Professional Documents

Culture Documents

Business Combi 2

Uploaded by

Erika Lanez0 ratings0% found this document useful (0 votes)

138 views1 pageOriginal Title

Business combi 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

138 views1 pageBusiness Combi 2

Uploaded by

Erika LanezCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

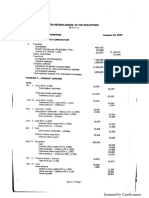

BUSINESS

COMBINATION – SUBSEQUENT TO DATE OF ACQUISITION

Problem 1: Prada Corporation acquired 75% of the outstanding shares of Salvatore Company on January 2, 2017 for

P287,400 excluding control premium of P20,000. Salvatore Company’s shareholders’ equity on January 2, 2017 were as

follows: Ordinary shares, P100 par, P131,400; Share premium, P52,500; Retained earnings, P105,000. Non-‐‑controlling

interest is measured on January 2, 2017 at fair value. The fair value of the non-‐‑controlling interest amount to P90,000.

Current fair value of non-‐‑controlling interest amount to P90,000. Current fair value of Salvatore’s identifiable net assets

exceeded their book values as follows: Inventories, P15,750 (1/3 were sold in 2017); Plant assets (economic life of 10

years), P26,250, while the book value of Patents exceeded their fair value (economic life of 5 years), P10,750. Both Prada

and Salvatore include depreciation expense and amortization expense in operating expenses. Both companies use the

straight line method for depreciation and amortization. Prior to acquisition the ordinary shares of Prada Corporation is

P180,000. Additional paid-‐‑in capital is P75,000 and Retained earnings is P150,000.

For the year ended December 31, Prada Company and Salvatore Company reported the following results of operations:

2017 Prada Salvatore

Net Income 178,000 15,000

Dividends 102,000 5,000

1. Prepare all journal entries in the books of Prada Company during 2017 to account for its investment in Salvatore

Company and Salvatore’s operating results using the cost model.

2. Prepare the working paper elimination entries for consolidated financial statements on December 31, 2017?

3. Compute the following on December 31, 2017:

a. Non controlling interest in net income

b. Non controlling interest in net assets

c. Consolidated net income attributable to parent

d. Consolidated retained earnings

e. Consolidated shareholders’ equity

Problem 2:On January 2, 2017, Proenza Company acquired 80% of Schouler Company’s ordinary shares for P810,000.

P37,500 of the excess is attributable to goodwill and the balance to a depreciable asset with an economic life of ten years.

Non-‐‑controlling interest is measured at fair value on date of acquisition. On the date of acquisition, shareholders’ equity

of the two companies were as follows:

Proenza Schouler

Ordinary shares 1,312,500 300,000

Retained earnings 1,950,000 525,000

On December 31, 2017, Schouler Company reported net income of P131,250 and paid dividends of P45,000 to Proenza.

Proenza reported earnings from its separate operations of P356,250 and paid dividends of P172,500. Goodwill had been

impaired and should be reported at P7,500 on December 31, 2017.

1. How much is the consolidated profit on December 31, 2017?

A. P447,187.50 B. P473,473.50 C. P450,000 D. P442,500

2. How much is the consolidated retained earnings attributable to parent’s shareholders’ equity on December 31, 2017?

A. P2,202,750.00 B. P2,197,500.00 C. P2,196,750.00 D. 2,599,687.50

3. How much is the non-‐‑controlling interest in profit of Schouler Company on December 31, 2017?

A. P23,439.50 B. P23,250.00 C. P26,250.00 D. P17,250.00

4. What amount of non-‐‑controlling interest is to be presented in the consolidated statement of financial position on

December 31, 2017?

A. P205,312.50 B. P208,500.00 C. P193,125.00 D. P181,875.00

5. How much is the consolidated profit attributable to parent shareholders on December 31, 2017?

A. P420,000.00 B. P445,500.00 C. P425,250.00 D. P450,000.00

Problem 3:Phelan Company purchased 75% of the ordinary shares of Sophie Company on December 31, 2012 at P525,000

more than the book value of its net assets. The excess was allocated to equipment in the amount of P234,375 and to

goodwill for the balance. The equipment has an estimated useful life of 10 years and goodwill was not impaired. For four

years, Sophie Company reported cumulative earnings of P2,362,500 and paid P682,500 in dividends. On January 2, 2017,

non-‐‑controlling interest in net assets of Sophie Company amounts to P984,375.

