8.90 9.05 8.40 8.91

Oct-2013 8.84 8.98 8.16 8.84

Nov-2013 8.78 8.90 7.82 8.76

Dec-2013 8.81 8.87 7.72 8.78

Jan-2014 8.79 8.87 7.60 8.76

Feb-2014 8.76 8.92 7.63 8.75

Mar-2014 8.80 8.95 7.88 8.79

Apr-2014 8.80 8.93 7.74 8.78

May-2014 8.75 8.92 7.44 8.73

Jun-2014 8.75 8.72 7.59 8.73

Jul-2014 8.78 8.90 7.72 8.76

Aug-2014 8.77 8.87 7.71 8.75

Sep-2014 8.72 8.86 7.63 8.70

Oct-2014 8.71 8.82 7.56 8.68

Nov-2014 8.71 8.78 7.50 8.68

Dec-2014 8.67 8.73 7.50 8.64

Jan-2015 8.65 8.70 7.41 8.61

Feb-2015 8.63 8.65 7.31 8.59

Mar-2015 8.60 8.62 7.62 8.57

Apr-2015 8.55 8.58 7.33 8.51

May-2015 8.54 8.52 7.27 8.49

Jun-2015 8.49 8.46 7.13 8.43

July-2015 8.42 8.37 7.05 8.35

Aug-2015 8.34 8.30 6.88 8.27

Sep-2015 8.05 8.18 6.76 8.03

Oct-2015 7.93 8.08 6.59 7.91

Nov-2015 7.89 8.01 6.60 7.86

Dec-2015 7.86 7.97 6.61 7.83

Jan-2016 7.81 7.92 6.56 7.78

Feb-2016 7.78 7.89 6.60 7.75

Mar-2016 7.75 7.88 6.61 7.73

Apr-2016 7.67 7.72 6.55 7.64

May-2016 7.61 7.71 6.72 7.59

June-2016 7.54 7.62 6.54 7.52

July-2016 7.51 7.59 6.41 7.48

Aug-2016 7.47 7.55 6.40 7.44

Sept-2016 7.44 7.49 6.42 7.41

Oct-2016 7.41 7.47 6.35 7.38

Nov-2016 7.34 7.43 6.22 7.32

Dec-2016 7.23 7.23 6.09 7.19

Jan-2017 7.20 7.12 6.06 7.14

Feb-2017 7.11 7.08 5.91 7.06

Mar-2017 7.02 6.96 5.95 6.97

Apr-2017 6.97 6.92 5.88 6.92

May-2017 6.90 6.88 5.83 6.86

June-2017 6.84 6.84 5.84 6.81

July-2017 6.79 6.77 5.87 6.75

Aug-2017 6.71 6.75 5.82 6.69

Sep-2017 6.67 6.74 5.76 6.65

Oct-2017 6.54 6.66 5.73 6.54

Nov-2017 6.49 6.66 5.73 6.50

Dec-2017 6.51 6.69 5.68 6.53

Jan-2018 6.52 6.71 5.72 6.54

Feb-2018 6.57 6.79 5.77 6.60

Mar-2018 6.65 6.84 5.83 6.67

Apr-2018 6.69 6.89 5.79 6.71

May-2018 6.67 6.95 5.84 6.71

June-2018 6.66 6.99 6.03 6.72

July-2018 6.65 7.00 6.02 6.72

Aug-2018 6.69 7.05 6.10 6.76

Sep-2018 6.70 7.06 6.25 6.77

Oct-2018 6.73 7.13 6.26 6.81

Nov-2018 6.75 7.17 6.36 6.85

Dec-2018 6.78 7.21 6.38 6.87

Jan-2019 6.80 7.24 6.44 6.91

Feb-2019 6.79 7.24 6.43 6.90

Mar-2019 6.77 7.24 6.52 6.89

Apr-2019 6.77 7.23 6.44 6.89

May-2019 6.78 7.21 6.29 6.89

Jun-2019 6.79 7.23 6.17 6.89

July-2019 6.74 7.19 6.07 6.85

Aug-2019 6.79 7.16 5.89 6.87

Sep-2019 6.79 7.10 5.76 6.84

Oct-2019 6.69 7.04 5.56 6.75

Nov-2019 6.65 6.91 5.38 6.68

Note: WADTDR have been computed based on data submitted by banks.

As banks often revise their past data, these data are provisional.

