Professional Documents

Culture Documents

Compendium III - Lines & Finance - Adv Acc v4

Compendium III - Lines & Finance - Adv Acc v4

Uploaded by

Mercedes Leon SilverioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compendium III - Lines & Finance - Adv Acc v4

Compendium III - Lines & Finance - Adv Acc v4

Uploaded by

Mercedes Leon SilverioCopyright:

Available Formats

CASE Maderas Peruanas SA

Prepared by Prof. Daniel Casiano

Maderas Peruanas is a Peruvian Company founded in 1968 by Mr. Giacomo Franchini dedicated to drying and processing

wood into finished products. Maderas Peruanas’s products are sold locally but mainly exported to international markets

like Europe, North America, and Asia. The varieties of tropical wood used for production includes species like Cumaru ,

Shihuahuaco , Capirona , among others. Among the finished products sold are: Stairs, Lumber and Moldings and

Hardwood Floors

Recently, Maderas Peruanas has received a purchase order from a buyer in Italy named WOOD IMPORT ASCHIERO SPA.

The purchase order has the following details:

Items : Wood Floors ( DECKS ) 35x35

Material : Cumaru

Designs : According to catalog

Quantity : 300 m2

Price : U.S. $ 250 FOB ( Incoterms 2000) per m2

Shipping : 1 shipment 300 m2

Terms of payment: T / T 75 days B / L

Time of shipment: 45 days confirmed after P.O. confirmation.

Additional information:

For extraction of raw materials and wood processing, Maderas Peruanas invests about 30 % of the P.O. This whole

process takes at least 45 days

Maderas Peruanas has three properties in Peru:

• A factory located on the Carretera Federico Basadre 11,250 km in the city of Pucallpa, Department of Ucayali.

• A sales and exports office located at 1880 Colonial Avenue, Lima.

• A branch and Showroom located at 255 Avenue Builders - La Molina.

1. What are the credit facilities to be required by Maderas Peruanas for this operation? Indicate the amount and term.

Consider that the bank covers a maximum of 90 % of the total transaction.

2. Consider that the loan is offered by two banks at the following rates:

BANK A: Annual effective rate in US Dollars 10.5%

BANK B: Libor +950 bps

Which one is the most convenient? Calculate interests to be paid for each option.

3. What condition would Maderas Peruanas consider in order to support its credit facilities with Banks?

4. What would be the total cost (interest + commissions) if Maderas Peruanas offers Sepymex to guarantee Pre

Shipment?

5.

Compendium of Cases III – Page 1 of 13

CASE MULTIPAPELES S.A.C.

Prepared by Prof. Daniel Casiano

The company MULTIPAPELES in its search for new suppliers found an excellent supplier in Germany named OVERSEAS

TRADING GMBH. The value of the material to be imported is US 57,500 dollars in CFR terms. As agreed between the

parties, payment is due 30 days from B/L with an avalized documentary collection. MULTIPAPELES sells its products after

90 days from the invoice date, so the credit terms offered by the supplier are not enough. According to the customs agent

of the buyer, INTEGRAL LOGISTICS SRL, duties and taxes to be paid to release goods are approx. up to 20% of the total

purchase order.

1. Indicate the credit facilities to be required by MULTIPAPELES SAC. Indicate amount, term and conditions.

2. What would be the total costs for the transaction if: EAR 12%, the cost for the collection: collection fee 0.10%,

Acceptance Fee: $120, Swift $20, Handling $3, Aval Fee 1.80% per year.

CASE - Export Credit Facilities

Exportadora del Norte SAC is a company dedicated to the agribusiness sector since the year 1995. The most part of its

customers are located in the USA and Canada. Currently one of its customers named Chiquita Foods is planning to

renegotiate the terms of payment. Until the month of August, Chiquita Foods used to pay in advance a 50% of the total

purchase order. However, due to the changes in the market, Chiquita Foods is no longer in position to keep this condition

available. The new terms consider a payment of 30% at the reception of documents through their bank in NY and the 70%

will be paid at 60 days from shipment (B/L). This situation represents a big challenge for Exportadora del Norte Financial

Manager as the company was not used to work with banks. According to the records, in order to prepare the shipment,

Exportadora del Norte demands at least 30% of an order to prepare it and ship the containers to the buyer. The new

shipment required by Chiquita Foods for the last quarter of the year is valued US$100,000 dollars to be delivered by the

end of October.

Notice:

- Consider that the payment of the balance is scheduled by the end of December.

Question:

What are the credit facilities to be requested by Exportadora del Norte SAC to its banker in Lima?