Assuming non-‐‑controlling interest is measured at fair value, what is the price paid by Phelan Company on the date of

acquisition?

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Acctg 100C 06 PDFDocument2 pagesAcctg 100C 06 PDFQuid DamityNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Midterm Examination - ABCDocument5 pagesMidterm Examination - ABCMaria DyNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Investment in AssociateDocument3 pagesInvestment in AssociateLui0% (3)

- ACTREV 4 Business CombinationDocument4 pagesACTREV 4 Business CombinationchosNo ratings yet

- SM09 4thExamReview-2 054657Document4 pagesSM09 4thExamReview-2 054657Hilarie JeanNo ratings yet

- Intermediate Accounting 1 Sample Problem For Debt Investments - CompressDocument55 pagesIntermediate Accounting 1 Sample Problem For Debt Investments - CompresslerabadolNo ratings yet

- 302 Take Home Assignment For FinalsDocument5 pages302 Take Home Assignment For Finalsedwin_dauzNo ratings yet

- Intermediate Accounting I Investment in Associate Part 2Document3 pagesIntermediate Accounting I Investment in Associate Part 2Fery AnnNo ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamDocument8 pagesACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamMariefel OrdanezNo ratings yet

- Answer Key - Exercise Problems Investment in Debt SecuritiesDocument5 pagesAnswer Key - Exercise Problems Investment in Debt SecuritiesApply Ako Work EhNo ratings yet

- Quizzer 1Document4 pagesQuizzer 1Arvin John MasuelaNo ratings yet

- Consolidated FS & Intercompany TransactionsDocument5 pagesConsolidated FS & Intercompany TransactionsJalieha MahmodNo ratings yet

- Assignment Business CombinationDocument2 pagesAssignment Business CombinationZarah H. LeongNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- FarDocument14 pagesFarKenneth Robledo100% (1)

- Acctg 100G 02Document4 pagesAcctg 100G 02lov3m3100% (1)

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Financial Accounting and Reporting (Basic Accounting Quizbowl)Document67 pagesFinancial Accounting and Reporting (Basic Accounting Quizbowl)Kae Abegail Garcia0% (1)

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- Business Combination 4Document2 pagesBusiness Combination 4Jamie RamosNo ratings yet

- AFAR TestbankDocument56 pagesAFAR TestbankDrama SubsNo ratings yet

- Module 1.2 - Investment in Associate (Hand-Outs 1)Document5 pagesModule 1.2 - Investment in Associate (Hand-Outs 1)riccifrijillanoNo ratings yet

- Auditing Problems MC Quizzer 02Document15 pagesAuditing Problems MC Quizzer 02anndyNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Accounting 3 Investment in AssociatesDocument2 pagesAccounting 3 Investment in AssociatesMina ChouNo ratings yet

- 8901 Audit of Shareholders Equity Self TestDocument6 pages8901 Audit of Shareholders Equity Self TestYahlianah LeeNo ratings yet

- AccountingDocument2 pagesAccountingMonica MonicaNo ratings yet

- Financial Accounting Part 1Document5 pagesFinancial Accounting Part 1Christopher Price100% (1)

- Additionial TanongDocument28 pagesAdditionial Tanongboerd77No ratings yet

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- AfarDocument18 pagesAfarFleo GardivoNo ratings yet

- Handout Investment in Debt Securities Answer KeyDocument4 pagesHandout Investment in Debt Securities Answer KeyJaimell LimNo ratings yet

- INSTRUCTIONS: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument15 pagesINSTRUCTIONS: Select The Correct Answer For Each of The Following Questions. Mark OnlyMendoza Ron NixonNo ratings yet

- 102 Quiz 1 She 2020Document6 pages102 Quiz 1 She 2020Eunice MartinezNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- BONDSDocument3 pagesBONDSjdjdbNo ratings yet

- BusCom SubsequentDocument7 pagesBusCom SubsequentDianeL.ChuaNo ratings yet

- 2nd Yr Midterm (2nd Sem) ReviewerDocument19 pages2nd Yr Midterm (2nd Sem) ReviewerC H ♥ N T Z60% (5)

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- SheDocument4 pagesShecedrick abalosNo ratings yet

- Exercises. Correction of ErrorsDocument7 pagesExercises. Correction of ErrorsGia Sarah Barillo BandolaNo ratings yet