Table 4: Bank-wise 1 Year MCLR (Month end)

(Per cent)

Banks Mar-2019 Apr-2019 May-2019 June-2019 July-2019 Aug-2019 Sep-2019 Oct-2019 Nov-2019 Dec-2019

(A) Public Sector Banks

1 Allahabad Bank 8.65 8.65 8.60 8.55 8.55 8.40 8.40 8.35 8.35 8.30

2 Andhra Bank 8.75 8.75 8.75 8.75 8.70 8.45 8.40 8.30 8.30 8.30

3 Bank of Baroda 8.65 8.65 8.70 8.70 8.60 8.45 8.40 8.35 8.30 8.25

4 Bank of India 8.65 8.65 8.70 8.65 8.60 8.35 8.35 8.30 8.30 8.20

5 Bank of Maharashtra 8.75 8.70 8.70 8.60 8.60 8.50 8.50 8.40 8.40 8.40

6 Bhartiya Mahila Bank - - - - - - - - - -

7 Canara Bank 8.65 8.65 8.70 8.70 8.60 8.50 8.40 8.40 8.35 8.35

8 Central Bank of India 8.65 8.60 8.55 8.55 8.50 8.30 8.25 8.20 8.20 8.15

9 Corporation Bank 8.90 8.90 8.90 8.85 8.85 8.70 8.65 8.60 8.60 8.60

10 Dena Bank 8.80 - - - - - - - - -

11 IDBI Bank - - - - - - - - - -

12 Indian Bank 8.65 8.65 8.65 8.65 8.60 8.60 8.45 8.35 8.35 8.35

13 Indian Overseas Bank 8.70 8.65 8.65 8.65 8.65 8.50 8.50 8.50 8.50 8.50

14 Oriental Bank of Commerce 8.75 8.75 8.75 8.70 8.65 8.55 8.40 8.35 8.35 8.30

15 Punjab and Sind Bank 8.85 8.80 8.75 8.75 8.70 8.50 8.50 8.50 8.45 8.45

16 Punjab National Bank 8.45 8.45 8.45 8.45 8.40 8.30 8.30 8.25 8.15 8.15

17 State Bank of Bikaner and Jaipur - - - - - - - - - -

18 State Bank of Hyderabad - - - - - - - - - -

19 State Bank of India 8.55 8.50 8.45 8.45 8.40 8.25 8.15 8.05 8.00 7.90

20 State Bank of Mysore - - - - - - - - - -

21 State Bank of Patiala - - - - - - - - - -

22 State Bank of Travancore - - - - - - - - - -

23 Syndicate Bank 8.65 8.60 8.65 8.65 8.60 8.35 8.35 8.35 8.35 8.25

24 UCO Bank 8.70 8.65 8.65 8.65 8.65 8.50 8.50 8.40 8.40 8.30

25 Union Bank of India 8.60 8.60 8.60 8.60 8.55 8.50 8.35 8.30 8.25 8.20

26 United Bank of India 8.85 8.80 8.80 8.75 8.70 8.55 8.45 8.45 8.45 8.40

27 Vijaya Bank 8.75 - - - - - - - - -

(B) Private Sector Banks

28 Axis Bank Ltd. 8.90 8.90 8.80 8.70 8.65 8.55 8.45 8.35 8.25 8.15

29 Bandhan Bank Ltd. 10.45 10.20 10.11 10.11 10.11 10.11 10.11 10.06 10.06 10.06

30 Catholic Syrian Bank Ltd. 9.90 9.90 9.90 9.90 9.90 9.90 9.90 9.90 9.90 9.90

31 City Union Bank Ltd. 9.30 9.30 9.30 9.30 9.30 9.15 9.00 9.00 9.00 9.00

32 Development Credit Bank Ltd. 10.84 10.84 10.84 10.84 10.84 10.65 10.65 10.47 10.31 10.31

33 Dhanalaxmi Bank Ltd. 9.90 9.90 9.90 9.90 9.90 9.90 9.90 9.80 9.80 9.80

34 Federal Bank Ltd. 9.20 9.15 9.15 9.15 9.15 9.17 8.98 8.90 8.82 8.90

35 HDFC Bank Ltd. 8.75 8.70 8.70 8.70 8.70 8.60 8.45 8.35 8.30 8.15

36 ICICI Bank Ltd. 8.80 8.75 8.75 8.75 8.65 8.65 8.55 8.45 8.35 8.25

37 IDBI Bank 9.05 9.00 9.00 8.95 8.95 8.85 8.85 8.65 8.65 8.65

38 IDFC Bank Ltd 9.25 9.20 9.50 9.50 9.50 9.50 9.30 9.35 9.30 9.30

39 Indusind Bank 9.90 9.85 9.85 9.75 9.70 9.65 9.55 9.45 9.45 9.40

40 Jammu and Kashmir Bank Ltd. 9.00 8.95 8.95 8.85 8.85 8.75 8.70 8.65 8.55 8.45

41 Karnataka Bank Ltd. 9.45 9.45 9.40 9.40 9.40 9.35 9.25 9.25 9.25 9.25

42 Karur Vysya Bank Ltd. 9.65 9.65 9.65 9.65 9.55 9.55 9.45 9.45 9.45 9.40

43 Kotak Mahindra Bank 9.00 8.90 8.90 8.90 8.85 8.75 8.75 8.60 8.50 8.40

44 Laxmi Vilas Bank Ltd. 9.90 9.90 10.05 10.00 9.95 9.95 9.95 9.95 10.40 10.55

45 Nainital Bank 8.45 8.45 8.50 8.50 8.45 8.40 8.40 8.30 8.30 8.30

46 RBL Bank 10.25 10.15 10.15 10.10 9.95 9.95 9.95 9.85 9.80 9.70

47 South Indian Bank Ltd. 9.45 9.45 9.50 9.50 9.50 9.45 9.25 9.20 9.10 9.00

48 Tamilnad Mercantile Bank Ltd. 9.20 9.20 9.20 9.20 9.20 9.20 9.10 9.10 9.10 9.10

49 Yes Bank Ltd. 9.70 9.70 9.70 9.70 9.70 9.75 9.70 9.70 9.70 9.70

(C) Foreign Banks

50 AB Bank Ltd. 6.95 6.03 7.03 7.60 7.60 7.72 7.85 6.67 6.42 6.53