CASE Import Credit Facilities

A company named Aceros de la Industria closed a deal with its supplier Mc Steel located in Brazil. The purchase order for

iron steel valued US$250,000 dollars is scheduled to be shipped by the end of October. The payment terms were

established as follows: 30% in advance by T/T and the balance payable through a letter of credit at sight issued by a Prime

Bank in Peru. The shipment of the merchandise from Brazil will take around 30 days and it will be released from Customs

by the end of November. According to their experience, Aceros de la Industria expects to receive an important payment

related to this order by the end of December. In order to have funds available to make the payments to the supplier, the

importer will request as usual the support of its banker in Peru, where it currently maintains the following credit facilities:

a. Revolving line of credit for working capital. Amount: US$250,000. Term up to 120 days

b. Line of credit for issuing Local Guarantees. Amount: US$200,000. Term up to 360 days.

Notice:

- Consider that the documents will be received by mid-November without discrepancies

- The Taxes and Duties for the release of goods from Customs represent 20% of the total purchase order.

- The current interest rate is 8% APR (Annual Percentage Rate).

Questions

a. What credit facilities should the importer require to its banker? Indicate amount and term for the loans to be

disbursed by the bank.

b. What is the total amount in interests that the importer will pay to the bank?

Compendium of Cases III – Page 2 of 13

Case ESTRUCTURAS MARINAS S.A.C (Marine Structures)

Prepared by Prof. Daniel Casiano

Marine Structures is a Peruvian company that manufactures cranes and instruments for the use of medium size fishing vessels. In spite

of the economic effects of the financial international crisis and of the climatic deviations, the Peruvian fishing had an important

performance in 2009, since his levels of extraction grew in 10%, stimulated principally by the sectorial policies such as the

establishment of quotas to take advantage to the maximum of the extraction of the ocean resource. Some of the factors that

determine the quota of extraction are the capacity of the cargo hold and the number of available ships. For this reason and given the

good perspectives for 2011 that they include, a growth of the aquiculture activity (principally on the Asian markets) and the minor

exportable offer of prime fish meal offered by Chile, the international scenery is positive enough for the development of our exports.

Considering the above, Marine Structures has seen convenient to increase gradually his demand for projects for the new fishing ships.

The principal input of the business of Marine Structures is the steel. The above-mentioned product is acquired locally to companies

such as Aceros Arequipa and Commercial del Acero (COMASA). Nevertheless, and as indicated lines above, for 2011, Marine Structures

foresees at least to duplicate his production given to the increase in the orders of purchase on the part of his principal clients as

Tecnologica de Alimentos (TASA) and Austral Group, two of the biggest companies of the fishing sector in Peru.

The above-mentioned circumstances have done that his needs of purchase of steel increase notably so the usual 50MT quarterly that

they need, might go up to 150TM for the same period. It is for that reason that financial management has decided to check the

available lines with the different banks to avoid future problems. One of the main decisions is to stop buying the steel locally and

instead to approach suppliers located in China. Regrettably, companies in China related to this sector do not work under the scheme of

open account. An example of it, has been the price received from Sheng Steel and Co located in Qingdao. This supplier has proposed

the sale of steel against 30 % of advance and the remaining 70% under an L/C. The first order will be of 150MT at USD1200/MT. The

details of the loading include that the merchandise will be ready four weeks after receiving the advance. Then, the supplier takes at

least two more weeks to prepare the documentation and to deliver it to his bank. One of the conditions is that the L/C has to be

payable for a bank in his country (BANK OF CHINA) against documents and that in addition, it allows him to move part of the total

amount of the L/C to a third party. The time of the voyage plus the nationalization is approximately eight weeks. To pick up the

merchandise from Customs, the assistant of purchases of Marine Structures has thought that there is needed at least 25 % of the

Purchase Order to pay the Custom duties &taxes. The process of manufacture of the equipment as a final product to be delivered to

the client is three weeks from the arrival of the raw material (it might slightly change according to the complexity of the design). Finally,

Marine Structures does not realize sell in cash terms, on the contrary, they offer their customers to pay 60 days from the delivery date.

For the credit lines with the bank, Marine Structures is ready to leave a mortgage for his principal premise located in Av. Argentina and

in addition they offer the imported steel as a guarantee. The rating of the company and his shareholders is 100% Normal with

registered sales as of 2010 for USD5MM for the year.

Answer the following questions based on what you read before:

1. ¿What are Marine Structures options to make the advance payment?

2. ¿Considering the payment for the remaining 70%, what characteristic should be kept in mind?

3. Detail in the chart provided below what are the Lines that Marine Structures should ask to their bank considering the information

requested under the header of each column.

Type of Line Destination / Use Term Amount Conditions Guarantees

4. Consider the following situation

18/05/2010 Shipment from Qingdao

25/05/2010 Remittance of documents (with discrepancies) to the Issuing Bank

30/05/2010 Documents found noncompliant by the Issuing Bank. Waiting for Applicants acceptance.

02/06/2010 Applicant is notified by the Insurance company of a happening (damage) during transport in the ocean.

Said happening is not covered by the Insurance Company.

05/06/2010 Issuing Bank refuses payment.

¿Is the Issuing Bank position correct? Justify your answer.