- Acquisition & Interest Date Interest Earned (5%) Interest Income (4%) Premium Amortization Book ValueDocument3 pagesAcquisition & Interest Date Interest Earned (5%) Interest Income (4%) Premium Amortization Book ValueGray JavierNo ratings yet

- ExtAud 3 Quiz 5 Wo AnswersDocument8 pagesExtAud 3 Quiz 5 Wo AnswersJANET ILLESESNo ratings yet

- Cpar AfarDocument21 pagesCpar AfarFrancheska NadurataNo ratings yet

- Basic Accounting Cup AnswerkeyDocument6 pagesBasic Accounting Cup AnswerkeyChichiNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- Business Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Document1 pageBusiness Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Akako MatsumotoNo ratings yet

- Business Combination Subsequent To Date of AcquisitionDocument1 pageBusiness Combination Subsequent To Date of AcquisitionAdrian MontemayorNo ratings yet

- Practice Problems - Audit of InvestmentsDocument10 pagesPractice Problems - Audit of InvestmentsAnthoni BacaniNo ratings yet

- ADV ACC TBch04Document21 pagesADV ACC TBch04hassan nassereddine100% (2)

- Auditing ProblemsDocument5 pagesAuditing ProblemsJohn Paulo SamonteNo ratings yet

- Business Combination Problem SetDocument6 pagesBusiness Combination Problem SetbigbaekNo ratings yet

- Audit of SheDocument3 pagesAudit of ShePrince PierreNo ratings yet

- Problem No. 1Document5 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- Exercise 4.1Document2 pagesExercise 4.1Nicole Anne Santiago SibuloNo ratings yet

- Auditing Problems SummaryDocument16 pagesAuditing Problems SummaryErika LanezNo ratings yet

- Cost Accounting: Job Order Costing SystemDocument6 pagesCost Accounting: Job Order Costing SystemErika LanezNo ratings yet

- MCQ - Corporation Law PDFDocument6 pagesMCQ - Corporation Law PDFErika LanezNo ratings yet

- MCQ - Negotiable Instruments PDFDocument9 pagesMCQ - Negotiable Instruments PDFErika LanezNo ratings yet

- Forex PDFDocument5 pagesForex PDFErika LanezNo ratings yet

- Buss CombiDocument2 pagesBuss CombiErika LanezNo ratings yet

- Tax Updates Vs Tax Code OldDocument7 pagesTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- AudPW ProbSln PDFDocument10 pagesAudPW ProbSln PDFErika LanezNo ratings yet

- RA 8791 General Banking ActDocument22 pagesRA 8791 General Banking ActStephanie Mei100% (1)

- Bouncing Checks: Liabilities For Violation of B.P. 22Document10 pagesBouncing Checks: Liabilities For Violation of B.P. 22Nickford AcidoNo ratings yet

- AudPW Theo PDFDocument18 pagesAudPW Theo PDFErika LanezNo ratings yet

- Audit Quizes CompilationsDocument37 pagesAudit Quizes CompilationsErika LanezNo ratings yet

- RA9194Document5 pagesRA9194Vernie BacalsoNo ratings yet

- AudPW Prob PDFDocument24 pagesAudPW Prob PDFErika LanezNo ratings yet

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- CERTS - Revenue CycleDocument8 pagesCERTS - Revenue CycleralphalonzoNo ratings yet

- Test of Controls Procedure PDFDocument6 pagesTest of Controls Procedure PDFNatsu DragneelNo ratings yet

- AP First PreBoard - Sol PDFDocument4 pagesAP First PreBoard - Sol PDFErika LanezNo ratings yet

- Audit RemovalDocument13 pagesAudit RemovalErika LanezNo ratings yet

- Preweek Practice ProblemsDocument18 pagesPreweek Practice ProblemsElai grace FernandezNo ratings yet

- At-030507 - Auditing in A CIS EnvironmentDocument15 pagesAt-030507 - Auditing in A CIS EnvironmentRandy Sioson100% (9)

- AP 8507 Receivables PDFDocument6 pagesAP 8507 Receivables PDFErika LanezNo ratings yet

- AP-5903 - PPE & IntangiblesDocument10 pagesAP-5903 - PPE & Intangiblesxxxxxxxxx100% (1)

- Test of Controls Procedure PDFDocument6 pagesTest of Controls Procedure PDFNatsu DragneelNo ratings yet

- At-5915 - Other PSAs and PAPSsDocument11 pagesAt-5915 - Other PSAs and PAPSsPau Laguerta100% (1)