51 Abu Dhabi Commercial Bank Ltd. 9.50 9.35 9.60 9.70 9.55 9.55 9.30 9.60 9.75 9.60

52 American Express Banking Corporation 7.36 7.32 7.19 7.25 7.31 7.03 6.76 6.98 5.57 7.14

53 Australia and New zealand banking group Ltd. 8.35 7.90 8.15 8.05 7.85 8.05 7.45 7.45 7.00 6.80

54 Bank International Indonesia 9.85 9.85 9.80 9.75 9.75 9.75 9.40 9.40 9.35 8.95

55 Bank of Bahrain and Kuwait 8.70 8.65 8.80 8.90 9.05 8.75 8.65 8.60 8.35 8.15

56 Bank of America 7.85 8.50 7.80 8.40 8.40 8.25 7.95 7.15 7.35 7.35

57 Bank of Ceylon 9.89 9.89 9.81 9.78 9.86 9.87 9.80 9.74 9.71 9.68

58 Bank of Nova Scotia 8.84 8.59 8.55 8.41 8.41 8.41 7.97 8.14 7.89 7.56

59 Bank of Tokyo Mits UFJ Ltd. 7.80 7.35 7.55 7.50 7.45 7.40 6.95 7.00 6.70 6.70

60 Barclays Bank 8.95 9.15 8.75 8.45 8.50 8.40 8.30 8.00 7.65 7.90

61 BNP Paribas 9.40 9.15 8.90 8.65 8.50 8.05 8.30 7.75 7.70 7.65

62 Citi Bank 8.75 8.85 8.85 8.70 8.60 8.50 8.45 8.30 8.45 7.95

63 Commonwealth Bank of Australia - - - - - - - - - -

64 Credit Agricole Corporate & Investment Bank 7.82 8.08 8.04 7.78 7.78 7.71 7.20 7.12 6.84 7.02

65 Credit Suisse AG Bank 8.25 7.81 8.07 8.08 7.99 8.00 8.00 7.33 7.70 7.27

66 CTBC Bank Co.Ltd 7.68 8.31 7.73 7.95 8.05 7.65 7.04 7.16 7.05 7.00

67 Deutsche Bank 10.25 10.35 10.25 10.10 9.85 9.70 9.55 9.50 9.45 9.40

68 Development Bank of Singapore 8.55 8.60 8.50 8.25 8.25 8.30 8.30 8.30 8.30 8.30

69 Doha Bank QSC 9.15 8.95 9.05 8.95 8.80 8.75 8.70 8.55 8.65 8.35

70 Emirates NBD Bank (P.J.S.C) 8.80 8.70 8.60 8.50 8.40 8.20 8.00 8.10 8.00 8.10

71 First Abu Dhabi Bank PJSC 7.50 7.80 7.90 7.90 7.80 7.40 7.10 7.00 6.10 6.50

72 Firstrand Bank Ltd 9.15 9.16 9.37 9.05 9.05 8.77 8.68 8.46 8.31 8.24

73 Hongkong & Shanghai Bkg. Corpn 9.04 8.90 8.91 8.78 8.78 8.65 8.50 8.45 8.30 8.30

74 Industrial and Commercial Bank of China 8.89 8.63 8.43 8.54 8.37 8.08 8.29 7.40 7.40 7.45

75 Industrial Bank of Korea 6.20 6.00 5.80 6.90 5.90 5.90 7.00 6.30 5.70 5.00

76 JP Morgan Chase Bank 9.05 9.05 8.80 8.85 8.25 8.05 7.80 7.70 7.45 6.90

77 JSC VTB Bank - - - - - - - - - -

78 KEB Hana Bank 8.45 8.45 8.45 8.45 8.45 8.45 8.45 8.35 8.30 8.25

79 Krung Thai Bank PCL 7.75 8.25 8.75 8.25 7.75 7.75 8.00 - - -

80 Mashreq Bank 8.75 8.80 8.55 8.55 8.59 8.17 7.04 7.99 8.31 7.97

81 Mizuho Corporate Bank 8.25 8.20 8.20 8.15 7.90 7.85 7.80 7.45 7.40 7.25

82 National Australia Bank 9.30 9.30 9.30 9.30 9.30 9.30 8.30 8.30 8.30 8.30

83 Qatar National Bank S.A.Q 8.15 8.25 8.30 8.30 8.10 8.10 8.70 7.50 7.40 7.20

84 Rabobank International 8.45 8.55 8.65 8.55 8.45 8.65 8.00 8.10 7.95 7.95

85 Sber Bank 8.73 8.73 8.73 8.73 8.57 8.34 7.10 7.10 7.10 8.17

86 Shinhan Bank 8.60 8.60 8.60 8.60 8.50 8.45 8.68 8.30 8.25 8.25

87 Societe Generale 8.45 8.30 8.40 8.20 8.20 7.90 8.50 7.65 7.65 7.60

88 Sonali Bank Ltd. 8.15 8.22 5.68 5.69 5.82 5.82 8.29 7.95 7.29 6.79

89 Standard Chartered Bank 9.60 9.50 9.45 9.45 9.45 9.45 9.35 9.25 9.25 9.20

90 State Bank of Mauritius 10.15 10.05 10.00 10.00 10.00 9.45 7.80 7.80 7.80 9.60

91 Sumitomo Mitsui Banking Corporation 8.35 7.55 7.95 7.55 7.30 6.90 7.00 6.60 6.55 6.90

92 The Royal Bank of Scotland 6.30 6.30 6.20 6.20 6.85 7.05 7.15 7.15 7.05 7.05

93 United Overseas Bank 8.89 8.97 8.83 8.67 8.34 8.41 8.28 7.63 7.34 6.80

94 Westpac Banking Corporation 8.75 8.75 8.75 8.75 8.75 8.75 8.75 8.75 8.75 8.75

95 Woori Bank 8.70 8.70 8.65 8.65 8.65 8.55 8.50 8.40 8.40 8.40

-:Not applicable

Note: MCLR refers to Marginal Cost of Funds based Lending Rate.

Table 5: Bank Group Wise MCLR (1 Year)

(Per cent)

Month Public Sector Banks Private Sector Banks Foreign Banks Scheduled Commercial Banks