5. Calculate the cost of the L/C and the Import Finance if:

- Issuing Commission: 0.15% quarter or fraction (*)

- Negotiation Commission: 0.15% of the face value of documents (*)

- Acceptance / Deferred Payment Commission: 0.80% annual

- Finance rate: Libor + 75 bps (Libor 120 days = 1.55)

Note: (*) Include Swift (USD5) & postage (USD1).

Assume that Marine Structures is requesting Finance for 100% of the L/C at a validity of 120 days.

6. By August 2010, Marine Structures is considering to start projects in Chile. For that reason the CFO is investigating the possibility of

having lines with Chilean Banks. ¿What are his options in terms of guarantees? ¿What would be the characteristics of such tool?

Compendium of Cases III – Page 3 of 13

Case Muebles Exóticos SRL (Exotic Furniture)

Prepared by Prof. Daniel Casiano

Exotic Furniture (EF) is a manufacturer of Furniture for Living & Dining Rooms with 3 years of experience in the market.

Today they supply the local market and export 20% of their production to the United States. However they are exploring

the possibility to enter the European Market. During the last Fair “Salón del Mueble” in Spain, they made several business

contacts, among them one with the company IKEA who showed to be interested in EF’s products. At the beginning of the

month they received the call from Miguel Marcos, Commercial Manager for IKEA, who requested a quotation for 3,000

units at USD.300 per piece. Today they received a Fax with the Purchase Order (P/O) confirming the acceptance of the

Quotation. The most important highlights of the P/O are:

IKEA’s P/O details

Items : Various pieces of Furniture for Living & Dining Rooms

Material : Mahogany Certified (Caoba certificada)

Designs : As per Catalog

Sale Price : USD.300 FOB (Incoterms 2010) per piece

Payment terms : T/T at 75 days from B/L

Shipments : 3 shipments with a 1,000 pieces each.

Time for delivery : 45 days from P/O.

Manufacturing Stage

For the raw material EF will invest around 30% of the P/O. Usually, their suppliers grant them 30 days to pay, however

due to the size of the order they have requested an advance payment of 50%. Additionally there is a 15% of extra costs

that need to be considered and that are related to getting the merchandise ready to be shipped and that happens in

about 45 days.

The Shipments

The negotiation with IKEA considered terms of sale of 75 days after B/L. It is for that reason that EF will have to cover

their Working Capital needs because every partial needs to be prepared as soon as the previous shipment has been

dispatched. The dispatching expenses for every partial represent approximately 10% of the P/O.

EF maintains current accounts with Banco Amigo. Without rethinking, Juan Zubiate, the CEO of EF, requested an

appointment with his Relationship Manager at the Bank to explain his new needs. Juan has also requested your help to

correctly establish what EF will require in terms of financing as he understands that the success in this sale depends on

the resources to finance it.

1. ¿What are the minimum requirements that the bank will request to EF?. ¿Would it be convenient to ask for a Line of

Credit or for a Specific Loan? Justify your answer.

2. If you decided to go for Lines of credit in question 1), indicate what would be the Lines to be requested to Banco Amigo

considering amounts an terms for each stage of the operation. Consider the total amount of the P/O as well as the fact

that the bank would finance a maximum of 90%.

3. Calculate total interests to be paid for the financed amount on each case. The Effective Rate offered by Banco Amigo is

12% per annum for all the operations.

4. Compare the proposal of Banco Amigo with the one from Banco Socio who offers Libor + 950 bps for all the operations

(see below Libor Rate as of 28/10/10).

10:34 28OCT10 THOMSON REUTERS BBA LIBOR RATES UK67516 LIBOR01

BRITISH BANKERS ASSOCIATION INTEREST SETTLEMENT RATES Alternative to <3750>

[28/10/10] RATES AT 11:00 LONDON TIME 28/10/2010 Disclaimer <LIBORDISC>

BBA Guide <BBAMENU>

USD GBP CAD EUR JPY EUR 365

O/N 0.21375 0.55125 0.28000 0.49750 0.17750 0.50441

1WK 0.33125 0.60500 0.37667 0.84125 0.19500 0.85293

2WK 0.37000 0.67250 0.40000 0.87500 0.22000 0.88715

1MO 0.42750 0.86000 0.44833 0.95875 0.29750 0.97207

2MO 0.84688 1.27375 0.65333 1.17188 0.45000 1.18816

3MO 1.03938 1.46500 0.83833 1.37875 0.55000 1.39790

4MO 1.27500 1.54250 0.99667 1.45688 0.61500 1.47711

5MO 1.47250 1.61438 1.16333 1.51438 0.67500 1.53541

6MO 1.57500 1.67750 1.30000 1.58188 0.72563 1.60385

Compendium of Cases III – Page 4 of 13

MINERA DE ROCAS

Case Prepared by Prof. Daniel Casiano

The Company MINERA DE ROCAS (MDR) has seen an increase of his sales in 100% since 2008 mostly due to Marco Osorio,

CEO’s decision to go into foreign markets.