- Auditing ProblemsDocument16 pagesAuditing ProblemsRegi IceNo ratings yet

- CparDocument6 pagesCparmxviolet100% (4)

- AP - LiabilitiesDocument4 pagesAP - LiabilitiesEarl Donne Cruz100% (4)

- CERTS - Expenditure CycleDocument12 pagesCERTS - Expenditure CycleralphalonzoNo ratings yet

- Chapter 19: Sales and Operations Planning: Mcgraw-Hill/IrwinDocument30 pagesChapter 19: Sales and Operations Planning: Mcgraw-Hill/IrwinMitali SapraNo ratings yet

- 2020 Academic Resume-Updated January 2020Document12 pages2020 Academic Resume-Updated January 2020Ajim MahmudNo ratings yet

- Tugas Kelompok 3 Intermediate Accounting IDocument9 pagesTugas Kelompok 3 Intermediate Accounting IEvelyn Purnama SariNo ratings yet

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Document3 pagesSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Nikky Bless LeonarNo ratings yet

- Trade Times TanishCapital DamuDocument20 pagesTrade Times TanishCapital DamuSrini VasanNo ratings yet

- BKM 9e Commonly Used NotationDocument1 pageBKM 9e Commonly Used Notationfossils1001No ratings yet

- IB - Course OutlineDocument4 pagesIB - Course OutlineChaitanya JethaniNo ratings yet

- Faculty Business Management 2020 Session 1 - Pra-Diploma Dan Diploma MKT243 260Document3 pagesFaculty Business Management 2020 Session 1 - Pra-Diploma Dan Diploma MKT243 260Najibah MohamedNo ratings yet

- Masstige Brands - Assignment PBM - Vasantha Arjun KalagaDocument5 pagesMasstige Brands - Assignment PBM - Vasantha Arjun KalagavasanthaNo ratings yet

- 3 Accounting MechanicsDocument50 pages3 Accounting MechanicsVasu Narang100% (1)

- Raguram Rajan's ThesisDocument14 pagesRaguram Rajan's Thesissum786No ratings yet

- PROBLEM Set 3 AnswerDocument5 pagesPROBLEM Set 3 AnswerAmalia RosadiNo ratings yet

- AXS - Home - Financial ReportingDocument2 pagesAXS - Home - Financial ReportingjoseyNo ratings yet

- Statement of Cash Flow by KiesoDocument85 pagesStatement of Cash Flow by KiesoSiblu HasanNo ratings yet

- LBODocument42 pagesLBOSandeep Kumar100% (1)

- Please List Team Members BelowDocument35 pagesPlease List Team Members BelowHarshit Verma17% (6)

- Function of Financial MarketsDocument4 pagesFunction of Financial MarketsFrances Mae Ortiz MaglinteNo ratings yet

- QUIZDocument14 pagesQUIZHanny chandraNo ratings yet

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- 2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Document38 pages2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Aya AzanarNo ratings yet

- Updates On Buy Back Offer (Company Update)Document52 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- 2.valuation of Goodwill &sharesDocument41 pages2.valuation of Goodwill &sharesvivekbNo ratings yet

- Foxconn Yuanta ReportDocument12 pagesFoxconn Yuanta ReportjtbocianNo ratings yet

- Quantitative Reporting TemplatesDocument124 pagesQuantitative Reporting TemplatesDeepika Darkhorse ProfessionalsNo ratings yet

- CFA Society Indonesia Career Guide - WebDocument31 pagesCFA Society Indonesia Career Guide - Webikram jalilNo ratings yet

- Project Report On Commodity Trading at IIFlDocument16 pagesProject Report On Commodity Trading at IIFlNarayan Sharma PdlNo ratings yet

- Operations Manager or Program Manager or Property Manager or ExeDocument2 pagesOperations Manager or Program Manager or Property Manager or Exeapi-79316127No ratings yet

- Fac511s - Financial Accounting 101 - 1st Op - June 2023Document5 pagesFac511s - Financial Accounting 101 - 1st Op - June 2023nettebrandy8No ratings yet

- Assignment Nicmar / Code OfficeDocument18 pagesAssignment Nicmar / Code OfficeNilesh SondigalaNo ratings yet

- Risk Analysis and Portfolio Management ModuleDocument113 pagesRisk Analysis and Portfolio Management ModuleLasborn DubeNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)