Min Max Median Min Max Median Min Max Median Min Max Median

Apr-2016 9.20 9.85 9.50 9.20 13.26 9.80 7.80 10.50 8.98 7.80 13.26 9.45

May-2016 9.15 9.85 9.50 9.15 13.26 9.85 7.80 10.50 8.80 7.80 13.26 9.45

June-2016 9.15 9.85 9.50 9.15 13.26 9.85 7.80 10.50 8.80 7.80 13.26 9.45

July-2016 9.15 9.65 9.50 9.10 12.90 9.85 7.40 10.55 8.80 7.40 12.90 9.40

Aug-2016 9.10 9.65 9.50 9.10 12.90 9.75 7.40 10.55 8.80 7.40 12.90 9.35

Sep-2016 9.10 9.65 9.45 9.05 12.90 9.75 7.40 10.55 8.73 7.40 12.90 9.35

Oct-2016 9.05 9.60 9.45 9.00 12.00 9.75 7.60 10.81 8.64 7.60 12.00 9.28

Nov-2016 8.90 9.60 9.40 8.90 12.00 9.60 7.40 10.81 8.45 7.40 12.00 9.25

Dec-2016 8.90 9.55 9.30 8.90 12.00 9.45 7.20 10.81 8.50 7.20 12.00 9.15

Jan-2017 8.00 9.20 8.65 8.15 10.52 9.10 7.00 10.51 8.25 7.00 10.52 8.60

Feb-2017 8.00 8.80 8.60 8.15 10.52 9.10 7.15 10.51 8.22 7.15 10.52 8.60

Mar-2017 8.00 8.80 8.60 8.15 10.52 9.10 7.10 10.51 8.15 7.10 10.52 8.60

Apr-2017 8.00 8.80 8.60 8.15 9.98 9.10 7.05 10.50 8.20 7.05 10.50 8.50

May-2017 8.00 8.75 8.60 8.15 10.50 9.10 6.95 10.50 8.20 6.95 10.50 8.55

June-2017 8.00 8.75 8.55 8.15 10.50 9.10 7.10 10.50 8.20 7.10 10.50 8.50

July-2017 8.00 8.75 8.55 8.15 10.50 9.10 7.20 10.50 8.15 7.20 10.50 8.50

Aug-2017 8.00 8.75 8.50 8.15 10.45 9.00 6.79 10.50 8.08 6.79 10.50 8.45

Sep-2017 8.00 8.75 8.40 8.15 10.30 8.95 6.89 10.50 8.05 6.89 10.50 8.30

Oct-2017 8.00 8.75 8.40 8.15 10.25 8.90 6.70 10.50 8.00 6.70 10.50 8.30

Nov-2017 7.95 8.65 8.40 8.10 10.20 8.90 6.50 10.50 8.00 6.50 10.50 8.30

Dec-2017 7.95 8.65 8.35 8.10 10.30 8.90 6.20 10.50 7.95 6.20 10.50 8.30

Jan-2018 7.95 8.65 8.35 8.10 10.16 8.95 6.44 10.50 8.00 6.44 10.50 8.30

Feb-2018 7.95 8.65 8.35 8.20 9.95 9.00 6.20 10.50 8.00 6.20 10.50 8.30

Mar-2018 8.15 8.75 8.40 8.30 9.91 9.00 5.80 9.79 8.08 5.80 9.91 8.40

Apr-2018 8.15 8.75 8.45 8.30 9.87 9.00 6.55 9.93 8.10 6.55 9.93 8.43

May-2018 8.15 8.75 8.45 8.20 9.90 9.00 5.96 9.87 8.20 5.96 9.90 8.49

June-2018 8.25 8.85 8.50 8.30 10.29 9.15 5.03 10.45 8.30 5.03 10.45 8.52

July-2018 8.25 8.85 8.55 8.30 10.38 9.15 5.71 10.15 8.40 5.71 10.38 8.55

Aug-2018 8.25 8.85 8.60 8.40 10.50 9.25 5.82 10.05 8.50 5.82 10.50 8.60

Sep-2018 8.45 8.95 8.65 8.40 10.50 9.30 5.82 10.35 8.58 5.82 10.50 8.70

Oct-2018 8.45 8.95 8.65 8.40 10.62 9.30 6.15 10.10 8.66 6.15 10.62 8.73

Nov-2018 8.50 8.95 8.70 8.45 10.74 9.30 6.42 10.10 8.65 6.42 10.74 8.75

Dec-2018 8.50 8.95 8.75 8.45 10.84 9.30 6.47 10.15 8.65 6.47 10.84 8.75

Jan-2019 8.50 8.95 8.75 8.40 10.84 9.30 5.98 10.30 8.65 5.98 10.84 8.80