MDR started exporting one year ago serving requests from Portugal. Then they received orders from Italy where their

products are highly appreciated. By the end of April, this year, they received a request from ITALMARBLE POCAI for

USD.30,000 FOB. The negotiation ended in the following sales terms: 50% against documents and the balance at 60 days

from shipment date.

MDR estimates that at the beginning at least 25% of the total amount would be useful to start production which would

take around 55 days. They also consider that after the first shipment they would require at least 30% of the P/O to cover

expenses, besides the necessary to liquidate the first loan.

As of the guarantees required by the Bank, they are evaluating to get a Line with one of the coverages offered by the

Government.

Finally, the last report requested to Dun & Bradstreet about their buyer shows that they are clean in respect of payments

to their suppliers. It is for that reason that they have decided to close the deal using a Documentary Collection as a Mean

of Payment.

According to the facts above:

- Specify the conditions of the Lines of Credit to be requested by MDR. Use the chart provided as guidance.

Amount Conditions for

Destination Term Required

Type of Line (Thousands of disbursement: Document

/ Use (days) Guarantees

USD) or Mean of Payment

a.

b.

REDACUICOLA S.A.

Case Prepared by Prof. Daniel Casiano

CATBE IMPORTACION Y EXPORTACION S.L. located in Madrid, Spain has closed a purchase with his Peruvian supplier

REDACUICOLA S.A. The import of hydro biological products from the above mentioned country, especially of filet and

points of frozen giant squid, has increased due to high demand of the product. Nevertheless, the conditions of purchase

rarely are in advance or against documents. Usually, buyers request terms of payment on credit that can go from 90 and

up to 180 days from the date of loading. REDACUICOLA S.A. in this case has offered his client 180 days from B/L. However,

they estimate that they will have gaps in their Cash flow that need to be covered with funds to be able to serve other

orders. Banco Amigo has offered an operation that will let them count on funds instantly. In exchange the company will

have to pay a preferential TEA (Annual Effective Rate) of 12% flat plus a commission of USD 45.

On the other hand, their alternative bank, Banco Socio has offered a Post Shipment Advance Account for the same period

and at the same rate.

As per the text above answer the following questions:

1. ¿What service or product is being offered by Banco Amigo and how is that it works?

2. ¿What is the total amount that REDACUICOLA will have to pay for the operation proposed by Banco Amigo?

3. ¿What are the advantages or disadvantages (if any) between the offers of the 2 banks?

Compendium of Cases III – Page 5 of 13

IMPORTACIONES RYO S.R.L.

Case Prepared by Prof. Daniel Casiano

The company IMPORTACIONES RYO S.R.L. imports pealed rice from countries such as Uruguay, U.S.A., Thailand, Bolivia

and Italy, which they sell locally under their own brand in several Supermarkets.

Generally, Peru is not a frequent importer of the product, however, every year and during at least 4 months there is a

demand that cannot be satisfied especially when the prices of the local production start going up. RYO S.R.L. wanted to

take advantage of that situation and has signed a contract with an exclusive supplier from the U.S. that up to 2008 use to

sell them in Open Account including credit for 90 days from the B/L. Things have changes, both the financial situation and

the market have changed and for that reason the supplier has set different sale conditions. The supplier is now requiring

one of the following options:

a. Letter of credit

Item Conditions

Validity 90 days

Payment Term 90 days from B/L

Amount USD.250,000

Commissions Issuance 0.30% per quarter

Negotiation 0.30% per set of documents

Acceptance 1.5% per annum

Other Subject to UCP600

b. Stand By Letter of Credit

Item Conditions

Validity 180 days

Payment Term At sight

Amount USD.250,000

Commissions Issuance 1.5% per year

Other Subject to ISP98

After Reading the above, kindly answer the following questions:

1. ¿What is the difference between both options? ¿What are the risks that the importer faces? Make a comparison

mentioning advantages and disadvantages.

2. ¿Which of the two is the most expensive one and why? Make the necessary calculations.

3. ¿What conditions should the importer bear in mind when using this type of instrument?

Compendium of Cases III – Page 6 of 13

EXPORTACIONES NATURALES S.A.

Case Prepared by Prof. Daniel Casiano

EXPORTACIONES NATURALES has the following conditions on their Purchase and Sale Agreement:

ITEM A : Fresh Lemons, quantity 6000 boxes. Price per box USD.5.50 FCA Jorge Chavez.

ITEM B : Lemon Juice, quantity 200 MT. Price USD.500/MT FOB Callao.

Assuming that the company requires financing at least 40% of the Purchase Order to prepare shipment (about 20 days)

and that the payment will be at 60 days from B/L, answer the following questions:

1. Indicate the Lines that EXPORTACIONES NATURALES should request their bank to finance their export and the

details using the chart provided below:

Destination /

Type of Line Term Amount Conditions

Use

2. Exportaciones Naturales exported approximately USD300 thousand (T.C. 2.85) during 2009, which represents a 100% of

their total sales. Their Rating in the Peruvian Financial System is a 100% Normal, same as their shareholders. ¿What are

the guarantees promoted by the government that they could use? Mention at least 2 characteristics from each of them.