Feb-2019 8.55 8.95 8.75 8.40 10.84 9.28 5.90 10.30 8.68 5.90 10.84 8.80

Mar-2019 8.45 8.90 8.68 8.45 10.84 9.38 6.20 10.25 8.70 6.20 10.84 8.75

Apr-2019 8.45 8.90 8.65 8.45 10.84 9.38 6.00 10.35 8.62 6.00 10.84 8.74

May-2019 8.45 8.90 8.68 8.50 10.84 9.45 5.68 10.25 8.60 5.68 10.84 8.75

Jun-2019 8.45 8.85 8.65 8.50 10.84 9.45 5.69 10.10 8.52 5.69 10.84 8.70

Jul-2019 8.40 8.85 8.60 8.45 10.84 9.45 5.82 10.00 8.41 5.82 10.84 8.60

Aug-2019 8.25 8.70 8.50 8.40 10.65 9.40 5.82 9.87 8.28 5.82 10.65 8.50

Sep-2019 8.15 8.65 8.40 8.40 10.65 9.25 6.76 9.80 8.14 6.76 10.65 8.45

Oct-2019 8.05 8.60 8.35 8.30 10.47 9.23 6.30 9.74 7.95 6.30 10.47 8.35

Nov-2019 8.00 8.60 8.35 8.25 10.40 9.18 5.57 9.75 7.70 5.57 10.40 8.31

Dec-2019 7.90 8.60 8.30 8.15 10.55 9.18 5.00 9.68 7.90 5.00 10.55 8.30

Note: MCLR refers to Marginal Cost of Funds based Lending Rate.

You might also like

- Sample data comparison over 4 groupsDocument1 pageSample data comparison over 4 groupssachin tendulkarNo ratings yet

- TransientsDocument58 pagesTransientsaoloroso801No ratings yet

- Date Open High Low Close Adj CloseDocument9 pagesDate Open High Low Close Adj ClosePaul Anton ValleNo ratings yet

- Chart 12 Months 1Document2 pagesChart 12 Months 1unnamed90No ratings yet

- Chart 12 Months 1Document2 pagesChart 12 Months 1Cris demaalaNo ratings yet

- 3-Month Weighted Moving Average Sales AnalysisDocument103 pages3-Month Weighted Moving Average Sales AnalysisAjay KaleNo ratings yet

- Data Lalu Lintas Senin Siang Kelompok 2Document13 pagesData Lalu Lintas Senin Siang Kelompok 2Purwa LojaNo ratings yet

- QualityDocument1 pageQualityPor ChhayNo ratings yet

- 1.1.6 Retail Sales, Selected Developing AsiaDocument2 pages1.1.6 Retail Sales, Selected Developing AsiaRifandiaPradiptaNo ratings yet

- Blockchain Statistics Report Bitcoin Addresses Over 1 BTCDocument6 pagesBlockchain Statistics Report Bitcoin Addresses Over 1 BTCFfcfNo ratings yet

- SR No Date Stock Price Invested Amount Stock Buyed Round UpDocument10 pagesSR No Date Stock Price Invested Amount Stock Buyed Round Upsalimmujawar333No ratings yet

- UntitledDocument4 pagesUntitledLiss VeraNo ratings yet

- PRESENSI PRAKTIKUM FARMASIDocument2 pagesPRESENSI PRAKTIKUM FARMASISUCI WULANDARINo ratings yet

- Daily precipitation and wind speed dataDocument240 pagesDaily precipitation and wind speed datahijiriNo ratings yet

- Alfathan Fathurrahman Aliyu - PM QC HBDocument6 pagesAlfathan Fathurrahman Aliyu - PM QC HBulyanaNo ratings yet

- DiciembreDocument74 pagesDiciembreGustavo HernandezNo ratings yet

- Eta Calculations: Touch Only Blue AreaDocument1 pageEta Calculations: Touch Only Blue AreaAamir SirohiNo ratings yet

- Kalendar Projek - Sesi Dis 2012Document1 pageKalendar Projek - Sesi Dis 2012projekpuoNo ratings yet

- Seasonal Time Series DataDocument14 pagesSeasonal Time Series DataSon TonNo ratings yet

- Periode: PERIODE Kredit Konsumsi KPRDocument4 pagesPeriode: PERIODE Kredit Konsumsi KPRMary GobelNo ratings yet

- SEBI classification on dividend yield fundsDocument122 pagesSEBI classification on dividend yield fundsSuhail MominNo ratings yet

- Estimacion Del Precio de Los Metales: ORO (Au) Plata (Ag)Document11 pagesEstimacion Del Precio de Los Metales: ORO (Au) Plata (Ag)malenaNo ratings yet

- Four Vanguard fund historical prices from 1997-2005Document14 pagesFour Vanguard fund historical prices from 1997-2005Poorni ShivaramNo ratings yet

- TIMES CENTRE FOR LEARNING PVT LTD Airtel statementDocument3 pagesTIMES CENTRE FOR LEARNING PVT LTD Airtel statementutkarsh rajawatNo ratings yet

- PP 7 B PS Oil Prices (H)Document4 pagesPP 7 B PS Oil Prices (H)Nimish PatankarNo ratings yet

- Priority Calls Dispatch TimesDocument6 pagesPriority Calls Dispatch TimesRecordTrac - City of OaklandNo ratings yet

- 24 Hour TestDocument12 pages24 Hour TestMazina RahmanNo ratings yet

- IGD Patient Transit Data December 2021Document6 pagesIGD Patient Transit Data December 2021igd rspkumuhmayongNo ratings yet

- Montos Pagados A La FechaDocument2 pagesMontos Pagados A La Fechajcespinoza2009No ratings yet

- Flujo Vehicular Maestro Surquillo 2021Document54 pagesFlujo Vehicular Maestro Surquillo 2021Raphael MTNo ratings yet

- Risk ReturnDocument2 pagesRisk ReturnVivek KheparNo ratings yet

- Time Sheet Alat PT - Dinamala Des 2021Document7 pagesTime Sheet Alat PT - Dinamala Des 2021Resni Amalia R.No ratings yet

- Muestra Fecha Hora X1 X2 X3 Media Por MuestraDocument5 pagesMuestra Fecha Hora X1 X2 X3 Media Por MuestraTaTiiz MartinezNo ratings yet

- Deuxième Année Matières CommunesDocument13 pagesDeuxième Année Matières CommunesHermod Jessia BefourouackNo ratings yet

- Air Pollutant Levels Jan-Mar 2014Document1,032 pagesAir Pollutant Levels Jan-Mar 2014Nambi HarishNo ratings yet

- Variacion Precio Del Petroleo: Año-Mes Precio $ PrecioDocument10 pagesVariacion Precio Del Petroleo: Año-Mes Precio $ PrecioADRIAN 77 :vNo ratings yet

- AULA ANALYTICS PARA GESTAO DE RISCOS - Solucao 2024Document26 pagesAULA ANALYTICS PARA GESTAO DE RISCOS - Solucao 2024Marcos SilvaNo ratings yet

- Chi Squared Test For Maintenance RecordDocument16 pagesChi Squared Test For Maintenance RecordGeorgina SuleNo ratings yet

- Data Curah Hujan Bulan Januari 2015: Tanggal JamDocument48 pagesData Curah Hujan Bulan Januari 2015: Tanggal JamCecep GunawanNo ratings yet

- Money Market Yield Curves4Document1 pageMoney Market Yield Curves4thetradingarcadeNo ratings yet

- J0417231045 Sabrina SitompulDocument338 pagesJ0417231045 Sabrina SitompulSylvina AzkyahNo ratings yet

- 2013-2023 Weekly Propane Sale Resale PricesDocument6 pages2013-2023 Weekly Propane Sale Resale PricesAtieNo ratings yet

- Cotton MKT ReportDocument4 pagesCotton MKT ReportcottontradeNo ratings yet

- UGRH Huaraz Temp - HR 2014Document11 pagesUGRH Huaraz Temp - HR 2014Danilo Enrique Montoro VergaraNo ratings yet

- Komatsu Engine Saa12v140ze 2 Workshop ManualsDocument20 pagesKomatsu Engine Saa12v140ze 2 Workshop Manualsdarleen100% (48)

- Beta of Colgate Nifty Closing Colgate Closing Price Date Close Daily Returns Date Close Price Daily ReturnsDocument7 pagesBeta of Colgate Nifty Closing Colgate Closing Price Date Close Daily Returns Date Close Price Daily Returnsnotes 1No ratings yet