3. Exportaciones Naturales wishes to have a safer payment scheme, ¿what would be their options? Indicate 3 instruments

that could help them to: i) mitigate the risk that the buyer might cancel the Purchase Order, ii) mitigate nonpayment risk.

¿What characteristics should have each of them? To facilitate your answer, present them in a chart.

4. Suppose that the company doesn’t qualify for credit lines ¿Would there be any option available? Consider that

Exportaciones Naturales wants to discount a 100% of the payment and they have been offered an Annual Effective Rate

of 9% ¿What would be the net amount to be received?

5. ¿What financial instrument could be used by the company to mitigate the Exchange rate fluctuations risk?

6. Suppose that the company is considering increasing their manufacturing capacity and for that reason they are planning

to invest in the acquisition of machinery and equipment, ¿What type of banking operation can they use?

=====================================/////////===============================

Compendium of Cases III – Page 7 of 13

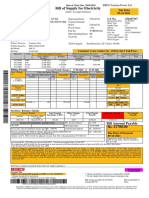

CASE: MITRALAND (Advance Account – Import Finance)

The following Documentary Credit is processed and your customer (you are the bank representative in charge of

the account) is asking you to calculate how much it would cost him to finance 85% of the amount of the LC for 90

days from the date of shipment. Considering that you have approved lines for this customer for Advance Account

and that the rates you would charge to the customer is LIBOR + 8 (Libor 90 = 0.35%). The usual commissions to

be considered are $38 to be charged at disbursement and $38 to be charged at cancelation of the loan. Bear in

mind that there will be 2 payments and 2 finance (one for the sight payment and one for the acceptance).

APPLICANT / IMPORTER

Account N°: xxxxxxxxxxxxxx Name: TEXTIL JOHNNY'S SRL

Address: LOS CANARIOS MZ E-2 LOTE 6 ATE

Contact: SR. JUAN GONZALES Tlf.: 555-5555 Fax:

FORMA DE PAGO AMOUNT TO BE PAID PARA USO DEL BANCO

CONCEPTO IMPORTE CONCEPT MON AMOUNT

Advance FOB Value US$ 13,693.60

Sight US$5,355.- Freight US$ 1,580.00

Insurance US$ 26.40

FINANCIADO POR Interests

Correspondent Bank: Other

Banco Peruviano: Total Amount US$ 15,300.00

Deferred Payment (Exporter): TYPE OF AMOUNT: Fixed Up To:

Acceptance (Exporter): $9,945.- Approximate (About): % Minimum......% Maximum.....

..1.... Expiry. at ..90.... days from date of: Amount in words: FIFTEEN THOUSAND THREE HUNDRED AND 00/100 U.S.DOLARS

Remittance Letter X Shipment Invoice

BENEFICIARY

Legal Name MITRALAND HARAPAN Tlf.: (62 21) 650.9959

Address WISMA MITRA SUNTER TOWER B LANTAL 7, TANJUNG PRIOK

City JAKARTA, UTARA 14350 Country INDONESIA Fax: (62 21).6530.1824

COMFIRMATION TYPE OF CREDIT VALIDITY

X Adding confirmation Transferable Revocable Validity up to: 90 days from issuance; or

Without confirmation Domestic

Fixed Date / /……..

X Irrevocable

SHIPMENT INCOTERM

Latest Shipment: 06 / 03 / 05 Place for Negotiation: X CIF CIP CFR

Via: X Maritime Air Road Rail Combined CPT FCA FOB

Partial Shipments: X Prohibited Allowed Transshipment:

Place/Port: CALLAO,

Prohibited X Allowed

Shipment from: TG PRIOK JAKARTA Incoterms 2000

Destination: CALLAO PERU Foreign Expenses on account of:

(Optional) Advise Beneficiary through: BANK PERMATA JAKARTA INDONESIA Applicant X Beneficiary

GOODS

ITEM HARMONIZED CODE VALUE ORIGIN OF THE DETAILED DESCRIPTION OR GENERIC FROM THE

NANDINA (Optional) FOB / FCA GOODS MERCHANDISE IN SPAÑISH (MANDATORY)

(SEE ATTACHED SHEET)

(Optional) Description of the goods as per:

Proforma Invoice N° 101/MHS/PRO dated 17/ 02 / 2005 Purchase Order N° dated / /

REQUIRED DOCUMENTS

...1...Original (s) and ..2. copy(ies) of the commercial invoice to our name issued in Spanish English indicating FOB value, freight and insurance

by separate, consigning the corresponding harmonized code.

...3....original (s) and ..3... copy(ies) of the Full Set. “Clean on Board” Bill of Lading, to the order of Banco Peruviano, under notification to us indicating:

X Freight prepaid Freight to be paid.