- Monthly Share Prices and ReturnsDocument52 pagesMonthly Share Prices and ReturnsParthNo ratings yet

- Rekapan Posyandu PondalusiDocument10 pagesRekapan Posyandu PondalusiLeonard Henukh FritsNo ratings yet

- Jadwal Peserta SKB Wawancara Dan Microteaching CPNS 2021 Universitas Singaperbangsa KarawangDocument8 pagesJadwal Peserta SKB Wawancara Dan Microteaching CPNS 2021 Universitas Singaperbangsa KarawangqhidNo ratings yet

- 12v140z-1 (JPN) All ShopDocument286 pages12v140z-1 (JPN) All ShopRedNo ratings yet

- Índice de Precios Del Consumo Total PaísDocument13 pagesÍndice de Precios Del Consumo Total PaísSharlin Tatiana HNo ratings yet

- Change Shift Every 3 WeeksDocument1 pageChange Shift Every 3 Weekspimpampum111No ratings yet

- Graduate Tracer StudyDocument100 pagesGraduate Tracer Study2021619874No ratings yet

- Calculo EvapotranspiracionDocument7 pagesCalculo EvapotranspiracionVictoriaHernándezNo ratings yet

- Sales Forecast for 2017-2018Document12 pagesSales Forecast for 2017-2018Javi GalleNo ratings yet

- Pore Volume CalaculationDocument3 pagesPore Volume CalaculationAtul KumarNo ratings yet

- Monthly inflation, exchange rates, money supply and interest rates in Indonesia from 2003-2012Document3 pagesMonthly inflation, exchange rates, money supply and interest rates in Indonesia from 2003-2012Indirasari Cynthia SetyoParwatiNo ratings yet

- Modified Essay Question 1Document9 pagesModified Essay Question 1supaidi97No ratings yet

- Schedule of Term Loan Repayment with Interest and PrincipalDocument14 pagesSchedule of Term Loan Repayment with Interest and PrincipalaejoseNo ratings yet

- Business Law: Case Studies Law of ContractsDocument50 pagesBusiness Law: Case Studies Law of ContractsShiva MehtaNo ratings yet

- Understanding Consideration in Contract LawDocument7 pagesUnderstanding Consideration in Contract LawShiva MehtaNo ratings yet

- Notes - Open Economy ModelDocument2 pagesNotes - Open Economy ModelShiva MehtaNo ratings yet

- Essentials of A Valid ContractDocument17 pagesEssentials of A Valid ContractShiva MehtaNo ratings yet

- BRM NotesDocument15 pagesBRM NotesShiva MehtaNo ratings yet

- Honda Kickstarts 3-Year Plan To Beat Hero in 2-WheelersDocument9 pagesHonda Kickstarts 3-Year Plan To Beat Hero in 2-WheelersShiva MehtaNo ratings yet

- Global Superstore DatasetDocument5,701 pagesGlobal Superstore DatasetHaroon FareedNo ratings yet

- Delta Corp Limited Consolidated and Standalone Financial Summary FY19-FY08Document5 pagesDelta Corp Limited Consolidated and Standalone Financial Summary FY19-FY08Shiva MehtaNo ratings yet

- Balance of Payments Explained: Current Account, Capital Account, Exchange Rates & MoreDocument4 pagesBalance of Payments Explained: Current Account, Capital Account, Exchange Rates & MoreShiva MehtaNo ratings yet

- TNC - TRXN Dec 2019Document2 pagesTNC - TRXN Dec 2019Shiva MehtaNo ratings yet

- Cost Modeling and Price Regulation in Telecommunications: Methods and ExperiencesDocument46 pagesCost Modeling and Price Regulation in Telecommunications: Methods and ExperiencesShiva MehtaNo ratings yet

- What Is A Liquidity Adjustment Facility?Document4 pagesWhat Is A Liquidity Adjustment Facility?Shiva MehtaNo ratings yet

- Bharti Airtel Limited Integrated Report Annual Financial Statements 2018 19 PDFDocument336 pagesBharti Airtel Limited Integrated Report Annual Financial Statements 2018 19 PDFPalo de RosaNo ratings yet

- Statistics SPSS ProjectDocument12 pagesStatistics SPSS Projectrishabhsethi1990No ratings yet

- AgileDocument4 pagesAgileShiva MehtaNo ratings yet

- Linear RegressionDocument76 pagesLinear RegressionShiva MehtaNo ratings yet

- Audited Financial Results March 31, 2019 Reliance Jio Infocomm LimitedDocument9 pagesAudited Financial Results March 31, 2019 Reliance Jio Infocomm Limitedaishwarya raikarNo ratings yet

- VIL Annual Report 2018 19Document282 pagesVIL Annual Report 2018 19Pankaj AdsuleNo ratings yet

- RELIANCE JIO INFOCOMM LIMITEDDocument2 pagesRELIANCE JIO INFOCOMM LIMITEDShiva MehtaNo ratings yet

- Data Dictionary - CarpricesDocument2 pagesData Dictionary - CarpricesShiva MehtaNo ratings yet