Compendium of Cases III – Page 8 of 13

REQUIRED DOCUMENTS

..…....Original(s) and ..….... copies of Airway Bill(s) consigned to Banco Peruviano, under notification to us

indicating: Freight prepaid Freight collect

Shipping documents must be send to Banco Peruviano: By Courier By Certified Mail

..….....original(s) and ....... Copy (ies) of the Certificate of Inspection issued by: ……………………………………………………….

OTHER DOCUMENTS AND/OR SPECIAL INSTRUCTIONS

1/3 Packing List

1/3 Certificate of Origin

Payments will be for credit to the account 090-4360-439 at BANK PERMATA JAKARTA INDONESIA

INSURANCE

Covered under policy N° Insurance company:

PAYMENT INSTRUCTIONS FOR BANCO PERUVIANO

Expenses and commissions to be charged to account N°: Amount of the Credit to be charged to account N°:

XXXXXXXXXXX XXXXXXXXXXX

GUARANTEES REQUIRED AT THE DELIVERY OF DOCUMENTS

Warrant % Amount Expenses and commissions to be charged to account N°:

Compendium of Cases III – Page 9 of 13

CASE: ADVANCE ACCOUNT 1

You are given on the following 2 sheets: a Pro Forma and a Disbursement request format. Fill out the format

based on the information provided on the Pro Forma. At the end, calculate the cost of the Loan knowing that the

effective rate will be 15% and the term of financing requested by the customer is 60 days:

TEXTIL MARTE EIRL

Ca. Los Pinos 280

Ate, Lima

Compendium of Cases III – Page 10 of 13

CARTA SOLICITUD

DESEMBOLSO DE FINANCIAMIENTOS DE COMERCIO EXTERIOR

Fecha :

I. Información del Cliente solicitante:

Nombre o Razón social :

Cta.Cte. para desembolso ( * ) -- Seleccione la moneda de su Cta.--

DOI / R.U.C. Nro. : Fono / Fax :

Funcionario de Negocios :

( * ) indique el número de vuestra Cta.Cte. y seleccione la Moneda correspondiente, para el desembolso.

El CLIENTE se compromete a presentar los documentos sustentatorios correspondientes a requerimiento del BANCO.

La información que se detalla en la presente carta solicitud se sujeta a los términos y condiciones del Contrato Marco

de Comercio Exterior cel

A continuación detallo el(los) documento(s), correspondiente(s) a la operación, por la que solicito financiamiento: de

Tipo de financiamiento : --- Seleccione tipo de financiamiento --- Plazo a financiar (en días) :

Nro. referencia instrumento : Número de Utilización :

II. Detalle de la operación y del Proveedor o del Comprador en el exterior (datos obligatorios):

Descripción de mercadería :

País de Origen : País de Destino :

Número o Referencia de la Moneda de Importe de la

Nr. Nombre o Razón Social del Proveedor o Fecha de embarque

Proforma o Pedido o Proforma / Proforma o Contrato

(**) del Comprador en el exterior B/L o AWB

Contrato o Factura o DUA Factura o Factura o DUA

5

(**) De ser necesario detallar mas de 5 documentos, adjuntar una lista con los datos solicitados.

Total : 0.00

-----------------------------------------------------------------------------

Firma y Sello del Cliente / Representante Legal

Cláusula de Protección

“En caso el CLIENTE hubiera accedido al presente formato de contrato a través de la web o de cualquier otro medio electrónico que el

BANCO hubiera puesto a su disposición, desde ya manifiesta que en el supuesto que existiera alguna

------------------------------------------------------------------------------ PARA SER LLENADO POR BANCO PERUVIANO-----------------------------------------------------

III. Detalles del Financiamiento :

Importe a Financiar : US$ Cuenta BT Cliente :

Tasa a aplicar (T.E.A.) : Fecha Vcmto. Financ. :

IV. Instrucciones para desembolso :

---------------------------------------------------------------- --------------------------------------------------------------------

Firma y Sello del Funcionario de Negocios Firma y Sello de Servicios Comerciales (BSC)

Compendium of Cases III – Page 11 of 13

CASE: ADVANCE ACCOUNT 2

Based on the L/C Application shown below, fill out the Disbursement Form that follows and calculate the cost of

an Import Finance Loan at the effective rate of 9%:

SOLICITUD DE CREDITO DOCUMENTARIO DE IMPORTACION

Sirvanse emitir por 2

nuestra cuenta una Carta de Crédito Irrevocable, en los Términos y Condiciones siguientes :

Transferible Doméstica Agregar Confirmación Sin Agregar Confirmación

DATOS DEL ORDENANTE / SOLICITANTE:

Cuenta N°: Nombre o Razón Social: Cia Fiquima SAC

Dirección: Ca. Los Heroes de la República 530

Contacto: Teléfono: xxxxxx Fax : xxxxxxxxx

E-Mail: xxxxxxxxx

DATOS DEL BENEFICIARIO / PROVEEDOR:

Razón Social: Grupo Sidesurgico Diaco SA

Dirección: Calle 1000 #9A-45 Piso 17

Ciudad/País: Bogota, Colombia E-Mail: xxxx

Contacto: xxxx Telefono: xxxx Fax : xxxx

INFORMACION SOBRE LA VALIDEZ DE LA CARTA DE CREDITO

Valido hasta: días de la emisión ó Fecha Fija: 30 / 3 / 2006

INFORMACION SOBRE EL IMPORTE DE LA CARTA DE CREDITO

Moneda: 1

U.S.Dolares Importe: 163,800.00 Tipo de Importe: Fijo ó Con Tolerancia: % más % menos

Hasta (Up to)

Importe en letras: CIENTO SESENTITRES MIL OCHOCIENTOS Y 00/100 U.S.DOLARES

FORMA DE PAGO AL BENEFICIARIO (UTILIZACION):

Adelantado Número de Cuotas/Vencimientos:

A la Vista 163,800.00 Periodo a: días de: 1

Fecha de Embarque

A Plazo: Pago 2 2

Diferido

Gastos del Exterior por cuenta del: Ordenante Beneficiario

EMBARQUE Y TERMINOS DE FACTURACION:

INCOTERMS 2000: Desde (Puerto / Aeropuerto / Lugar): CARTAGENA Y/O TOLU

Marítima FOB CFR CIF Hasta (Puerto / Aeropuerto / Lugar): IQUITOS,PUCALLPA,PERU

Vía de Aereo Ultima Fecha de Embarque:

FCA CPT CIP

Transporte: Terrestre Embarques Parciales: 1

0

3 Permitidos

Multimodal Otro: EXW 1 Transbordos: 1

Permitidos

MERCADERIA - DESCRIPCION

BARRA CORRUGADA DE 3/8'' X 9MTS. (124 TM)

DOCUMENTOS REQUERIDOS

ORIG / COP IA

1 / 1 Factura comercial

1 / 1 Conocimiento de Embarque "limpio", consignado a la orden del Banco Wiese Sudameris, notificar a: ORDENANTE

indicando: Flete Pagadero en Destino Flete Prepagado

1 / 1 Certificado de Origen emitido porCAMARA DE COMERCIO

1 / 1 Lis ta de Empaque

/ Certificado emitido por

/ Otro: __________________________________________________________________________________________________________

/ Certificado o Póliza de Seguro con cobertura a todo ries go por el 110% del Valor CIF/CIP, endos ada a favor del Banco Wies e Sudameris .

Los documentos deben ser remitidos al Banco Wiese Sudameris, vía Courier.

OTROS DOCUMENTOS Y/O CONDICIONES ESPECIALES:

FORMA DE PAGO DEL CREDITO DOCUMENTARIO

Los gastos y servicios bancarios se debitarán en la cuenta N° XXXX El importe del crédito se debitará en la cuenta N° XXXX

Apreciaremos financiar el importe de: 163,800 por el plazo de (días): 180 DS DEL B/L

Compendium of Cases III – Page 12 of 13

CARTA SOLICITUD

DESEMBOLSO DE FINANCIAMIENTOS DE COMERCIO EXTERIOR

Fecha :

I. Información del Cliente solicitante:

Nombre o Razón social :

Cta.Cte. para desembolso ( * ) -- Seleccione la moneda de su Cta.--

DOI / R.U.C. Nro. : Fono / Fax :

Funcionario de Negocios :

( * ) indique el número de vuestra Cta.Cte. y seleccione la Moneda correspondiente, para el desembolso.

El CLIENTE se compromete a presentar los documentos sustentatorios correspondientes a requerimiento del BANCO.

La información que se detalla en la presente carta solicitud se sujeta a los términos y condiciones del Contrato Marco

de Comercio Exterior cel

A continuación detallo el(los) documento(s), correspondiente(s) a la operación, por la que solicito financiamiento: de

Tipo de financiamiento : --- Seleccione tipo de financiamiento --- Plazo a financiar (en días) :

Nro. referencia instrumento : Número de Utilización :

II. Detalle de la operación y del Proveedor o del Comprador en el exterior (datos obligatorios):

Descripción de mercadería :

País de Origen : País de Destino :

Número o Referencia de la Moneda de Importe de la

Nr. Nombre o Razón Social del Proveedor o Fecha de embarque

Proforma o Pedido o Proforma / Proforma o Contrato

(**) del Comprador en el exterior B/L o AWB

Contrato o Factura o DUA Factura o Factura o DUA

5

(**) De ser necesario detallar mas de 5 documentos, adjuntar una lista con los datos solicitados.