- Logistic RegressionDocument33 pagesLogistic RegressionRajat ShettyNo ratings yet

- Honda Kickstarts 3-Year Plan To Beat Hero in 2-WheelersDocument9 pagesHonda Kickstarts 3-Year Plan To Beat Hero in 2-WheelersShiva MehtaNo ratings yet

- BRM NotesDocument15 pagesBRM NotesShiva MehtaNo ratings yet

- Renewal Premium Receipt: Life Insurance Corporation of IndiaDocument1 pageRenewal Premium Receipt: Life Insurance Corporation of IndiaMusic worldNo ratings yet

- Consumer insights into low-cost daily essentialsDocument3 pagesConsumer insights into low-cost daily essentialsShiva MehtaNo ratings yet

- Marketing Management Report - Exercise1-GroupADocument9 pagesMarketing Management Report - Exercise1-GroupAAnkit KumarNo ratings yet

- Renewal Premium Receipt: Life Insurance Corporation of IndiaDocument1 pageRenewal Premium Receipt: Life Insurance Corporation of IndiaMusic worldNo ratings yet

- HP Channel Services Network PDFDocument2 pagesHP Channel Services Network PDFShiva MehtaNo ratings yet

- HP Care Pack service certificate for HP Pavilion laptopDocument2 pagesHP Care Pack service certificate for HP Pavilion laptopShiva MehtaNo ratings yet

- SBI RTI Details for Bhopal CircleDocument105 pagesSBI RTI Details for Bhopal CircleMranal MeshramNo ratings yet

- Manufacturing TechnologyDocument25 pagesManufacturing TechnologyGadget 98No ratings yet

- Placement Records 2023Document3 pagesPlacement Records 2023AmitNo ratings yet

- Pending applications for SEBs as of July 2011Document61 pagesPending applications for SEBs as of July 2011Raktima Majumdar0% (1)

- General Awareness For All Competitive ExamsDocument36 pagesGeneral Awareness For All Competitive ExamsSandeep PKNo ratings yet

- Dfat An India Economic Strategy To 2035 PDFDocument516 pagesDfat An India Economic Strategy To 2035 PDFhoneyNo ratings yet

- Leather Industry SCMDocument11 pagesLeather Industry SCMaruns2509639No ratings yet

- Reliance Retail Presentation PDFDocument32 pagesReliance Retail Presentation PDFRatnesh SinghNo ratings yet

- List of Incubation Centre TIDE 2.0Document3 pagesList of Incubation Centre TIDE 2.0feniNo ratings yet

- Mobile Telephone Number Codes For IndiaDocument13 pagesMobile Telephone Number Codes For IndiaSantoshNo ratings yet

- AngelExcelCode 1Document1,873 pagesAngelExcelCode 1rasila013No ratings yet

- Committees and Their Purposes - Indian PolityDocument3 pagesCommittees and Their Purposes - Indian PolityRashid FarooquiNo ratings yet

- Guide to ATM Centres in Surat by Area and BankDocument22 pagesGuide to ATM Centres in Surat by Area and BanksuchjazzNo ratings yet

- New Microsoft Office Excel WorksheetDocument6 pagesNew Microsoft Office Excel WorksheetTirumala AutomationNo ratings yet

- Overseas Education Consultants HyderabadDocument5 pagesOverseas Education Consultants HyderabadfutureoverseaseduNo ratings yet

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDocument1 pageRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountazazerooneNo ratings yet

- Tybfm Sem Vi Project Topics Allotment - 21-22Document5 pagesTybfm Sem Vi Project Topics Allotment - 21-22Vignesh SirimallaNo ratings yet

- Acct Statement - XX2482 - 04032023 PDFDocument13 pagesAcct Statement - XX2482 - 04032023 PDFKoushik ChakrabortyNo ratings yet

- SadfsdDocument5 pagesSadfsdkushal pugaliaNo ratings yet

- Provisional List PDFDocument74 pagesProvisional List PDFShubham RajputNo ratings yet

- Samples 250 - 2Document6 pagesSamples 250 - 2dpkrajaNo ratings yet

- GlobalizationDocument15 pagesGlobalizationSushil Kumar100% (2)

- Emerging Sectors of Indian EconomyDocument16 pagesEmerging Sectors of Indian EconomyHrutik DeshmukhNo ratings yet

- Introduction Tata SteelDocument2 pagesIntroduction Tata SteelNikam PranitNo ratings yet

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- Unit 3 - Policy Regimes (Part 1)Document57 pagesUnit 3 - Policy Regimes (Part 1)Sagar DasNo ratings yet

- Biotech CompaniesDocument18 pagesBiotech CompaniesJikku JohnNo ratings yet

- Madhya Pradesh 0Document19 pagesMadhya Pradesh 0Saurabh AnandNo ratings yet

- Civil Services Mentor May 2012 PDFDocument121 pagesCivil Services Mentor May 2012 PDFBhavtosh ChaturvediNo ratings yet

- Tata Docomo Nodal Appellate DetailsDocument2 pagesTata Docomo Nodal Appellate DetailsSanju Mohan VNo ratings yet