Total : 0.00

-----------------------------------------------------------------------------

Firma y Sello del Cliente / Representante Legal

Cláusula de Protección

“En caso el CLIENTE hubiera accedido al presente formato de contrato a través de la web o de cualquier otro medio electrónico que el

BANCO hubiera puesto a su disposición, desde ya manifiesta que en el supuesto que existiera alguna

------------------------------------------------------------------------------ PARA SER LLENADO POR BANCO PERUVIANO-----------------------------------------------------

III. Detalles del Financiamiento :

Importe a Financiar : US$ Cuenta BT Cliente :

Tasa a aplicar (T.E.A.) : Fecha Vcmto. Financ. :

IV. Instrucciones para desembolso :

---------------------------------------------------------------- --------------------------------------------------------------------

Firma y Sello del Funcionario de Negocios Firma y Sello de Servicios Comerciales (BSC)

Compendium of Cases III – Page 13 of 13

You might also like

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- 4 Pas 7 - Statement of Cash Flows: Objective and ScopeDocument17 pages4 Pas 7 - Statement of Cash Flows: Objective and ScopeRose Aubrey A Cordova100% (1)

- E-Commerce AssignmentDocument2 pagesE-Commerce AssignmentRishiNo ratings yet

- Shop Electricity Bill PDFDocument1 pageShop Electricity Bill PDFR DNo ratings yet

- Bank Fraud and Its SolutionsDocument19 pagesBank Fraud and Its SolutionsRituparn UniyalNo ratings yet

- Discover Statement 20200225 4656 PDFDocument4 pagesDiscover Statement 20200225 4656 PDFCarlos Estrada60% (5)

- Vouchers SampleDocument1 pageVouchers SampleLex AmarieNo ratings yet

- Tally9.0: The Version of This PackageDocument9 pagesTally9.0: The Version of This PackagetvksrajaNo ratings yet

- Summary Taxes BrazilDocument29 pagesSummary Taxes BrazilRegis NemezioNo ratings yet

- SQLAccountWorkBook 5Document19 pagesSQLAccountWorkBook 5CliNo ratings yet

- PowerWater Maintenance2015Document9 pagesPowerWater Maintenance2015Engr Muhammad HussainNo ratings yet

- Payment For HonorDocument4 pagesPayment For HonorasiegrainenicoleNo ratings yet

- Credit Card Application Form: Applicant'S InformationDocument4 pagesCredit Card Application Form: Applicant'S InformationStacy BeckNo ratings yet

- Q 1 To 15 CIVIL LAW MOCK BAR QUESTIONS EDITED AND REVSIEDDocument12 pagesQ 1 To 15 CIVIL LAW MOCK BAR QUESTIONS EDITED AND REVSIEDTyroneNo ratings yet

- Fulfillment Process Presentation Final Team 5Document11 pagesFulfillment Process Presentation Final Team 5Bhargav MehtaNo ratings yet

- Sponsorship Prospectus - FINALDocument20 pagesSponsorship Prospectus - FINALAndrea SchermerhornNo ratings yet

- BPMLT TemplateDocument4 pagesBPMLT TemplateraaghuNo ratings yet

- Acc 451 (Accounting Systems & Controls)Document20 pagesAcc 451 (Accounting Systems & Controls)Naveed Karim Baksh100% (1)

- Zambia College of Agriculture-Monze: Application Form (2020) Diploma in General Agriculture-RegularDocument4 pagesZambia College of Agriculture-Monze: Application Form (2020) Diploma in General Agriculture-RegularJedediah PhiriNo ratings yet

- UE Online Registration 2Document2 pagesUE Online Registration 2Jovcel ObcenaNo ratings yet

- Banking Module 1Document7 pagesBanking Module 1BINDU N.R.100% (1)

- Credit Terms Newest FormDocument1 pageCredit Terms Newest FormPhú Nguyễn HoàngNo ratings yet

- Fai GlobeDocument2 pagesFai GlobeDon HirtzNo ratings yet

- Banking Domain Knowledge For TestersDocument9 pagesBanking Domain Knowledge For TestersAniket SinghNo ratings yet

- Feasibility Study of A Bank in Canlaon CityDocument136 pagesFeasibility Study of A Bank in Canlaon CityMJ Tan89% (18)

- QuestionBank RASCI RetailCashierDocument17 pagesQuestionBank RASCI RetailCashierChittaranjan MaharajNo ratings yet

- Madokero Client Update 43 - Payment Platforms PDFDocument4 pagesMadokero Client Update 43 - Payment Platforms PDF123owenNo ratings yet

- C Bill Form - Cement RamavaramDocument4 pagesC Bill Form - Cement RamavaramKrishna KrishnaNo ratings yet

- 1 Obligations QuizzersDocument83 pages1 Obligations QuizzersAllanis SolisNo ratings yet

- Chapter 4 (Business Law)Document24 pagesChapter 4 (Business Law)Steffi Anne D. ClaroNo ratings yet

- Lockbox - User GuideDocument68 pagesLockbox - User Guidekrishan0432No ratings yet